Table of Contents

Benefits of Visa Infinite Credit Card

Most people would think higher tier credit cards like Visa Infinite require high income and come with hefty annual fees, or annual fee waiver program that require to spend ridiculous amount, but there are Visa Infinite credit cards that are easy to apply and with no annual fees too!

These credit card without annual fees are usually known as “free for life” cards, but they are less popular because they don’t usually come with attractive points rewards, cashback or air miles rewards like those credit cards with annual fees.

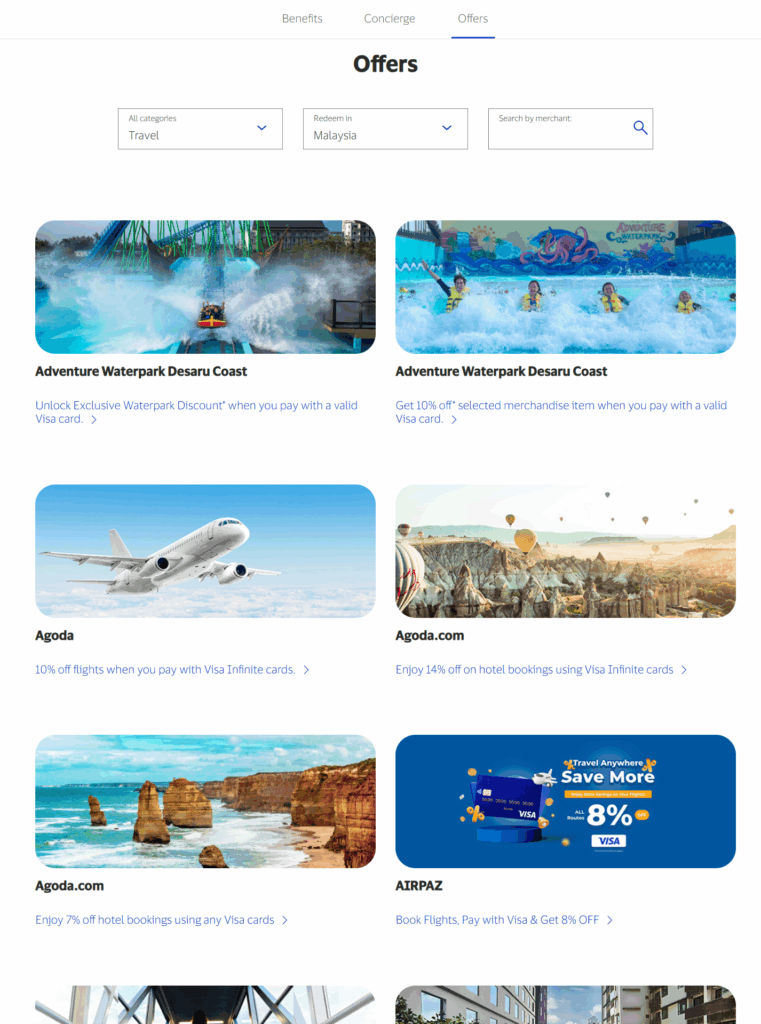

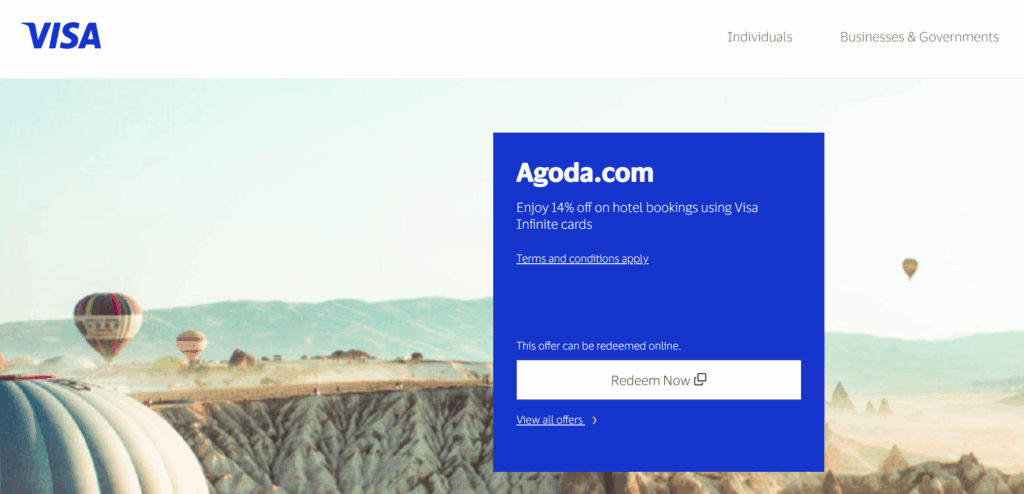

However if you do not have any other Visa Infinite cards yet, these Visa exclusive deals are the benefits why you might want to consider getting a “free for life” visa infinite card, as Visa Infinite get you access the best deals.

For example, I have made close to hundred of bookings from Agoda using Visa Infinite in the past few years, using Visa Infinite has given me access to discount of up to 14% off, compared to 7% with just regular Visa.

