Table of Contents

CIMB Preferred Visa Infinite Credit Card Intro

In this post we will talk about CIMB Preferred Visa Infinite credit card, which gain some popularity recently and people have been curious about what it offers, what is the requirement to apply and if the benefits are great or not.

As the name suggest, this credit card are only eligible for CIMB Preferred customers, so in this post we will talk about how to become CIMB Preferred customer as well.

Benefits & Air Miles Earning Rates

The reason this card became popular recently because they are having a campaign for the period of October 2024 until September 2025, which give bonus credit card points for overseas spending and local dining, and that is the main benefits we are going to talk about.

Within the campaign period you can earn bonus credit cards with below spending:

- Overseas spending: 2 point + 6 bonus points per RM1 spent

- Local dining: 1 point + 7 bonus points per RM1 spent

- Other spending: 1 point per RM1 spent (no bonus)

The overseas spending means transaction in foreign currency, which can be online spending as well, not necessarily physically spending at overseas, the points will be given based on the converted amount in Ringgit.

CIMB credit card points can be use to redeem air miles, physical goods and to use as cash for purchase at retail, but most people are going to redeem air miles because that usually has the highest value per points.

Redeem bonus points for air miles & hotels point

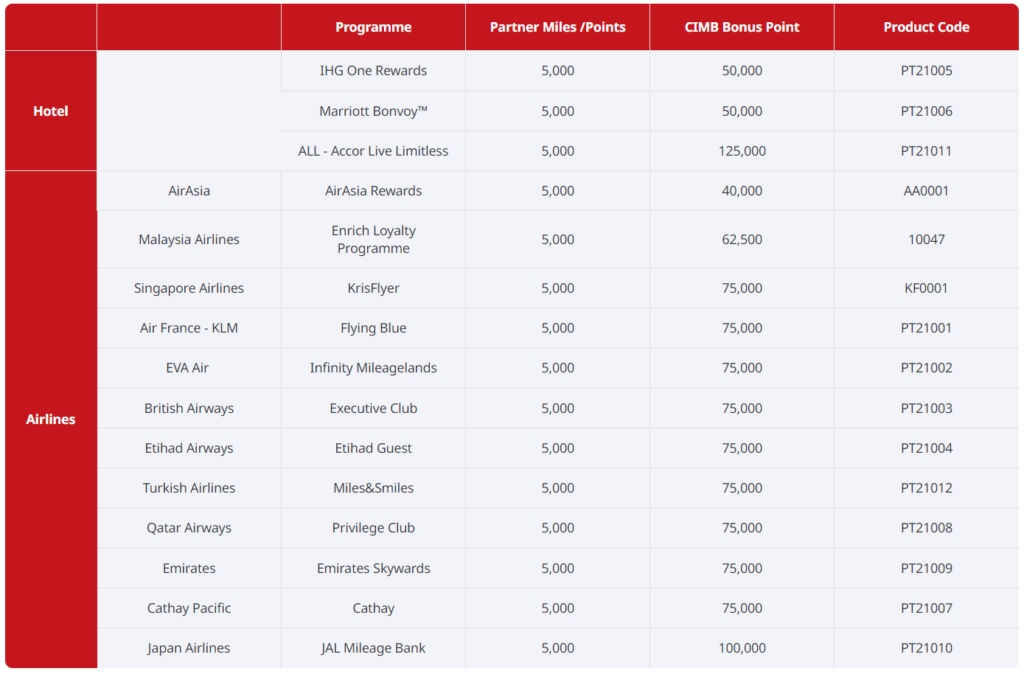

One great thing of the air miles redemption catalogue of CIMB is they have a lot of airlines miles available for redeem, which some may appreciate during a long vacation.

As usual we are going to calculate the earning rates based on Enrich miles, because it’s the main airline in Malaysia and it’s more likely to be utilize by more people than other airlines, and we always assign a value of 4 cents per Enrich miles for a normalized comparison of all cards.

From the catalogue we can see it cost 62500 bonus points to redeem 5000 Enrich miles, and here is our miles per ringgit and ROI calculation:

MPR = (points per RM1 spent) / (points needed per mile) = 8 / (62500/5000) = 0.64

ROI = (MPR * value per mile) = 0.0256 = 2.56%At 0.64 miles per Ringgit this card provide us a ROI value of 2.56%, this is when you spend it on overseas spending or local dining, it is not the best MPR/ROI for overseas spending, but we will look at the cost and requirement first to decide whether the card is worth considering.

