Table of Contents

Introduction

Moomoo Malaysia is a recently popular stock brokerage in Malaysia, it provide an access to local stock market as well as US stock market.

Personally I rarely pay attention to smaller stock brokerage platform, this is because most of the time they can never compete with larger platforms on fees, order execution quality and market access, this is expected because of the economic of scale.

That is also one of the reason why I never pay as much attention to invest in Malaysia stock market, because the cost to invest are generally much higher, which directly impact your risk adjusted return.

But I still understand some people would like to invest in local stock market, maybe because they are more familiar with the local market, or particular company and business, so that is one of the reason I want to make some review for local stock market brokerage options.

The other reason I decided to make a review on Moomoo Malaysia, and I want to be completely honest, is because they have been running very generous campaign to attract new users, and I’ll talk about exactly how you can get the campaign bonus later in this post.

My referral link: moomoo.malaysianpf.com

Are Moomoo Malaysia a Legit Brokerage?

Moomoo parent company is Futu Holdings which originate from Hong Kong and the parent company are also listed on NASDAQ under the ticket FUTU.

It is currently providing brokerage services to multiple countries such as US, Canada, Australia, Singapore and Malaysia. They also held multiple licenses in these countries to provide financial services.

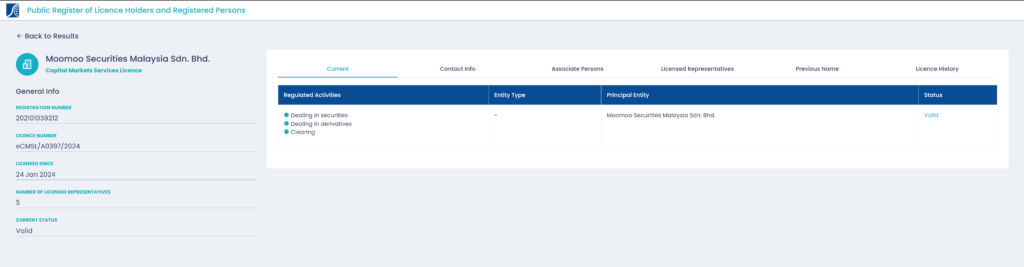

Since this post is about Moomoo Malaysia, we are just going to look into Moomoo Securities Malaysia Sdn. Bhd. the subsidiaries that offer stock brokerage services in Malaysia.

We can see it indeed maintain a valid license from Securities Commission Malaysia for dealing securities, derivatives and clearing.

They are also a participating members of Bursa Malaysia, which make them also participated in the Capital Market Compensation Fund (CMCF) which provides up to RM100,000 protection to investors.

Based on that I will think Moomoo are relatively safe and legit stock brokerage, especially when your funds are below the RM100k protection limit.

Market Accessibility – Malaysia & US Stock Market

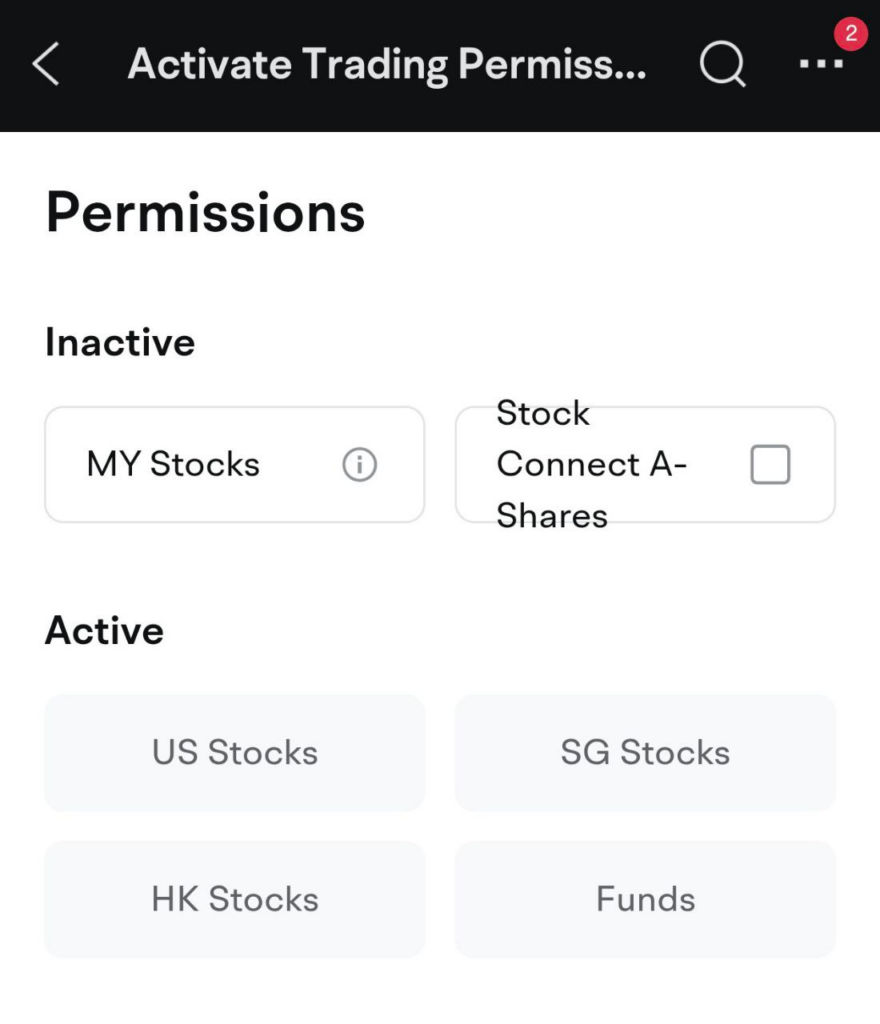

In Moomoo Malaysia, it gives you access to Malaysia, US, Singapore, Hong Kong stock market, it also let you buy stocks from China via stock connect.

So you can trade stocks, funds and exchange traded funds (ETFs) within these market, and for US stock you can also trade options.

However as someone who mainly invest in US stock market, it’s important to understand the taxation when investing US stock, first of all there is a 30% withholding tax of any dividend on US stocks, this mean if you invest in high dividend yield stock you might take a larger hit on taxes.

The other thing to note is if your investment in US stock is exceeding $60k, you will have to pay attention to estate tax, this mean if something happen to you, your family will incur taxes up to 40% on amount above $60k.

This is the reason why I invest in US index ETFs using Irish domiciled funds, which provide better tax advantages, but unfortunately you can’t buy them in Moomoo Malaysia as of writing this.

Common Fees

In this section I’ll only look at the fees most people will be interested in, which will be deposit/withdrawal fees, the trading fees for Malaysia and US stocks, as well as the currency exchanges fee.

