Table of Contents

Why Do I Use Interactive Brokers?

I registered an account with Interactive Brokers LLC (IBKR) many years ago, before using Interactive Brokers as my main brokerage account I used to buy and hold US stocks with TD Ameritrade.

Back then TD Ameritrade changed the fees structure while transferring their Malaysian clients to TD Ameritrade Singapore, back then when I was a broken student, a minimum fee of $10 per trade isn’t ideal for my monthly small sized investment.

After looking for an alternative I found Interactive Brokers, it has a much lower fees, good reputation, and give me access to a lot more major markets so that I can be even more diversified globally.

Commissions and Fees of IBKR

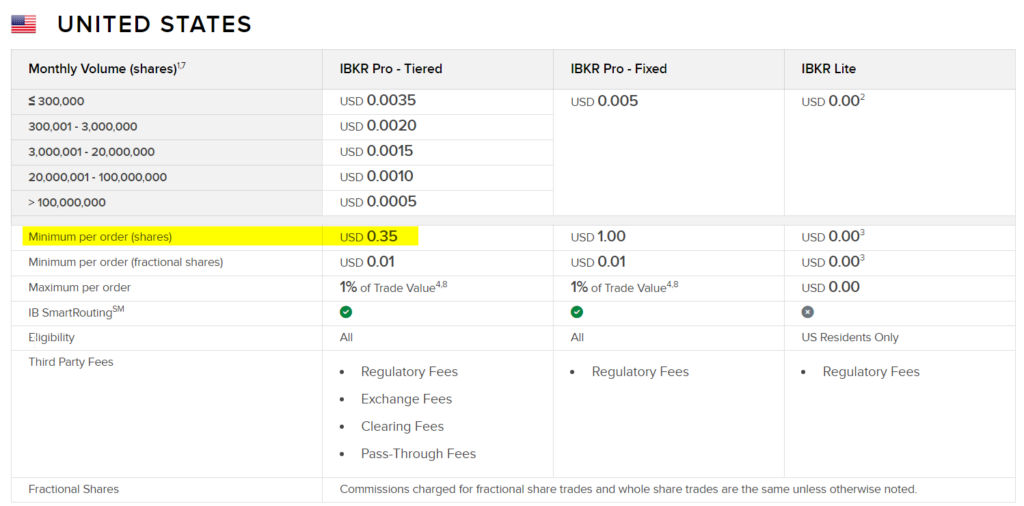

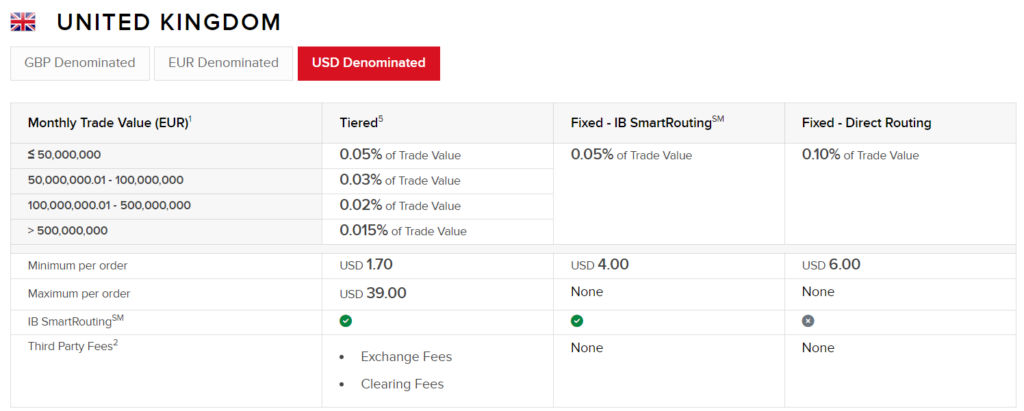

Interactive Brokers account has different fees type you can choose for, if you usually buy shares in smaller quantity (most people do), then their Tiered based account fees per order can be as low as $0.35.

On some stock exchanges you can even get a lower fees by adding liquidity, in plain words you use limit price order and place and order that get added to order book that is not immediately matched.

