Table of Contents

CIMB Travel Platinum Credit Card Intro

In my previous credit card review we’ve look into UOB ONE Card which surprisingly it is a great basic cashback card, so this time let’s look at a popular basic travel credit card from CIMB.

From their official product page, it seems to offer a few benefits such as airport transfer, inflight wifi, lounge access and bonus points that appeals to travelers. So, in this post we’ll look into them, and see if they are actually good benefits that worth applying this card for.

Lounge Access, Airport Transfer & Inflight WiFi

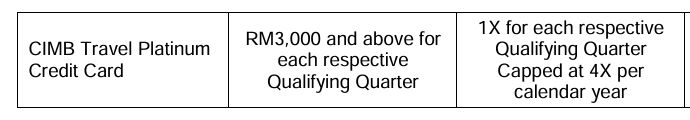

This card lets you access to Plaza Premium Lounge, but there’s a catch, you need to spend at least RM3000 in a single quarter to earn one time access, and from the terms it seems the entry can only be used by the principal card holder.

*You can check out the participated Plaza Premium Lounges here.

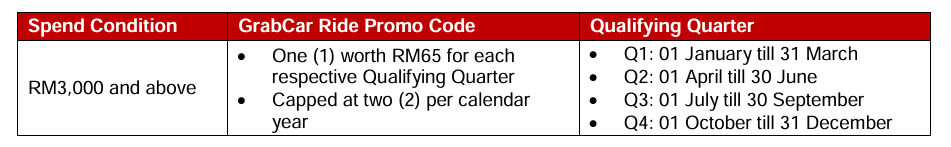

The other benefits you get for spending RM3000 in a single quarter is you will receive a RM65 promo code for Grab, and it can only be used to transfer to or from airport in Malaysia.

As for the inflight wifi, it is in a cashback form of up to RM30, but let’s be honest it’s very unlikely you will have them in short range flight, and many MAS flight that are supposed to have the wifi always tell me they are “not working” when asked.

In my opinion airport lounge are overrated, especially the one in Malaysia, it’s just a canteen with mediocre food, the Grab promo code is at least practical.

But for a basic card that required to spend RM3000 in 3 months? It’d probably be better to just use cashback card. Unless you’re having a flight in 3 months time and you REALLY want to access the lounge.

Bonus Points & Airmiles

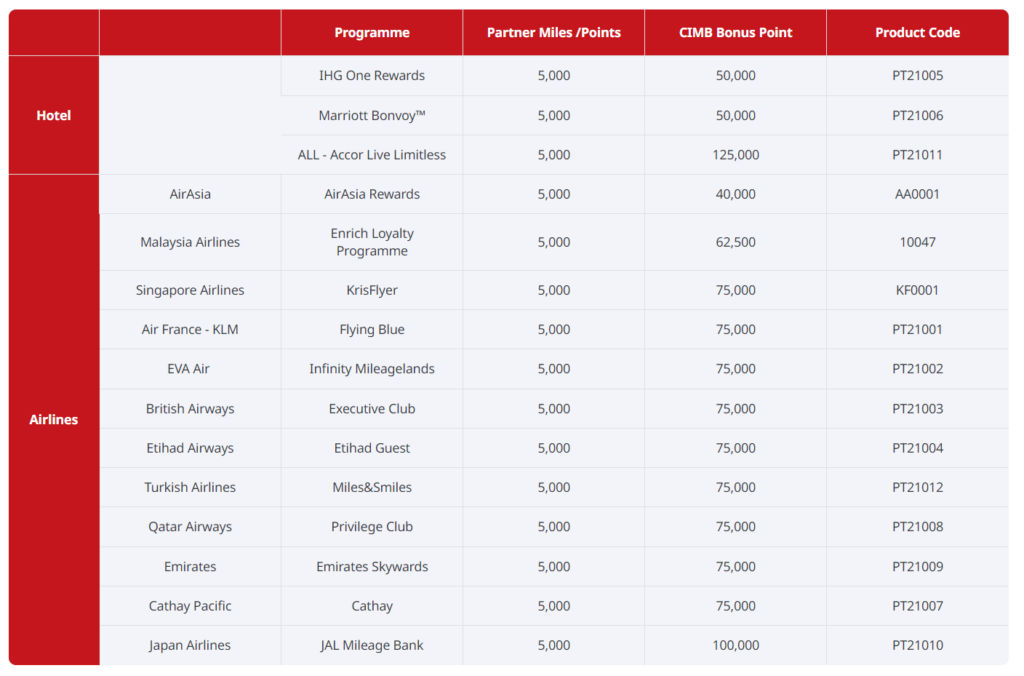

Airmiles or points that can be used to redeem airmiles is another offer people usually look for when getting a travel credit cards, so let’s look at the offer:

- 5 points for overseas, airlines and duty free stores spending

- 2 points for other local spend

- 1 point for local education, insurance, utilities

From the hotel and airmiles redemption catalogue by CIMB, it shows that you can redeem 5000 Enrich miles for 62500 points, which translate into 0.4 miles per ringgit when you spend with this card overseas.

