Recently I received a fund of RM200,000 after disposing one of my property, and coincidentally I wanted to buy some US stock during a dip.

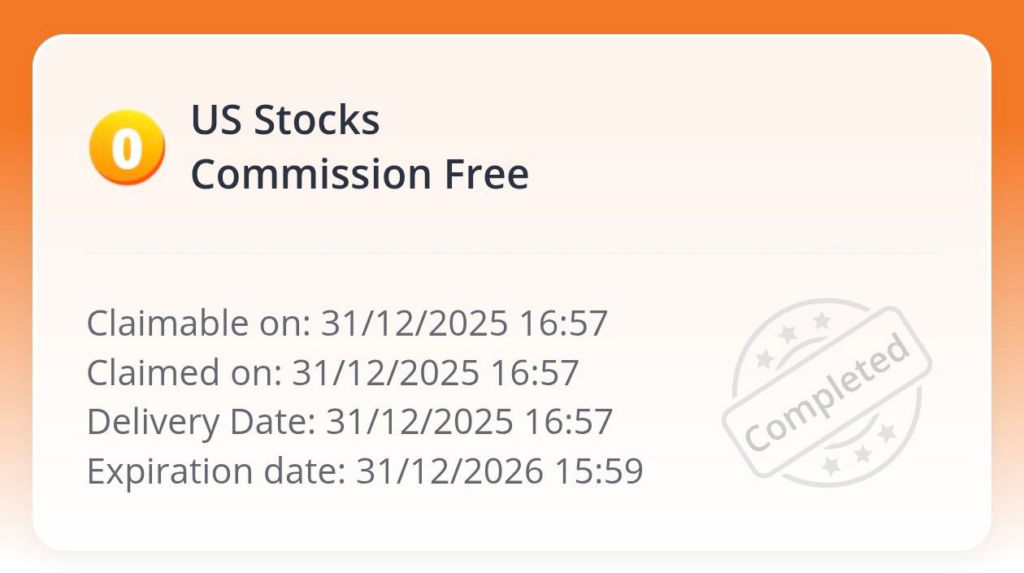

As I expect this to be a short term play and my Webull account still has a commission free voucher for the entire 2026, I decided to save myself some hassle and not use IBKR for this purpose.

However, I still want to be sure I’m not paying for outrageous fees for trading US stock and especially for the currency conversion between USD and MYR, so I made some calculations and comparing it to Moomoo MY.

Currency Conversion Fees

This is the rate I am getting on 31 Jan 2026 on both Webull and Moomoo for RM200,000.

| Moomoo | Webull | |

| from MYR | RM 200,000 | RM 200,000 |

| to USD | $ 50,369 | $ 50,540 |

| back to MYR | RM 197,436 | RM 198,223 |

| Roundtrip Loss | -1.28% | -0.89% |

Apparently Webull is much cheaper than Moomoo for currency conversion with a roundtrip exchange totaling less than 1%, here’s a detailed breakdown.

| Moomoo | Webull | |

| USD Sell Rate | 3.970713605 | 3.957261575 |

| USD Buy Rate | 3.919799328 | 3.922099921 |

| Spread | 1.30% | 0.90% |

| Wise Mid Rate | 3.942 | 3.942 |

| Sell Spread | 0.73% | 0.39% |

| Buy Spread | 0.57% | 0.51% |

Seems like Moomoo has a higher premium on USD selling, I am saving about RM787 or 0.39% with Webull in this case, but we will also look at the trading fees just to be sure.

