Table of Contents

First Bill Under New Tariff

There was some drama when TNB first introduced the new tariff. Many solar panel users, including myself, felt backstabbed by the government. However, they have since revised the tariff’s impact on NEM users.

Now that my first TNB bill under the new tariff has arrived, let’s see if everything is as expected. More importantly, let’s answer the question: Does it cost solar users more or less with the new tariff?

New Format Of TNB Bill Statement

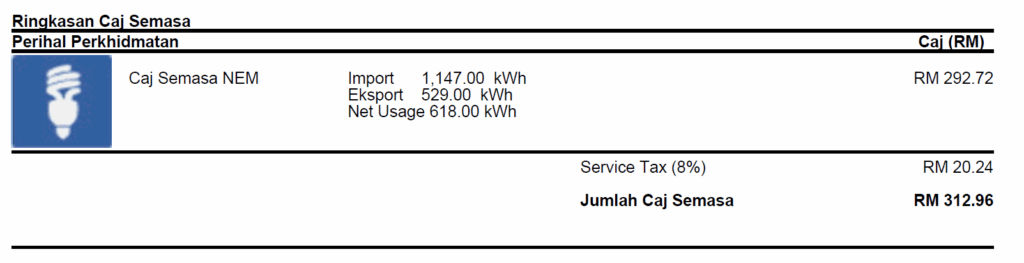

Right off the bat, the first page of the new statement shows how much energy I imported from and exported to TNB.

Since our family was having a trip in July, there is about 10 days of us not at home, so the total import is much lower as expected, and unfortunately, this means I’ll have to wait until next month’s bill to see if the new inverter air conditioners I installed are actually reducing my electricity consumption as much as I expected it to.

I installed the inverter air conditioner because I was trying to control the consumption below 1,500kWh to save the ICPT charges, but with the new tariff structure, I’ll talk about the difference between using above 1,500kWh later.

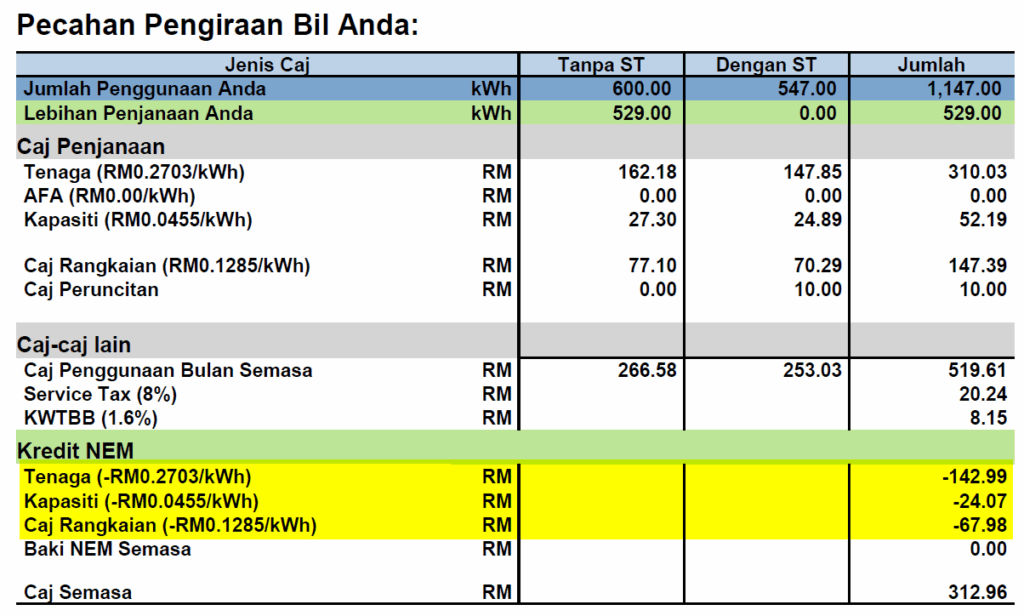

Here is the details breakdown of the charges and what is being offset:

As expected since the revision NEM are now getting offset for energy, capacity and network charges, the KWTBB and SST are same as before.

