Table of Contents

Introduction

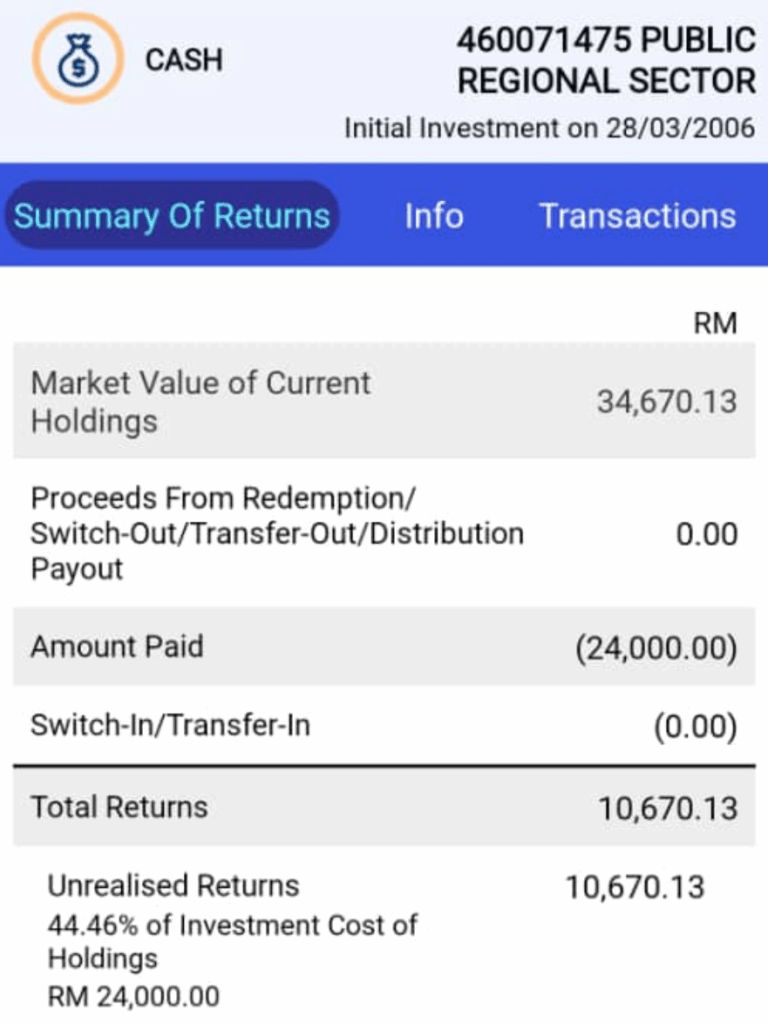

Last weekend a friend of mine share with me that he made some “good investment” from his “advisor” recommended mutual funds, he has been buying the Public Regional Sector Fund (PRSEC) from Public Mutual every month automatically for more than 10 years, and had made a cumulative profit of 44.46% with this investment.

However, what he did not know is the cost he paid for this investment and what the alternative difference would mean to him financially.

I’m not going to compare every investment to a market average return or something like S&P 500 index, while that’s generally a good starting point for many regular investor, in some cases it make sense some people would like to add exposure to certain region or sectors based on their belief and market outlook.

Which is why this friend of mine invested in Public Regional Sector Fund which are mostly stock in Asia region excluding Japan, or maybe it’s just whoever sold him this fund told him to invest this, which is more likely the case, lol.

However in this post I’d like to show why most retail mutual fund in Malaysia is unlikely to be an efficient and financial sensible way to do that.

Why Retail Mutual Fund Are Structurally Inefficient

Now mutual fund are incredibly profitable, but it is for the fund managers, not to the investor, this is because regular retail mutual fund are meant to make consistent profit for the fund managers, not the investor.