For most Malaysian to save an additional 15% of withholding tax on dividend when investing in index ETFs, we usually choose the Irish domiciled variants, which typically trade on London Stock Exchange (LSE) and the fees starts from $1.7 per order.

Established and Regulated Broker

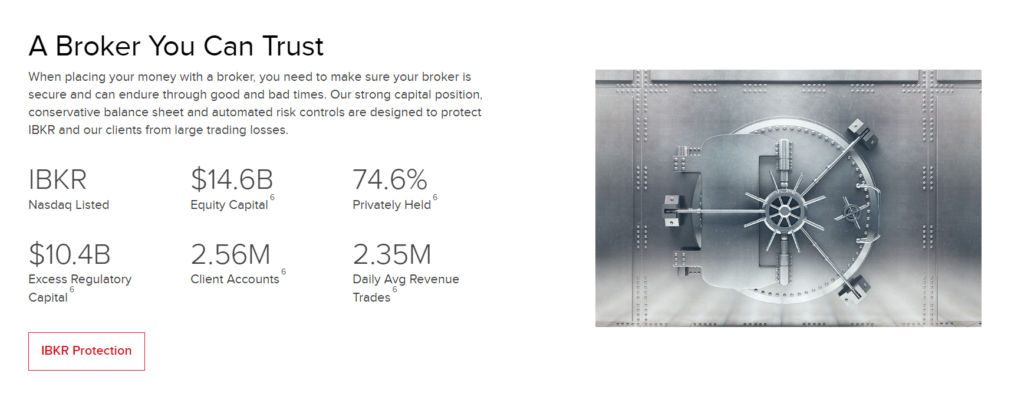

As a publicly listed company on NASDAQ under the ticker IBKR, Interactive Brokers is a highly established broker, having been founded in 1977. With decades of experience in the industry, IBKR has built a solid reputation for reliability and innovation in the financial markets.

IBKR is also subject to strict oversight by regulators from multiple countries, ensuring adherence to international standards. This extensive regulatory framework provides clients with a reliable and secure trading environment.

Client Assets Protection & Insurance

Interactive Brokers (IBKR) offers robust client asset protection by segregating client funds daily, maintaining a large buffer to protect client assets. Unlike most brokers, who calculate client reserve obligations weekly or monthly, IBKR performs this calculation daily, significantly reducing the risk of clients not receiving a full refund in the event of the firm’s liquidation.

Additionally, IBKR does not engage in proprietary trading, which means it solely facilitates client trades without taking on risky proprietary bets. This reduces the likelihood of IBKR going bankrupt due to its own trading activities.

Client accounts at IBKR are protected by SIPC for up to $500,000, including a $250,000 limit for cash. IBKR also has an excess SIPC policy through Lloyd’s of London, providing further protection up to $30 million with a $900,000 cash sublimit, ensuring comprehensive coverage against broker-dealer failure.

*SIPC is a non-profit organization that protects customers if their brokerage firm fails. You can learn more about them here: https://www.sipc.org/for-investors/investor-faqs

Global Markets Access

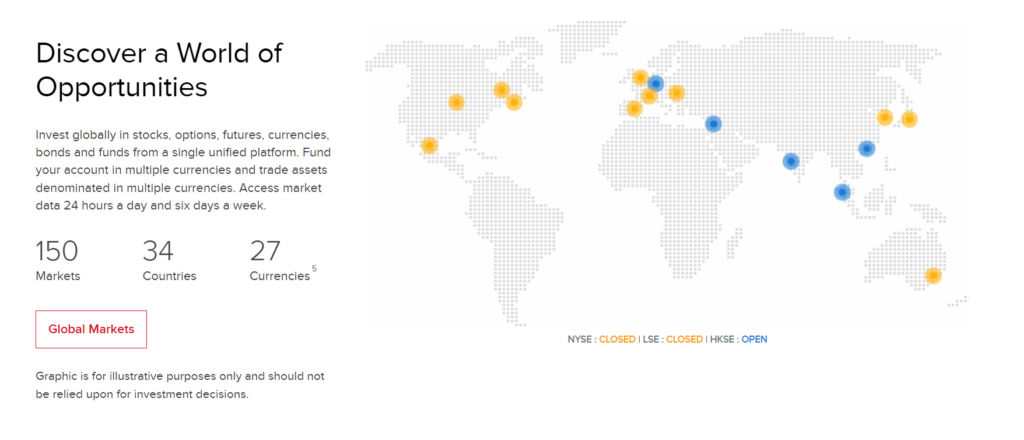

Looking for geographical diversification? Interactive Brokers provides access to up to 150 markets across 34 countries and 27 currencies.

