Table of Contents

What Is Maybank Global Access Account

Maybank Global Access account is a new product offered by Maybank which is a multi currency saving account. It can be directly seen as a competitor to Wise.

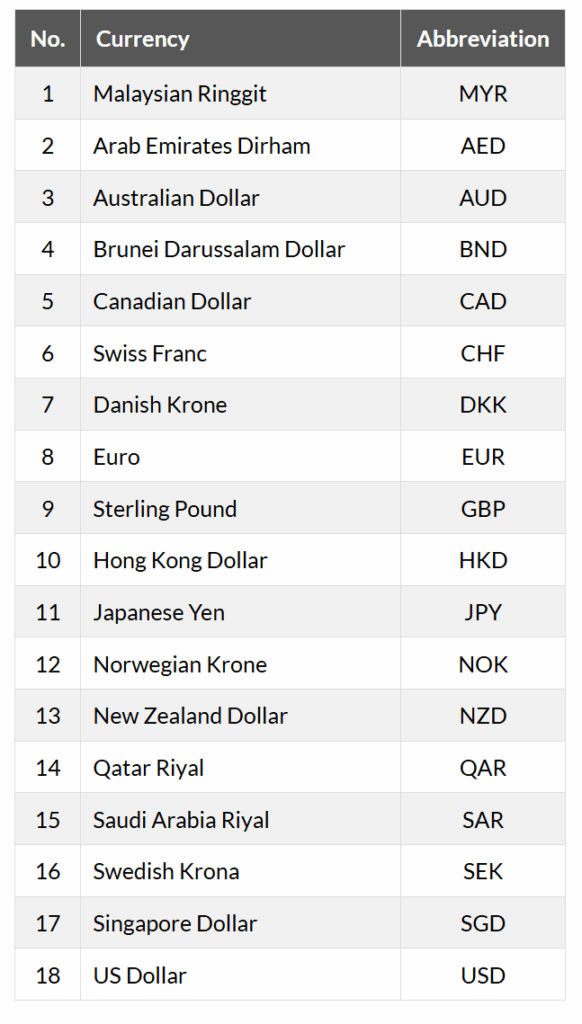

As of now it offers 18 different currencies that you can use with the account, it’s a relatively smaller number than Wise at 150 or even at other competition bank like RHB Multi Currency Account at 33.

In this post I am going to compare the rates and fees to see if it would be better than Wise when using the card to make payment abroad, or moving money between countries.

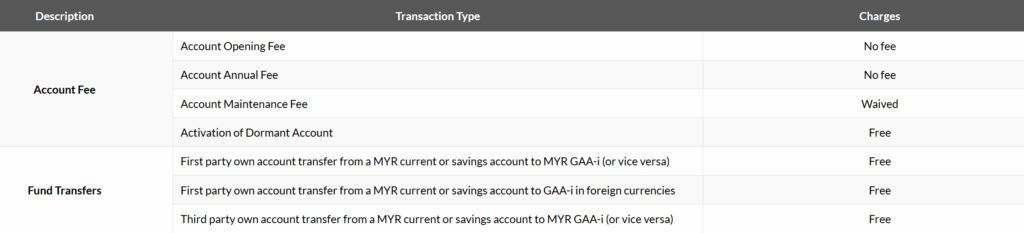

Global Access Account Fees

There are no fees to open an account, no annual fees to maintain the account and no dormant fees, but there is a debit card which comes at an annual fees of RM8/year. No transaction fees for transaction between MYR too.

The debit card are automatically applied when you apply for the account, which also require an initial deposit of RM50, the debit card fees are included.

Telegraphic Transfers Charges (Wire Transfer / SWIFT)