Does It Cost More For Solar Users?

Now before we answer the questions we have to isolate the impact from new tariff and solar system, that is we need to find out these:

- TNB bill from old and new tariff with solar system

- TNB bill from old and new tariff without solar system

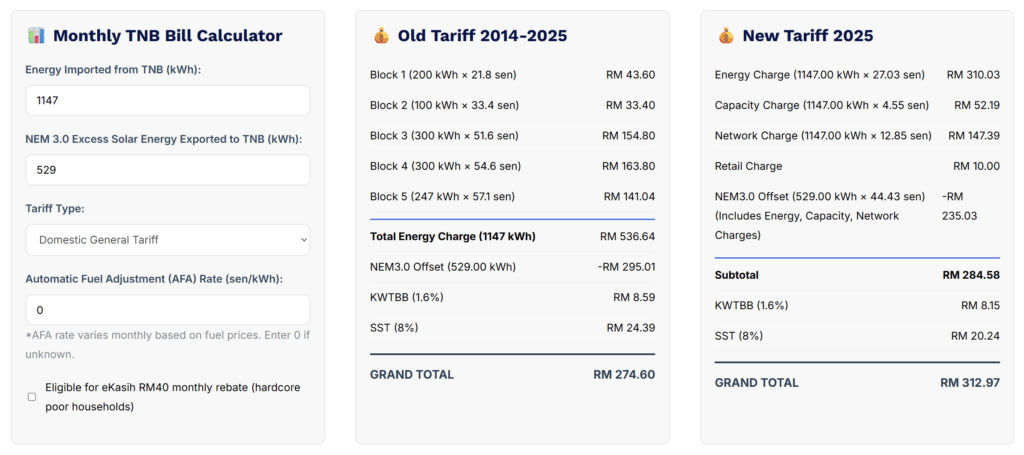

Here is my current bill from old and new tariff with 1147kWh import and 529kWh export, so this month I am paying RM312.97 instead of RM274.60 to TNB, plus RM565 for the installment of solar system.

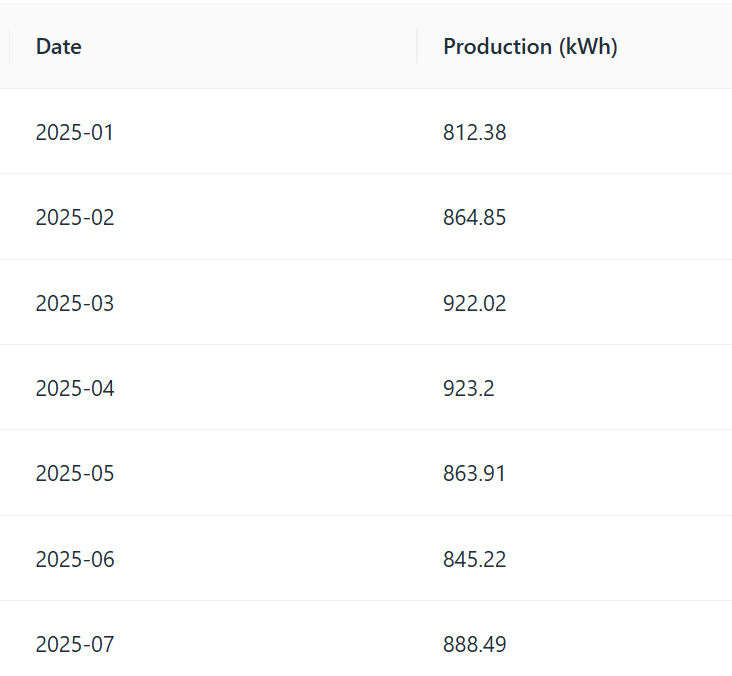

Next we need to calculate our bill as if I did not install solar system and sign up NEM, based on the DTU data, my solar system generated 888.49kWh in July, and 529kWh is exported to TNB, so the balance 359.49kWh is consumed.