No Deposit & Withdrawal Fees

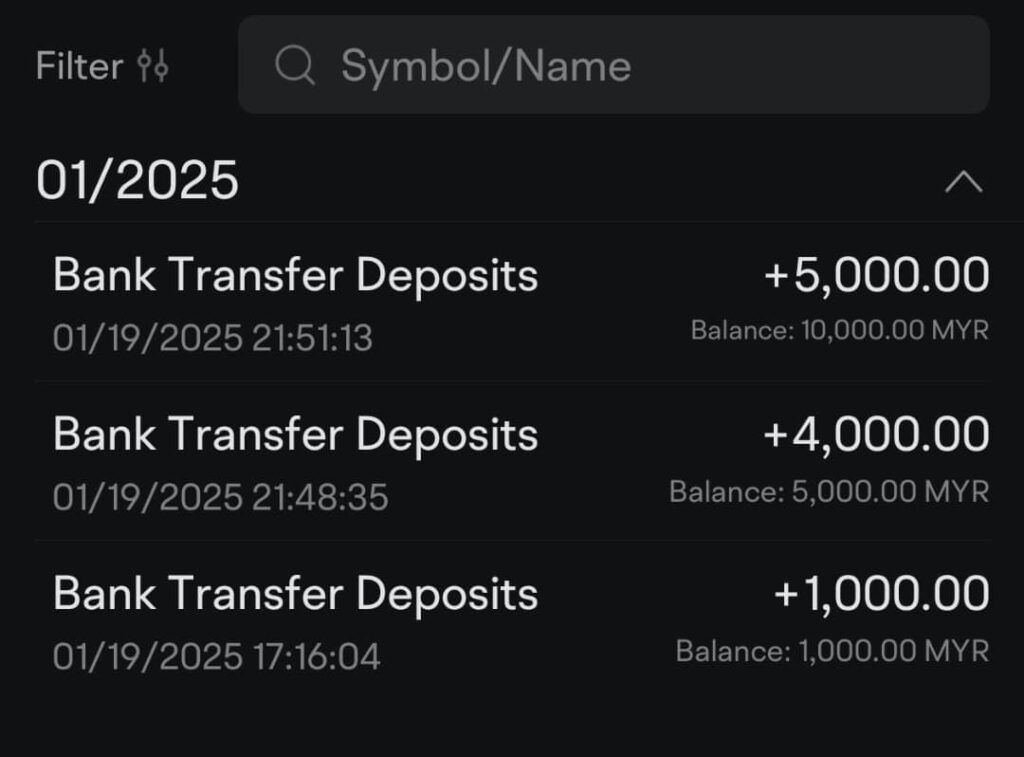

The great news is there is no deposit or withdrawal fees, and I made 3 deposits totaling RM10k with FPX deposit options and these deposit reflected in my account instantly.

You can also use manual bank transfer which may take longer time to reflect to your account.

Currency Exchange Fees

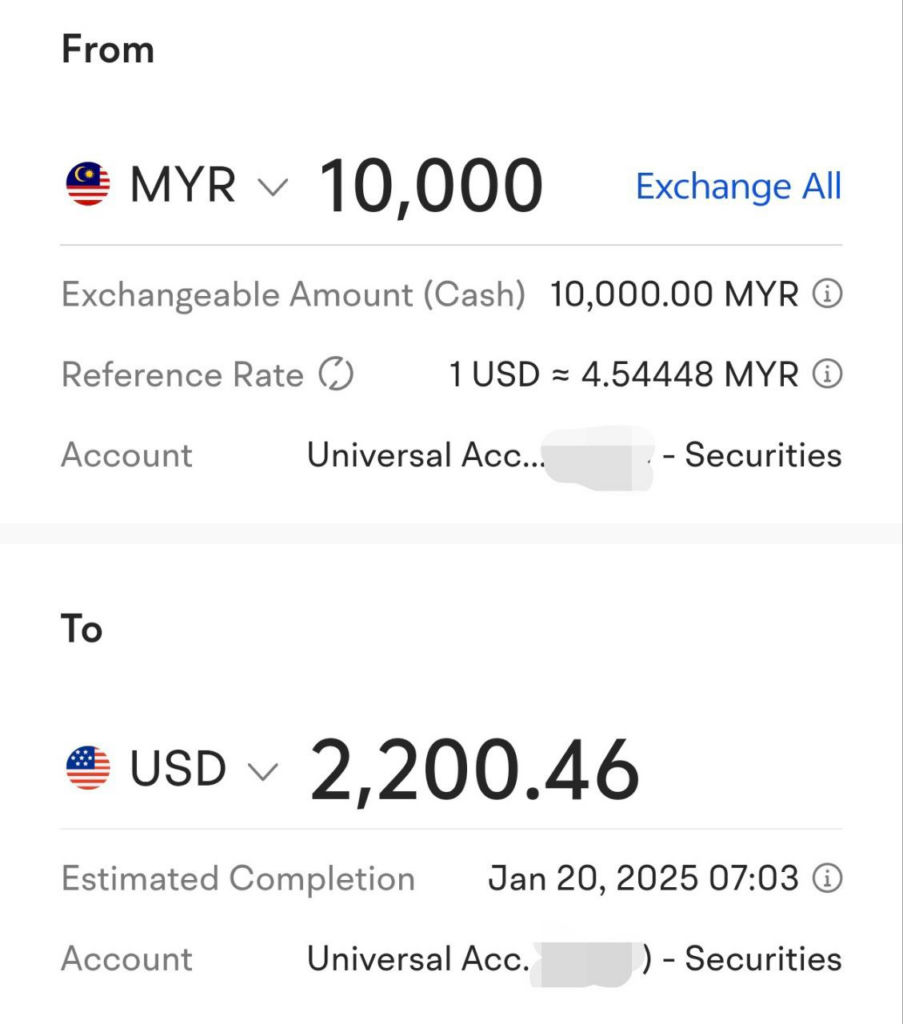

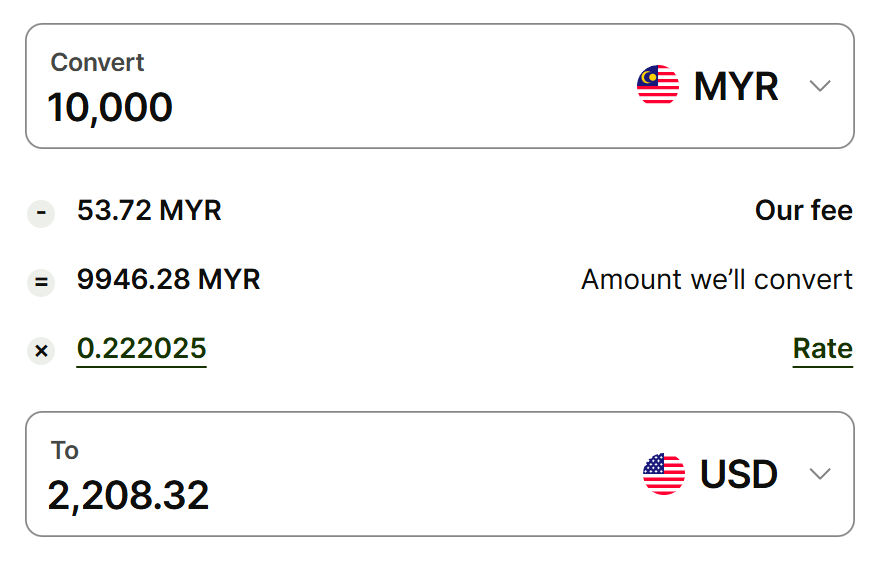

The next thing I immediately look at this the currency exchange fees, because I am very sure there many people will use their Moomoo Malaysia account to buy US stocks, so I want to know if the currency exchange cost.

