Table of Contents

UOB Preferred Card Introduction

The UOB Preferred Card has some unique benefits but also lets you collect UNIRM, the credit card points of UOB that can be use as cash, redeem airmiles, or other products.

While it’s not a card that I would recommend to anyone, its benefits may still be appealing to some, and we’ll talk about it right now and you can decide if you need this card.

Benefits Overview

There are three main benefits with this card — Coffee Bean buy one free one, Golden Screen Cinemas ticket buy one free one and UNIRM for airmiles.

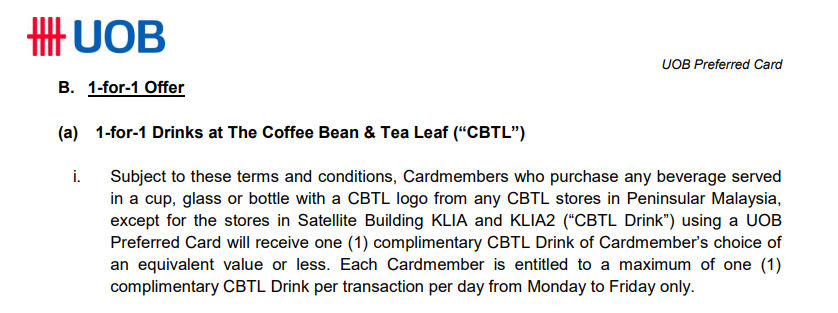

The Coffee Bean & Tea Leaf Buy One Free One

If you purchase a drinks at Coffee Bean store with this card, you are entitled for another complimentary drinks at same or less value, and this offer are available once a day during weekday, for all chain in Malaysian except KLIA Terminal One and KLIA Terminal Two.

This can be very appealing for someone, back in few years ago I used to get my coffee at Starbucks/Coffee Bean every day, usually two drinks each order for my daily caffeine needs, if I had this card back then it can probably saved me couple hundreds each month.

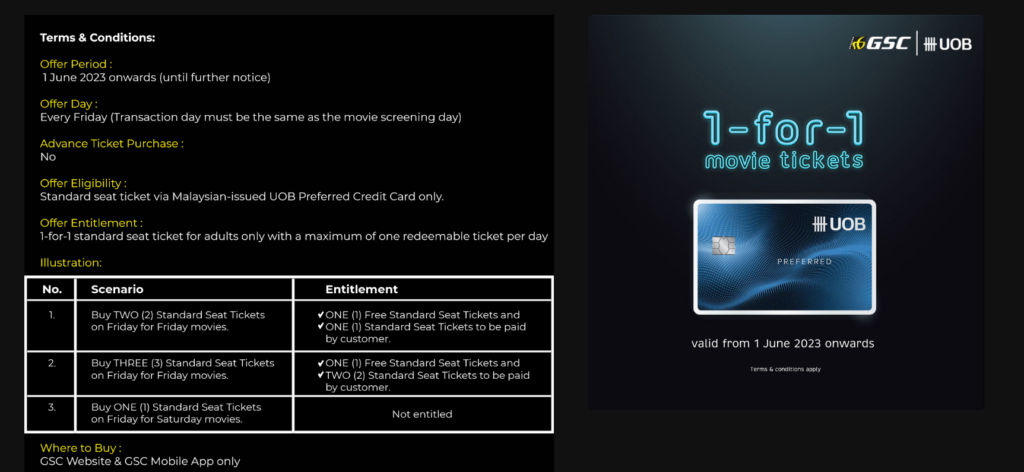

Golden Screen Cinemas Buy One Free One on Friday

This is another nice to have benefits, I’m not the type of person that goes to Cinema very often but it’s a great benefits for couples or friends that like to enjoy movies at cinemas.

However this is only applicable for the standard seating, and it’s only on Friday, so it may be very crowded if there’s many cardholders claiming this benefit at the same day, but that may not be an issue for everyone.

Collect UNIRM to use it as cash or redeem airmiles

UNIRinggit or UNIRM is basically the credit card points name by UOB credit cards, but unlike the other bank, you can spend the points directly, and redeem airmiles or other products like usual.

You can gain UNIRM for below spending category:

- 5 points for every Ringgit spent on dining, entertainment and grocery

- 3 points for every Ringgit spent on petrol and recurring transactions

- 1 points for other local spending

Pay with UNIRinggit

The UNIRinggit at normal rate are 1000 to RM1, assume that you earn 1000 points with a RM200 dining, and you spend those points with this rate, it means you are effectively getting only RM1 cashback from RM200 spending, or 0.5% ROI.

I wouldn’t say it’s entirely bad if this is the only credit card you have, but you can easily find tons of credit cards with much higher ROI. However they may have campaign from time to time that increase the value of UNIRinggit.

