Table of Contents

Requirement for Short Term Cash Parking

Every few months I would sell some stocks from my brokerage account to cover my bills and some living expenses, since these are meant to cover bills for the coming few months, it would be losing out some opportunities if they are sitting in my low interest saving account.

So I spent some time and compared a few options and finally decided a few place I would park my cash in, and this is my requirement:

- Minimal risk and predictable

- No lock in periods

- No front loaded fees

- Can be withdraw within 2 business day or less

Personally I ended up with money market fund, and here I will share what I found.

Money Market Fund (MMF)

Money market fund is a low risk unit trust or fund that invests in short-term, high quality and highly liquid instruments like treasuries, bonds, government securities, and bank deposits.

It aims to preserve capital while providing better returns than regular savings accounts, thus it’s ideal for parking cash in short term.

However, it isn’t fully capital secure, it is subject to interest rate changes and credit risks, for example it can lose value if the underlying assets default.

You can see money market fund as a step up from fixed deposits since it provide better average return and more flexibility with no penalty for early withdraw.

In long term bond funds would generally offer higher returns and lower overall risks, but because they can be more volatile in the short term making it less ideal for parking cash compared to MMF.

Where To Subscribe Money Market Funds?

Money market funds in Malaysia are licensed financial products regulated by the Securities Commission Malaysia (SC).

They are typically offered by licensed fund management companies and distributed through approved platforms like unit trust agents, banks, or digital investment platforms.

Here are the digital investment platforms offering MMF and some of them are used by myself.

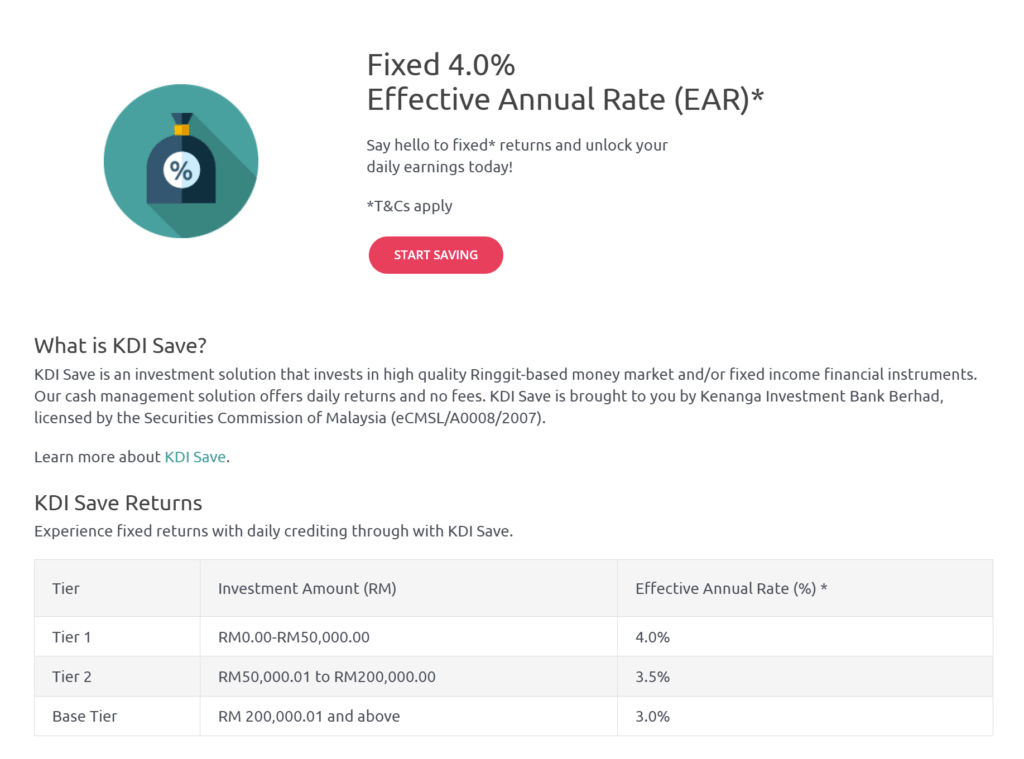

KDI Save by Kenanga Digital Investing

Website: https://digitalinvesting.com.my/save/

It comes with one of the best rate at up to 4% for the first RM50,000 and unlike other platform it doesn’t have a bunch of annoying tasks or “quests” to do to unlock higher interest.