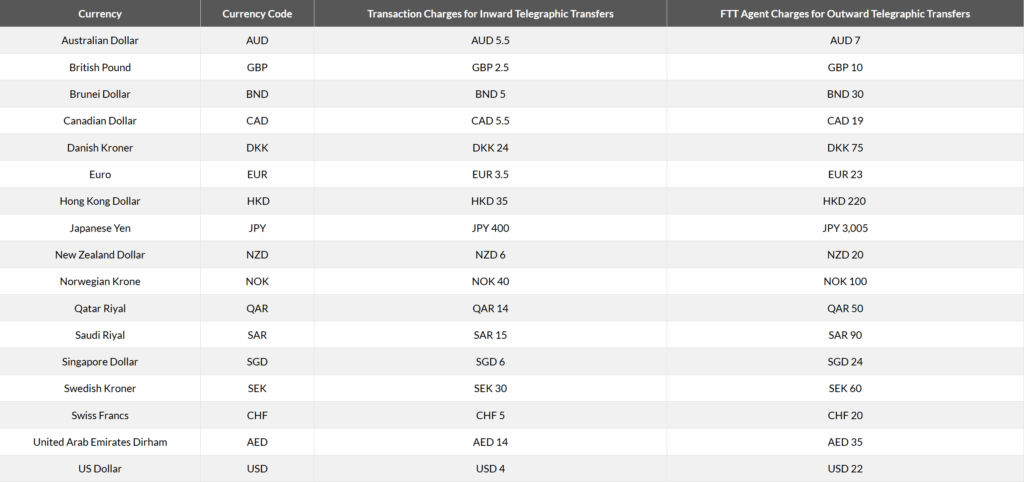

Foreign currencies can be directly transfer in or out from the account, but they come with some fees, and below table is the fees for both inward or outward transfers.

We can immediately see the outward fees are quite expensive when compared to platform like Wise, for example, to transfer out USD it will cost $22 USD, with Wise it’s much lower at less than $2.

The above fees table are taken from the official Global Access Account product page from Maybank.

Spread From Currency Exchange Compare To Wise

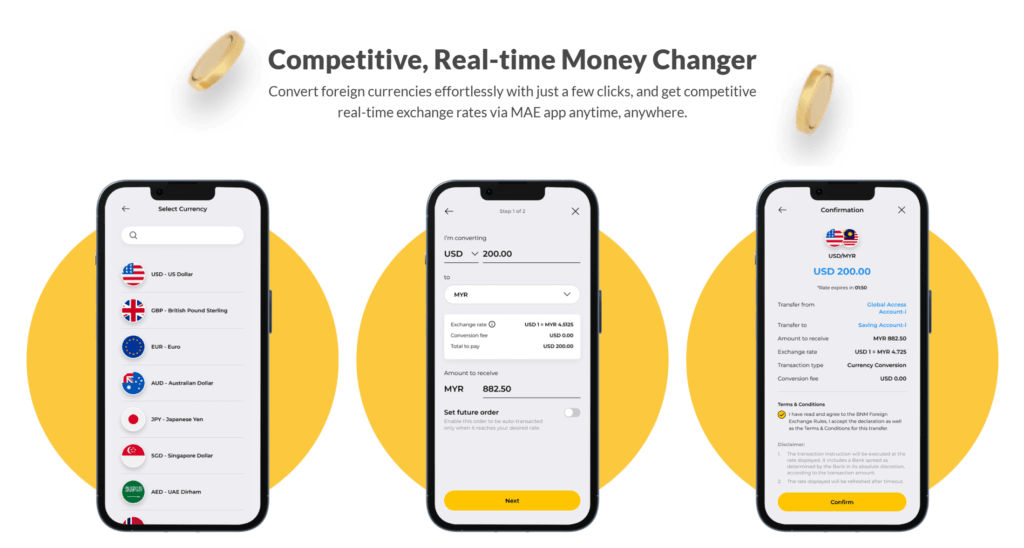

Now that we know the fixed fees, we can check the buying and selling rates of foreign currencies to see if the spread is competitive.

Tighter spread means you will be getting buying and selling rate closer to the mid market exchange rate, which is what we want from currency exchange services like this.

Platform like Wise do not provide a direct buying and selling rate, instead they show the mid market rate and charge a fees usually around 0.54%~0.71% on the exchange amount.