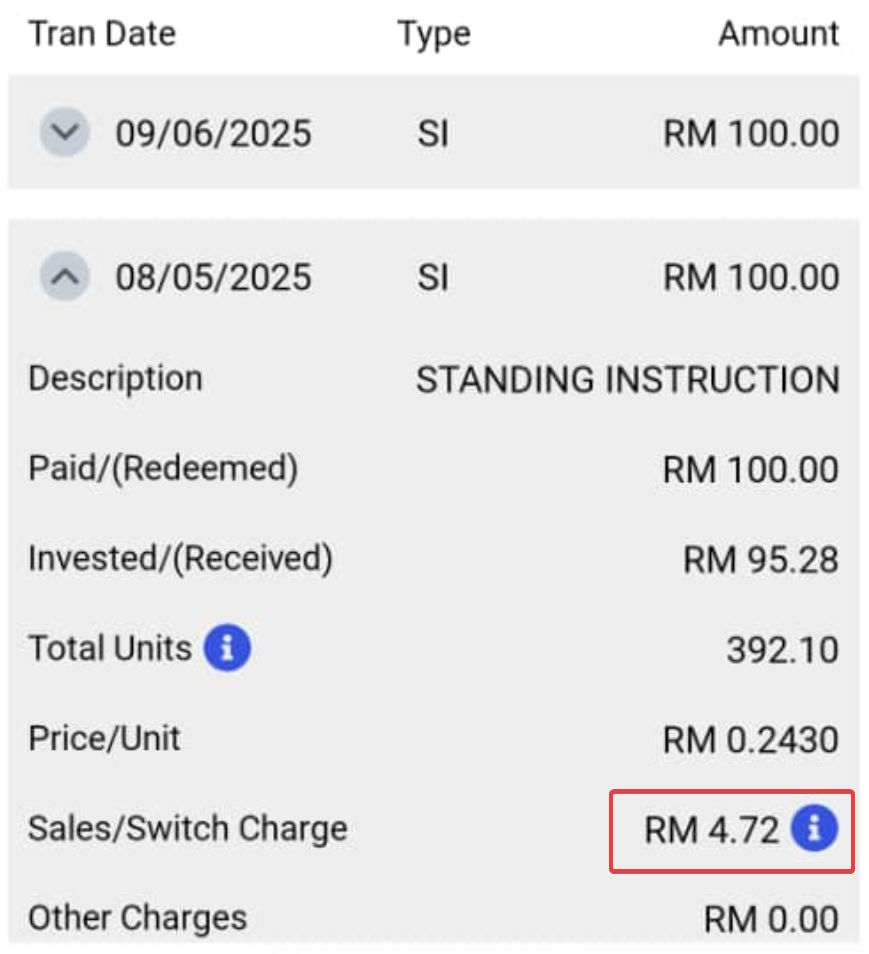

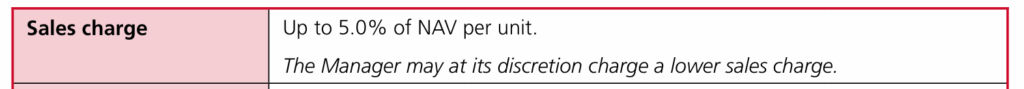

Look at above screenshot this is the automatic monthly deduction from his bank account to purchase the fund, and for every ringgit he invested, nearly 5% are taken as fee immediately, I believe a large portion of this goes to whoever persuaded him to invest in this fund.

That explained why most self claimed “financial advisor” (with no qualifications and fiduciary duty to act in your best interest) in Malaysia like to sell recurring investment products like these, sometimes they are also bundled with insurance or stuff like that.

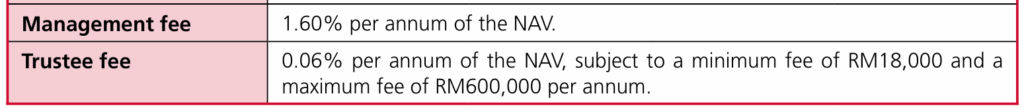

Then you have the typical active managed fund fees, which are usually higher in Malaysia due to the smaller size of the fund, while it make sense for the fund managers, it definitely doesn’t make sense for investor like yourself.