This extensive global reach is a key reason I chose Interactive Brokers as my main broker, allowing me to purchase assets from various markets all under one account.

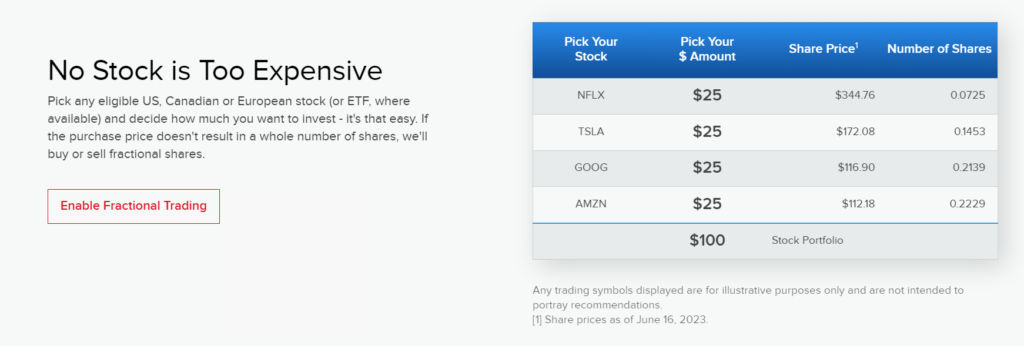

Fractional Shares

Interactive Brokers also provide fractional shares, which means you doesn’t need to buy a whole share, you can buy a fraction of most eligible US stock within IBKR, this can be useful for young investors to start building their diversified portfolio without a larger capital requirement.

How to Register Interactive Brokers Account

You can register with my referral link (click here) to support me.

*You will get $1 per every $100 deposited in the form of IBKR stock, for me I’ll get $200 if you maintain a balance above $10,000 over a year.

The account registration process and interface may be updated in future, but the process will more or less be the same, the account opening application should be self explanatory, but I’ll quickly walkthrough it with you as there’s some details you might need to pay attention to.

Account Opening Walkthrough (With Images)

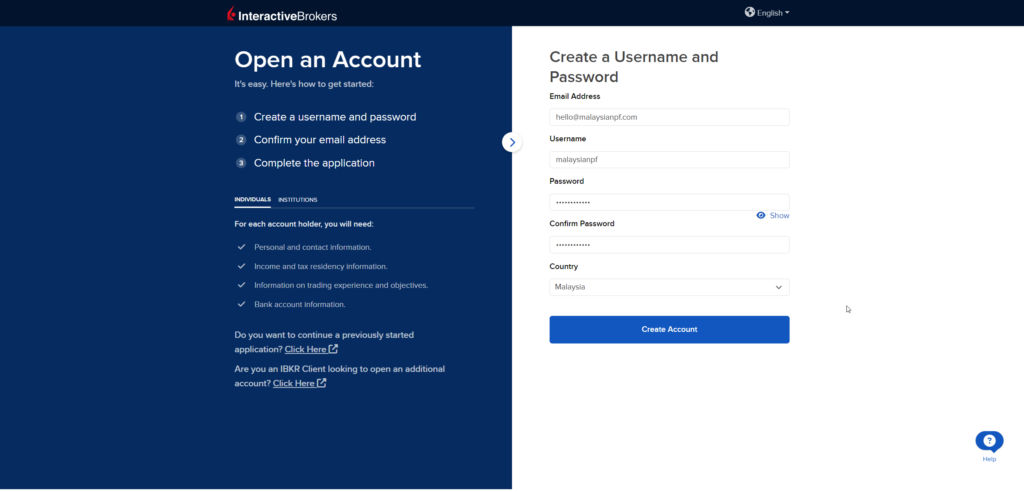

1. Starting from the account opening page, you will first have to setup your email, username, password and country, and then click “Create Account”. If you want to continue the application in different language you may choose so on the top right corner.