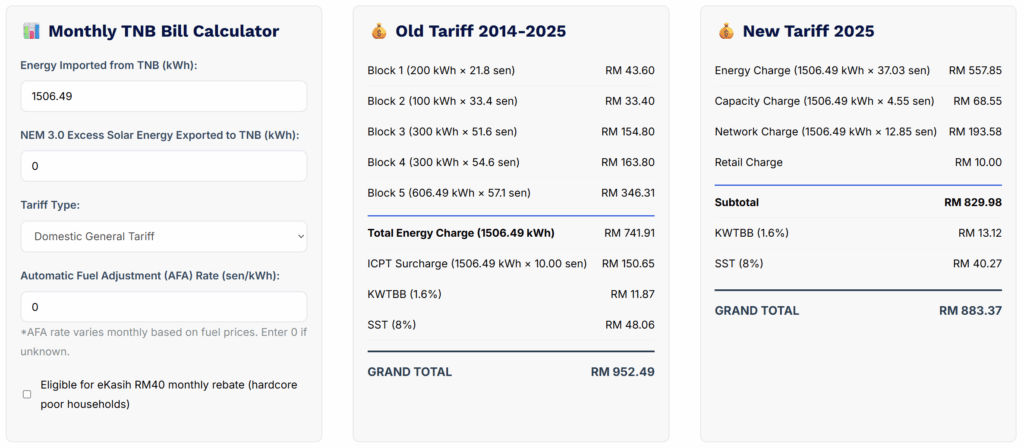

Adding back the 359.49kWh to my import then we get 1506.49kWh, which would be my total import from TNB if I do not have solar system, and this is the bill of that:

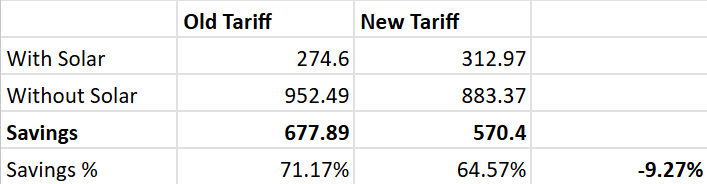

Now we have a clear picture, with solar system installed our TNB bill actually cost more, while without solar system our bill cost less with the new tariff, here is the difference between savings.

As you can see, under the old tariff, solar helped me save 71.17% on my TNB bill. With the new tariff, it only saves 64.57%. That’s a 9.27% decrease in savings, which is significant.

While the benefits from my solar system have obviously been negatively impacted, does this mean it wouldn’t be worth installing if I had known about this new tariff beforehand?

Based on this specific month usage, the answer is, installing solar still worth it, and that should be obvious to you, because the nominal savings of RM570.4 is still larger than the RM565 installment.

To answer whether solar system still worth it for you if you had knew about the new tariff, there is one important factor, which is do you use above 1,500kWh or not.

Difference Between Using Above Or Below 1,500kWh

The easiest way for me to show the difference is to use an example of 3 different usage, with and without solar system in old and new tariff.

And assume they all use the same solar system, which come with a 60 months installment of RM565 per payment.