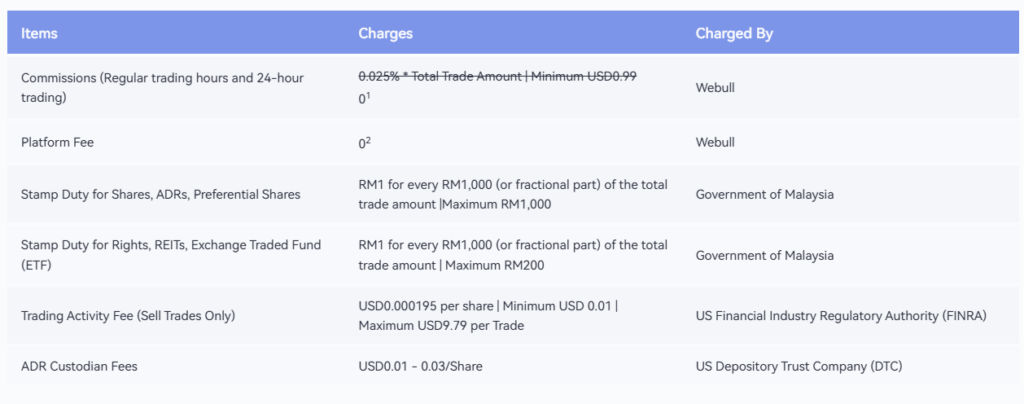

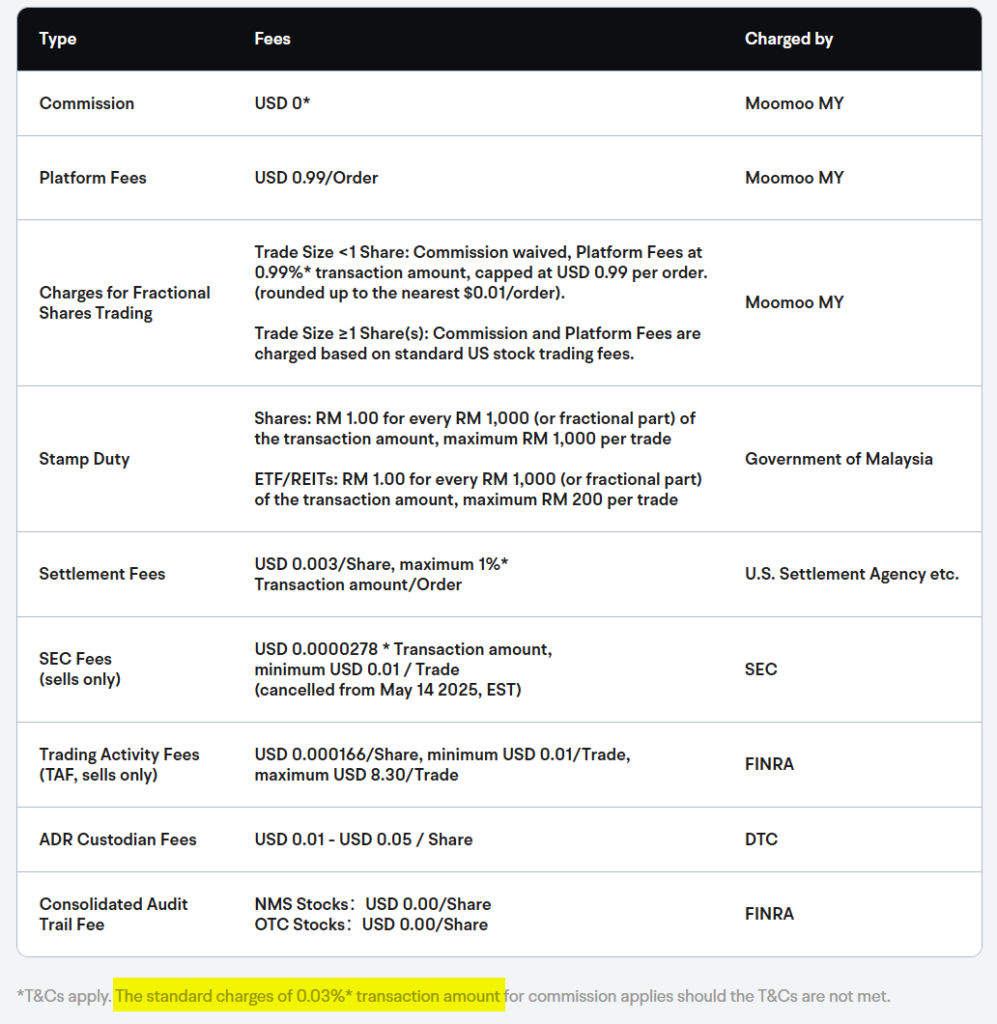

Commissions and Trading Fees

I checked the pricing page on both Webull and Moomoo and here’s their fees:

The comparison here is quite clear and simple, considering that I would be using limit orders on a highly liquid stock, the execution flow and quality is less of my concern here.

Stamp duty is a big one, but since they are charged by Malaysia government on any licensed brokerage in Malaysia, they can be removed from my comparison here.

So really the only fees are the commissions and platform fees:

| Webull | Moomoo | |

| Comission | 0.025% | 0.03% |

| Platform Fee | 0/order | 0.99/order |

| Trading Fees per Share (Sell) | $ 0.000195 | $ 0.000166 |

| 2000 Stock @ $25 Fees | $ 12.89 | $ 15.33 |

Again they are very close here, but still Webull win slightly in the lower commissions and 0 platform fees at this moment, the trading fees are charged by FINRA but they are negligible for the size of my order.

What I chose in the end

So with that in mind, obviously Webull Malaysia is cheaper right now with lower currency conversion fees and commissions and most importantly I have a commission free voucher that last for the entire 2026 year.

Moomoo does provide commission free voucher for new signups too, but it only last 180 days and I am not new sign ups.

I have no idea how I obtained the Webull voucher but it seems to be given to me automatically without me participate in any promo campaign, this is not the voucher from signups which I already received previously and expired.

Webull also given me a voucher for their moneybull (MMF products) that give bonus APY for up to 6% until March, so this becomes an obvious choice for me right now.

PS: Keep in mind I am expecting to pay at least RM400 in the stamp duty for a roundtrip of buy and sell of the stock, the 0.1% stamp duty of local brokerage make it unfavored for frequent trading, but for typical buy and hold case it is probably still fine.

More Conversion Comparison

So I made the conversions on 2 Feb 2026 and I want to compare it again with Moomoo using the actual amount I have converted from Webull.

| Moomoo | Webull | |

| from MYR | 200,000 | 200,000 |

| to USD | 50,338 | 50,450 |

| back to MYR | 197,181 | 198,174 |

| Roundtrip Loss | -1.41% | -0.91% |

Looks like the rate is slightly worse compare to two days ago, I should’ve convert it early, but while the spread on both platform is higher today, Moomoo is more worse today, there’s an extra 0.51% of spread from Moomoo compare to Webull, which was 0.40% 2 days ago.

| Moomoo | Webull | |

| USD Sell Rate | 3.973119463 | 3.96430068 |

| USD Buy Rate | 3.91711298 | 3.928099875 |

| Spread | 1.43% | 0.92% |

| Wise Mid Rate | 3.942 | 3.942 |

| Sell Spread | 0.79% | 0.57% |

| Buy Spread | 0.64% | 0.35% |