Table of Contents

Why Consider Diversify Globally?

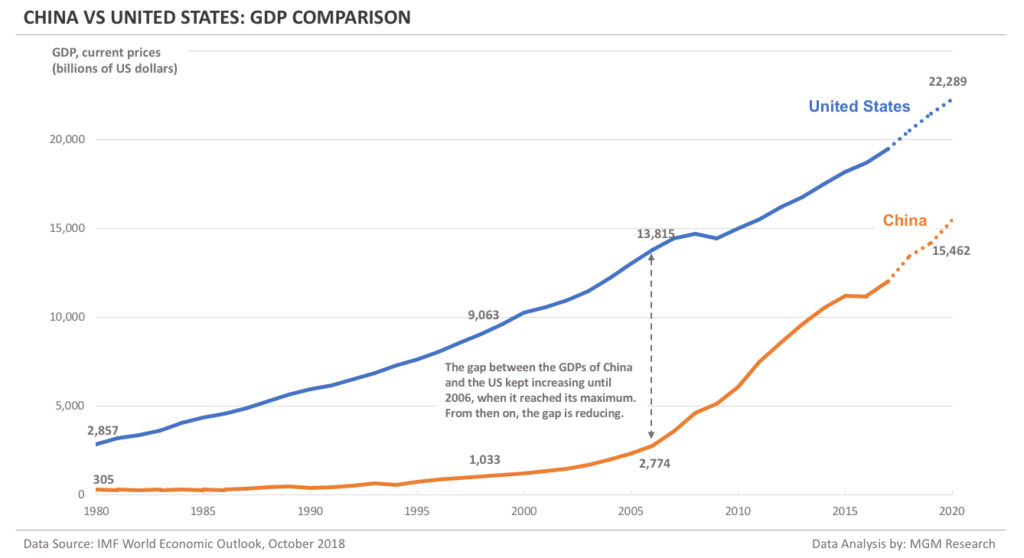

The global economic power are shifting rapidly, while US has been leading for many decades, we cannot dismiss the possibilities of other countries catching up, for example China GDP growth rate has generally outpaced US for the last two decades.

Plus with recent tariff wars started by the Trump administration which forced many countries to rethink the economic partnership with US, and many start to see US as an unreliable partner and my cause people to divest from US economies.

What this mean for regular folks like us is, there is no way to guarantee the US stock will continue to outperform the world in next few decades, and one option to hedge against that uncertainty is to diversify globally.

Previously I have also recommended some Irish domiciled ETFs, but in this post we will focus on achieving global diversification with our portfolio and what is the concept behind the diversification weighting.