The interest are paid daily, and the withdrawal time is about two business day, and the minimum deposit is RM100, no lock in, no penalty, so it checks everything on my list.

But there is no info about the actual underlying fund, and just like every other MMFs it is not PIDM protected because it’s an investment fund.

This is one of the popular options mostly because it offer better rates than others and are more straightforward, Kananga is also an established brokerage in Malaysia.

Cash Plus by Moomoo

Website: https://www.moomoo.com/my/invest/cash-plus

Moomoo is a full fledge licensed brokerage platform and unlike other platform it offers multiple option of money market funds with from their partners include Maybank, UOB and Eastspring.

You can also choose to park you cash in USD, but for me I’m focusing on the money market funds denominated in Malaysia Ringgit, because I don’t want my short term fund expose to currency risks.

I couldn’t find exact wording to confirm if the interest is calculated and pay out on a daily frequency, but I think from some marketing material it suggest that is the case.

One thing to take note is the interface shows the annualized yield from last 7 days, which could be misleading for those who are less aware, for example the MMF from UOB shows 3.89% in the screenshot, but this is the actual fund performance in longer term:

This is taken from the fund product page on UOB asset management website: United Money Market Class R

In reality they are more or less the same in terms of performance, the MMF from UOB has higher management fee at 0.75% compared to Maybank Retail Money Market-I Fund or Eastspring Investments Islamic Income Fund at 0.25%.

FSMOne by iFAST Capital

FSMOne is a digital brokerage platform by iFAST Capital, which is a popular brokerage platform from Singapore and licensed by SC Malaysia.

The platforms offer large variety of unit trust and funds, which includes many money market funds from Malaysia’s fund management company.

You can use the funds selector with money market fund filter to look at all of the available MMF, and sort by performance or fund size.

This is great for anyone already have the account with FSMOne, and I think this is more straightforward, no extra layer of branding on top of these fund with all the misleading marketing material or “promo rates” that only last for a few days or “limit to the first RM1000”.

However the interface can be intimidating for some that are just looking for a quick a simple way to park their cash.

What About Other Platforms? (Versa, Stashaway, etc)

I’ll quickly go over the other few platforms and explained why I am personally not considering them, but keep in mind this is completely personal preference.

Versa Cash

The underlying fund of Versa cash is Affin Hwang AM Enhanced Deposit Fund, the MMF perform more or less the same as other MMFs in the market with 0.5% management fees.

What I do not like with Versa is the “do quests to unlock higher rates” part, which they pay extra with their customer acquisition budget, but it makes the expected rate confusing and misleading at times.

I also prefer daily interest payout instead of the once per month payout from Versa, which make it hard to keep my money concentrate when I move them, leaving breadcrumbs every where.

There has been cases where users reporting errors in calculating their profit, while it has been resolved but it still give me an impression they are less professional.

By the way you can subscribe to the same MMF with FSMOne too, this is the AHAM Enhanced Deposit Fund page on FSMOne.