Best Free For Life Visa Infinite Credit Cards

Only those explicitly stated free for life without conditions will be recommend here, those with waiver program are not really free for life.

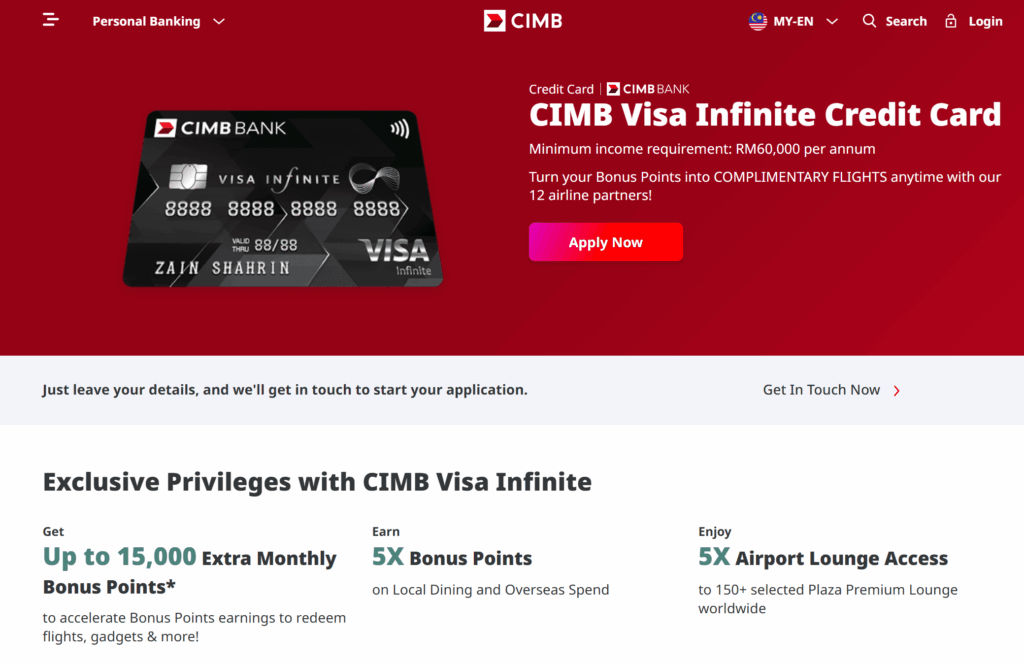

CIMB Visa Infinite Credit Card

With an annual income requirement of just RM60,000 CIMB Visa Infinite is one of the easiest to obtain Visa Infinite in Malaysia, and it’s truly free for life without annoying spending conditions.

It provides 5 points per ringgit on overseas spend and local dining, and based on the air miles redemption table from CIMB, this means 0.4 Enrich miles per ringgit, or about 1.6% cashback equivalent of miles.

However keep in mind for foreign currency there will be an extra 1% charge on top of Visa rate, which is common for most Visa card from local bank, but this make it not an ideal card for overseas spending, for local dining it’s fine.

