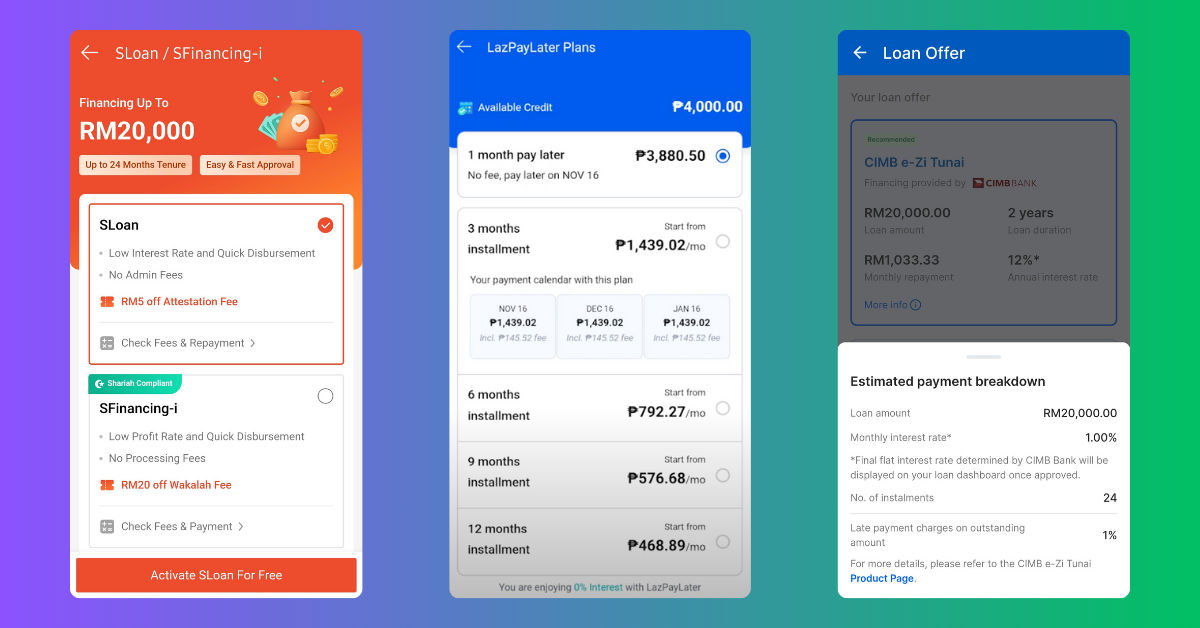

Recently Shopee apps tried to push their new financial products to me, which is their short term financing services SLoan, it’s marketed as “low interest rate”, so I decided to take a look but found out it’s actually a financial trap.

Shopee SLoan / SFinancing-i

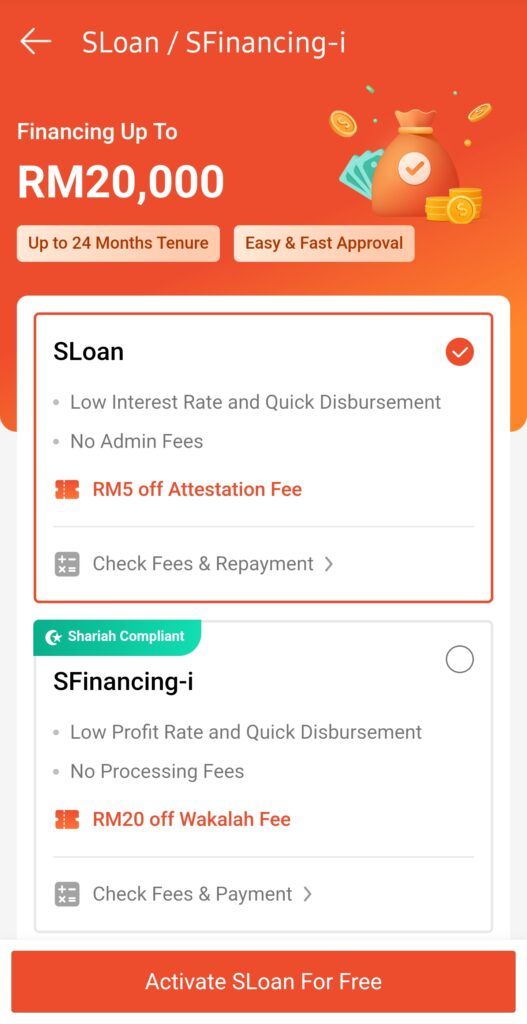

Let’s take a look at the actual loan offer from Shopee, we’ll use the default RM20,000 amount and 24 months tenure.