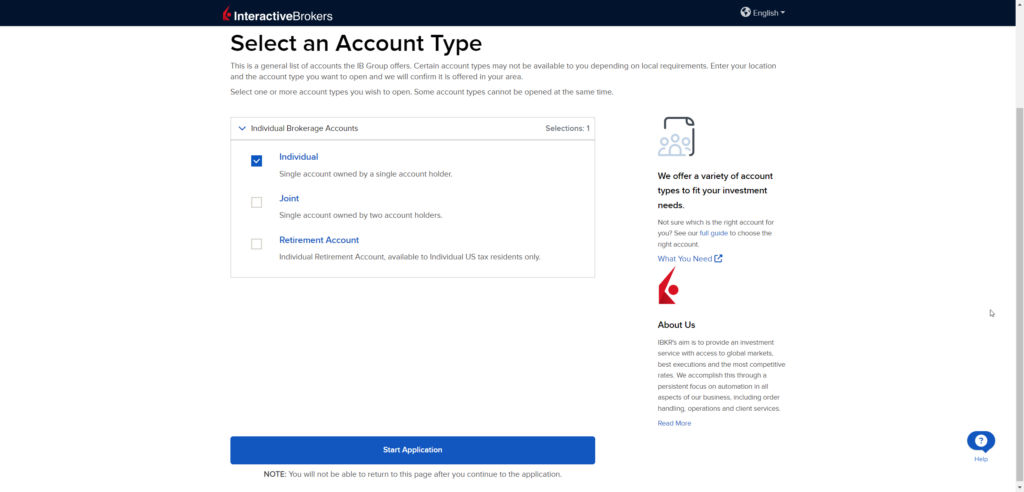

2. Select the account type for your new interactive broker account, typically it will be Individual for most of Malaysian.