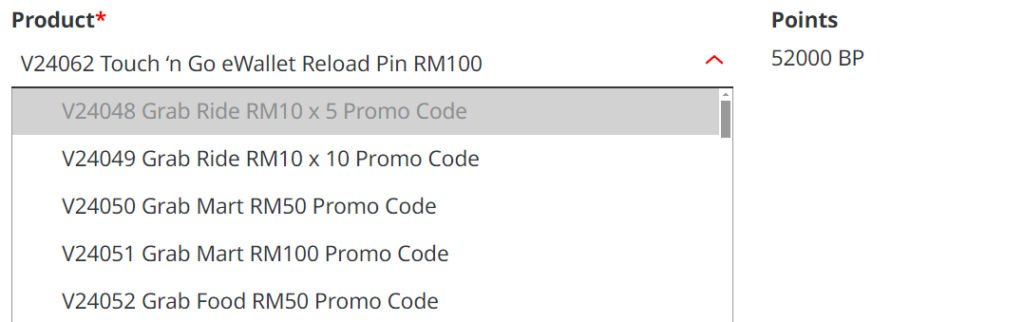

Redeem bonus points for everything else

Like every other bank, the credit cards point can also used to redeem other goods, such as gadgets, electronic appliances, e-voucher, annual fees & services tax discount, but usually these have lower value per points.

Take the TNG eWallet RM100 reload pin as example, it requires 52000 bonus point, which you will have to spend RM6500 to achieve, and the ROI is RM100/RM6500 = 1.54%, a much lower value than air miles option.

Using bonus points as cash with CIMB Pay With Points

As per the term an conditions listed on CIMB Pay With Points introduction page, you can only use the points as cash on participated merchants, and every 500 bonus points are equivalent to RM1.

You are require to spend RM62.5 for 500 bonus points and RM1 return for every RM62.5 spend is equal to 1.6%, similar to exchanging bonus points for TNG eWallet reload pin, but still significantly lower value than redeeming air miles.

Foreign transaction fees implications to ROI

When I use the term ROI, it doesn’t mean there’s a return on investment here, the more accurate term would be “return per money spend with this credit card”, but because the calculation is same, and it’s only meant to be a metrics to compare cards, so I just use the term ROI for simplicity.

Anyway, like every other bank, CIMB does impose a 1% fees on top of the Visa exchange rate for overseas spending, which means the true ROI after factoring the fees will be 1% less, for example the ROI for air miles redemption become 1.56% and the ROI for redeeming TNG eWallet become 0.54%.

This is the ROI you should use when comparing cards with different fees on foreign transaction, such as the TNG Debit Visa card that has 0% or the American Express card with 1.5%.

Other Benefits

Within the campaign period it will also include below benefits:

- 8X Plaza Premium First and Plaza Premium Lounges access (participated lounges)

- Free access to Flight Club Signature at KLIA Terminal 1

- RM80 cashback for in-flight wifi purchase

- Cheaper foreign exchange rates at CIMB currency exchange booth

- Travel insurance when you buy flight ticket with CIMB Preferred Visa Infinite card

The lounge access are pretty common in higher end credit cards, maybe it is important to some, but to me I think the more interesting benefits are the cheaper foreign exchange rates, so I look into it.

How cheap is cheaper foreign exchange rates?

For clarification this benefits are not limited to the card holder, it is available for all CIMB Preferred customers and are not part of the campaign, so it will always available, but let’s see if it’s really cheaper.