The interest rate is 1.5% per month or 18% per year, that is nothing about low interest rate, in fact, based on Malaysia Law, Hire-Purchase Act 1967 the lending rates of credit card loan is 18%, you are getting maximum credit card loan interest rate market as “low interest rate”, how nice!

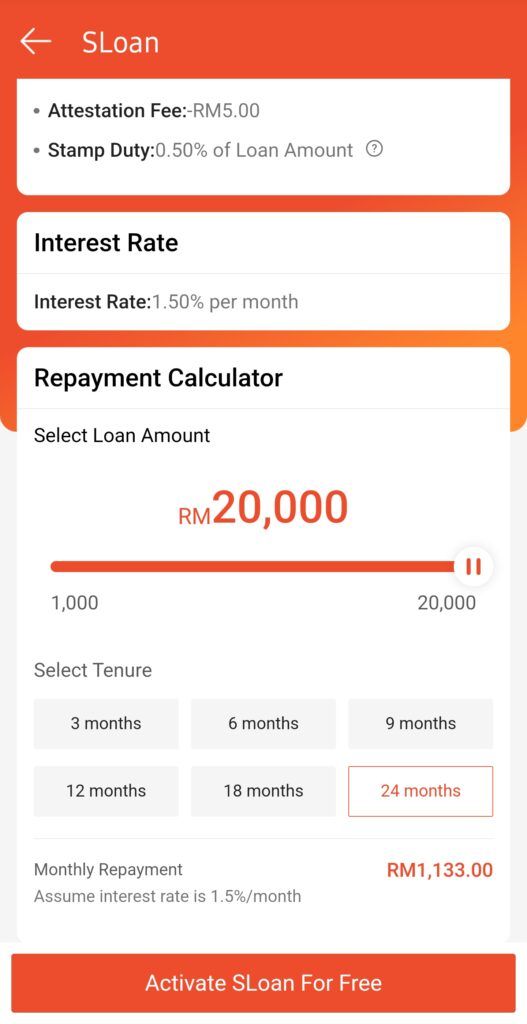

What about Shopee SPayLater (BNPL)?

Let’s take a look at the buy now pay later option for a RM579.01 purchase on Shopee using SPayLater with 12 months tenure:

RM56.93 * 12 = RM683.16 (Total Payable)

RM683.16 / RM579.01 = 1.179876 ≈ 18% Interest RateAs you can see, the buy now pay later option from Shopee SPayLater is basically offering short term loan at the same maxium interest rate of 18%

BUT, I would like to point out the 3 month option offered by SPayLater with “0% installment” label are indeed 0% interest, which is actually a good offer, remember not all loan is bad, loan with zero interest or below risk-free rate are usually good loan if you can use it to your advantage.

TNG eWallet Cash Loan (Touch ‘n Go)

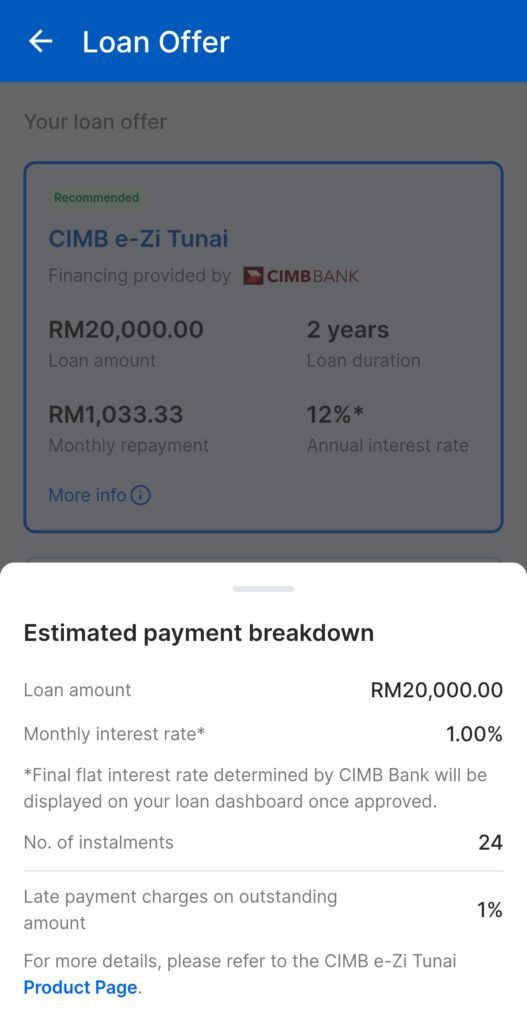

Since we are at it, let’s also take a look into short term loan by other fintech company, ewallets & ecommerce. TNG also offer cash loan by CIMB in their ewallet, we’ll use the RM20,000 and 2 year tenure offer as example.