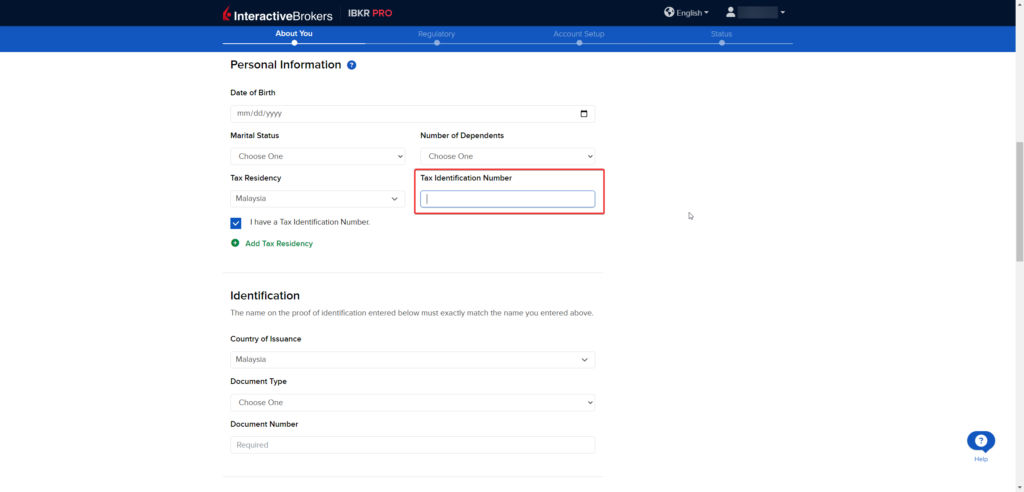

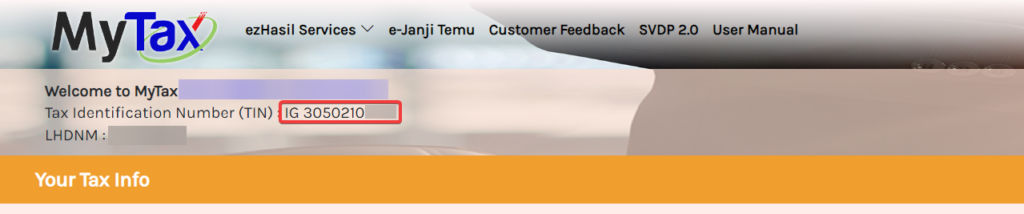

3. In this page you will fill up your personal information, for Tax Residency you will select your country, in this case Malaysia, then you will have to fill in your Tax Identification Number.

You can obtain your TIN from your income tax report e-BE form, or you can also login to LHDN MyTax website to find that tax identification number.

It should look like this “IG 305021XXXX” and you will only need to fill in the numeric parts “3050210XXXX” as TIN.

If you do not have a MyTax account you may also register one, but if you are students or do not have a TIN yet, you can uncheck “I have a Tax Identification Number” and choose the reason, just make sure to update the TIN once you have it, it can be updated in profile settings later.

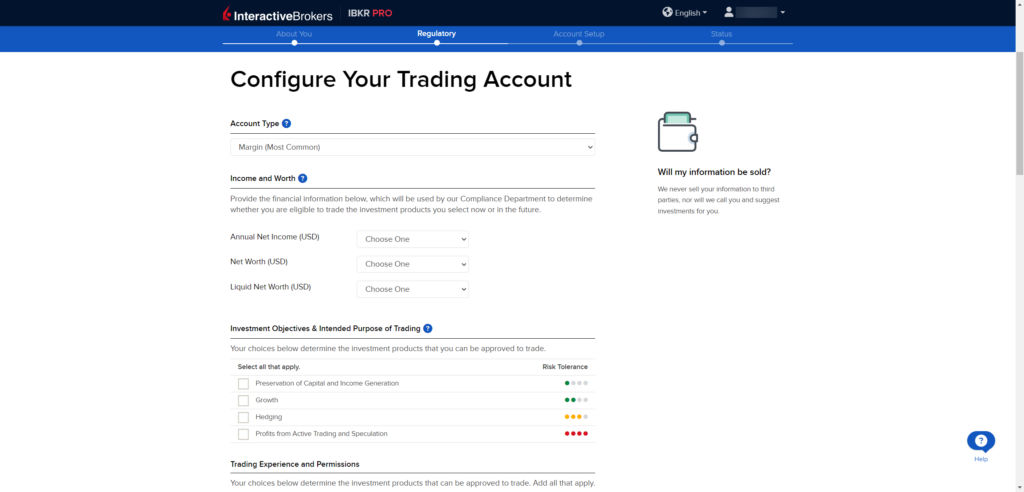

4. Next we will be configuring our trading account, in this section you can choose to create a Margin account or Cash account, as the name suggest Margin account allow leveraged trade with borrowed funds, if you wish to avoid that you can select Cash account in Account Type.

The next few sections helps Interactive Brokers to understand your financial situation, investment objective and risk tolerance. Based on these information IBKR may decide to restrict certain complex and risky financial products for you, such as options and leveraged ETFs.

Some people choose to overstate their experience and financials to reduce restriction and enable access for more financial products, but I do not endorse touching financial products you have no understanding, these restrictions are to protect you.