Since the other popular way for people to invest in US market is using Interactive Brokers, and Wise is the common funding method, we will compare with Wise exchange rate.

Right of the bat we can see Wise has a much better exchange rate, the difference isn’t insignificant either, that’s a ~0.357% more when you exchange with Wise instead of Moomoo.

Keep in mind in investment world, people prefer SPYL over CSPX (both are S&P 500 Index ETFs) because SPYL has an annual total expense ratio of 0.03% compare to the 0.07% of CSPX.

Which mean the conversion fees itself are able to pay for nearly 12 years of the fees when you compare to SPYL, currency exchange fees like this will turn many serious investors away.

US Stock Trading Fees

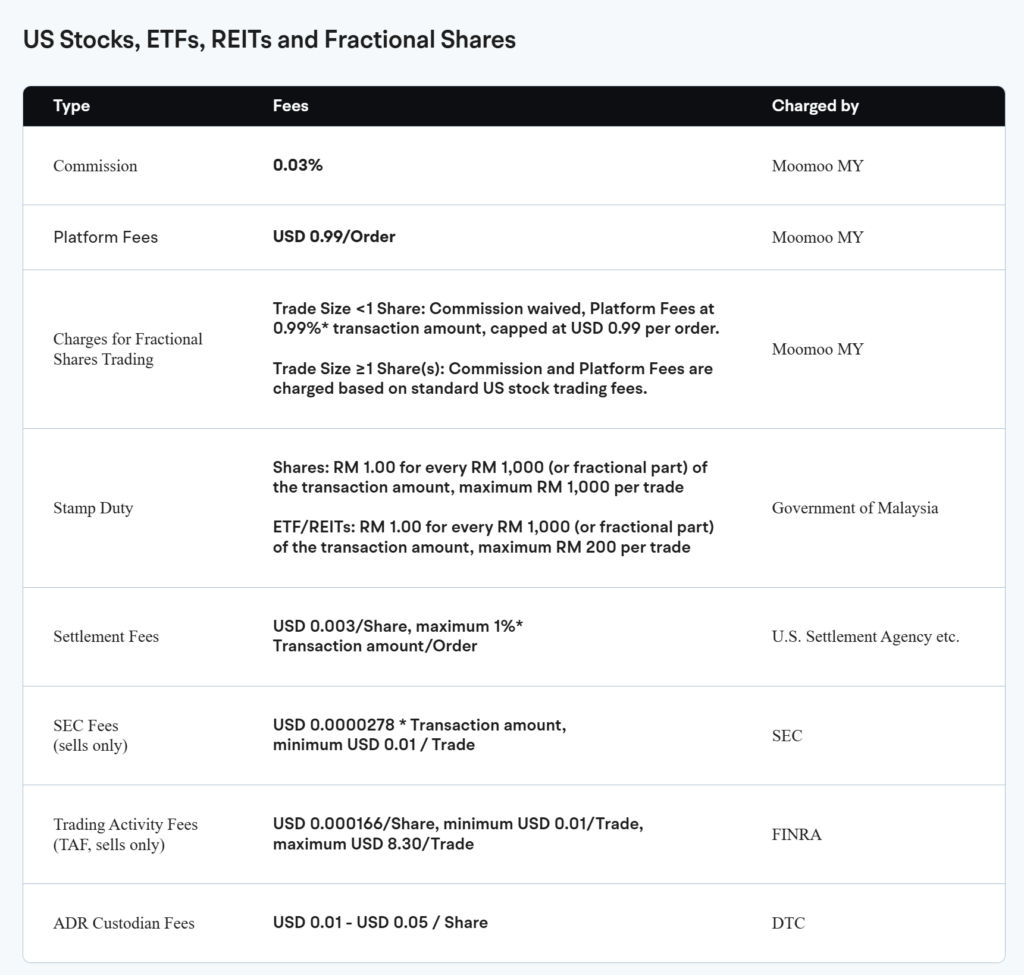

Let’s compare buying US stock on Moomoo Malaysia and again, we will compare with buying US stock in Interactive Brokers, first let’s look at Moomoo’s fee schedule:

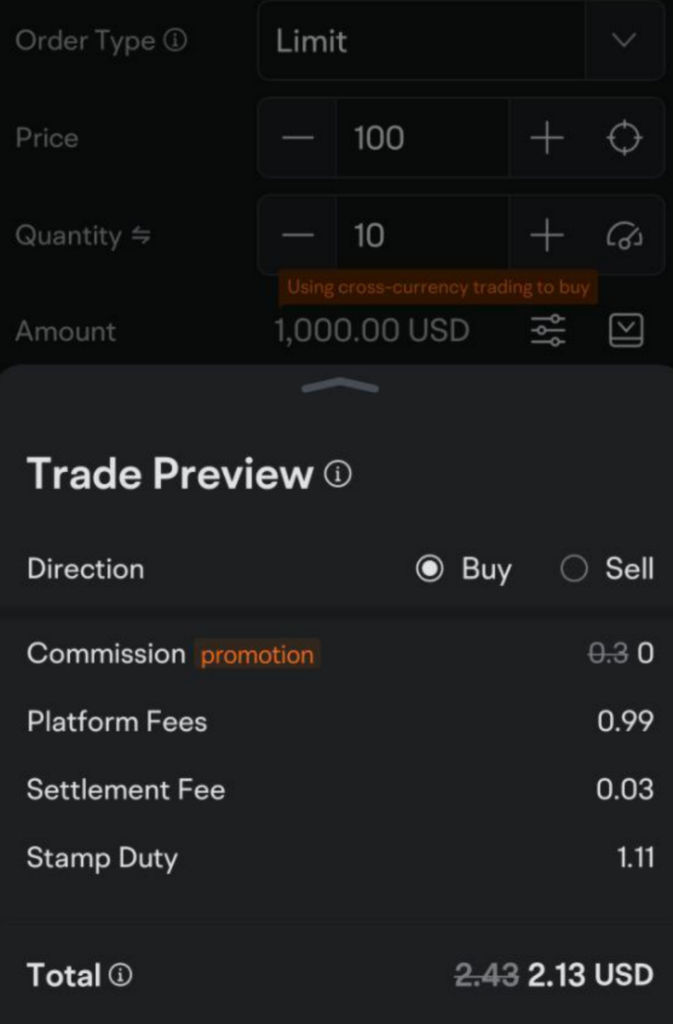

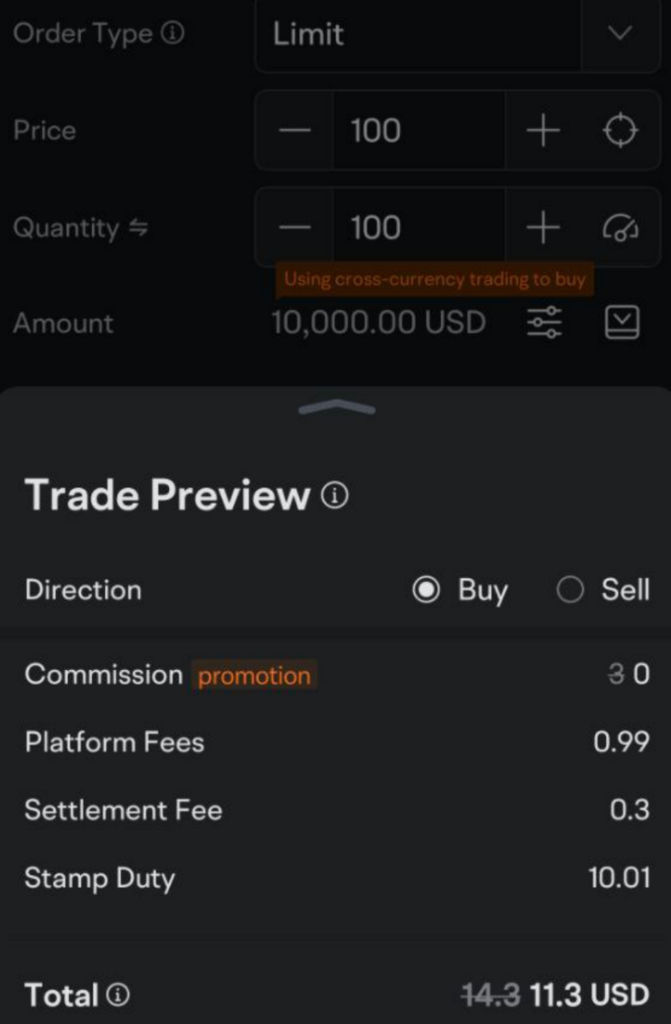

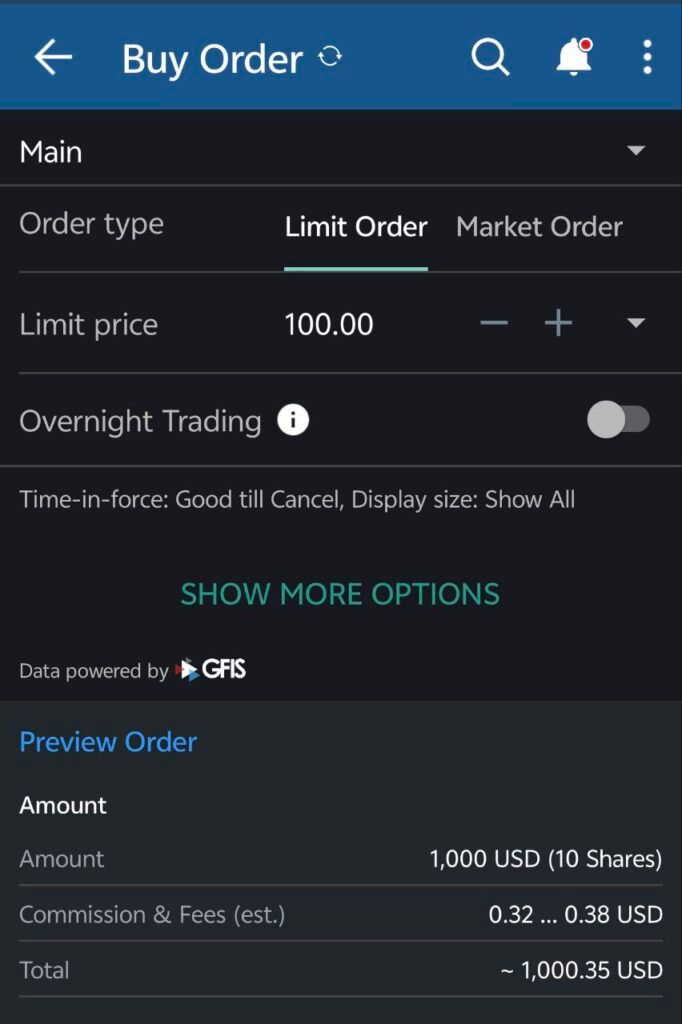

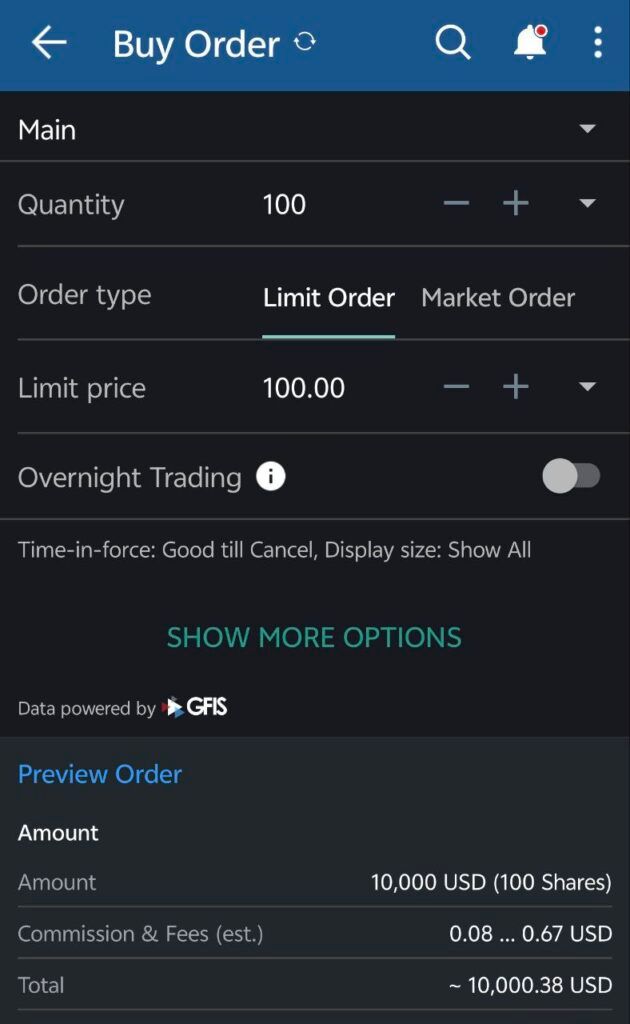

Let’s look at the case of a $1000 and $10000 order how much fees we are going to expect on Moomoo Malaysia, we will use SGOV ticker, limit price at $100:

Next we will compare it to placing the same order on Interactive Brokers tiered account:

What we can observe here is the commission and platform fees, where both are charge by Moomoo are way more expensive than the fees charge by IBKR. Without promotion, the commission and platform fees are $1.29 and $3.99, while on IBKR are $0.35 and $0.38 ($0.35 is the minimum fees).

The commission fees and platform fees are basically the same fees charges by Moomoo, the reason why there are two different fees are most likely by doing so they will ensure to be able to earn a minimum fees of $0.99 but also have higher potential to earn more fees when you make larger order.

For stamp duty fees that is the charge imposed by Malaysia when a client buy and sell shares from a Malaysia government regulated brokerage, in plain words, you are paying for the government effort in vetting the platform.

Interactive Brokers are not “officially vetted” and “regulated” by Malaysia Security Commission and it not a members of Bursa, but that doesn’t make it less credible, in fact they are one of the largest stock brokerage firm in the US, operate internationally and regulate by many government bodies, it is also a public listed company on NASDAQ under ticker IBKR.

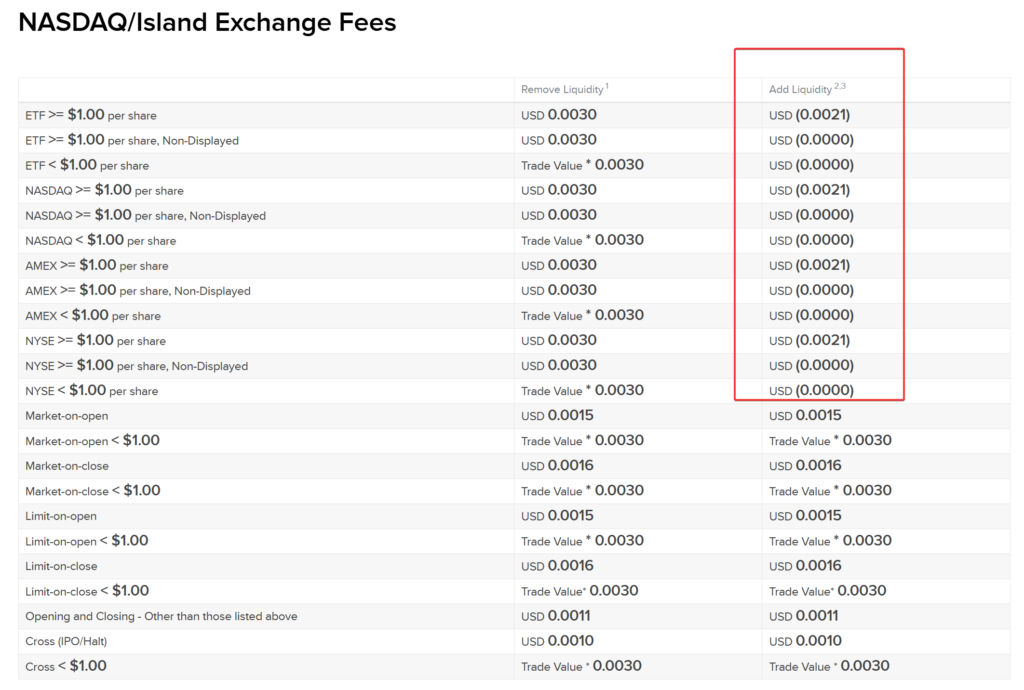

Another thing to note is, sometimes you can even pay lower fees or even get a rebate when you place a limit order that isn’t directly matching with an existing offer, this rebate comes from exchange because you are providing liquidity to the market:

So for me, I wouldn’t use Moomoo Malaysia as my main brokerage to invest US stock because of the currency exchange and transaction fees are way higher than what I’m already using.