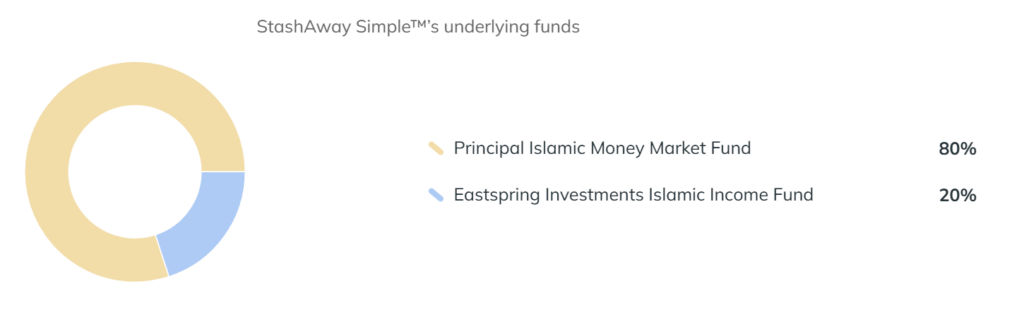

StashAway Save

Nothing wrong with StashAway Save, but nothing much special anyway, maybe it’s just me I personally don’t find there’s a reason to use platform that just rebrand MMFs like Versa or StashAway or TNG.

And okay, I’ll admit I also have some prejudice with “robo advisor” platform, because I think these are stupid idea and encourage people to stop thinking about their financial planning.

Asking a few questions to determine if you should be 60/40 or 80/20 on stock bond mix was insultingly basic to anyone with a deeper understanding of finance, then users end up by underperforming the market because of the extra layer of fees.

Okay I’m sorry for the rant, let’s focus back on the topic, the StashAway Save does however provide 0.15% “bonus rate” for new customers in the first 6 months.

Go+ from Touch ’n Go

The underlying money market fund in Go+ is Principal e-Cash Fund by Principal Malaysia, the fund has a management fee of 0.45%.

I actually liked this one, not because of the underlying MMF nor does it offer additional rate bonus, but because it is so convenience.

Since TNG is so common and many vendor accept payments from TNG, so the idea that you can keep your cash in this eWallet while letting it automatically subscribe to MMF to earn some interest is such a great idea…

Until I encountered a fraudulent transactions on my TNG Visa Debit card.

I did eventually get back the stolen fund after I file a disputes, but that taught me a lesson, that convenience idea actually came with a risk, because card skimming is not uncommon in Malaysia, and TNG doesn’t even ask for confirmation to approve transactions means it is unsafe for me to leave my money in the ewallet, especially when TNG doesn’t even have a monthly statement makes spotting fraudulent transactions even harder.

So my conclusion is, while able to earn interest from MMF in my ewallet is great, but because it is tie to the Visa card that I use in everyday life, I think it’s much safer to separate these funds.

Other Platforms

I may not be able to include all the platform that allows you to subscribe to money market fund, but in my opinion they are all similar, most of them are just a branding and different UI/UX for the same underlying funds.

You can even subscribe those MMF from full fledged brokerage platform that offers unit trust and mutual funds.

My Personal Choice For Short Term Cash: KDI Save

I chose KDI Save simply because it’s straightforward, and they have been providing the promotion rates of up to 4% for more than two years, without requiring me to fulfill various conditions.

I think as long as KDI Save can continue to provide this promo rates, which is unlikely and unsustainable in my opinion, because they are paying extra interest as a customer acquisition on the difference of the money market funds actual return.

The only thing I dislike from KDI Save is for not disclosing the actual underlying funds, I think this should be a requirement for such platform, because we should able to know the details where our money is invested to.

The second platform I would use is likely Moomoo because I already had the account, or FSMOne if I decide to buy some specific MMF, but in my opinion choosing either of them is more or same the less, I’ll explain abit in next section.

Final Thoughts: MMFs Are Not For Long Term

It is crucial to remember that money market funds are a tool for a specific job: keeping your short-term cash liquid, safe, and working a little harder than it would in a standard savings account.

They are not a substitute for a long-term investment strategy. For wealth accumulation over the years, you’ll want to look towards other instruments like stocks and bond funds that are designed for growth.

Ultimately, the differences in returns between the top money market funds in Malaysia are often minimal for the amounts most of us would park for a few months.

The best choice often comes down to your personal preference for user experience, convenience, and which platform you trust the most.

What Do You Think?

I’ve shared my research and personal preferences, but now I’d love to hear from you.

- Which platform are you using to park your short term cash?

- Have you had a particularly good or bad experience with KDI Save, Versa, StashAway Simple, or another platform?

- Are there any other great options I might have missed?

Drop a comment below and let’s help each other make better financial decisions!