How to Diversify Globally with Market Cap Weighting

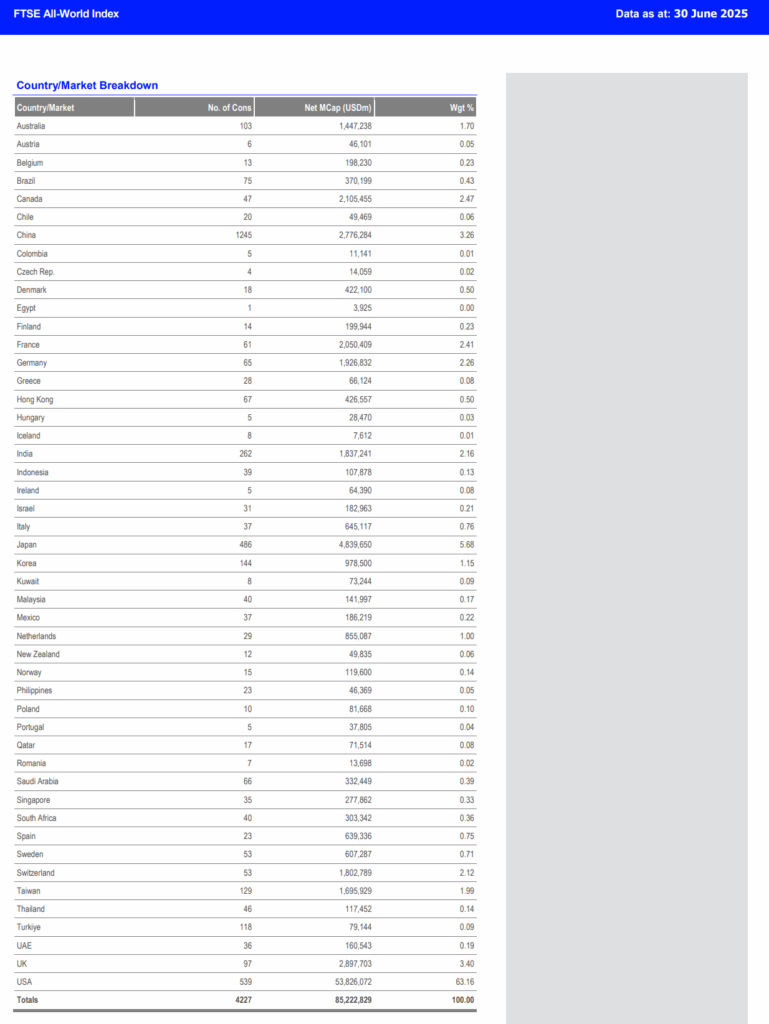

The most common approach to diversify globally is based on the market capitalization of every country stock market, which is the combined value of all outstanding shares multiply by their price in every country.

More specifically the industry use free float market capitalization, which exclude the shares that are not publicly tradable in the market, or shares held by insiders, governments and other restricted entities.

Free float market capitalization is considered a more accurate reflection of a company’s market value for investors because it focuses on the shares actually available for trading.

This is why later you will find out a global diversified portfolio still consist a large portion of US stocks, because US still has the largest free float market capitalization.

Popular Global Equity Indices

To create a passive portfolio that is globally diversified, we will focus on ETFs that track indices, and we want indices that cover as much global market as possible with the free float market capitalization methodology.

That way our portfolio will be self-adjusting, as the economy of countries and companies grow or shrink, their market cap changes, and index weighting changes, our portfolio will be adjusted along with it.

The MSCI ACWI Index and FTSE All-World Index are the two most popular index, the MSCI ACWI includes 23 developed market and 24 emerging markets with a total of 2,528 companies, it claims to cover approximately 85% of the global investable equity.

FTSE All-World claims to cover even more constituents with a total of 4,227 companies, making their index covers 98% of the world investable equity.

While these two are the more popular indices, but the even more comprehensive indices exist too, for example the S&P Global Broad Market Index claims to cover 10,000 companies, FTSE Global All Cap Index, Dow Jones Global Index, etc.

However it’s harder to find ETFs track the indices that consist of much more smaller cap company because it is harder and more costly to replicate such index.

Global Diversified Irish Domiciled ETFs

Now I’ll recommend a few Irish ETFs that track those indices, personally I look for ETFs with low expense ratio, USD denominated, larger fund size for good liquidity, low tracking error and use accumulating as their dividend distribution policy.