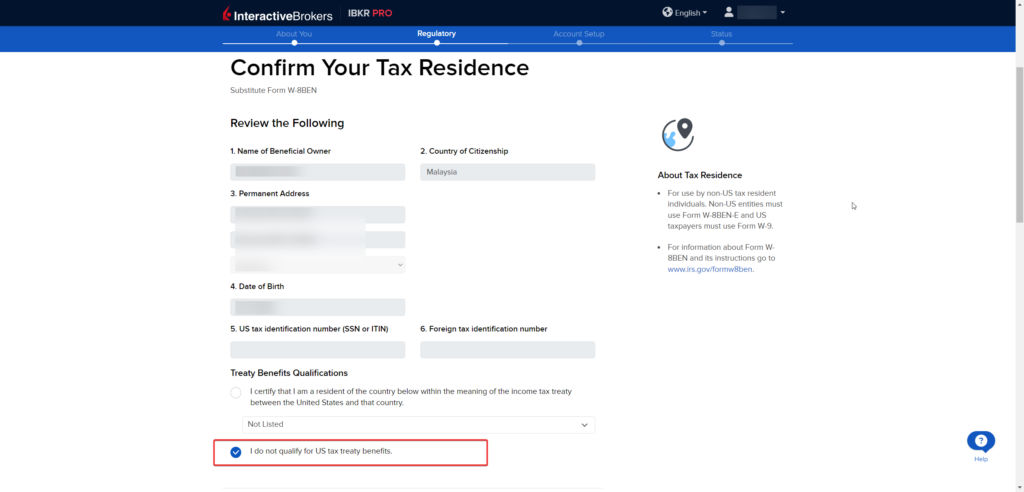

5. Unfortunately there is no tax treaty between US and Malaysia, so in this section just select I do not qualify for US tax treaty benefits.

Tax treaty mainly impact the tax on dividends, for country without tax treaty with US, there will be a 30% withholding tax on all dividends payment, for example, Nvidia (NVDA) has a dividend yield of 0.018%, but 30% of that will be tax and you will only receive 0.0126%.

However some instruments are exempt from any withholding tax, such as SGOV, an ETF that buys US short term treasury bills. There’s also ways to save tax such as focus on growth stock with lower dividend yield or buy Irish domiciled ETFs.

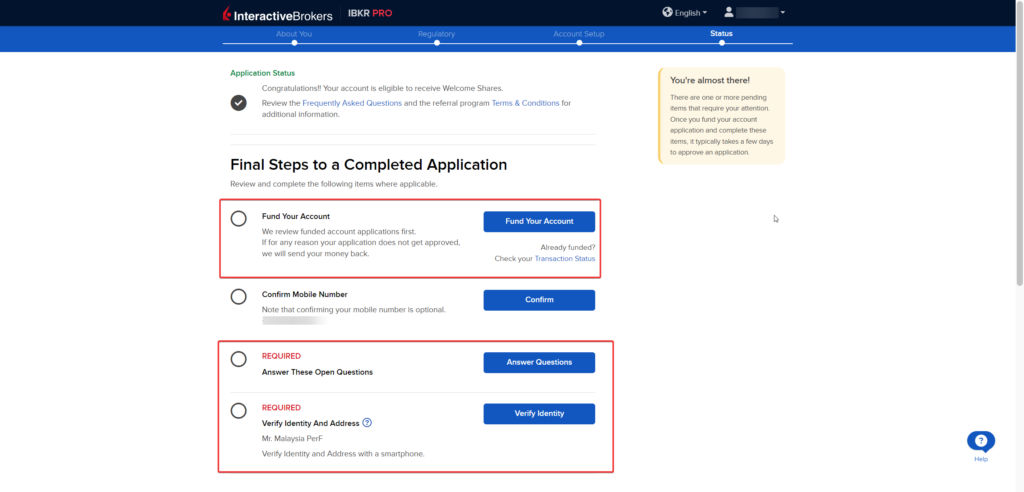

5. In the final steps there will be some additional required info which you will need to provide them to have your account open, the requirements may be different for everyone.

Once you provided the required information in this step, you can choose to fund your account which expedite the account approval time, you can fund any amount. From my experience a funded account application can be approved as soon as within a working day, a non funded account may take a few more working days.

You can register with my referral link (click here) to support me.

*You will get $1 per every $100 deposited in the form of IBKR stock, for me I’ll get $200 if you maintain a balance above $10,000 over a year.

Closing Notes

I hope this guide can give you a quick overview on Interactive Brokers, and the account opening process, if there’s anything I missed out and you believe it should be included in this post, do leave a comment and let me know, I read all the comments!

hi. just registered for IBKR. saw ur post in LYN.

Congrats on making move! You might be interested in some ETFs with better tax advantage – https://malaysianpf.com/best-irish-domiciled-etfs/