For example with the above campaign you can choose your existing credit card purchase from last 60 days and paid it off with UNIRinggit within their app, effectively getting an ROI of 1.25%

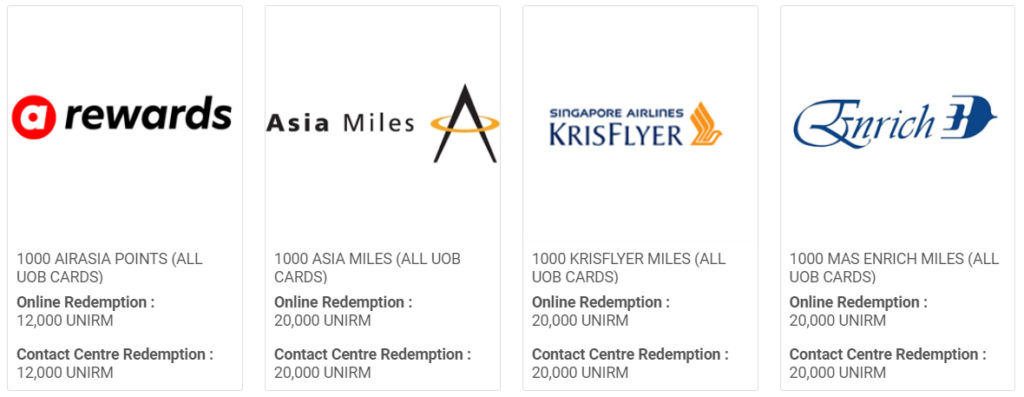

Redeem airmiles with UNIRM

Assuming you spent RM4000 to collect 20000 UNIRM and exchanged it for 1000 Enrich Miles, and in my blog I assign a value of RM0.04 for each Enrich Miles, so that is RM40 worth of miles.

This means the ROI are 1% for redeeming airmiles or 0.25 miles per ringgit.

That isn’t a horrible rate, especially after all the banks cutting down benefits from their card in 2024 and 2025, but again the calculation is based on dining, entertainment and groceries spending only.

Redeem other products with UNIRM

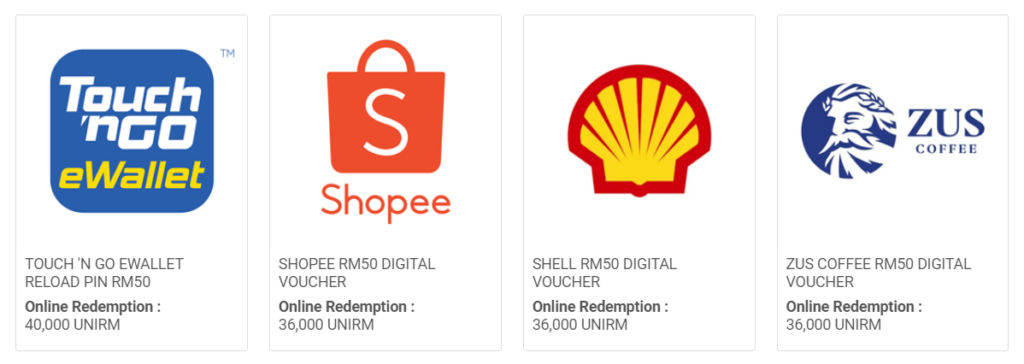

You can use the points to redeem other goods such as to pay your credit card services tax and annual fees, gift vouchers such as TNG Reload Pin, or electronics like iPad.

However most of the time these are just going to be worse value than airmiles, it’s basically a low cost way for banks to “reclaim outstanding points”.

For example RM50 TNG Reload Pin for 40000 UNIRM which you will need to spend RM8000 on dining, that ROI value is 0.625%, maybe better than Pay with UNIRinggit, but definitely worse than airmiles.

Annual Fees & Salary Requirement

The annual salary requirement for this credit card is RM36000 or a monthly income of RM3000.

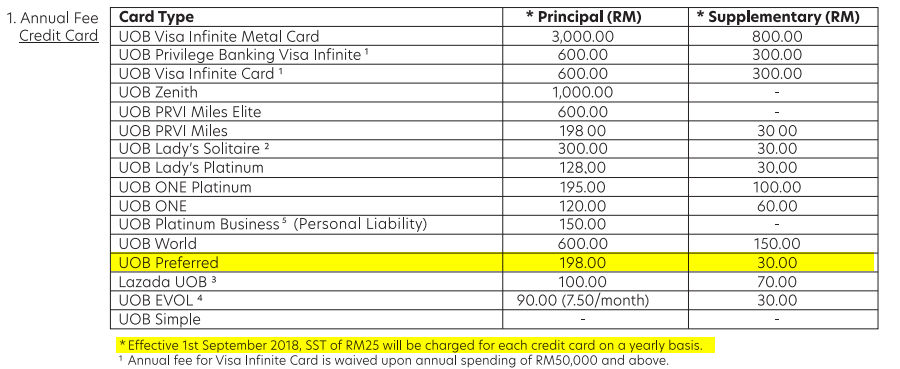

The UOB Preferred Card has an annual fees of RM198 for principal and RM30 for supplementary card, as well as the standard RM25 service tax for each activated card.

Who Should Get UOB Preferred Card?

In my opinion the UNIRM or UNIRinggit value of the credit card are quite mediocre and the spending categories are very limited as well, personally I prefer credit card that has broad categorization, so I can skip the hassle of thinking which card to use all the time.

However I think the card can offer great value if you are already spending on Coffee Bean frequently, going for movies at GSC for twice a month, or mix of both. The UNIRM are just a bonus for you if you don’t already have a better cashback card or airmiles card.

Anyway if you have a better credit cards or want me to review a specific cards, just let me know in the comments below!