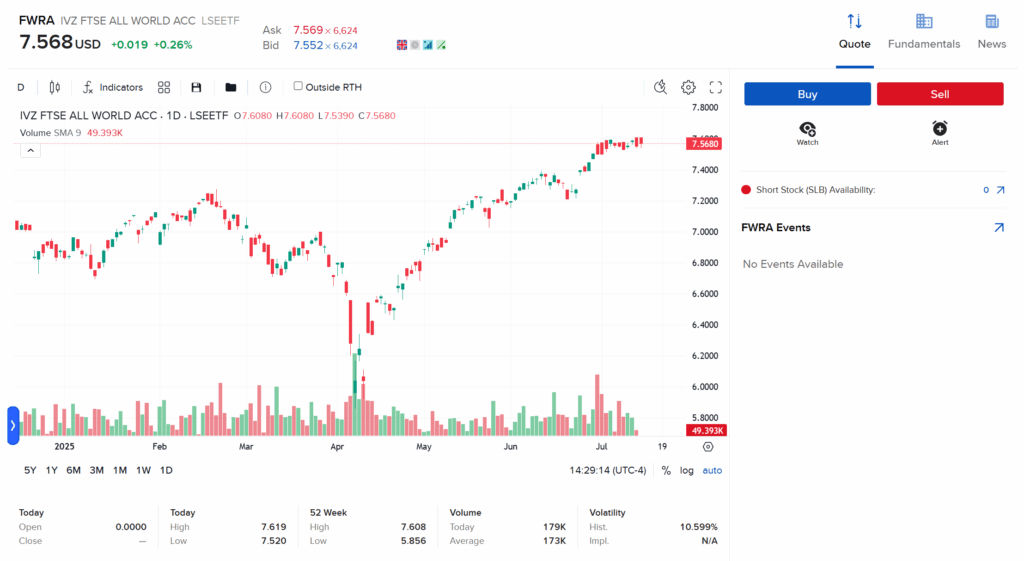

FWRA – Invesco FTSE All-World UCITS ETF

This is a relatively new ETF from Invesco that track the FTSE All-World index, but it has quickly attracted many investors because of the lower expense ratio compared to the others at 0.15% TER. Since it’s inception from June 2023 it now has EUR 1.43 billion AUM. (But only 2,419 holdings)

I can buy them within my IBKR account under the ticker FWRA from London Stock Exchange

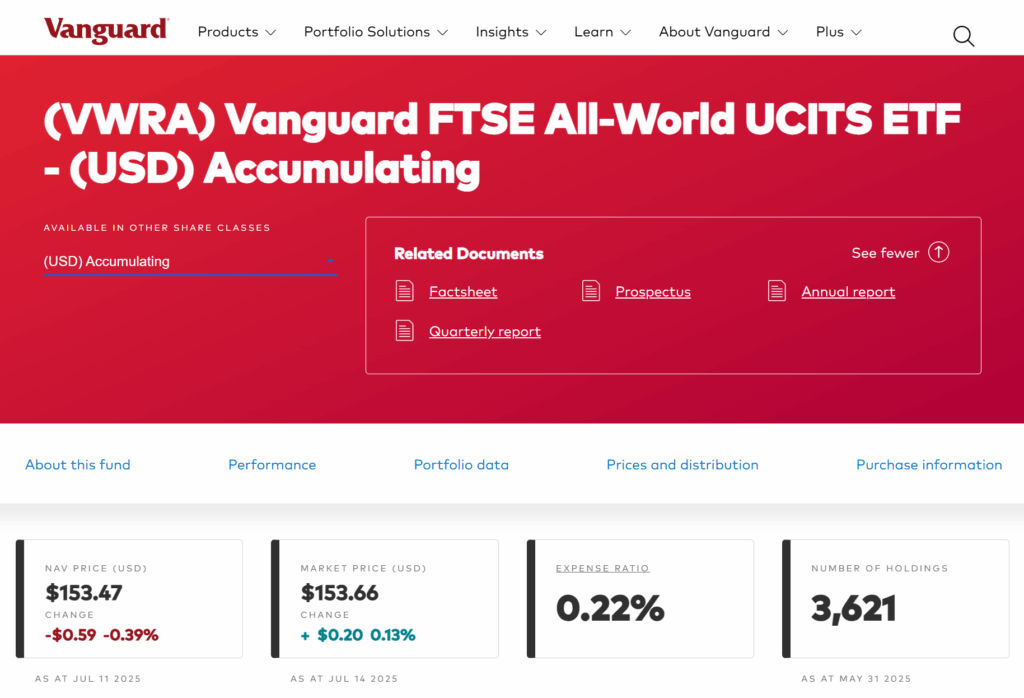

VWRA – Vanguard FTSE All-World UCITS ETF

This is the older ETF from Vanguard that track FTSE All-World, it is much more popular with EUR 20 billion AUM, its holdings consist 3,621 companies compared, it includes much more smaller cap company than FWRA, but with higher TER at 0.22%. USD denominated and accumulating dividend as well.