And if we assume 4 cents for each miles that means RM0.016 value back per RM1 spent, the ROI of about 1.6%.

*In my blog I always use Enrich miles for example and assign a value of 4 cents for calculation estimated ROI, so that I can normalize benefits from all airmiles credit card and compare them.

There are some cappings in merchant category ranging from RM10k~20k spending, and total of RM200k spending per statement cycle, which shouldn’t be problem for a basic travel card.

However please keep in mind this card does have a 1% foreign transaction fees on top of the Mastercard exchange rate, if you factor that into the ROI it become about 0.6%, it’s important to keep this in mind when comparing to other cards that has 0% foreign transaction fees.

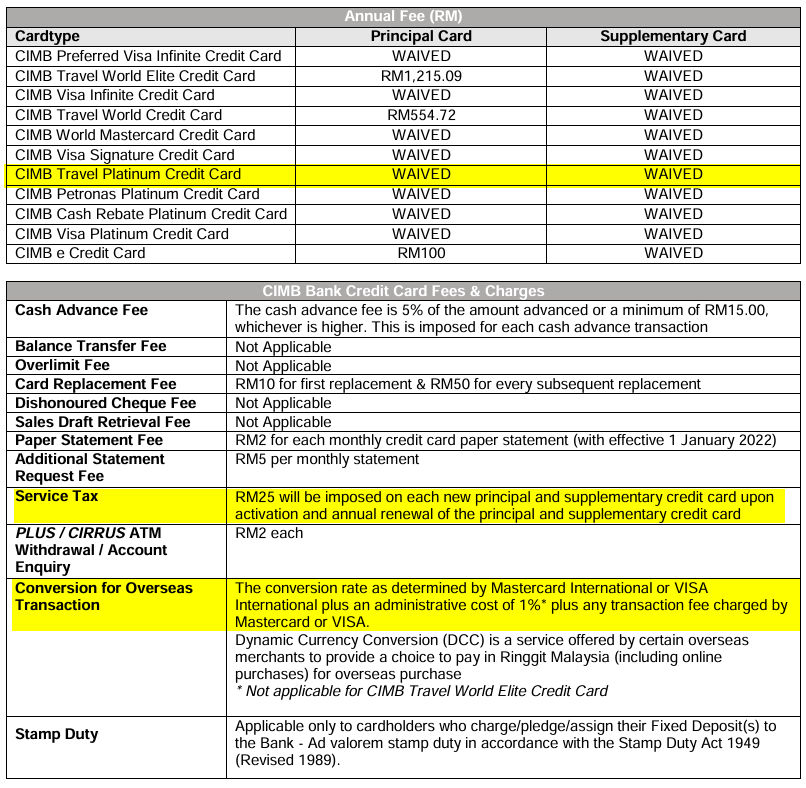

Annual Fees & Salary Requirement

As this is a basic card, the annual salary requirement is RM24000, that means it can be apply by any fresh grads with a salary from RM2000/month.

There are also zero annual fees for this card, it is a free for life credit card, but of course the RM25 services tax still needs to be paid every year.

Who Should Get CIMB Travel Platinum Credit Card?

This is a basic travel card that are suitable for anyone with a basic income that wants to start collecting airmiles with overseas spending, in fact most other airmiles credit card for overseas spending usually have higher salary requirement and annual fees.

However for local spending I’d recommend getting a cashback card first if you aren’t eligible for the higher requirement airmiles credit cards, for online ecommerce spending you can opt for Alliance Visa Platinum/Virtual.

The Grab promo code and Plaza Premium Lounge access will have expiry date, so unless you’re expecting to use that in a few months, if not, there are better cards for local spending, such as the UOB ONE Card.

I hope this post helps you in planning your credit cards for highest and relevant rewards, if you have any questions feel free to leave below, I’ll reply them whenever I see them!