Table of Contents

Property Investment Are Rarely Profitable in Malaysia

There is a stage in our life where everyone around us seems to be talking about property investment, plan to make their first property purchase, or persuading their friends to buy a property because they are a property agent.

I am not sure if this is a thing in Asian culture especially for Chinese, or this is the same for everyone in the world, but for some, it makes them insecure to not have at least a property under their name when they reach certain ages.

In my opinion, invest in a wrong property is one of the worst mistake one can make for their financial, it can slow your wealth accumulation progress for years, and in worse scenario, make you lose money in the long run.

What do I mean property investment are rarely profitable?

Now when I say property investment are rarely profitable in Malaysia, I do mean it, and there’s no way you can argue that with data:

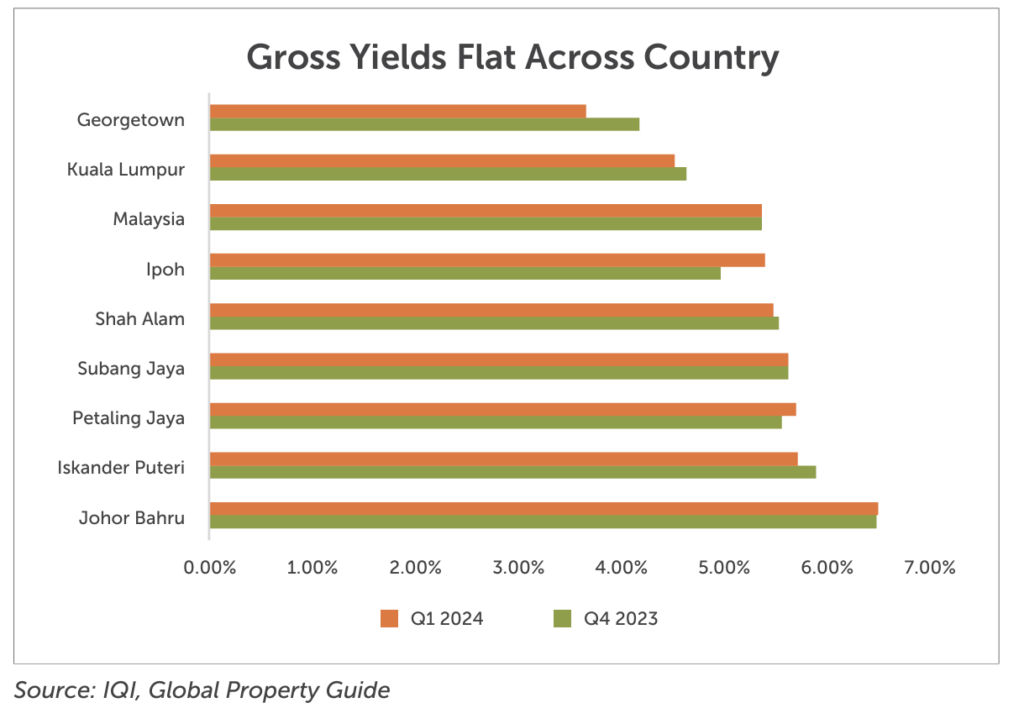

The gross rental yield from IQI home rental index report shows around ~5.16% for Malaysia average, and keep in mind, this report came from a popular property agency where they generate profit from selling you property, and this report are meant to present you an “attractive opportunity”.

Now before you think 5% is good rental yield and other countries have far lower rental yield, let’s see how Global Property Guide actually get the data:

Gross rental yield alone is rarely a useful metrics to look at when deciding if a property investment present an opportunity or not, to make a proper decision, you have to include other factors into your decision, and for most people that invest property with mortgage, the interest rate is a major one.

The mortgage lending rate from banks are typically around 4~5%, while Malaysian government plans to maintain the overnight policy rate (OPR) at 3%. That means before we even look into more details, a large chunk of the rental income are going straight to paying loan interest, this alone should tell you why most property investment are not going to be profitable.

Still interested in property investment? Let’s look deeper in the topic, and I will share what I personally look for and should have look for when I invest in property.

How Do Property Investment Generate Profit

There are two common ways a property generate profit for its investor which is the appreciation of the property market price and the rental income.

Appreciation of Property Market Price

First of all I am no expert in predicting the future market price of a property, personally I don’t think most people are anyways.

To be able to have a proper prediction in future property value, you will probably need to have a team of data scientists, financial analysts and source of reliable data to build a model, and even so many of these highly sophisticated model still fail to predict the market, why?

Because property market are shaped by numerous elements such as economic data, geopolitical developments, investor sentiment, and market psychology. This intricate interplay often results in unpredictable behavior that is challenging to model with precision.