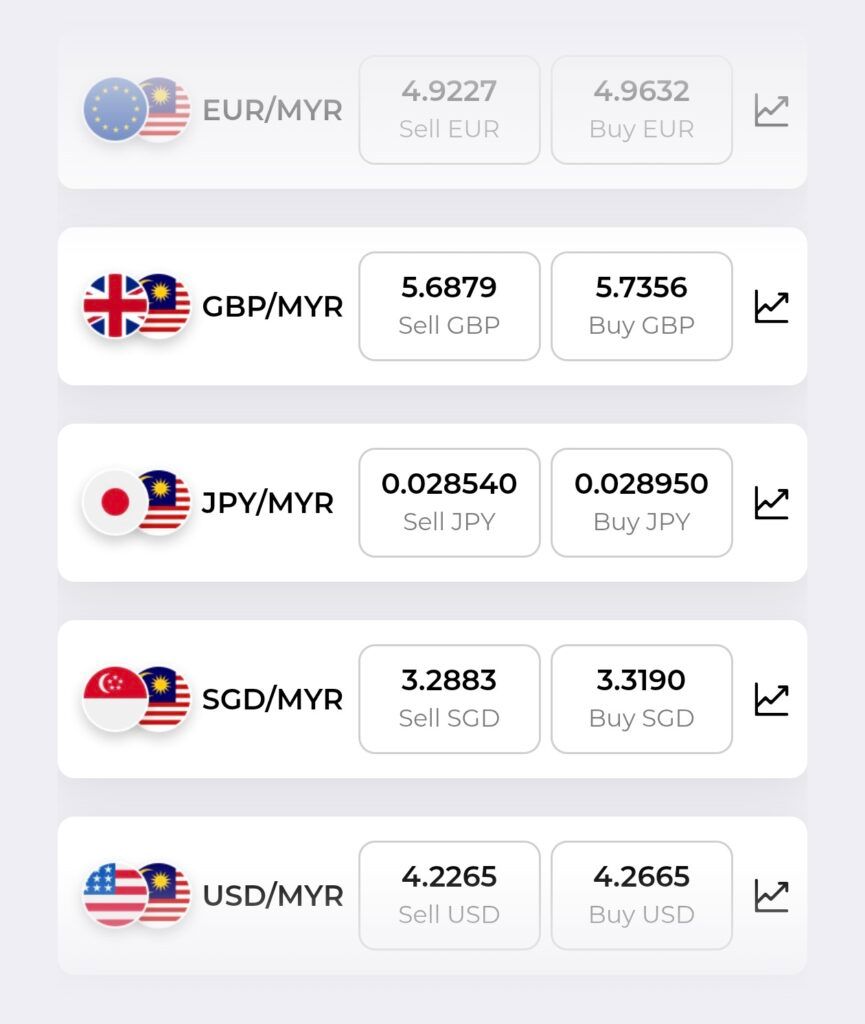

This screenshot are taken directly from MAE app in the Global Access Account watchlist, which you can access even without the account, and it shows the buying and selling rate.

Now let’s find out the spread, and we will use the mid market rate from Wise, which Wise stated they advertise real mid market rate, and it’s also important for the purpose of comparing it to Wise.

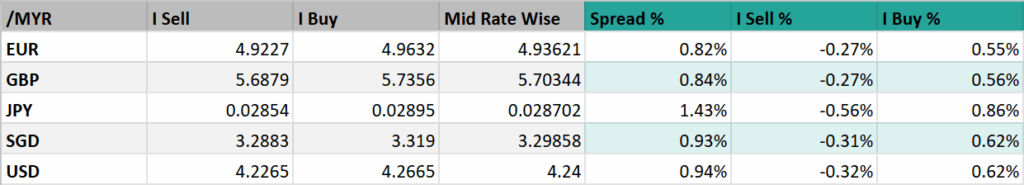

I calculated the overall spread and the spread separately with buying and selling rate, from the table we can see that buying (exchange MYR to foreign currencies) seems to be more expensive than selling.

The spread in buying is very close to the “variable fee” from Wise, but it is still slightly higher, which mean Wise still won at buying foreign currencies.

The spread in selling foreign currencies to Maybank is also very close to the variable fee from Wise, but in some currencies the Maybank give slightly better rate in buying, for example as of writing this the the variable fee to convert JPY to MYR is about 0.7% while Maybank is 0.56%.

Same case for selling USD to MYR, the variable fee at this moment is 0.36% from Wise, but Maybank Global Access is 0.32%, but are still very close.

Now that we know the spread, let us look at the real world practicality of using the Maybank Global Access account.

Benefits of Global Access Account in Real World?

In this section I will cover a few scenario where I can use Global Access Account, but answer whether if it is actually worth using it or if it’s not better than other alternatives.

Using the Debit Card During Travel

Both TNG Visa debit card and GXBank Master debit card has no conversion fees when use abroad, plus there is an ongoing campaign that gives up to 2% cash rebate, so let’s see how Maybank Global Access Account debit card stand up against that.

