Alliance Bank used to offer three of the best credit cards for air miles: the Visa Infinite, Visa Platinum, and the Visa Virtual. Unfortunately, good things don’t last long. This month, they imposed a limit on how many air miles can be earned per month.

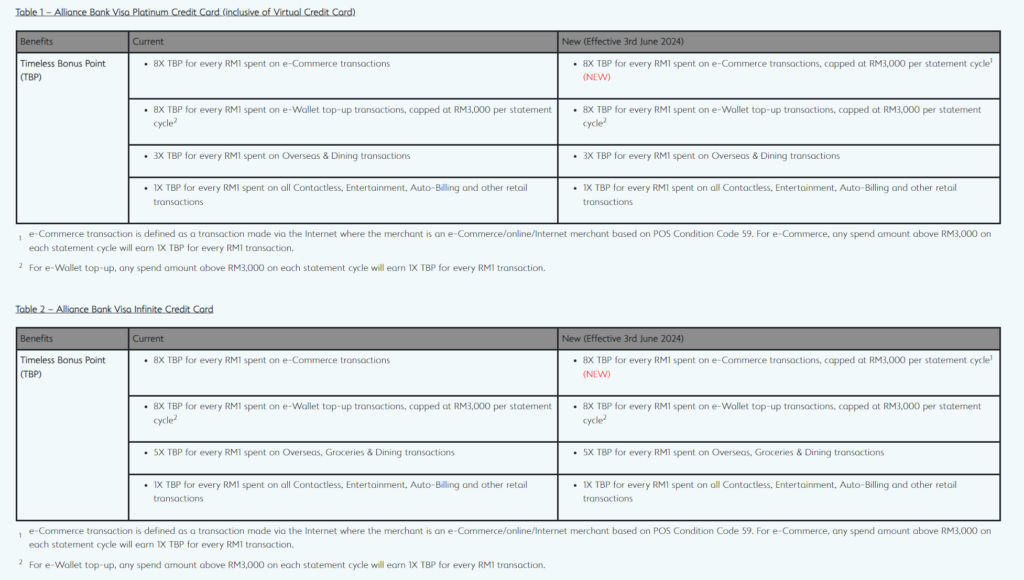

According to their official announcement posted on May 12, 2024, all three credit cards now have a cap of RM3,000 for online e-commerce spending. This means only the first RM3,000 you spend will be rewarded with 8X Timeless Bonus Points; any amount above that will only earn 1X TBP.

This new changes are quite disappointing, because it means now if you purchase larger item such as a new iPad Pro 13′ that released this month with a starting price of RM6,799 you within a single transaction, you will only earn 27,799 TBP, which equals to 1853 air miles, or only 0.27 miles per ringgit spent.

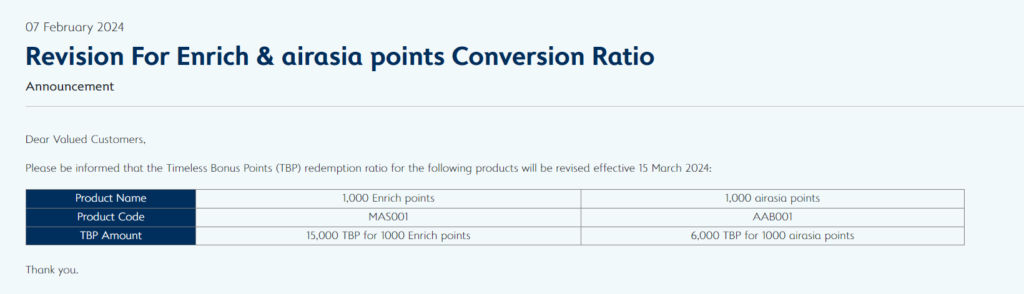

Previous Revision to Air Miles Redemption

During February, they also devalued the Timeless Bonus Points by increasing the points required to exchange for air miles by 50%, from 10,000 TBP for 1,000 air miles to 15,000 TBP for 1,000 air miles.

Unfortunately, I wasn’t aware of this announcement and left a large sum of TBP in my account.

Is It Time to Cancel The Credit Card Yet?

If you possess all three credit cards from Alliance Bank affected by the changes, which I do, you’ll need to check if your online e-commerce spending exceeds RM12,000 per year. If it does, you can still keep all the cards, just ensure you spend at least RM12,000 on the Visa Infinite to avoid the annual fee of RM438.

If your spending is below that, you might consider canceling the Visa Infinite card but keeping the Visa Platinum and Visa Virtual. Together, they still provide a combined spending limit of RM6,000 per month or RM72,000 per year to maximize the TBP rewards.

Don’t Cancel the Visa Virtual Credit Card

I strongly recommend keeping the Visa Virtual credit card, primarily because it is free for life without annual fees (except for the RM25 SST imposed by the government). It is very handy to have different credit card numbers for different use cases, especially when making purchases on smaller websites, as you can set an available limit to prevent being overcharged.

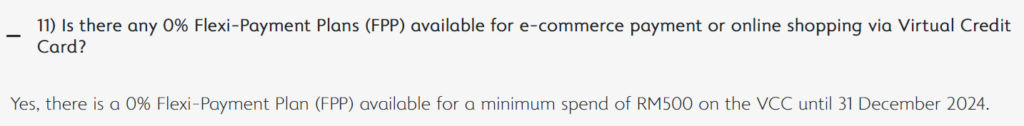

Additionally, it offers one of the best 0% Flexi-Payment Plans (FPP) available for any purchase above RM500 until the end of 2024.

In fact, I believe this 0% FPP alone is better than the air miles reward if you understand how to utilize this campaign. You can read my post on balance transfers to learn how I utilize the 0% interest capital effectively.

Conclusion

Overall, while the recent changes to Alliance Bank’s credit cards have made earning air miles more challenging, there are still valuable benefits to consider.