Malaysia Stock Trading Fees

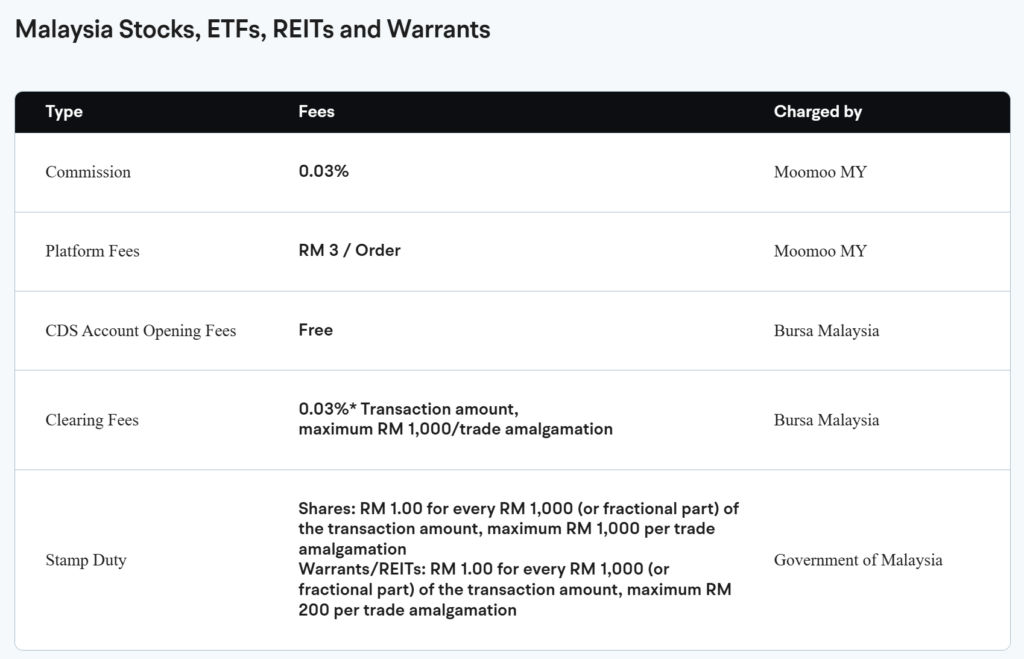

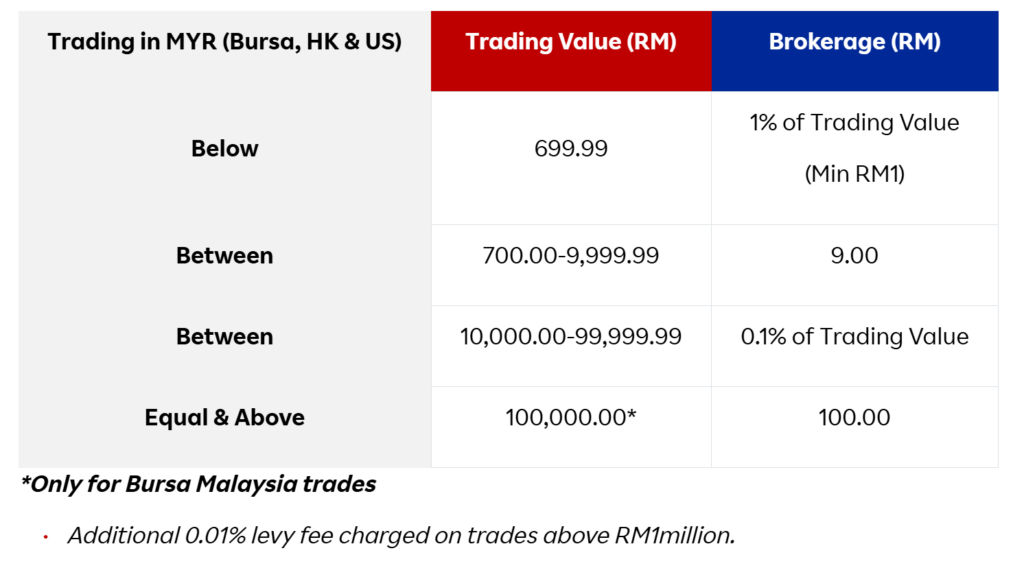

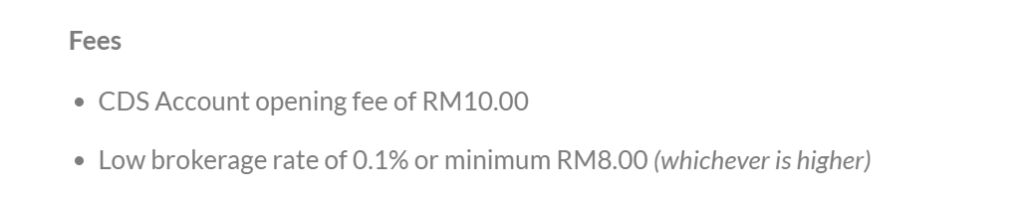

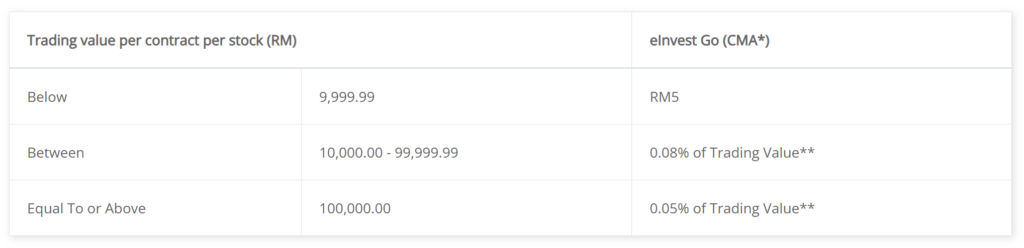

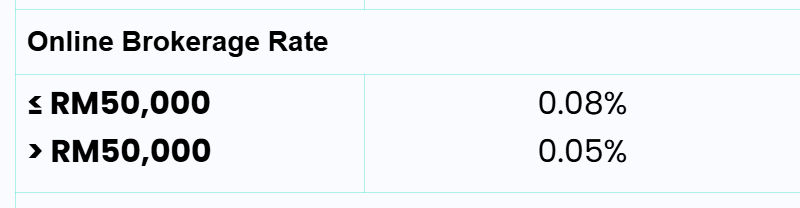

Next we’ll look at the fees for trading Malaysia stock, but this time we will not compare it with Interactive Brokers because we can’t have MYR balance in IBKR, instead we will compare with other local stock brokerage options.

The stamp duty and clearing fees will be the same for trading Malaysia stock on any brokerage, so we will just compare the brokerage fees directly.

Moomoo Malaysia has a commission fees of 0.03% and RM3 per order, while you can get a few months commission free, we will ignore that and only consider fees in long term.

The average fees charge by most local brokerage are hovering between 0.08%~0.1% of the trading volume, which does make the 0.03% fees from Moomoo the cheapest option amongst the competitor.

Except with Affin eInvest, if your typical order size is below RM10k then the RM5 would be the a cheaper option, unless you are able to trade commission free with Moomoo Malaysia.

As far as I know, even for order above RM10k, there’s no reason you can’t split that into multiple orders to take advantage of the RM5 fees with Affin eInvest.

While Moomoo Malaysia does offer commission free period of 6 months for new sign ups and you can exchange “points” for commission free, but that may not always be available so I did not consider the commission free period into comparison.

So the conclusion is unless you are able to consistently achieve commission free trading within Moomoo or else it may be cheaper to use Affin when investing local stocks.

Promo Campaign for Up to RM1800 Reward

I will be very honest with you, at this moment the only real reason for you to sign up Moomoo are because of their generous promo campaign which allows people to get up to RM1800.

Consider joining with my referral link if you decide to take advantage of the campaign reward:

moomoo.malaysianpf.com

The current promotion runs from 15th January 2025 until 26 February 2025, but they have been renewing similar promotion campaign since 2024, so even if you read this after the campaign is over, you can still check their current promotion to see if there’s similar running campaign.

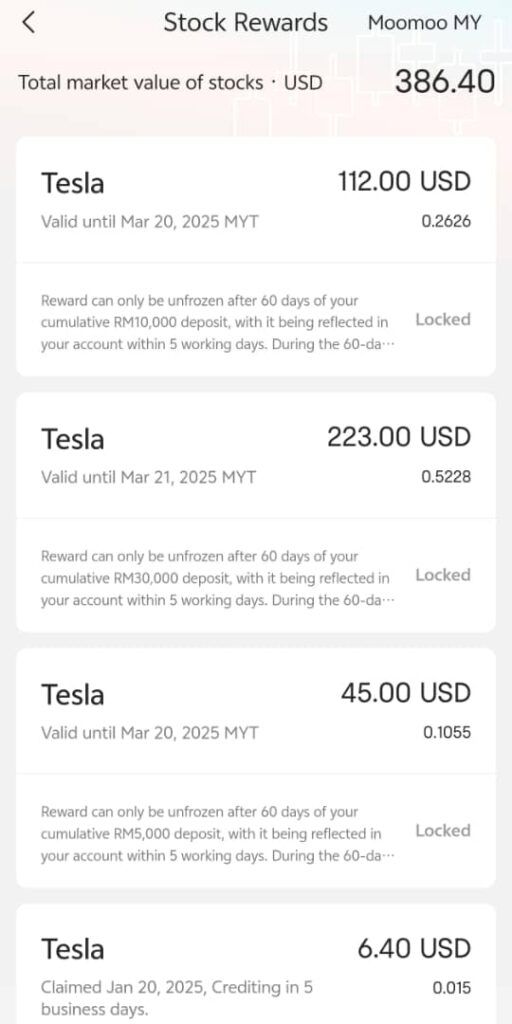

Currently you can get up to RM1800 for meeting below conditions:

- RM100 cash voucher for depositing a cumulative of RM1,000

- RM200 worth of Tesla stock for depositing a cumulative of RM5,000

- RM500 worth of Tesla stock for depositing a cumulative of RM10,000

- RM1000 worth of Tesla stock for depositing a cumulative of RM30,000 and make at least two trade (Limited to first 5000 participants)

- You will need to maintain the deposited amount for 60 days

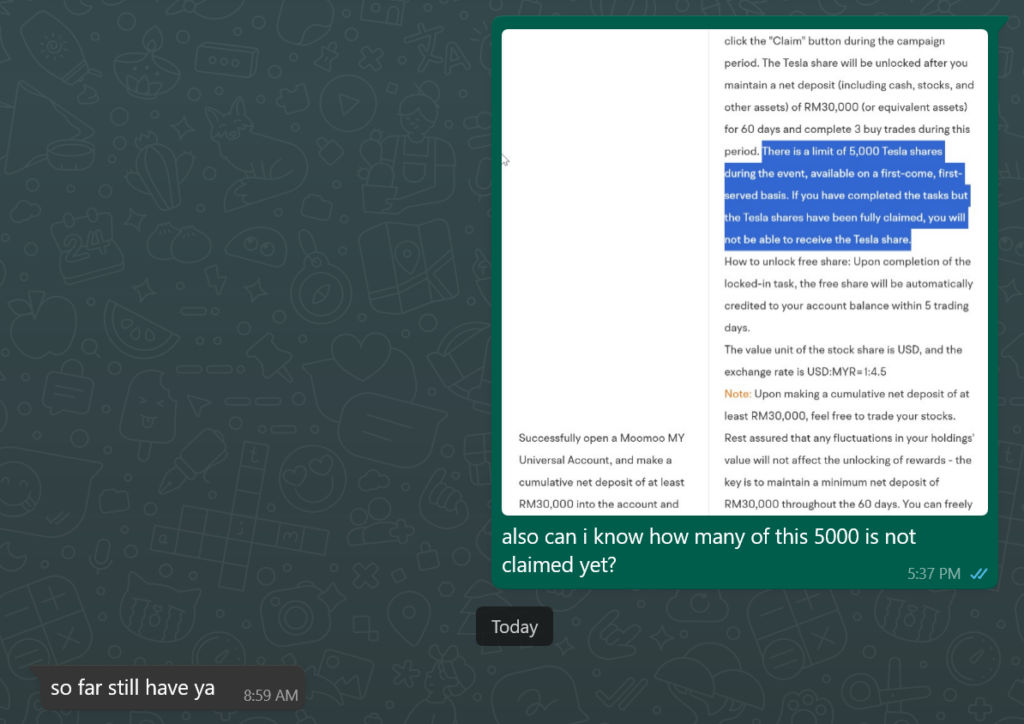

In total you can get up to RM1,800 in total for deposit RM30,000 and make two transaction, however since the last reward is limited to first 5000 participants it’s best to check with the customer support before deposit RM30,000.

If the first 5000 participants reward are claimed, you can just deposit RM10,000 and claim the other cash rewards of up to RM700, and decide if you want to use the cash voucher to get the other RM100.

RM700 cash reward with RM10,000 deposit are equal to 7% in 60 days period, or 42% annualized return, which in my opinion is a very generous offer to take advantage of.

Claiming the cash voucher

The first reward gives you 2 cash voucher of RM25 value when you first make a cumulative deposit of RM1,000 and another cash voucher of RM50 will be given on day 60 after you maintained the deposited amount.

Here’s how the cash voucher work, you will have to place order that meet the voucher minimum amount, in this case RM200, and then once the order is completed and settled you will be credit RM25 directly into your account.

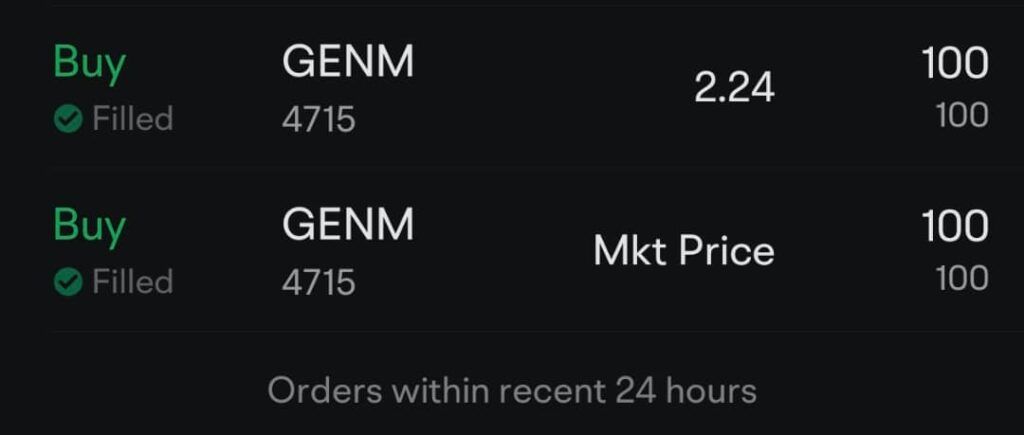

Personally I just picked some random stock with a lot price above RM200, which I buy the stock twice in two different orders then sold it at the same day, there’s some platform fees of RM6 incurred, but in the end you get back RM50.

You just need to do this once more time at day 60 when you receive another cash voucher of RM50. If you are depositing RM30,000 to claim the RM1,000 reward, you probably will also do this to meet the criteria of completing two orders.