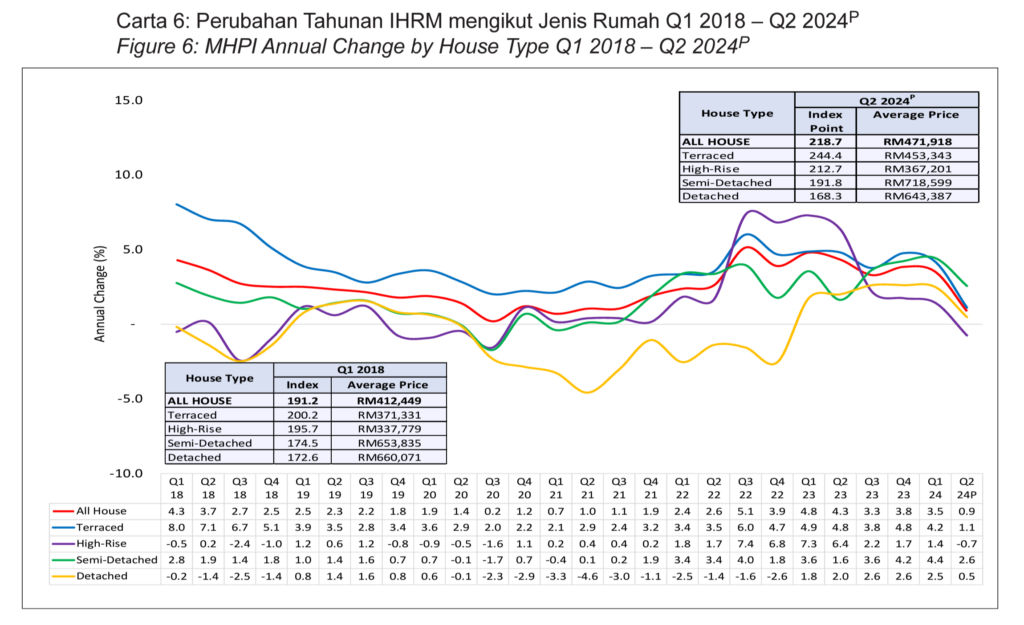

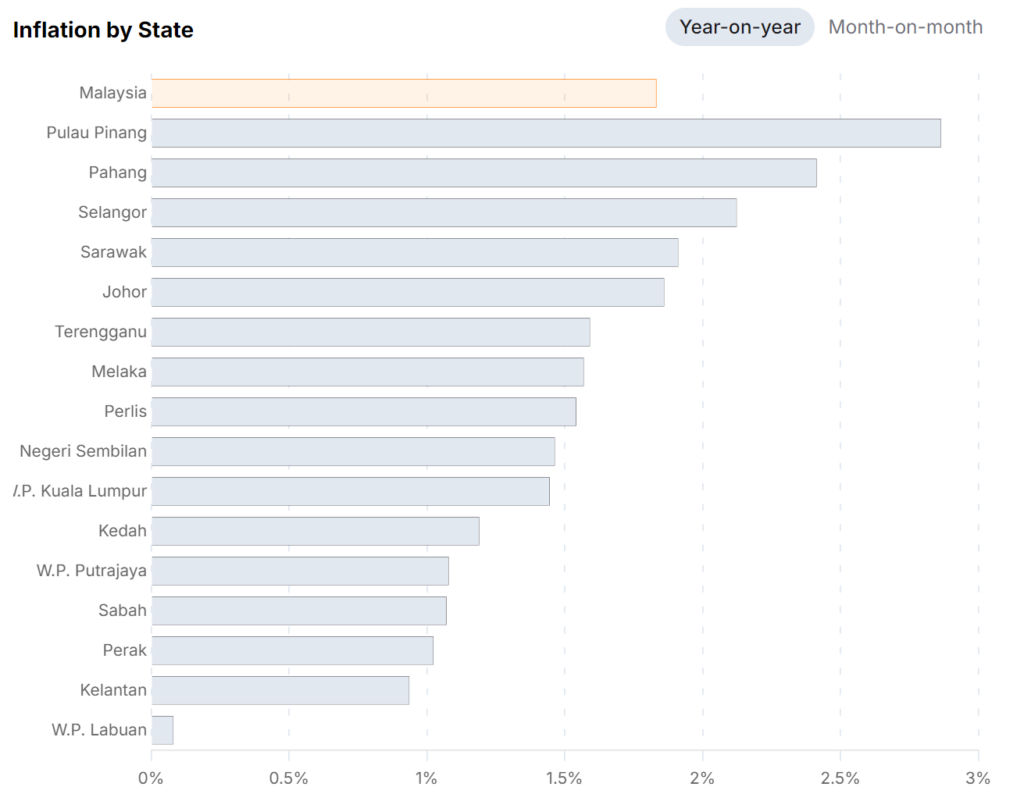

While the Malaysian house price index seems to paint a picture of housing value have an average growth rate of 1~4%, but the reality is these property are barely keeping up with the inflation and the devaluation of our currency.

That is why I prefer to look into the rental income of a property instead of predicting future market appreciation, which can sometimes feels like a gambling, and is the reason why I prefer to look at rental income instead of betting on future market price growth.

Rental Income from Property

Unlike predicting the future growth of property market price, rental income are relatively easier to estimate, for example you can look at the region’s rental rate on similar sized properties, the availability of similar properties.

This post also focus on calculating the cost and expected return of a rental property, and in the rest of the post you can assume I am talking about rental property investment without focusing too much on market price appreciation.

The Cost of Rental Property Investment

In this section I will cover the major cost you should consider before investing in a property, this include monetary cost, opportunity cost and other non-monetary cost.

Mortgage Interest from Banks

This is the biggest cost factor for most investors that plan to finance their property purchase, and as of writing the typical mortgage interest rate is around 4~5% depending on which bank you choose, if you have weaker financial profile you will typically get worse interest rate because the bank ask for more when you are a client with higher risk to default, and vice versa.