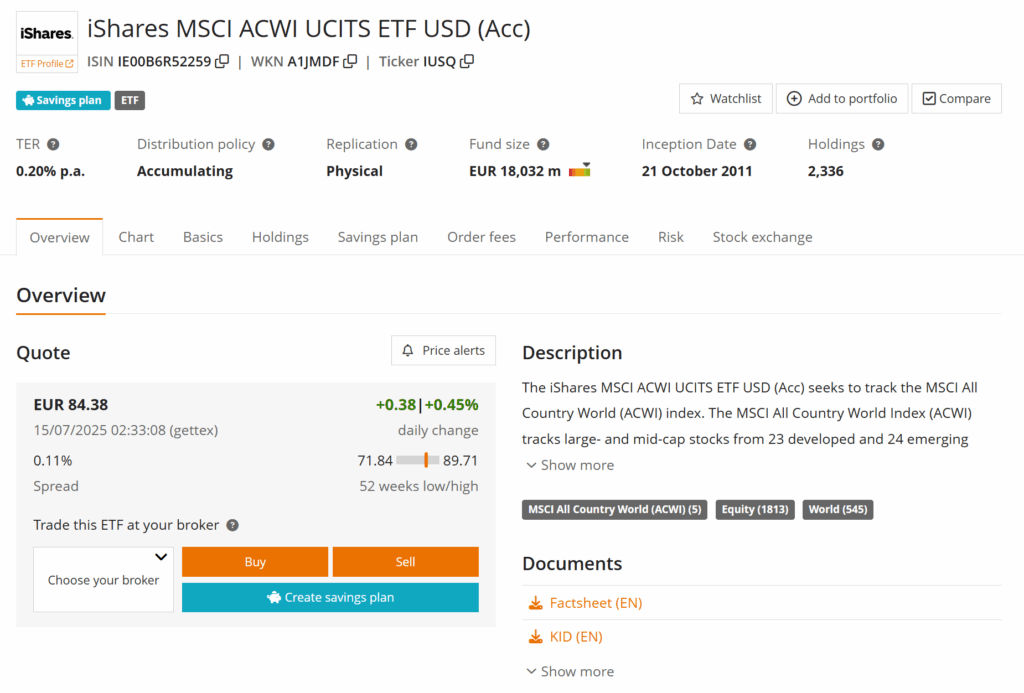

ISAC – iShares MSCI ACWI UCITS ETF

This Irish ETF is from BlackRock iShares and it tracks the MSCI ACWI index, it’s a much older fund with inception date on 21 Oct 2011. Its holdings consist of 2,336 companies, with a total fund size of EUR 18 billion, total expense ratio at 0.20%.

