Table of Contents

Introduction

It’s been a while since my last post about travel credit cards. Today, I want to share about an incredibly useful debit card from Charles Schwab that’s available for international customers with a Schwab One Brokerage account.

Most of us already have our favorite travel credit cards, but we know not every place accepts card payments. This usually means exchanging cash before trips, often at money changers in shopping malls or airports where the rates aren’t great. That’s where this Charles Schwab debit card comes in – it’s changed how I handle cash during my overseas trips.

Main Benefits – ATM Fees Reimbursement & 0% Fees

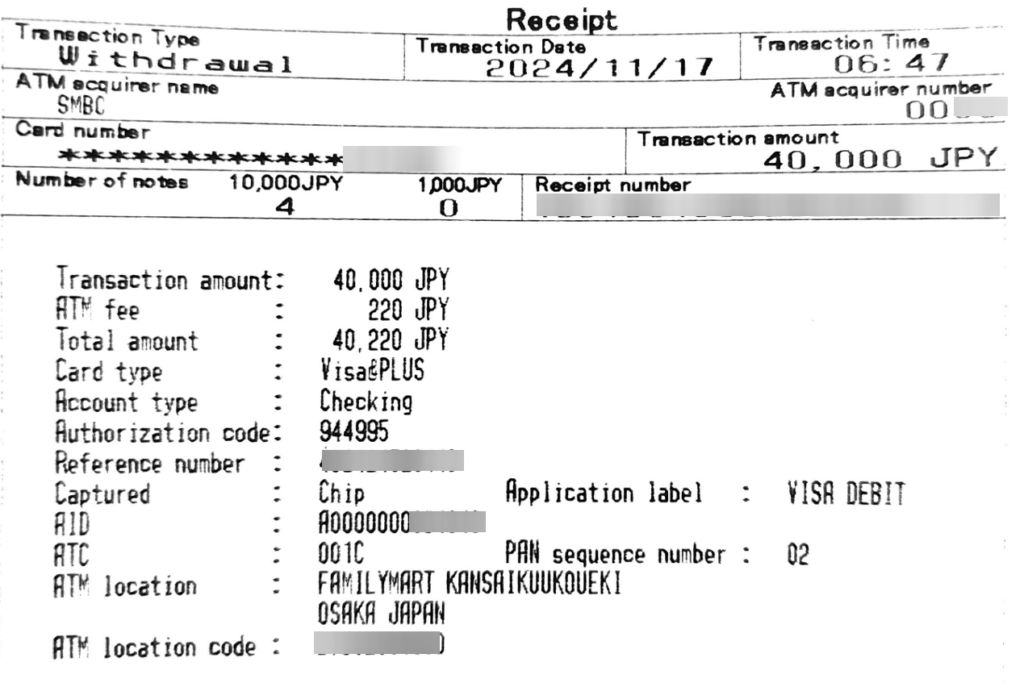

Ever since getting this card, I rarely exchange money before traveling. Instead, I simply withdraw cash from ATMs when I arrive at my destination. Here’s what makes this card special:

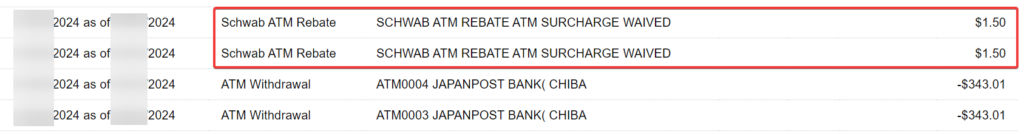

- No ATM fees worldwide – Charles Schwab reimburses all ATM fees

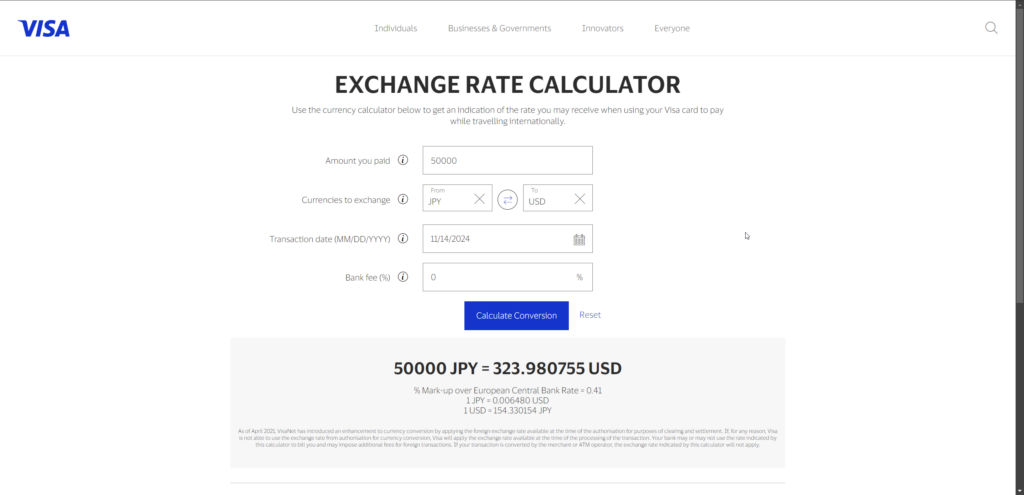

- Zero currency conversion fees – only pay Visa’s network rate

- No minimum withdrawal amount – take out exactly what you need

When using regular foreign cards at ATMs, we usually get hit with multiple fees. Your local bank charges ATM fees, your card issuer adds currency conversion fees, and if you’re using a credit card, you’ll face high interest rates for cash withdrawals. The Charles Schwab debit card eliminates all these extra costs.

Another great feature is the transparency in exchange rates. You can check exactly what rate you’ll get on Visa’s website (https://www.visa.com.my/support/consumer/travel-support/exchange-rate-calculator.html) before making any withdrawal. Unlike regular credit cards where you discover the final rate 2-3 days later, what you see on Visa’s calculator is exactly what you’ll get.

How to Apply

Getting started with Charles Schwab is surprisingly straightforward. There used to be a $25,000 USD minimum requirement, but this doesn’t appear on their website anymore. I’ve personally helped family members open accounts with much lower amounts without any issues.

The application process has two main steps:

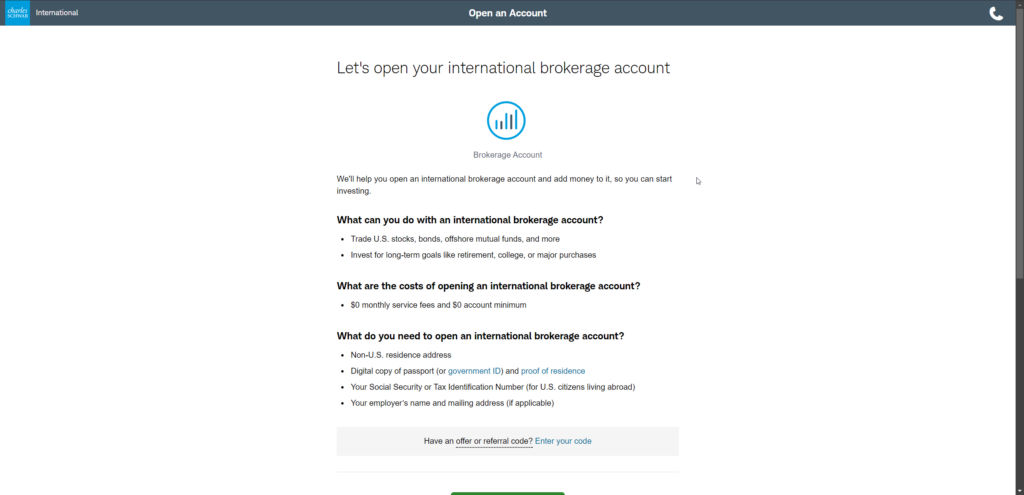

1. Open a Schwab One Brokerage account (https://international.schwab.com/)

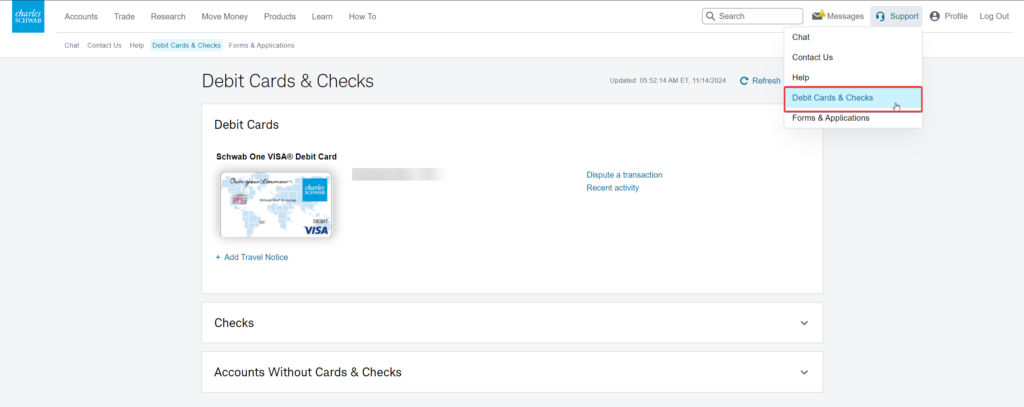

2. Request your debit card through the support section

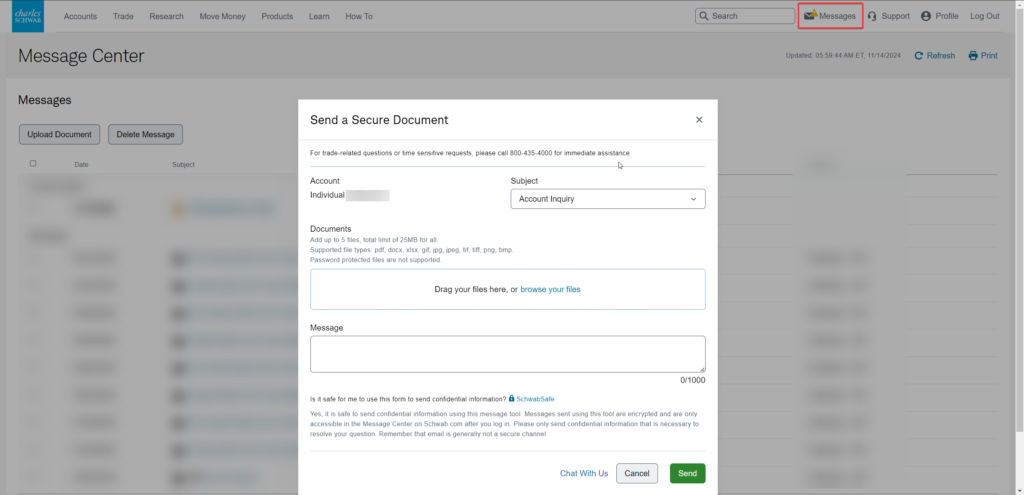

You’ll be asked to fill up a simple form, including the name you want to be appeared on the card, then you can upload via the message center.

*When using the card you may need to go back to the card section and put in a travel notice to let Schwab know where you’ll be using the card or they may reject card usage as theft prevention measurement.

Important Considerations

Before applying, here are some key points to think about. Since Charles Schwab is a US brokerage, your account will be in USD. This makes it particularly suitable for people who:

- Already invest in US stocks

- Plan to start investing in US markets

- Are comfortable with USD currency exposure

If you’re not planning to invest in US assets, you might want to explore other options for your travel needs.

My Personal Experience

For me, this card makes perfect sense as I already invest in US stocks through Interactive Brokers. Opening this account gave me an opportunity to diversify my portfolio across different SIPC-insured brokerages while gaining a fantastic travel tool.

My typical routine when traveling is simple – I make sure to have some settled funds in the account before my trip (basically sell whatever amount I plan to withdraw 1~2 days before), then withdraw cash as needed at my destination.

Since there are no ATM fees to worry about, I can make multiple smaller withdrawals instead of carrying large amounts of cash.

Final Thoughts

While this solution might not be for everyone, it’s been incredibly valuable for those of us who invest in US markets and travel internationally. The combination of zero ATM fees and transparent exchange rates has made managing travel expenses much simpler.

If you’re interested in applying or have any questions about my experience with the card, feel free to drop a comment below.

I know this won’t always be the case because it’s not sustainable for GX, but right now their debit card has no foreign transaction fee, no withdrawal fee worldwide, and 1% cashback for overseas spend.

Also, keep it up! I like your posts

Thanks, yes GXbank does offer 1% cashback, but the 1.2% foreign transaction fees are waived until 31 Dec 2024, which means next year it will be visa rates + 1.2% (fees) – 1% (cashback)

TnG eWallet Visa also offered 2% cashback and no foreign transaction fees, but will also end by this year, but next year it will still be visa rates + no fees, making it slightly cheaper than GXbank.

Charles Schwab debit card are good ONLY if you already had investment in USD, and need to use cash in overseas.

I’ll see next year when both campaign end if there’s any extension or new campaign and make a post about it!

Before GX and TnG came into the scene, I used OCBC’s 0% foreign transactions fee debit card, guess I’ll switch back to that now that the party is over. But I am considering opening that Schwab One account since I do have USD investments.