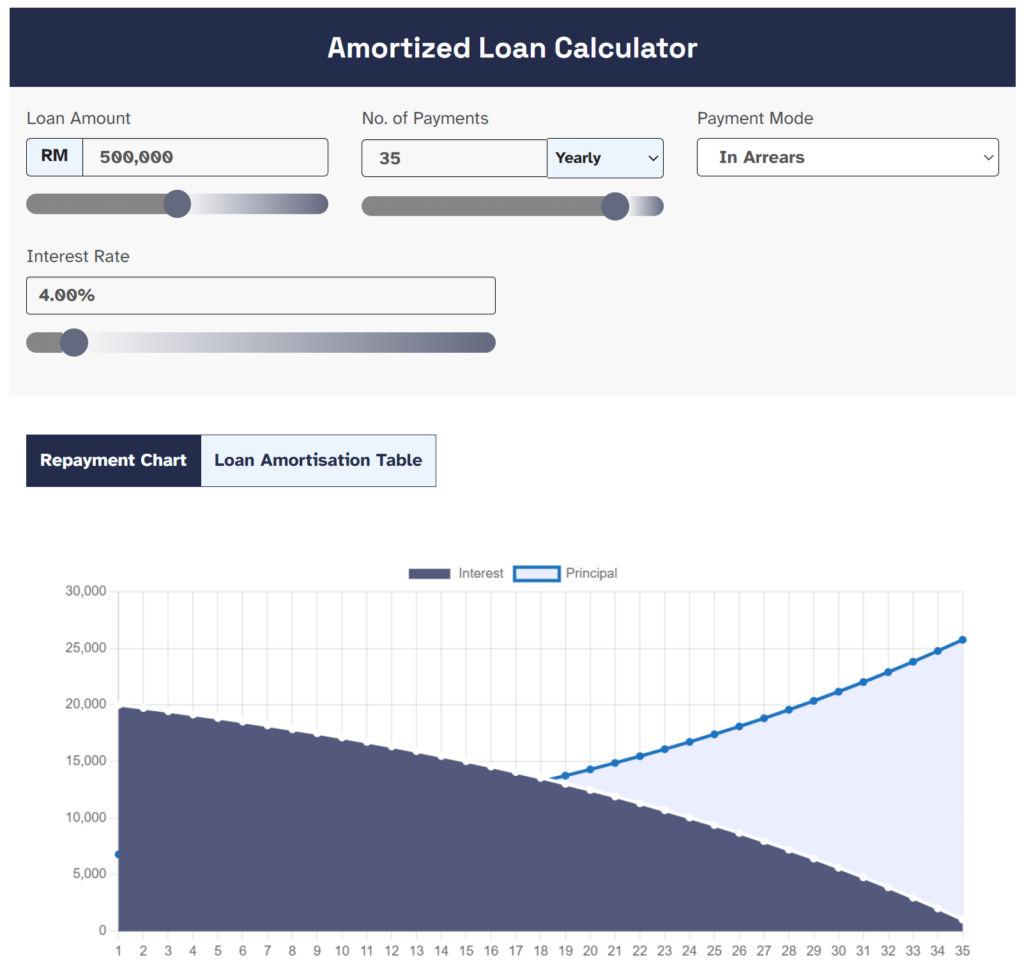

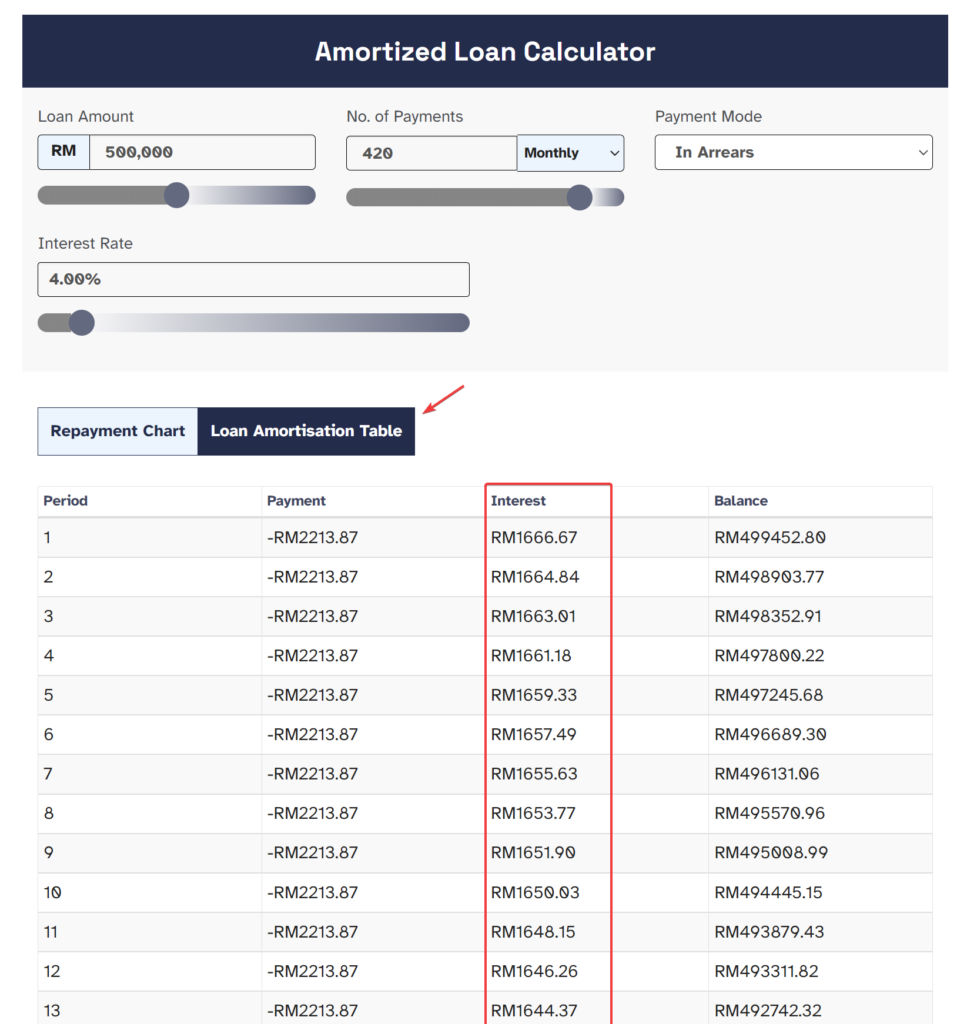

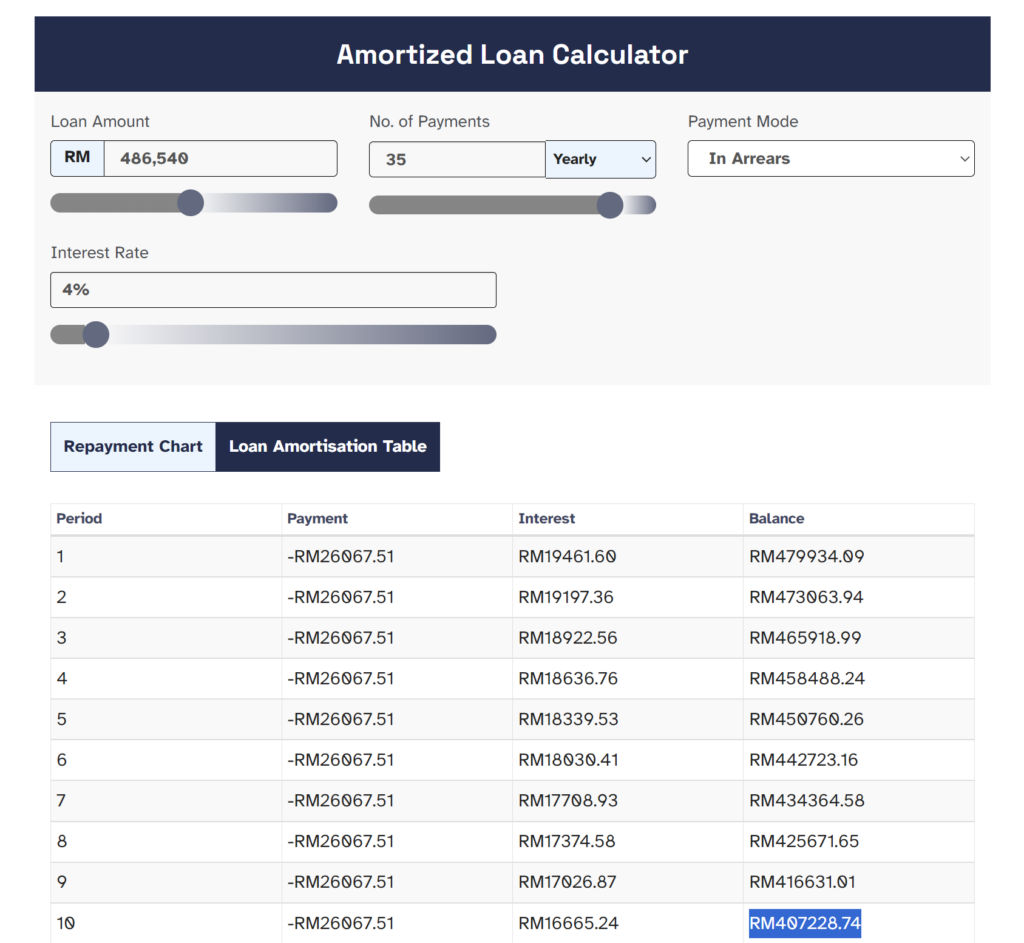

If you do not know yet, property loan in Malaysia are also known as amortized loan, which means the interest are calculate monthly based on the outstanding loan, this means every monthly installment you pay actually comprise of two parts, the payment to interest and the payment to the principle balance.

The monthly installment are calculated with fixed rate mortgage payment formula by banks to ensure the monthly payment stays at the same amount, but you can check the actual interests and principle payment with our amortized loan calculator using the loan amortized table:

The payment to interest is a direct cost to your property investment, and the payment to principle can be view as asset class switches from cash to property ownership, while the latter one shouldn’t be see as direct cost, it does come with opportunity cost which we will talk about later.

Government Taxes – Cukai Tanah & Cukai Taksiran

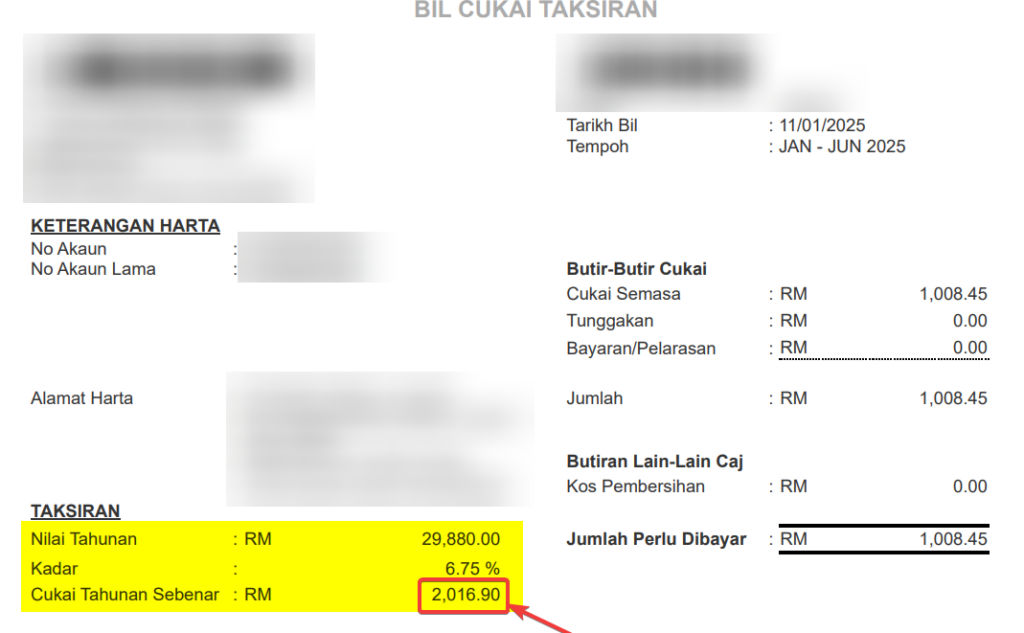

For most investors buying rental property, the property are usually high rise, such as apartment and condominium, so it may not incur quit rent (Cukai Tanah), but it will surely come with assessment tax (Cukai Taksiran).