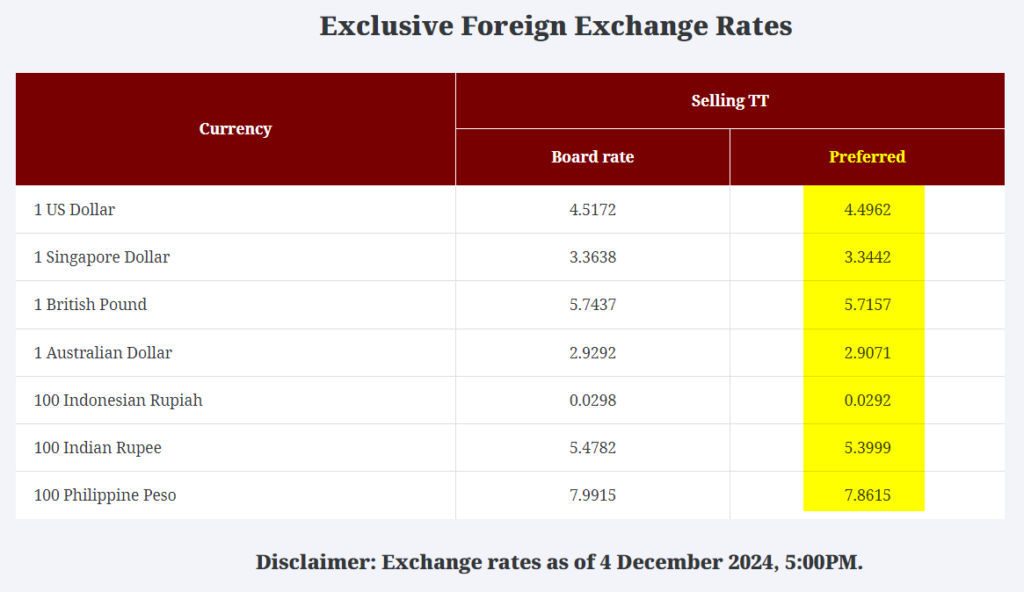

We will compare the exchange rates on the date 4th December 2024, we can see that US dollar are being sold at RM4.4962, Singapore dollar at RM3.3442, British Pound at RM5.7157 and AUD at RM2.9071.

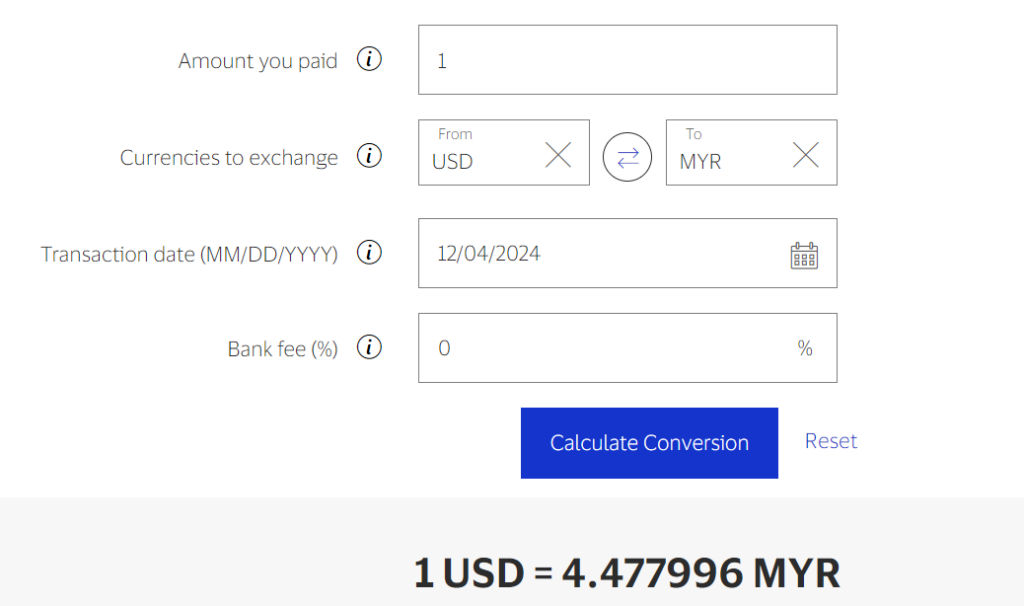

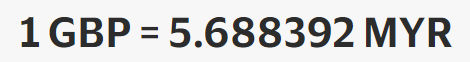

Now let’s assume we withdraw cash directly from overseas ATM machine from a Visa Card with no foreign exchange fees, just the Visa rate.

Based on the comparison it seems that CIMB does indeed offer a competitive currency exchange rate for CIMB Preferred customers, while the fees are slightly above Visa rate, keep in mind withdrawing cash from ATM at overseas even with a zero foreign transaction fees card will still incur some other cost and inconveniences.

