Table of Contents

Changes Coming to EPF (KWSP) Retirement Account

If you’ve been employed as a salaried worker, you likely have two EPF accounts under your name with the KWSP. The EPF (Employees Provident Fund) is a retirement savings account contributed to by both you and your employer as part of your salary.

Beginning May 11, 2024, if you’re below 55 years old, a new EPF account with the KWSP will be added, bringing the total number of accounts to three.

- Account Persaraan: Formerly known as Account 1, this serves as a repository for savings intended for retirement.

- Account Sejahtera: Formerly known as Account 2, it is tailored to address various life cycle needs.

- Account Flexible: Offering flexibility for short-term financial needs, savings in this account can be withdrawn at any time. (The new account)

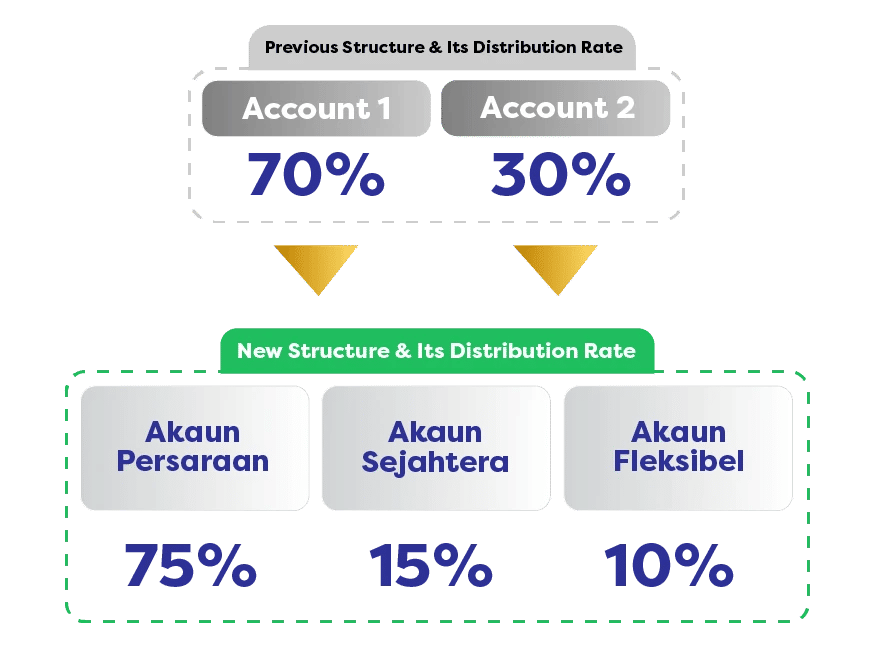

Previously, your monthly EPF contributions were allocated with 70% going into Account 1 and 30% into Account 2. However, following the changes, it will be allocated as 75% into Account Persaraan, 15% into Account Sejahtera, and 10% into Account Flexible.

For example, if your monthly EPF contribution is RM1,000, then RM750 would be allocated to Account Persaraan, RM150 to Account Sejahtera, and RM100 to Account Flexible.

My Opinion On The New Account Flexible

The key feature of the new EPF Account Flexible is that you can now withdraw money from it at any time, without any requirements. This is unlike Account 1 (Account Persaraan) and Account 2 (Account Sejahtera), where specific ages or criteria must be met before accessing the funds.

For me, having the ability to access my own funds and manage them myself is always a positive aspect. It allows me to choose whether to deploy the funds into different investment vehicles that align with my portfolio strategy.

For example, since I’m still young and have a long time horizon for investment, I have a higher risk appetite. Therefore, I can choose to deploy such funds into an index fund with a better risk-adjusted return and have more time to let it play out.

BUT let’s be honest, the introduction of the new EPF account is largely due to many people requesting access to their retirement funds earlier, not necessarily for positive reasons, but because they are facing financial hardship today. This poses a significant issue, as it could result in many future retirees retiring with much less savings, potentially creating a greater burden for society.

Regardless, let’s refocus on how we can take advantage of the newly accessible retirement funds, with the hope that we can all be better off in the future.

Withdraw 33% From EPF Account Sejahtera (Account 2)

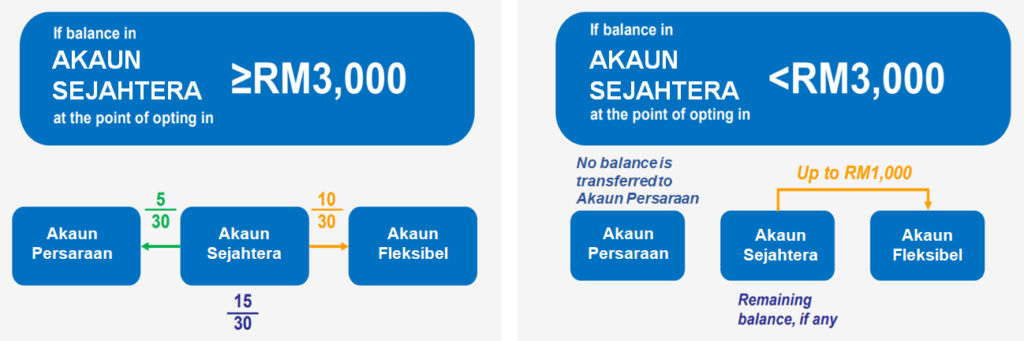

Another important change coming with the new Account Flexible is that during the initial phase, you can apply to have one-third of your existing balance in Account Sejahtera transferred into Account Flexible.

In other words, you would immediately gain access to approximately 10% of your existing EPF account savings. Let’s take a look at your EPF account now to see how much that is!

How To Apply For The Initial Transfer from Account Sejahtera?

According to KWSP website info:

To initiate this one-off transfer, you can apply through the KWSP i-Akaun app, or you may also visit any EPF offices to apply through the Self-Service Terminals (SST) starting from 12 May 2024.

KWSP

So basically, just make sure you have the app set up with your account linked to your EPF and wait for the update on May 12, 2024.

Some Rumors About EPF Account Flexible

There are rumors suggesting that the annual interest rate of Account Flexible will be lower than that of Account Persaraan and Account Sejahtera. However, this has not been verified by KWSP, and in my opinion, it is not likely for this to happen.

Regarding using Account Flexible like a regular bank savings account but with a higher interest rate, information about whether you can deposit funds into this account is not readily available. We may have to wait until May 11, 2024, to confirm this. However, if this turns out to be the case, many bank savings accounts may become less competitive compared to the KWSP EPF Account Flexible.