The assessment tax are typically around one month rental rate of your property, and you are supposed to pay to your local government every year, for example this is the cukai taksiran of my property

The rental of this property are around the same figure, so when you are estimating the cost in your potential property investment, make sure to discount one to one and a half month from the rental income for government taxes.

Property Agent Finder Fees

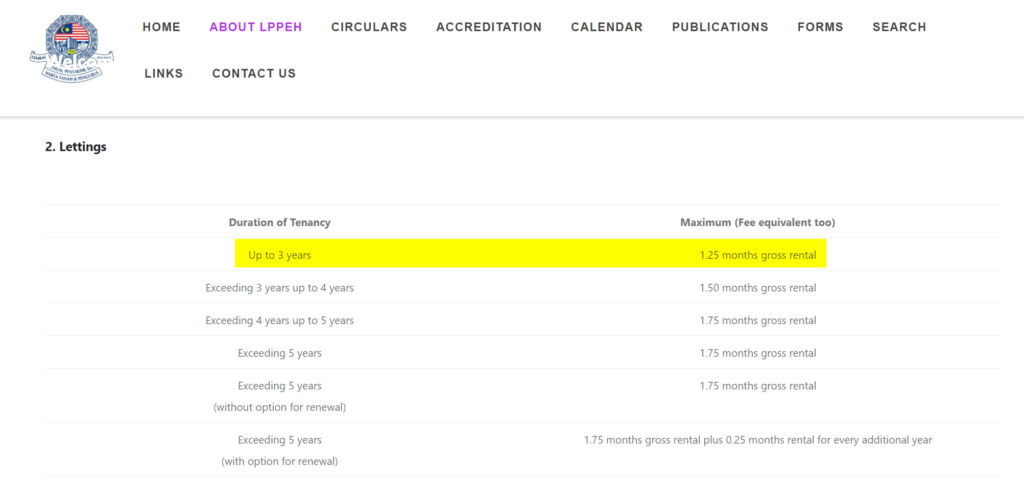

The government guidelines for lettings fees is up to 1.25 months of rental shall be paid to the agent as a commission to find you a tenant, but when calculation the potential cost I like to use one month per year.

The turnover rate for your tenant largely depends on where your property locate in, and who is the main target audience. If your property is an apartment locate near a university, then you can assume higher turnover rate, and can assume you will pay one month worth of rental income to your agent every year to find a new tenant.

If your property is a commercial property for business, they may have lower turnover rate because business doesn’t move as often for obvious reasons, then you can probably account for one month of rental income for every two year or higher.

Property Maintenance Fees & Sinking Funds

Most rental property are usually considered as strata properties, and that means there will be a management entity (JMB) to provide proper maintenance and management for the buildings and common spaces.

The maintenance fees are usually around RM0.35~0.40 per square feet for a residential property and RM0.45~0.60 per square feet for commercial properties.

The property I shown earlier with around RM2000 rental is a commercial property, and I am paying around RM653 for maintenance fees and sinking funds every month, which is more than a quarter of my monthly rental income.

Insurance for Property – MRTA / MLTA

MRTA and MLTA are basically insurances that help you pay off your property when something happens to you, such as death or permanent disability, while it is not compulsory to purchase insurance, most banks insist you to buy these insurance in order to approve your loan.

Since this post is not about insurance, I’ll explain MRTA and MLTA quickly, MRTA insured amount are reducing along with the outstanding balance of your loan, usually bank will bundle MRTA into the loan, and they are usually around 2~3% of the insured amount.

MLTA insured amount doesn’t reduce like MRTA does, and it is transferable, it’s basically behave like a regular life insurance, the premium are usually paid monthly, and the total premium are expected to be much higher than MRTA.

Other Upfront Fees, One-Time Cost, Periodic Cost

To prevent making this post overly long, I have decided to include some of the other important cost you should consider as upfront or one-time cost:

- Fire insurance for the property

- Sales & purchase agreement fees (SPA) (1~1.25% on property price)

- Loan agreement fees (1~1.25% on property price)

- Title transfer fees (MOT)(1-4% tiered base)

- Other legal fees (1% of the property price)

- Renovation fees (to appeal to renters)

- Touch up for wear and tears

- Other servicing and repair fees

Opportunity Cost

In my opinion this is the most important part where most people overlook, any fees you paid, regardless if it’s the upfront cost of monthly interest fees, or wear and tear touch up cost that come after few years, all these money can be invest in elsewhere, which introduce opportunity cost.

The biggest argument I have against investing property are the opportunity cost, and I will illustrate this in later part of this post, but in general I like to use the US stock market average return as the opportunity cost benchmark.

Some people may argue, why do I use US stock market average as a benchmark? Why not? The US stock market are well-diversified, highly liquid, and represents the largest free-float investable asset in the world.

Other Non-Monetary Cost

Now maybe this is just me, but to me I really hate receiving calls from my tenant or agent regarding anything to the property, sometimes it’s a pipe leaking, the wall painting damage by water, wanting to discuss about rental, or need help to apply something with the JMB.

And have to remember to chase rental payment from your tenant, dealing with the excuses why they are late this month, these are super exhausting in my opinion.

I’m not exaggerate when I say these stuff add mental stress to me, and it’s the main reason why I stopped invest in property and want to get rid of my properties and not look back again.

Real Example: Calculate The Cost & Expected Return

Now the best way for me to show you how to incorporate these costs when evaluating a property investment would be using the real example, you will see how exactly I do a rough and quick calculation before investing in a property.