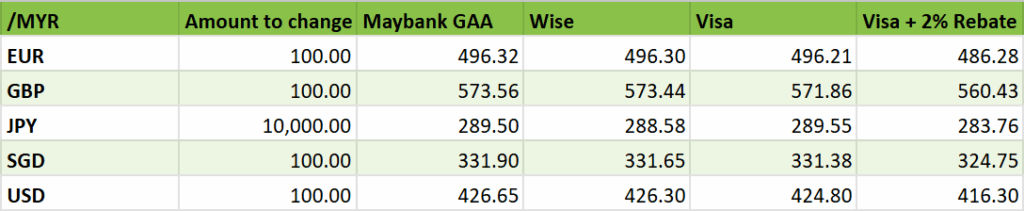

We will look at the Visa exchange fee with USD, JPY, SGD, EUR and GBP for a quick comparison.

Then we compare it with Wise and TNG Visa debit and here’s the comparison:

The table shows Maybank conversion rates are not cheaper than Visa, and with TNG and GXBank rebate campaigns, there is no reason to use the Maybank GAA debit card during travel.

Using Maybank Global Access Account To Fund IBKR

I made a post earlier to compare the method to fund Interactive Brokers account, and during that time it was Wise, but the problem with Wise is there is a daily limit of RM20K, so if we fund larger amount can we maintain the same cost with Maybank GAA but fund it in one lump sump?

Based on the exchange rate in earlier part of this post, Maybank Global Access Account USD selling rate is about 0.62% above the mid market rate, slightly higher than the 0.54% from Wise.

Wise funding to IBKR have a fixed fee of $1.13 USD while Maybank GAA have a fixed fee of $22 USD, which is about 19.4 times higher.

So this would make it even if you transact about 20 times of the RM20K from Wise daily limit, which is RM400k, but even at this amount you would still pay 0.08% more with the higher rate, or RM320.

In absolute terms, Wise is cheaper, but the difference is negligible given the extra days delay, especially if you want to buy a market dip quickly.

Update: Real Example of Funding IBKR with Maybank Global Access

After reading this post a friend of mine are curious about the practicality of using Maybank Global Access to fund his Interactive Brokers account, and comparing it to Wise. He let me documented the entire process so I can share it on this post.

First thing we noticed is there is a RM100,000 daily limit for outgoing telegraphic transfer, that means $22 USD fees for every RM100,000 transfer is the “lowest fee” you can get. This was written on the product page but I didn’t notice the first time I read it.