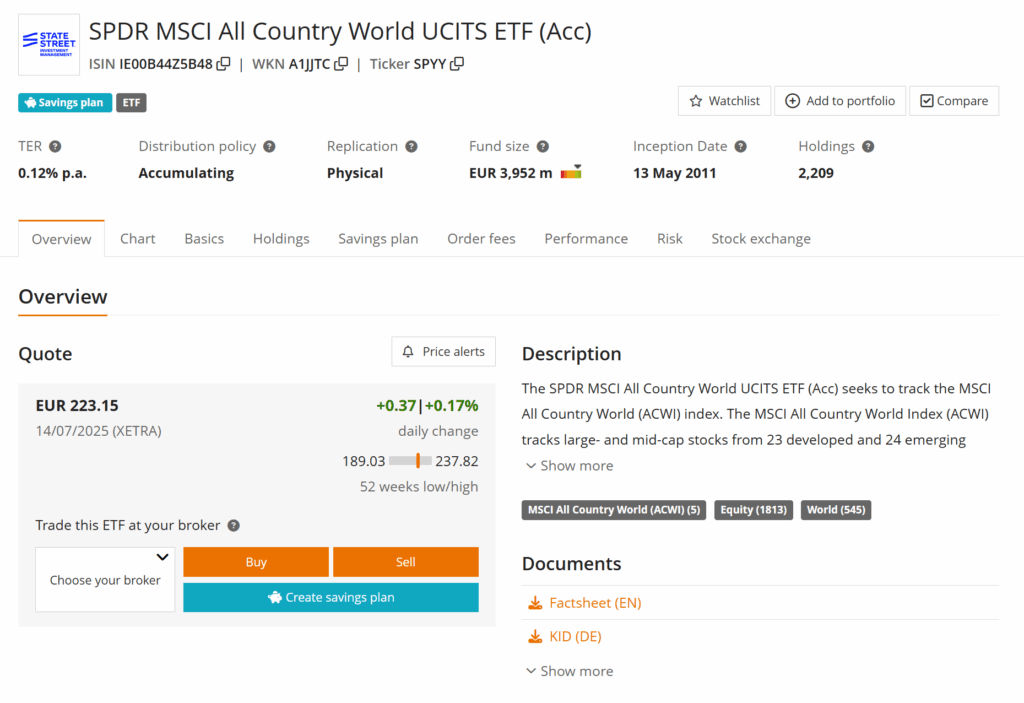

ACWD – SPDR MSCI All Country World UCITS ETF

Similar fund from ISAC but State Street Global Advisors (SSGA) reduced the fees from 0.40% to 0.12%, effective from Aug 2024 which now make this fund has lower fees than ISAC and may be a better choice for now.

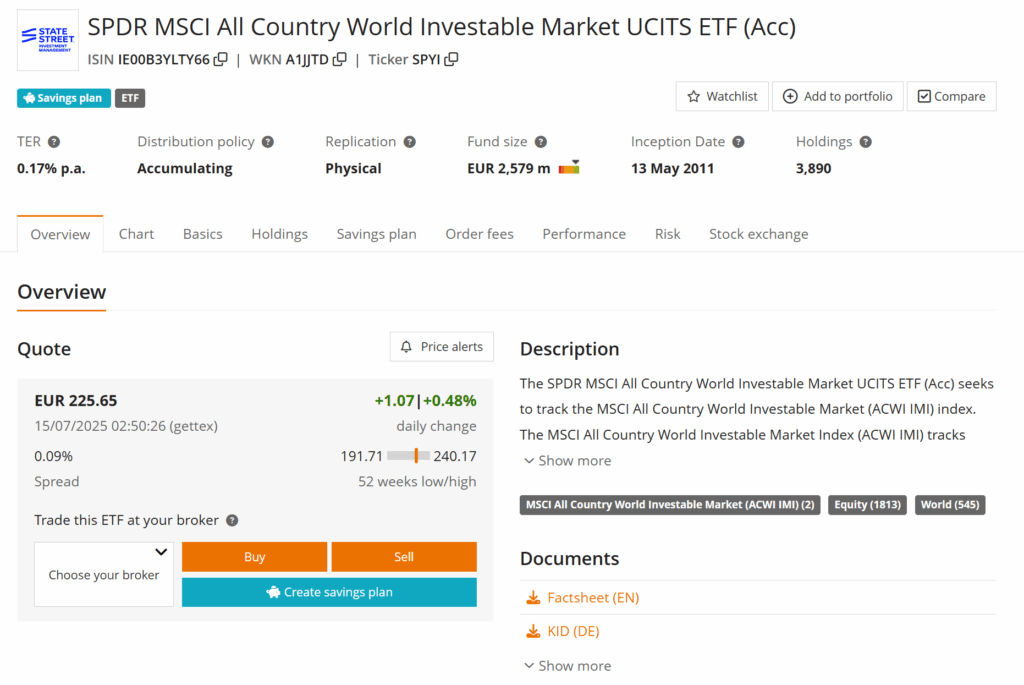

IMID – SPDR MSCI All Country World Investable Market UCITS ETF

Another fund from State Street but this track the broader MSCI ACWI IMI Index, with 3,890 companies in its holdings, this come with a higher TER at 0.17%, and the fund size is EUR 2.58 billion.

Other Strategies to Build Global Diversified Portfolio

While market cap weighting is more common for passive investing, some people also prefer to use different weighting methods, for example some customize the weighting of developed and emerging market with SWRD + EIMI.

Some use equal weighting, and some even use GDP weighting as they argue market cap can be a lagging indicator and GDP is a better reflection of a country economy importance.

Personally I’d stick with the market cap weighted index ETFs as I believe other strategies are less passive, it requires much more dedication and effort and it’s an more active approach to build global diversified portfolio, plus free float market cap weighting just make more sense to me.

Anyway I hope this post helps anyone looking to diversify globally, if you have any question feel free to comment below I will read and reply, you can share other funds missed by me too.