It also give lounge access but with spending conditions of RM60,000 per year, which in my opinion is not an important feature that worth pursuing.

Personally I do own this card after I cancelled my Alliance Bank Visa Infinite since their revision in July 2025, and the main purpose of this card is just to help me unlock the 14% Visa Infinite discount on Agoda, and occasionally take advantage of 0% balance transfer or 0% IPP installment plan offered by CIMB.

HLB VISA Infinite Credit Card

The minimum annual income requirement for HLB Visa Infinite is RM100,000 while it’s slightly higher than CIMB it’s still relatively lower threshold than the average Visa Infinite cards, and yes it’s free for life without conditions.

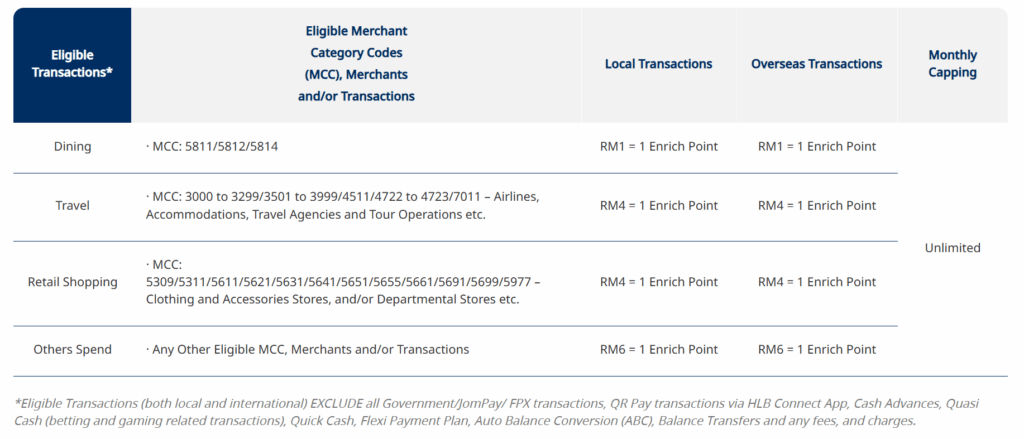

Unlike CIMB Visa Infinite this card are actually good for accumulate Enrich air miles, for both local dining and overseas dining you get 1 Enrich mile per ringgit spend, which is about 4% cashback equivalent for local dining.

Other local spending within travel and retail categories are not too bad either, with 0.25 Enrich mile per ringgit spent that is 1% cashback equivalent.

However keep in mind card like this not worth pledging RM30,000 in fixed deposit to apply, you are losing at least 5~7% in opportunities cost which is unlikely for you to make up from the benefits.

Public Bank Visa Infinite Credit Card

The minimum annual income requirement for this card is RM100,000 as well, but are less attractive than the one from Hong Leong Bank because none of the offer really stand out.

The MegaBonus cashback is capped at RM80 per statement, and when you consider Public Bank charge 1.25% on top of the Visa exchange rate, the real cashback is actually just 0.75%, much lower than the 2% cashback from TNG Visa debit card as of writing.

(Yes, Public Bank charge higher than other bank for conversion fees at 1.25% instead of the common 1% of other bank’s Visa credit card.)

The lounge access required RM1,000 monthly spending before you visit the lounge, it’s fine but again in my personal opinion lounge benefits are not so important, there’s too many card that give lounge access.

You also get travel insurance when you use it to purchase flight ticket, it provides up to RM500,000 for death or permanent disabilities but it doesn’t state any coverage for medical expenses, so I would still recommend to buy a comprehensive travel insurance.

AmBank/AmBank Islamic Visa Infinite Credit Card

This card require an annual income of RM120,000, and it’s free for life as well.

Nothing really stand out from this card with the higher annual income requirement make this card highly unattractive at the moment.

Overseas spending get you 5 points, which you can convert for 0.5 Enrich mile (or 0.25 Krisflyer mile), but with the 1% conversion fee, the real value is only 1% cashback equivalent of miles.