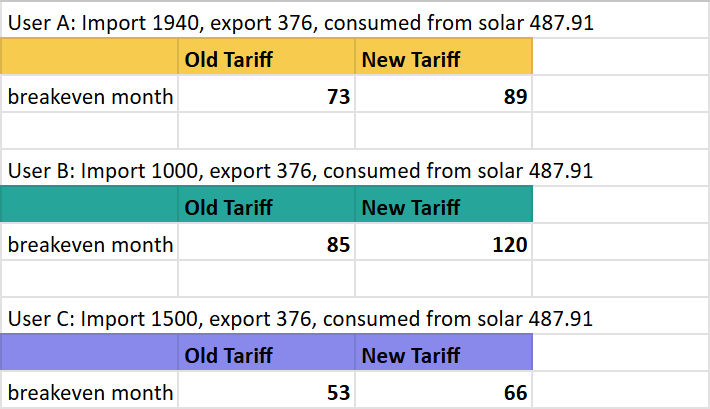

User A: Regularly Use Well Above 1,500kWh

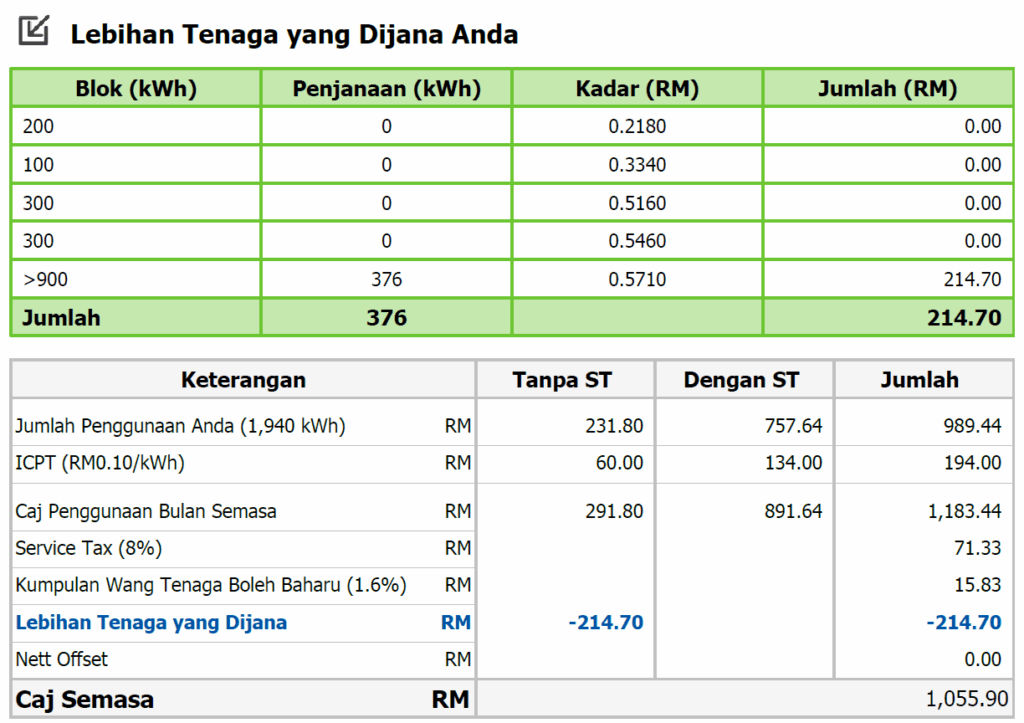

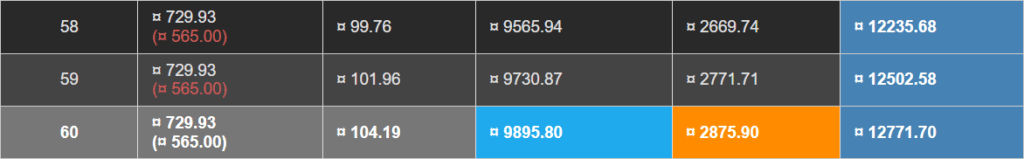

This is based on my previous bill of May 2025, before the new tariff, and ICPT are incurred because of usage above 1,500kWh even with solar system.

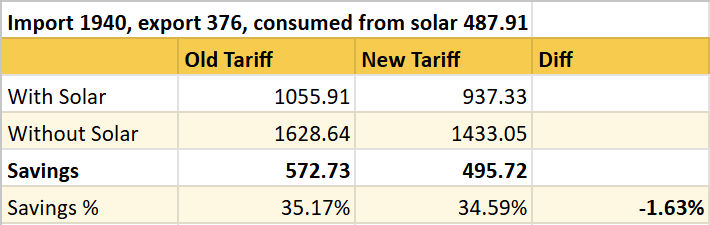

That month I generated 863.91kWh from solar system, 376kWh was exported to TNB, so 487.91kWh was consumed directly and 1940kWh is imported from TNB.