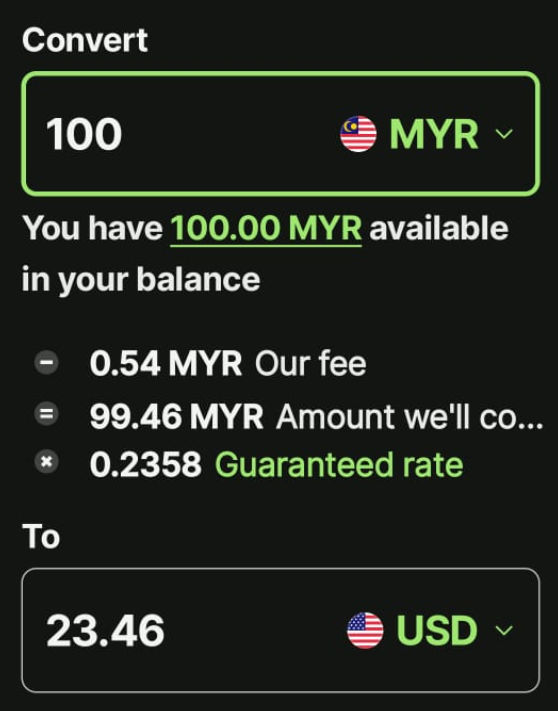

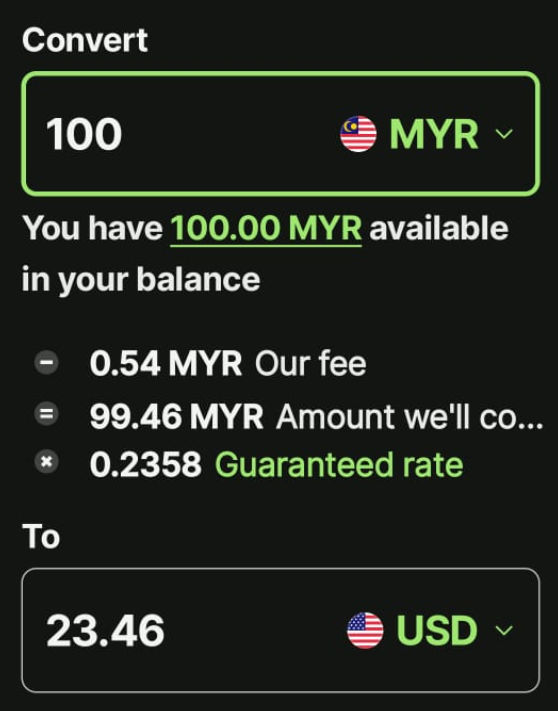

Second issue is the misleading conversion rates and fees, on the first page where we are about to convert RM100,000 to USD, it shows us the amount $23,664.04 with no fees.

Once we press next we notice the conversion rate are different from the first page, and just before you think I’ve waited too long and the rate has changed, that is not the case.

I have retested this multiple times, it’s always show different conversion rate once we press next, and I really don’t like this, cause it’s either incompetent developer made this app or this is intentionally cheating.

The next annoying part is we can’t transfer the entire balance we have converted from RM100,000 and the system show that transaction is over RM100,000 limit, which is kinda annoying, apparently the developer of the app think it’s a good idea to use a different rate to decide the RM100,000 daily limit rather than the actual rate we convert our money.

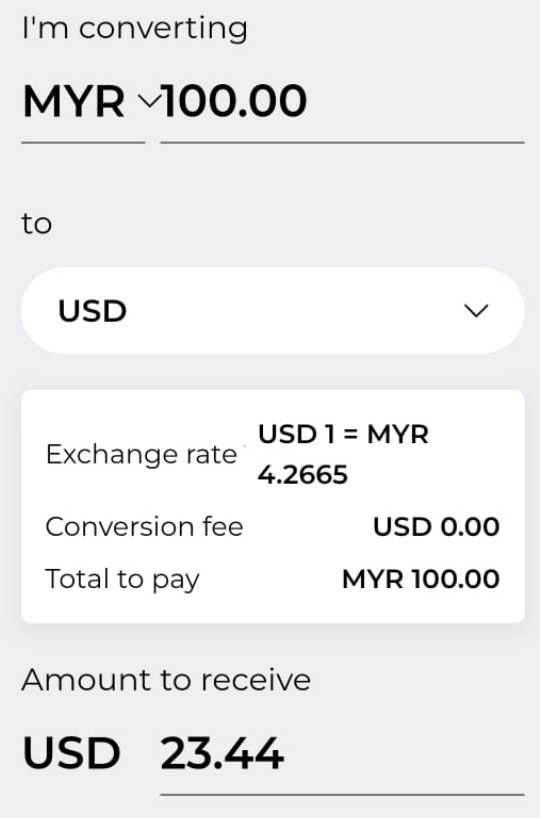

So we tried different amount, $23,500, $23,400, $23,300 and end up successfully transferring $23,000 but here’s the stupid part, even though we had the exact receipt that show we successfully transfer $23,000, the final real amount transferred is $23,300, which is the amount that was showing us transaction failed.

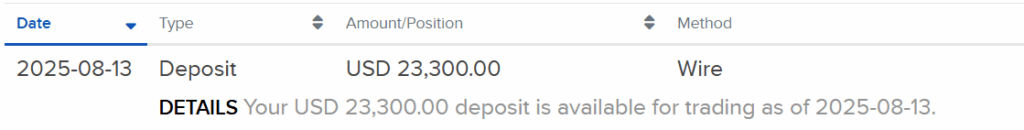

The final received amount is $23,300 from IBKR

So far the experience has been messy, the only upside is that the transaction are fast when we do it at early morning, the money have arrived and available by evening, took less than 12 hours.