This is a property recommended from an agent recently, here’s the general info:

- 750sqft condominium at RM477,000

- Full loan up to 35 years at 4% interest for RM2,112/month payment

- Free legal fee and SPA fee

- Title transfer fee at RM9,800

- Maintenance fee is RM0.38/sqft

- The rental around the area for similar property is RM1,800/month

- A basic renovation package at RM10,000

The SPA price are actually higher, but developer give a 20% “discount”, so that customer can purchase the property with loan at 80% SPA price, it’s a common trick developer uses to offer “zero down-payment” property, bank knows too, the price after discount is the actual selling price anyway.

The downside with this you are still going to pay certain agreement fees and legal fees based on the SPA price, not the discounted price, the upside is when you sell the property, the real property gain tax (RPGT) is based on the selling price minus the SPA price, but no agent will tell you these.

Let’s take a look at the gross rental yield, assume we can get higher rental because of newer unit, RM2000 rental per month means RM24,000 rental year, which means the gross rental yield is about 5.03%

Rental yield after considering fees

First we will factor in the loss of rental income when there’s no tenant, usually I will expect 12 months without rental income of a 10 year period. This mean in 10 year period, whenever you tenant move out, the time it takes for your agent to find a new tenant, or giving out rent free month for the tenant to move in, and we account 10% rental loss on our rental income, so RM24,000/year become RM22,000/year.

Then we’ll add the other recurring costs, the maintenance fee at RM0.38/sqft means the monthly maintenance is RM285/month or RM3420/year, the agent fee is one month per year at RM2000, the government tax is RM2000 per year as well, these fees add up to RM7,420/year, that means after paying these fees our rental income will end up at RM14,580/year

You can see how easily the fees shrink the rental yield down to 3.05% and most of these fees I’m not even exaggerated, these fees estimation are what I’ve been using to evaluate properties. Don’t forget I didn’t even include the cost to touch up wear and tear.

You can of course use lower fees in your estimation, but in my opinion you would rather use higher fees than lower fees, because using higher fees will give you more margin of error.

Monthly cashflow estimation

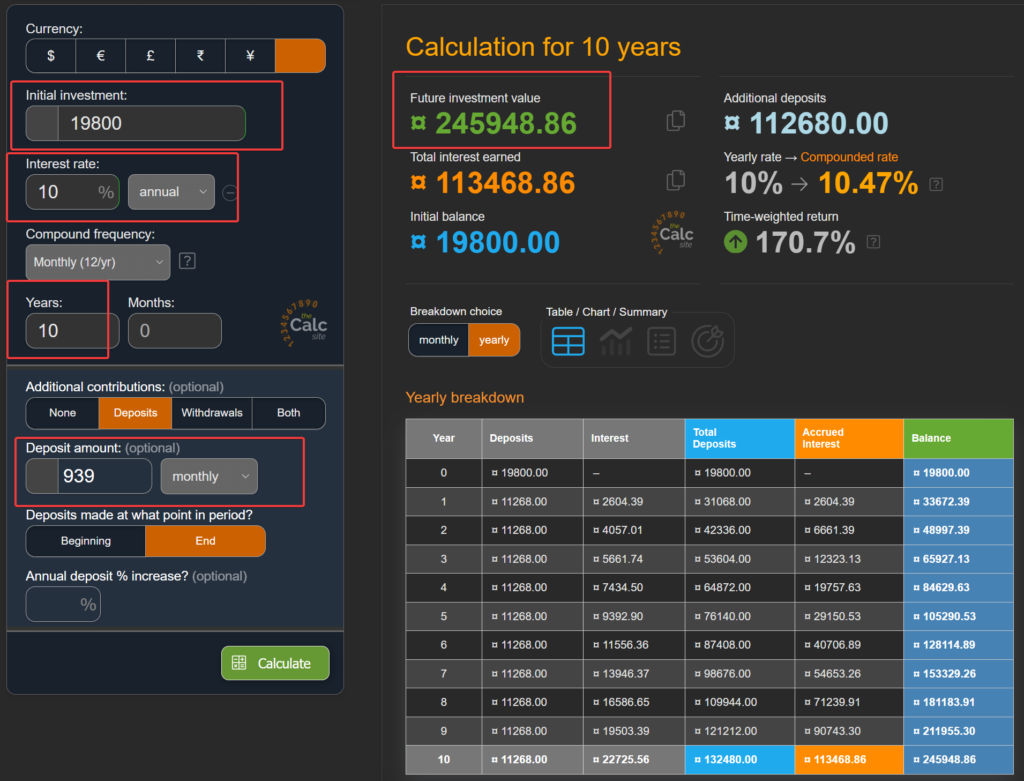

The property loan we are going to apply for is RM477,000 but remember bank will want you to have insurance in order to approve your loan, so let’s assume the bank offer MRTA at 2% and bundle that into your loan, so now you will have a loan of RM486,540 with 35 years tenure at 4% interest rate that means a monthly payment of RM2,154/month or RM25,848/year.

Your annual rental income is RM14,580 so now you will have an annual negative cashflow of RM11,268 or RM939/month.

Next we will see if the negative cashflow from the property investment is worth, we will look at the opportunity cost of that cashflow and other upfront cost.

Comparing it with alternative investment

Now let’s look at the numbers, how it will perform in a 10 year horizon, to invest in the rental property, we will have an upfront cost of RM10k for taking the renovation package, RM9800 for title transfers and RM939/month for the installment that aren’t cover by rental.

We will see how it will perform if the same amount of cash is invested in US stock market using a low cost index fund.