The monthly interest rate is 1% or 12% per year, it’s lower than Shopee but again, this is definitely not a low interest rate loan, in fact the interest rate are still incredibly high, especially when you convert the flat interest rate into effective interest rate, which we will talk about it later.

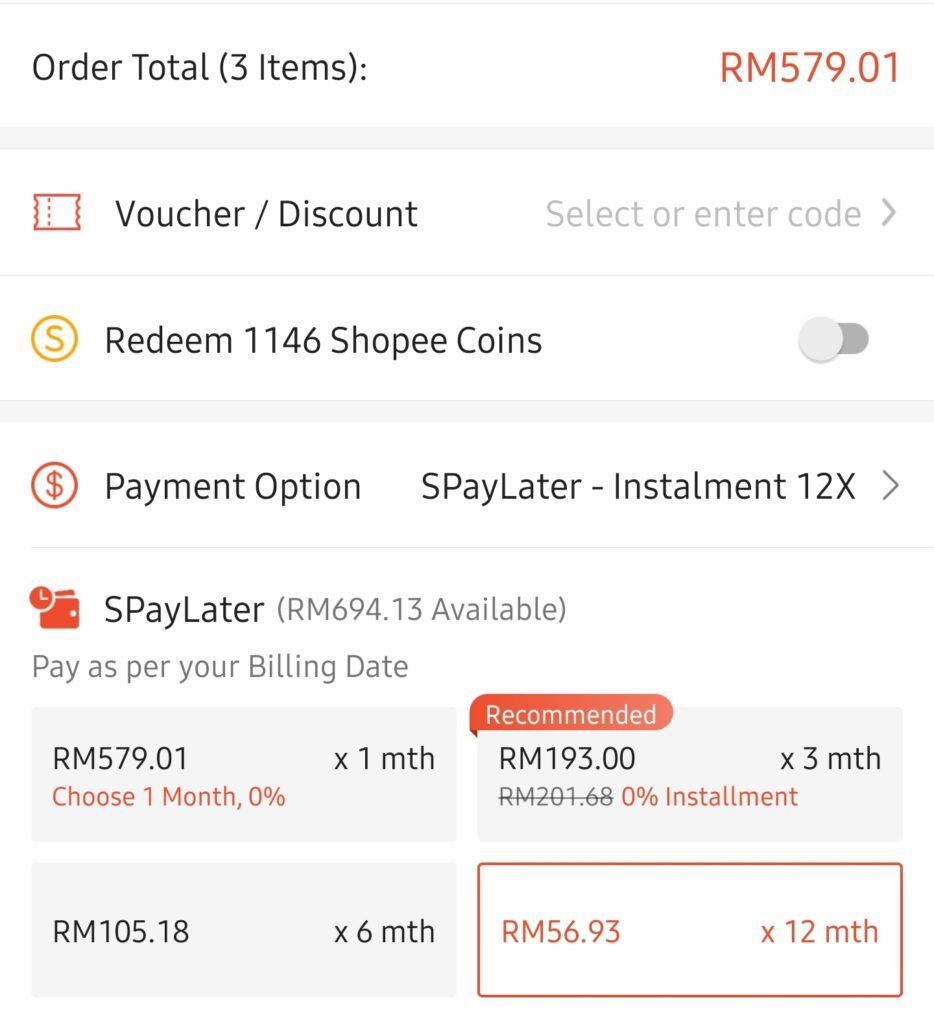

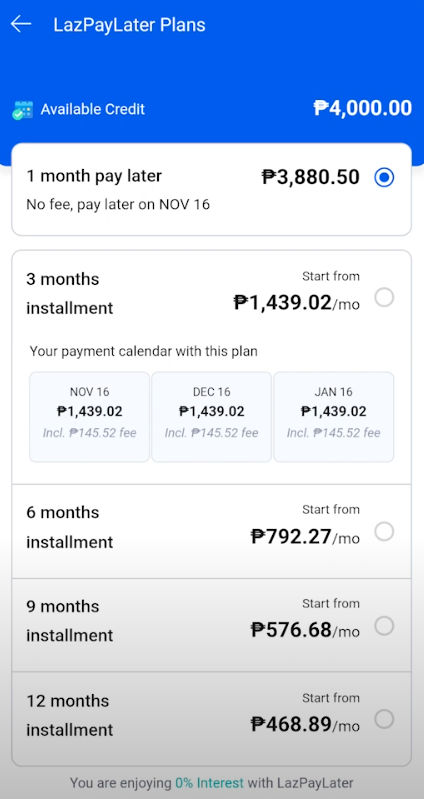

Lazada LazPayLater

Unfortunately I didn’t signed up for LazPayLater nor have the intention to, but here’s a LazPayLater screenshot I found from Philippines Lazada, the financial law are different, but nevertheless it will help you to understand what kind of loan these company would offer when the maximum interest rate by law is higher or not limited.