Again TNG Visa Debit still offer 2% cashback with no conversion fees as of writing this post, and it’s cash not miles, which is always better than miles when the value is same or higher.

AmBank 0% balance transfer are also lower value compared to other bank, it only offers 6 months instalment and capped at RM15,000 limit.

Overall there is no good reason for anyone to apply for this card at all.

Bank Muamalat Visa Infinite-i Credit Card

This is coming from a relatively smaller commercial bank, but the Visa Infinite credit card they offer are surprisingly quite competitive, but the annual income requirement is RM120,000 and free for life.

Now let’s talk about the benefits of Bank Muamalat Visa Infinite, usually when I talk about benefits I prioritize benefits that has actual monetary value that is easily quantifiable, repeatable and meaningful, that is why I always look at cashback rate, air miles earning rates, and any potential of 0% or low interest loan.

First this card let you convert any transaction above RM500 into a 0% interest 6 months installment plan, and transaction above RM1,000 into 0% 12 months installment. (Similar to Alliance Bank Visa Virtual offering)

You can also do a 0% balance transfer with 6 months installment up to 70% of the available limit, while it’s only 6 months but unlike AmBank this is not a short term promo with expiry date, which mean this benefits will always be available until they revise it.

As for cashback you get 1% cashback on e-commerce capped at RM100 per month, 0.5% cashback on contactless payment capped at RM50 per month and unlimited 1% cashback for overseas spend.

For overseas spending it comes with 1% conversion fees, so it offset with the cashback and you will be spending at Visa exchange rate, but you can still convert any spending above RM1,000 to 12 months installment, and if you can make use of that it will be better than any other card that give you merely 1~2% one time cashback.

(Because any cash you don’t have to pay right away come with a potential earnings, from a risk free rate of 4% to market average return of 10% depends on how you manage it. This is why I love any 0% interest loan / installment / balance transfer, banks are giving up that opportunity cost for you to take advantage)

Oh and one more thing for those looking for lounge access, this card while it doesn’t offer many lounge location, it does however let you access to Premium Plaza First at KLIA Terminal 1.

RHB Visa Infinite Credit Card

RHB Visa Infinite card comes with an annual income requirement of RM150,000 and free for life annual fee.

You earn 5 LoyaltyPlus points for every ringgit spent overseas and 1 LoyaltyPlus points for other retail spending, 5 LoyaltyPlus points is equal to 0.5 Enrich mile (or 0.35 Krisflyer mile), which again, with the 1% conversion fee, the real return is just 1% cashback equivalent of miles for overseas spending.

You get the typical Plaza Premium Lounge access with RM1,000 monthly spending.

However the travel insurance from this card are actually quite comprehensive, it is comparable to the silver and gold tiers of travel insurance from Etiqa TripCare 360, and in some part are even exceeding the Platinum plan.

For example the Platinum TripCare 360 cover death of permanent disablement up to RM500,000 but the travel insurance from this card is up RM2,000,000. The only part it falls short is emergency medical expenses are only up to RM95,000 per family.

RHB may also offer 0% balance transfer of up to 80% available limit from time to time, as of writing the 0% Smart Move Balance Transfer campaign is near ending at 31 Jul 2025.

Overall this card isn’t great for day to day spending, as it doesn’t offer much benefits compare to other Visa Infinite cards mentioned in this post, but the travel insurance is okay.

Did I Missed Other Free For Life Visa Infinite?

Let me know if I missed any free for life Visa Infinite credit cards!

I hope this post will provide some value for anyone haven’t had a free for life Visa Infinite or are currently looking for one.

For me personally the favorite is HLB Visa Infinite for local dining, and using it to unlock deals like the one from Agoda, Hotels, etc.

Just 1 question on HL Visa Infinite, where do you see the requirement to maintain RM30,000 in fixed deposit in order to apply for one?

I am talking about pledging money to apply, some people with foreign income or saving does not use monthly income to apply card usually pledge a fixed deposit to apply card