Lower Fees Alternative

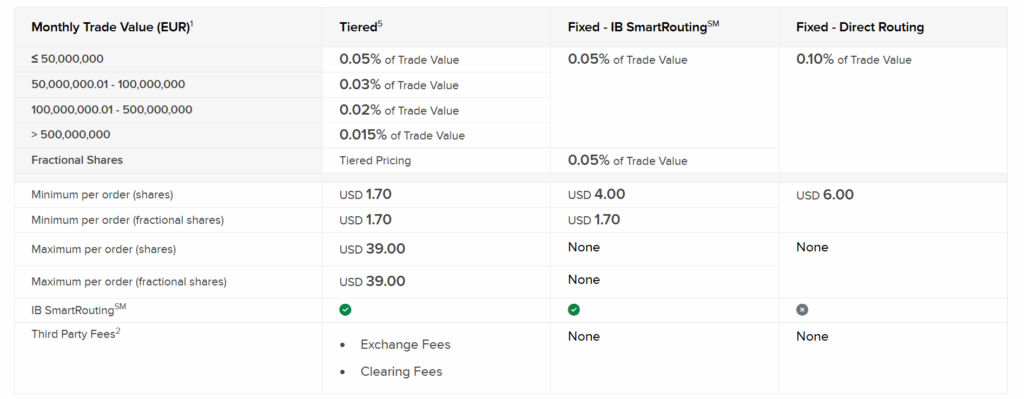

When I say the management fees are usually higher in Malaysia, let me back that up with proof. Let’s look at the alternative funds with similar exposure, first let’s look at iShares MSCI AC Far East ex-Japan UCITS ETF, an Irish domiciled funds which track the same index that was used by the Public Regional Sector Fund itself.

The total expense ratio (TER) are 0.74%, less than half of the Public Regional Sector Fund management fees. Or what about similar fund from HSBC ETF.

The total expense ratio are even lower at 0.45% per year, nearly just a quarter compare to Public Mutual offerings. Because it is an accumulating funds, it is also more capital efficient to capture all the benefits of compounding return.

Now I’ll use both of their USD denominated variant and put it on a 10 year chart indexed to 100 to show you the small difference in fees and distribution policy does make a different in long run.

To make it comparable I have selected adjusting data with dividend to reinvest the dividend from the iShare ETF, as you can see the HSBC ETFs ends up slightly higher. (Tracking error plays a role too but that’s out of scope for this post, maybe we will talk about that some post in future.)

While it is not accurate to direct compare the performance of these funds to the Public Mutual funds because the Public Regional Sector Fund does not directly aim to replicate the index, but I’d argue aren’t the purpose of an actively managed funds suppose to “beat the passive index” that’s why there’s a much higher fees in the first place right?