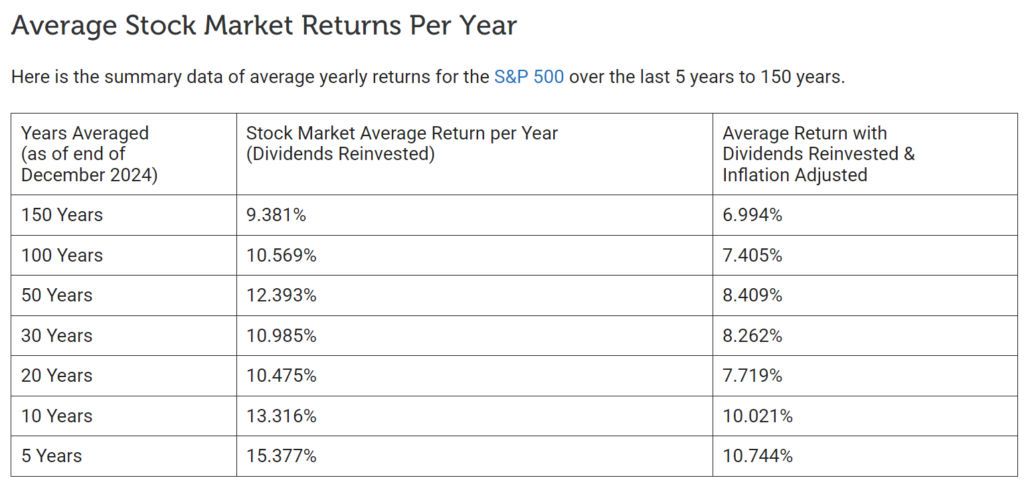

This is the US stock market return with 150 years of historical return annualized, for simplicity we will use 10% for our comparison.

The alternative investment will end up with a portfolio of RM245,948 at the end of 10 year period, now let’s look at what that means for our property.

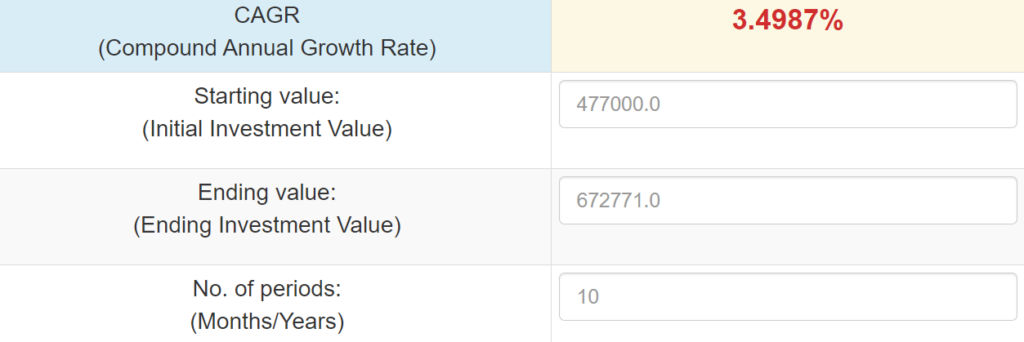

At the end of the 10 year period we will still owe bank an outstanding balance of RM407,228 which means in order for the property investment to break even with our index fund investment, the property need to sell at a value that will cover the loan balance and net the same profit, which is RM653,176 or RM672,771 if you account for the standard 3% agent fee.

That means you will need a compounded annual growth rate of ~3.5% to be able to match the performance of alternative investment.

Comparing Risk Adjusted Return

Now I showed you how I do my calculation, but what I haven’t tell you is, whether the property is worth investing or not, this is entirely up to your own interpretation on their risk adjusted return.

Unfortunately while in stock market we can use price variance to represent risk, in property market the risks come in different ways, and much more complex to quantify and comparing it directly.

Do you think property investment has higher or lower risk than a diversified S&P index fund? If you think higher than you will need expect higher return to reach an equal risk adjusted return, if you think lower risk, then you can accept lower return with property investment.

To me, invest in a single property are higher risks, particularly these risks:

- Concentration risks

- One specific type of property in one specific location

- While S&P 500 index fund give me exposure to 500 companies across different sector and regions, or a total market index fund to be even more diversified at 3500+ companies

- Liquidity risk

- You can’t sell a portion of a property quickly if you need cash, unlike index fund shares which can be sold instantly during market hours

- Tenant/vacancy risk

- Your returns heavily depend on finding and keeping good tenants

- Maintenance risk

- Unexpected repairs can significantly impact returns, again we didn’t even include wear and tear fees in our 10 years comparison

This mean property investment that just breakeven with index fund return will not cut it for me, I’m not going to consider it unless the return are significantly higher than what I can get from index fund to justify taking more risks.

One More Thing to Consider – Malaysia Economy

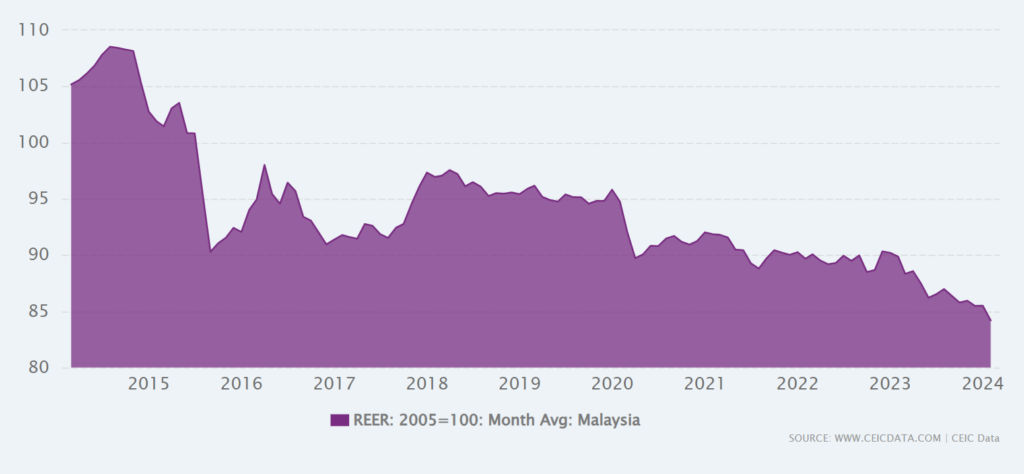

You see during the comparison between US stock market index fund and Malaysia property investment, I haven’t included the currency risks, let’s look at MYRUSD over the last 10 years:

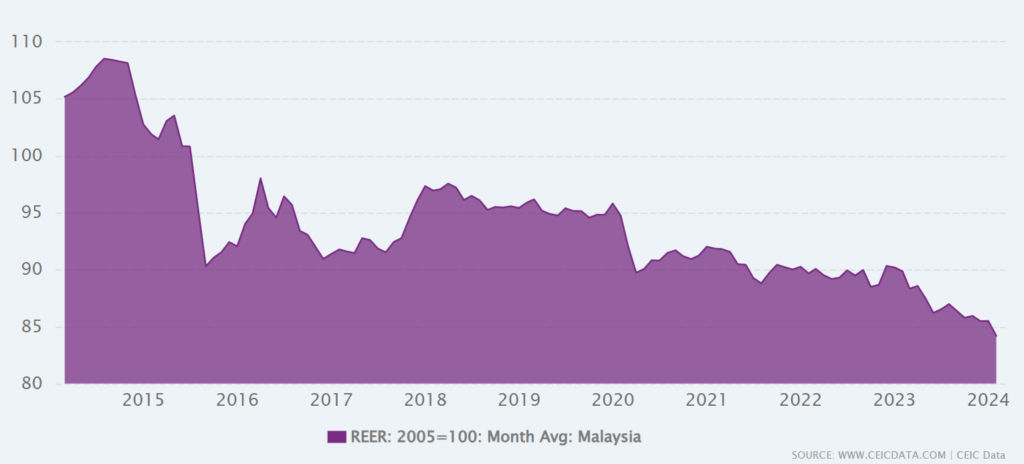

This is a chart where the beginning is indexed to 100, which shows you our currency has been losing 20.89% over the last 10 years, and just in case you think it’s US economy stronger than everyone else, don’t forget the real effective exchange rate (REER) I shown earlier paint the same picture:

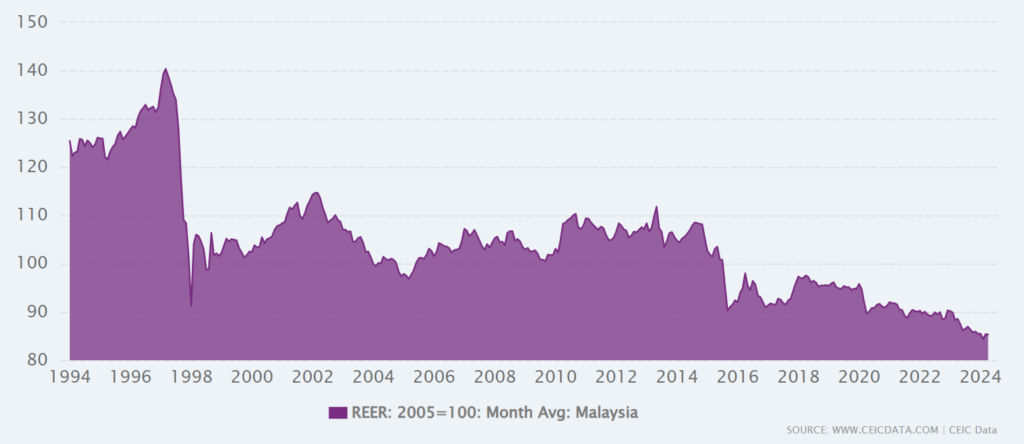

Or how about the longer timeframe if you think Malaysia economy are only weak for the last 10 years:

In fact if we account for the weakening currency in our previous comparison, you will need to expect an even higher return from the property investment in Malaysia market to match the performance of the index fund.

Closing Thoughts

Some may think why I kept using US stock market average as a benchmark for every investment opportunity from Malaysia and keep bring up the weakening currency of Malaysia.

That’s because this blog is about my take on personal finance as a Malaysian, but it doesn’t matter if I’m Malaysian, Singaporean or Indonesian, the purpose of managing personal finance is for the betterment of our life or our family life.

The only responsible way to that is to be rational and logical when making financial plans, not emotional and sensational.

Do I want Malaysia to have better economy? Of course I do, and I am trying my best to help, which is writing blog posts about personal finance that help other fellow Malaysians to make better informed decision with their financials.

Anyway I hope this post will help provide people struggling between the decision to invest or not invest in Malaysia property.

Excellent analysis on return of property investment in Malaysia ! Also excellent comparison of property investment vs S&P 500.

In my opinion, people invest in property to collect monthly rental & the same time waiting for capital appreciation. Also good property can hedge against inflation. Invest in S&P 500 also can hedge against inflation.

It depends on your situation:

? Choose Property if:

✔ You want steady rental income and are okay with managing real estate.

✔ You plan to leverage a mortgage to amplify returns.

✔ You prefer a tangible asset that can hedge against inflation.

? Choose S&P 500 if:

✔ You want higher long-term returns without property management hassles.

✔ You prefer a liquid, diversified, and passive investment.

✔ You have a longer investment horizon (10+ years) and can handle market volatility.

? Best Approach?

? Diversify! Many investors do both—owning real estate for stability & rental income, while also investing in the S&P 500 for long-term growth.

Excellent article, and excellent blogs in general. I like how the information in your blogs are all encompassing and complete, I rarely leave with questions.