You can see the difference of percentage savings is only 1.63% less with the new tariff, but in nominal value the difference is still significant.

The savings were RM572.73, which perfectly covered the monthly installment. This means that after the 60 month installment period, the solar system is considered ‘broken even.’ I would then have the remaining 60 months (of the 10 year NEM contract) to enjoy pure savings.

But with the new tariff the savings of RM495.72 savings is not enough to fully cover the installment, the user would still require to fork out additional RM69.28 per month.

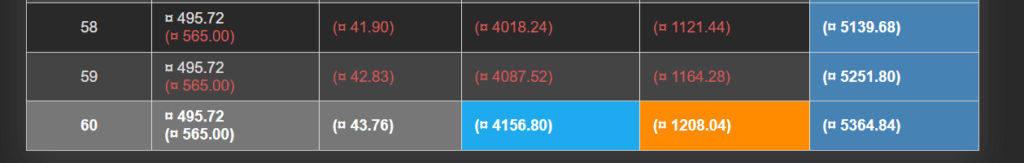

Now let’s assume our opportunity cost is 10% per year, this is what our solar investment looks like when the installment is fully paid at month 60.

We are still in negative of RM5364.84 before we break even, you can see that as a debt with interest of 10% (opportunity cost), which mean you will need another 12 months to fully paid it off.

That means with the new tariff user A will now expect 72 months to break even and only leave him with 48 months to enjoy pure savings with the NEM contract.

User B: Always Use Well Below 1,500kWh

What I mean by always use below 1,500kWh is no matter with or without solar system, the usage on TNB statement is always below 1,500kWh.

So when it’s with old tariff there is no ICPT charges, when it is with new tariff, the energy charge is always RM0.2703/kWh.

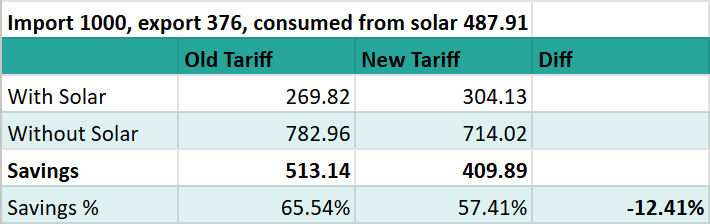

We will have the same solar energy generated as user A, export and consumed directly the same amount, but only difference is user B only import 1000kWh when using solar.

This time you will notice the savings percentage are decreased much harsher for user B, where the savings in percentage are decreased by a whopping 12.41%

Under the old tariff user B will require 69 months to break even, left with 51 months to enjoy pure savings from NEM contract.

Here’s the worst part: with the new tariff, User B will now need 94 months to break even, leaving them with only 26 months to enjoy pure savings from their NEM contract.

That is nearly 8 years to break even, which in my opinion before it even break even there may be newer generation of solar systems that either generate energy more efficiently, better shade resistant, or simply cost much less to install.

User C: Statement Usage Within 1,500kWh After Solar System

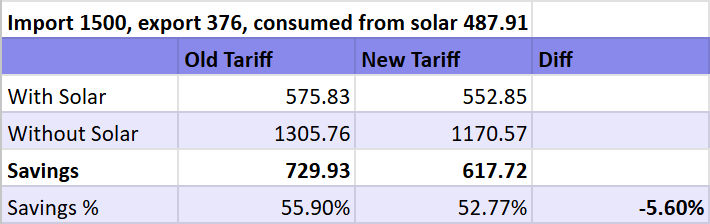

This is the case where the real consumption is above 1,500kWh, but because of solar system, the energy generated and consumed during day time are able to lower the import to just within 1,500kWh.

With old tariff that means effectively avoided ICPT charges, with new tariff that means energy charges drop from RM0.3703/kWh to RM0.2703kWh.