Comparing Performance

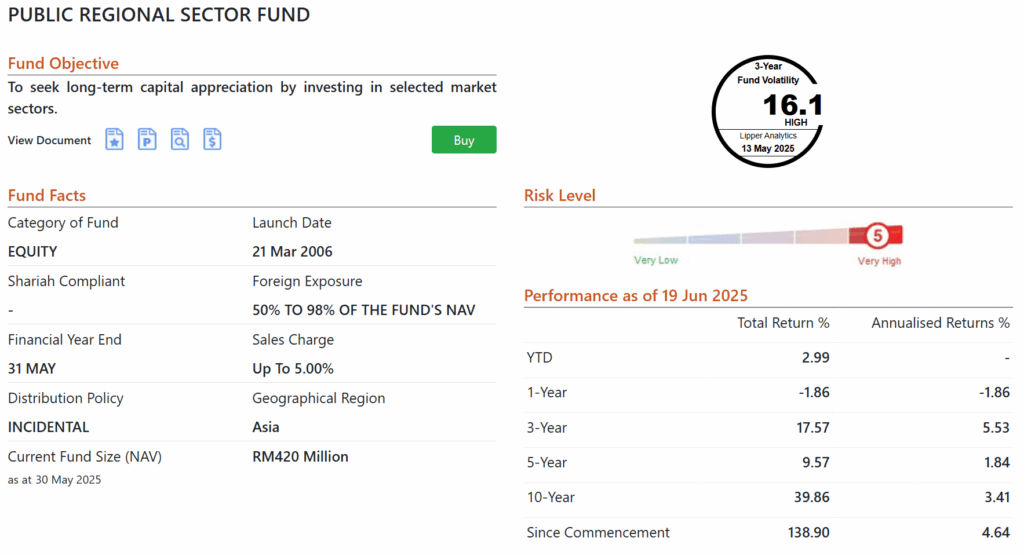

So here’s the performance of Public Regional Sector Fund from their own website:

The 10 years total return is 39.86% including all the paid dividend reinvested, and annualized return is 3.41%, so let’s compare them with the iShares and HSBC fund but we have to remember to convert them back into Ringgit denomination.

We get a 10 years total of 67.15% (annualized 5.27%) with HSBC ETF and 63.81% (annualized 5.06%) with Blockrock ETF that both track the index MSCI AC Far-East Ex-Japan which is the benchmark for the Public Mutual Fund.

That’s a pretty substantial difference right there, the mutual fund that are supposed to beat or at least track the index end up far below the passive ETF that track the same index, it’s not hard to tell from the annualized return difference which a huge part can be explained by the management fees itself.

Why Was Mutual Fund So Popular Back Then?

We know most of the time retail mutual fund does not make sense but let’s talk about why it was so popular back then and when does it make sense as an investment instrument.

Lack Of Alternative Options Or Market Access

The most common reason people invest in retail mutual fund is because the lack of alternate options, back in one or two decades ago, there not many low cost brokerage option like Moomoo or Webull, and I remember about 10 years ago when I am trying to open Interactive Brokers account the minimum amount was $10,000 USD.

Most brokerage back then does not focus on low value customers, but things changed when the finance industry saw startup like Robinhood quickly capture the younger generation market share, if they don’t lower the barrier they might lose the entire generation of market.

Now there are various of brokerage out there with low barrier to start using them, some even offer commission free trade (they make profit from market makers, known as PFOF), and as long as limit order is used these shouldn’t be an issue for average investors.

Sales Agent Cosplaying Financial Advisor

The second reason, which still happens now, the market is flooded by agents promoting these mutual fund, typically bundling them with insurance, they call themselves financial planner or financial advisor without CPA or CFA licensed.

Most importantly, they are having conflict of interest where they get paid by selling you the mutual funds that are not financially sensible in the first place. They do not have the fiduciary duty to act in your best interest.

And many of them don’t know anything better. This is a sad and unfortunate reality, some of them truly believe they are selling great financial products, they may even invest themselves, simply because they lack the financial literacy to know otherwise.

But it’s not all bad though, I don’t want to paint them as the bad guy, in certain scenario they are still doing some good in an indirect way, for example I know some people who spent all their income and have trouble in discipline to save and invest, these product with recurring invest does help them, since it’s better than spending it all and live paycheck to paycheck.

When Do Mutual Fund Make Sense?

While in my opinion retail mutual fund are usually the less ideal investment instrument due to the fees structure, they still make sense in some scenario.

For example if your financial planning take into consideration of savings in EPF and you want specific exposure in some sector or region, and some mutual fund fulfill that criteria is approved to be invest within your ETF, then you can argue it make sense.

Another example are less likely the case for average investors, for example private mutual fund that are usually invite only or are only available for high net worth individual, these fund may be employing specific strategy, or some celebrity fund manager.

Closing Note

For the average investors in Malaysia, the retail mutual fund they have access to are usually not the ideal investment instrument to construct your portfolio, most of the time you should be able to find a lower cost alternative.