468.89 * 12 = 5626.68

5626.68 / 3880.50 = 1.45 ≈ 45% Interest RateBased on how they offer their rates in other operating country, it’s safe to assume they aren’t running charity and it is very likely they will just offer a similar rates to Shopee, or interest rate as close as the Malaysia law allows 18%.

Other Short Term Loan / BNPL (Grab, Boost, etc..)

While I do not have plans to look into every platform that offers short term loan or buy now pay later scheme, it’s safe to assume there’s a reason why every fintech and ecommerce company rush into this financial market offering loan, that’s because there’s crazy profit to be made.

Deceptive marketing practices on loan offers

The point of this blog post is to inform everyone to be aware of these short term loan, especially not to get tricked by deceptive marketing that tries to market a maximum financing product into a “low interest rate” loan.

It is quite disappointing our government did not do anything to educate citizens about these predatory loan offer, and allow use of deceptive marketing tactics by all these company.

In my opinion, there should be a guidelines that requires all these loan offerings to be as honest and transparent as possible, for example, Shopee can continue to offer the maximum interest rate of 18% if there willing to remove the “low interest rate” label and add a disclaimer “We offer loan at maximum interest rate by law”.

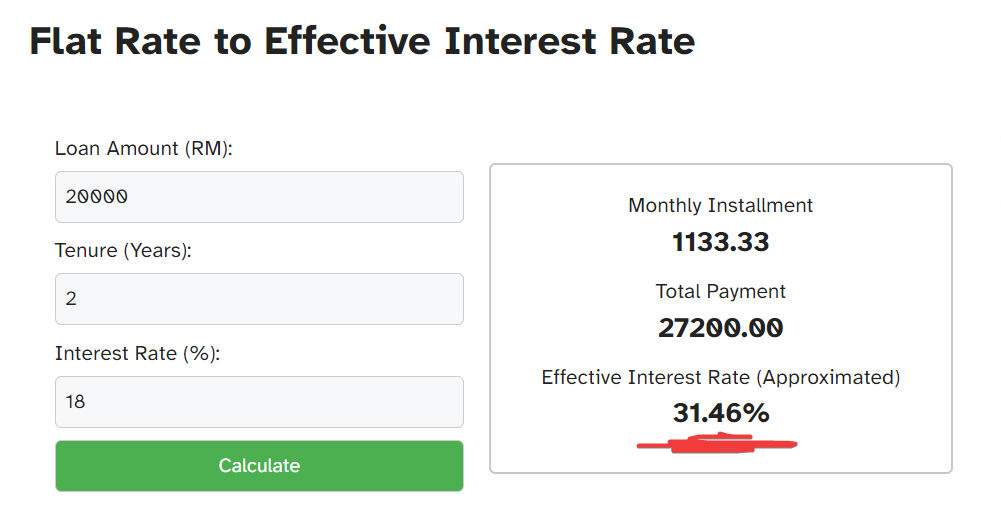

The deceptive nature of Flat Interest Rate

I have talked about flat interest rate in my previous posts, and I even included a flat rate to effective interest calculator on my website. Before I explain why I think flat interest rate are deceptive, let’s calculate the effective interest rate by Shopee SLoan.

The effective interest rate of 18% flat rate are 31.46%, and that is crazy amount of profit for the lenders, to give you some perspective, the effective interest rate of a housing loan as of writing is only around 4~5%

It’s understandable uncollateralized will have highest interest rate, because lenders would need to cover the loss of a default loan by profit from other loans, but 31.46% is just crazy.

So what’s flat rate and effective interest rate? I’ll try to explain this as short as possible if you do not plan to read my previous post.

With flat rate, you’re paying for interest on the loan that are partially repaid, effective interest rate calculate the actual interest rate based on loan that are unpaid only, also known as amortized loan.

With amortized loan, the interest payable on every tenure is based on the actual outstanding loan, which is the loan still in effect, which in my opinion is more reasonable and sensible, I only pay fees on loan that I’m actually using.

Closing thoughts

Again I’d like to remind everyone not all loans are bad, in fact I love “cheap loans”, I’d even argue loans that have low interest fees or no interest fees are the only free lunch in financial market.

In fact many successful company and people build their wealth by leverage low cost loan, they can even negotiate for a much lower cost loan than regular people have access to.

That’s why when I buy from Shopee, I’ll often choose the 0% interest 3 month installment option, or my credit card 0% installment plan, or any 0% balance transfer.

What do you think about this post? Did I missed anything that you think it’s important? Please leave a comment to let me know and I’ll make correction!