Increased Spending Requirement to RM800

Less than a year since I made a review on UOB One Classic card and actually commended it as a great card for many regular spenders, they increased the spending threshold required for useful cashback rate.

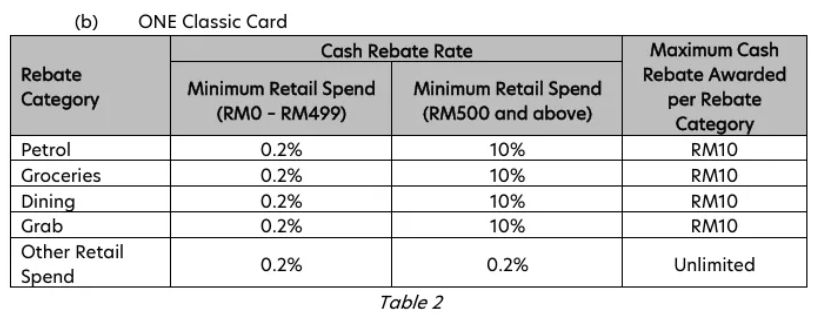

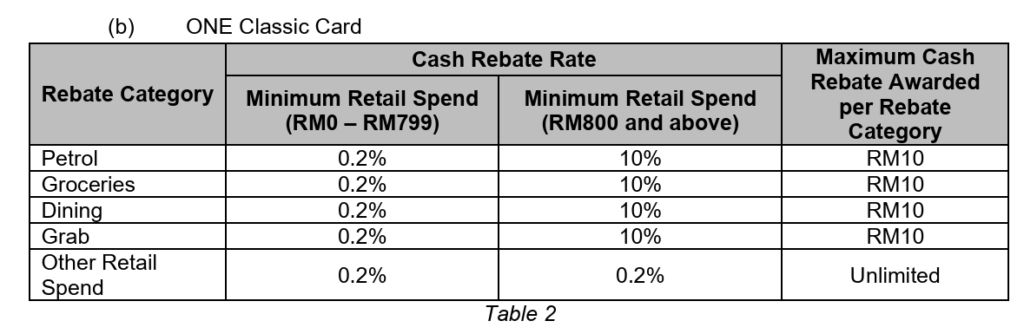

(Source: Updated Terms for UOB One Card)

It went from spending RM500 to unlock the useful cashback rate.

To spending RM800 to unlock the useful cashback rate.

How It Change the Math for Benefits

Now you will have to spend something like this:

- RM100 – Petrol

- RM100 – Groceries

- RM100 – Dining

- RM100 – Grab

- RM400 – Other retail spend

To get the similar cashback amount of RM40.8 compared to previous spending RM500 to get RM40.2 in cashback.

This reduced the cashback rate from 8.04% to 5.1% and when you factor the annual fees and SST, the effective annual cashback rate is at most 3.59% given you spend just exact amount to unlock the max cashback, but in reality it should be less.

Annual Fee Waiver

There is no written terms for automated waiver, but there are people reporting on getting full or half waiver on the annual fee, but this is not guaranteed, it depends on luck.

Still Worth It?

For a basic card that only require RM24,000 annual income, if you are able to allocate those spending to this card then maybe it’s still an okay card, just that it’s no longer as attractive as previous.