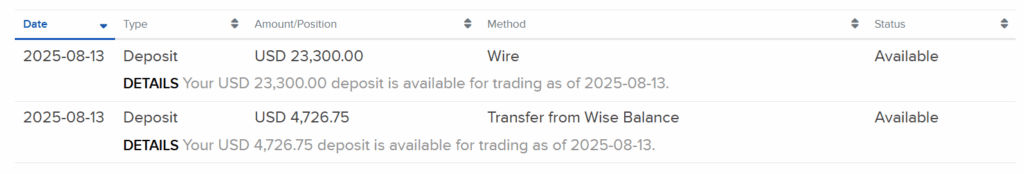

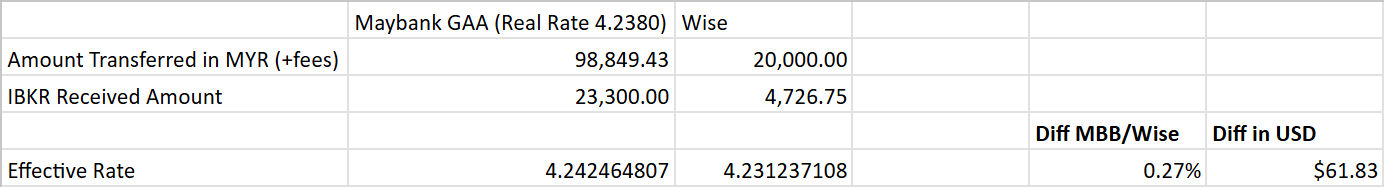

Now let’s answer the real question, how much more did we pay in fees compared to Wise? To save everyone time I’ll skip the calculation and show you the sheet:

So here you have it, when we transfer at the max daily limit of RM100,000 with Maybank Global Access, we ended up paying 0.27% more compared to Wise, or around $61.83 USD in nominal value.

The entire difference can be mostly explained by the real conversion rate on step two of conversions, but to answer the question, is it worth paying the 0.27% extra?

That depends on how fast do you need the money available in your IBKR account, in situation where you are buying a “dip”, then maybe it make sense to pay the extra 0.27% fees.

Using It To Receive Withdrawals From Foreign Brokers

Similar to above but this time it’s withdrawal, and based on the rate we figured out previously, converting USD to MYR has a spread of 0.32% to mid market rate with Maybank GAA, while with Wise it’s 0.36%, so Maybank is 0.04% cheaper.

I have not been withdrawing from foreign brokers to Wise for a long time because my Wise account was closed for some reason, so I’m not sure if the RM20K limit still applies here, but the inward fees with Maybank Global Access Account is $4 USD which is significantly lower than outward.

If you are withdrawing above $10K USD then it would probably be better with Maybank Global Access Account, because 0.04% of $10K is $4, so for any higher amount this is a better option.

Compare To CIMB Singapore Withdrawal

Now, for some people like myself do not use Wise for withdrawal, but instead I have an account with CIMB Singapore which is linked to CIMB Malaysia account.

So our process of withdrawal from IBKR is to convert USD > SGD then withdraw to CIMB Singapore, then convert from SGD > MYR while withdrawing to CIMB Malaysia.

This is arguably the cheapest method to withdrawal, especially during business hours when converting SGD to MYR with CIMB Singapore, the spread is the lowest among other popular options.

To show you the differences I made a comparison of all popular method at the same time, assuming we are going to withdraw $10,000 USD, and all fees are included in calculations:

Withdraw to Maybank Global Access Account then convert to MYR has the worst rate of all the options, which you will get RM42,108.15 from a $10K withdrawal, about 0.54% lower than mid market rate.

The best option remain to be using CIMB Singapore, which you will convert the USD balance in IBKR into SGD at mid market rate, then convert to MYR with CIMB Singapore, you will end up with RM42,231.79, which is only 0.24% below mid market rate, making it the lowest spread option.

Surprisingly the second best exchange rate is actually spend or withdraw the USD with Charles Schwab debit card with Visa rate, 0.32% below mid market rate, but this obviously requires your balance is in the brokerage.

For withdrawal using Wise, if you withdraw USD to Wise then convert to MYR the spread is 0.34% below mid market rate, and if you convert to SGD in IBKR then withdraw to Wise and convert to MYR again then you get 0.36% spread, slightly higher.

Worth Open Maybank Global Access Account?

At the end of the day, Maybank Global Access Account is a solid entry in the multi currency space, but it’s not the Wise killer some might hope for.

It shines in certain niches like large foreign withdrawals, but loses out on day-to-day travel spending and low cost outward transfers. I hope we can see the outward transfers fee lower, better spreads on buying and selling, and support for more currencies.

For now, it’s a good secondary tool, especially if you withdraw from foreign brokers frequently, and the RM8 annual fee isn’t outrageous either, so I think it’s worth opening an account.