Claiming the rewards

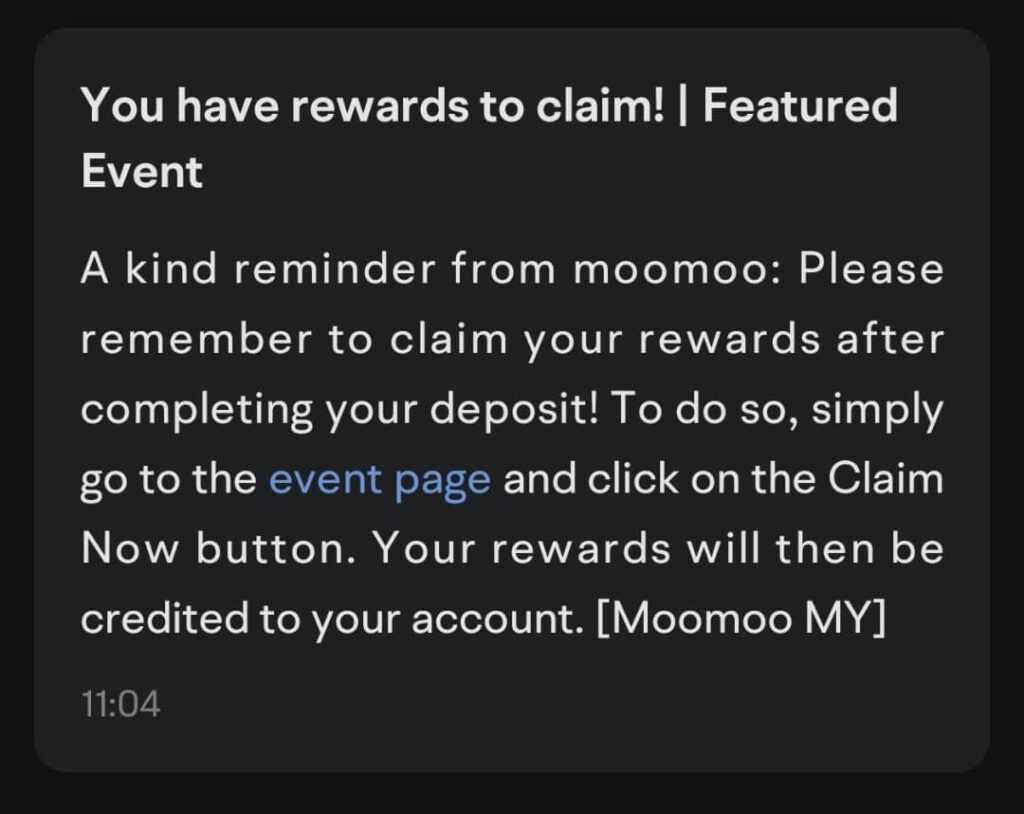

Whenever you met the criteria for claiming rewards it will send you a notification like below:

Make sure to click into the event page and claim every rewards that you are eligible to claim, then the rewards will marked as received:

You can see the rewards within your account page, as stated previously they will be freezed for a 60 days vesting period, and you will be able to sell them on day 60.

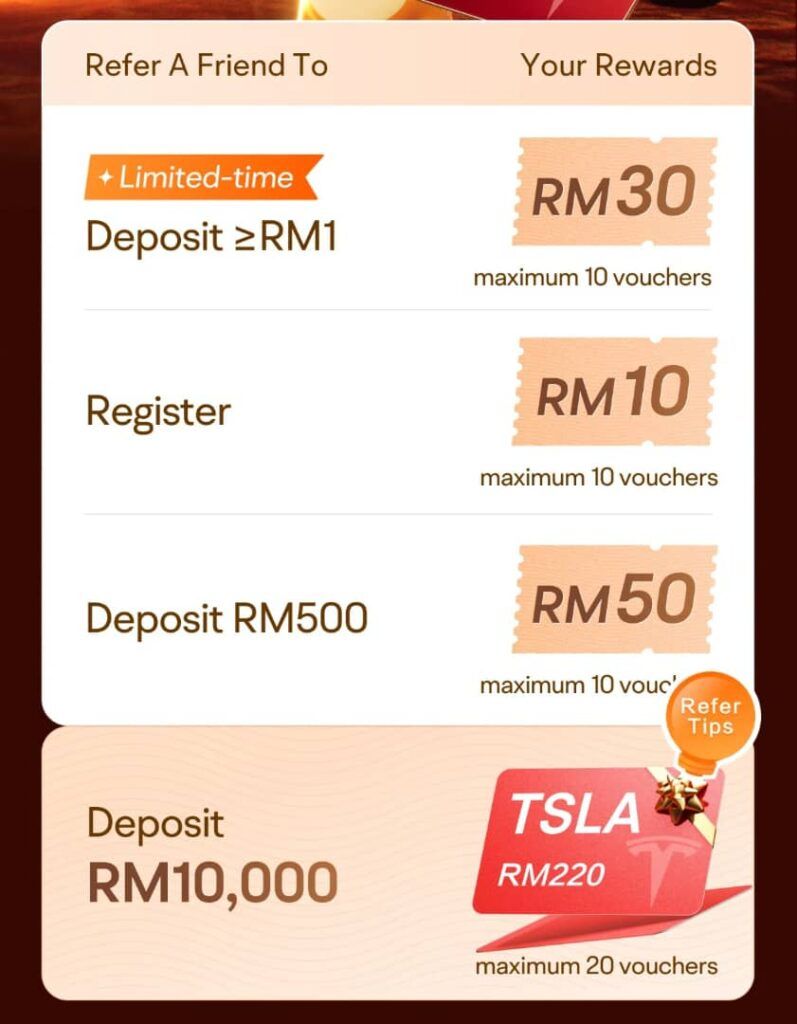

Referral campaign and rewards

You’ve seen me sharing my referral link to sign up Moomoo Malaysia, now if you don’t already have an account you can consider using my link, which has no cost to you.

So what do I get from the referral and how you may take advantage of the referral campaign?

The referral campaign will give me a total of RM310 for every user register from my referral link and make a deposit of RM10,000. But obviously there’s a limit of 10 to 20 vouchers on each categories.

What you can do is you can refer your friends and family, if they wanted to take advantage of the cash rewards then ask them to consider sign up with your link, BUT make sure to make disclaimer to them you are merely sharing a referral link of a stock brokerage licensed by Malaysia Security Commission.

The government is the one who done the vetting, and the Bursa capital market compensation fund (CMCF) are the one providing protection of RM100k, I am not guarantee anything personally.

Final Conclusion

For US stock invest I still think Interactive Brokers fees, market accessibility and execution quality are simply better than small brokerage like Moomoo.

For Malaysia stock invest Moomoo isn’t the cheapest option too when there is no commission free offer.

Personally the only reason I will sign up and use Moomoo Malaysia will be just for claiming the rewards, maybe whatever I deposit during the campaign will stay there to buy some stocks, or maybe I will just withdraw entirely when I needed the cash.

Anyway I hope this review will be useful to you, if you have any questions feel free to leave them in below comments!

Excellent analysis! Fully agreed with you that Interactive Brokers is better than Moomoo for U.S stock purchases.