In terms of saving percentages, it is decreased by 5.6% with the new tariff, which is the middle of user A and user B.

As the nominal savings are well above the monthly installment, this mean for this user, solar system is always a no brainer, even when the new tariff still lowered the savings.

Under the old tariff, user C are expected to make a profit of RM164.93 per month, and by the time the installment is fully paid, he has already made a profit of RM12,771.70

Similar case with the new tariff, user C still make profit, albeit lesser, at RM52.72 per month, and by month 60 when the installment is fully paid, he will have made a profit of RM4082.48

The net positive cashflow from solar system with installment is the reason why I recommended people to take longer installment with 0% interest rate when I make the solar system case study previously.

Solar System Purchase With Cash vs. Installment

Let me quickly show the case where the solar system is purchase with cash instead of installment.

To be fair, the vendor did provide us a cash price discount, so you can argue I am not even really getting a 0% interest rate installment.

So let’s assume I purchase the same exact solar system with cash price of RM31,000 and see how it perform under three different usage. (user A, user B, user C)

As expected all scenario breakeven time will become longer, no matter with old and new tariff, and the situation is worse for those whose real consumption is below 1,500kWh. If they paid cash to install this solar system, the NEM contract would expire before they even break even.

For user C with old tariff while the break even only took 53 months, but please keep in mind the excess savings help to accumulate profit before the installment is paid off, and the accumulated profit are able to paid off the outstanding installment by month 44 if user C wish to.

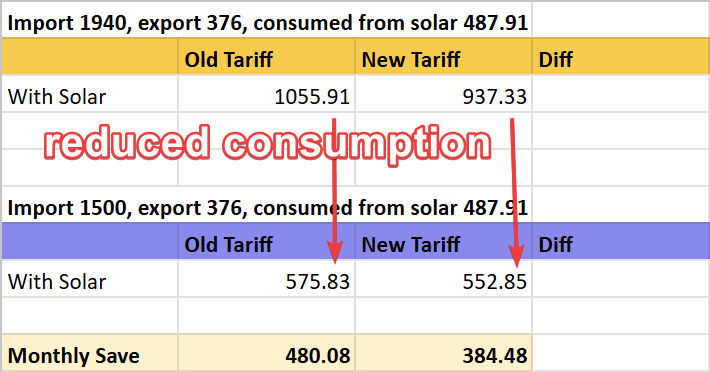

Reduce Consumption To Make Statement Usage Within 1,500kWh

Now as I mentioned user A scenario was based on my actual TNB bill, so one thing I was trying to achieve before the new tariff is announced, is that I am trying to reduce my consumption so that my total energy import from TNB stays within 1,500kWh and effectively avoid ICPT charges.

What I did is replaced 3 old non inverter AC into inverter AC with highest energy rating as stated in my post, and I expect to shave off about 450kWh per month.

It cost me RM8400 to replace those AC, with the old tariff I am expected to break even with the new AC in just 18~19 months, but now with the new tariff it would be around 23~24 months.

Once I break even on the AC, then the monthly savings from the reduced 450kWh will be pure savings result in lower cash outflow per month.

However by now you should know I never pay for anything in cash when I can get it with 0% interest installment, which mean my break even time could be even shorter with no impact on cash flow even at the begining.

Does Solar Still Worth It With New Tariff?

Now that I showed you three different cases, are your scenario closer to user A, user B or user C?

The reality of the new tariff is that all solar users are negatively impacted. For most, the break even time has become longer, and this is especially true for users with real consumption below 1,500kWh.

In my opinion when the break even is longer than 5 years it starts to become a less attractive solution, especially with more significant negative cash flow from installing solar system.

So do you think it is still worth it for your investment with your expected break even time?

Not worth to install Solar with the new TNB calculation. ROI is too long to recoup.

Well not that they can apply with NEM 3.0 anyway, but it’s important for existing users to know how we have been losing on this new tariff.