For example the TNG eWallet debit visa card has zero foreign exchange fees, but because of the fixed fee of RM10 for overseas ATM withdrawal, it usually net off with the small difference, plus there will also be ATM fees imposed by the local banks, and withdraw limit per withdrawal from the ATM and TNG.

That however also doesn’t mean CIMB Preferred has the best exchange rate, for people that have assets in USD, the Charles Schwab One debit card offer zero foreign transaction fees and reimburse on every ATM fees.

Annual Fees and Eligibility to Apply

The CIMB Preferred Visa Infinite credit card are only for CIMB Preferred customers, and there is no annual fees, except the RM25 service tax per activated card.

Criteria to become CIMB Preferred customer

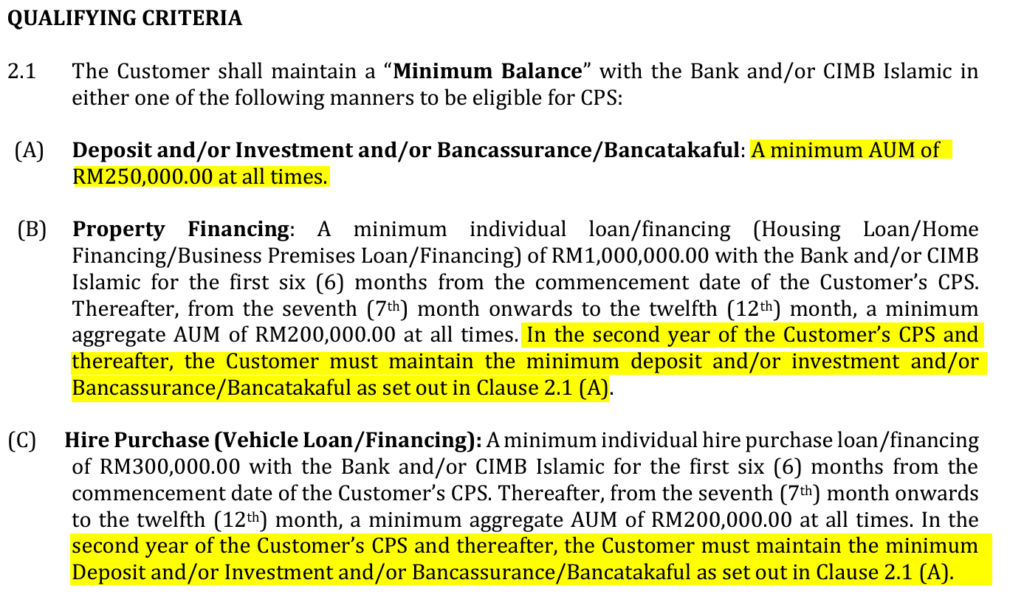

Based on the terms, you are required to maintain RM250,000 asset under their management, it can be fixed deposit or other investment products such as unit trust.

If you have a property loan above RM1mil or hire purchase or personal loan above RM300,000 you can also obtain the CIMB Preferred status, but on the second year onwards you will still need to maintain the RM250,000 AUM regardless.

Is It Worth Getting the CIMB Preferred Visa Infinite?

If you already maintain CIMB Preferred status with CIMB, then sure, apply for the card, there is no annual fees, so basically a card with some benefits but no additional cost to you.

However if you are not yet CIMB Preferred customers, but you are considering becoming one just to get the credit card, then I would say it is probably not worth it, because of the opportunity cost.

To elaborate on that point, most people think about getting CIMB Preferred with RM250,000 fixed deposit placement, but you will most likely end up losing more in opportunity cost than getting it back from all the CIMB Preferred benefits, especially when there is cards with better air miles earning rate but with lower cost to obtain.

Regardless how much RM250,000 is to your net wealth, a bad ROI deal is a bad ROI deal, unless you like to pay a premium for everything OR you really want that card with CIMB Preferred card for some other reasons…

Another valid reason you may apply for it is that you are actually wanting to invest more than RM250,000 in financial products offered by CIMB, then that is fine because this is just bonus with no additional cost to you, we will talk about CIMB financial products some other day in this blog.

Finally, thanks for reading my blog posts, if you have any questions or opinions feel free to leave a comments below, and I will reply as soon as I see it!