Table of Contents

Flat Rate Loans: The Deceptive Deal

Many people in Malaysia do not realize that there are different types of loans offered by banks. Flat rate loans are typically used in car loans and personal loans. Sometimes, they are also known as simple interest loans or flat interest loans.

Flat rate loans are often misunderstood by many people, who sometimes directly compare them to other types of loans such as house mortgage loans, which are usually amortized loans. This can create the illusion that car loans are much cheaper than housing loans.

However, in reality, the real cost of borrowing for car loans is usually twice as much as the flat rate suggests.

How Flat Rate Loans Work

Let’s first delve into how flat rate loans work. The formula used to calculate the total loan interest is simple, as follows:

Loan Amount * Flat Interest Rate * Years = Total InterestAnd here’s how you calculate the monthly installment:

(Total Interest + Loan Amount) / Months = Monthly InstalmentConfused? Let’s look at a real-world case. For example, let’s say you applied for a RM100,000 loan for 9 years at 3%. Here’s how you calculate the total payable interest:

RM100,000 * 0.03 * 9 = RM27,000Now, let’s find out the monthly installment with:

(RM100,000 + RM27,000) / 108 Months = RM1,176Now that you have a clear understanding of how flat rate loans work, let’s explore another type of loan.

Amortized Loan: The Fairer Way to Borrow

Often used for housing loans, the calculation for amortized loans is a bit more complex. However, even if you can’t remember how to calculate an amortized loan, understanding how it works is important whenever you deal with loans.

You can also use the amortized loan calculator on our site for a quick estimate of your loans.

As the name suggests, in an amortized loan, the loan balance is gradually written off, and the interest is calculated every period based on the outstanding balance. So, you will be paying less interest over time as the loan balance decreases.

The monthly payment includes both the principal and the interest. The principal paid is used to write off your loan balance. However, to ensure that the monthly installment stays the same, an annuity formula is used.

This is the annuity formula to calculate the monthly instalment (A):

Where P equals to the principal amount (loan amount), n equals to periods (months), and i equals to interest of month (annual interest / 12)

Let’s calculate using the same example used in the previous flat rate loan, assuming the loan amount is RM100,000 for 9 years and a 3% interest rate:

Monthly Instalment = RM100,000 * [ (0.0025 * (1 + 0.0025)108) / (1 + 0.0025)108 - 1]Solving the equation in the calculator gives us RM1,057.69. If you multiply that by 108 months (9 years), you will find out the total payment is RM114,230.52.

The total interest paid is RM14,230.52, which is about half of what you would pay with a flat rate loan.

My Opinion on Flat Rate Loans

Personally, I dislike flat rate loans and believe they can be somewhat of a trap for people with less financial literacy. I think if you were to ask random people on the street, more than half of them wouldn’t be able to tell you the difference between flat rate loans and amortized loans.

Many countries actually discourage the use of flat rate loans and prefer amortized loans for larger loan like housing and car purchase. For example, car loans in the US or UK are usually amortized loans. Flat rate loans from these countries are typically used by less reputable lenders or only for short-term loans.

It also discourage early settlements of your loan, because the total outstanding already included interest that are predetermined, early settlement won’t save you any more money.

The reason I believe banks in Malaysia like to use flat rate loans is because they’re less transparent and obscure the true cost of borrowing. They also create an illusion of being “cheaper than amortized loans” for unsuspecting people.

How to find out true cost of borrow for flat rate loans

A simple rule of thumb is to double the flat interest rate to get an approximate effective interest rate, also known as the true cost to borrow.

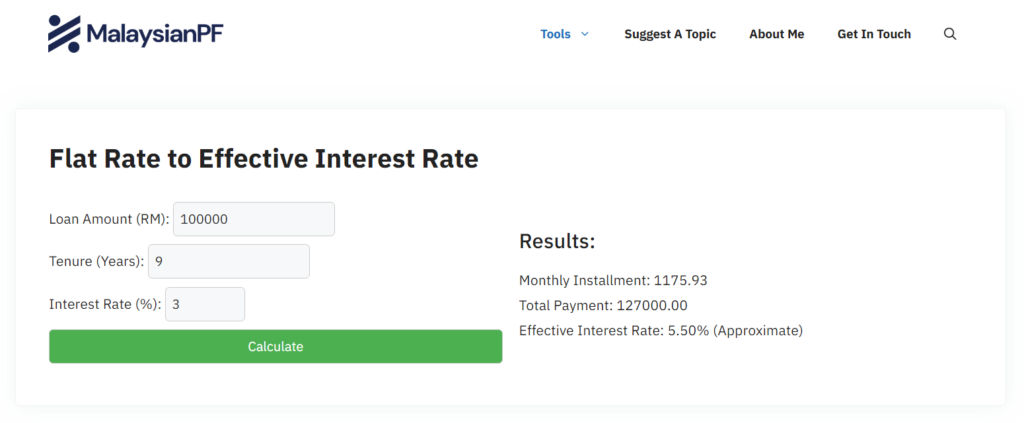

You can also use our flat rate to effective interest rate calculator to get an estimation of how much the interest rate would be if the loan were translated into an amortized loan.

Help Spread the Word and Protect Others

I hope this post helped you understand the difference between flat rate loans and amortized loans. If you’re considering a car or any other major purchase, look closely at the loan terms. Always ask if it’s a flat-rate or amortized loan to determine the true cost of borrow.

Share this information with your friends and family. Together, we can make smarter financial decisions and avoid unnecessary overpaying on loans.