Table of Contents

Introduction

When we talk about how much is required to retire, what numbers come to your mind? Some people say RM2 million, while others suggest RM4 million. So, who’s correct? The answer is neither.

The amount of money you need for retirement will be different for everyone, depending on their expenses, retirement lifestyle, and life expectancy.

In this blog post, I’ll share the thought process I personally use to determine the right number for myself, so you can find your own retirement number too.

Estimate Monthly Expense and Life Expectancy

First, we need to define how much you will need every month after you retire. Everyone’s number will be different, but many people tend to underestimate their potential monthly expenses for retirement.

This underestimation often occurs because people set a lower value to deceive themselves into thinking they can retire earlier, or they haven’t fully considered their needs. For example, when you are working, you have less time to spend money. However, when you retire, you have more free time and might start thinking about traveling and other activities that may increase your spending.

That’s why planning your retirement early gives you more time for adjustments and increases the likelihood of achieving your goal.

For the purpose of this post, let’s assume the amount we would like to have every month in retirement is RM10,000 in present value or current purchasing power.

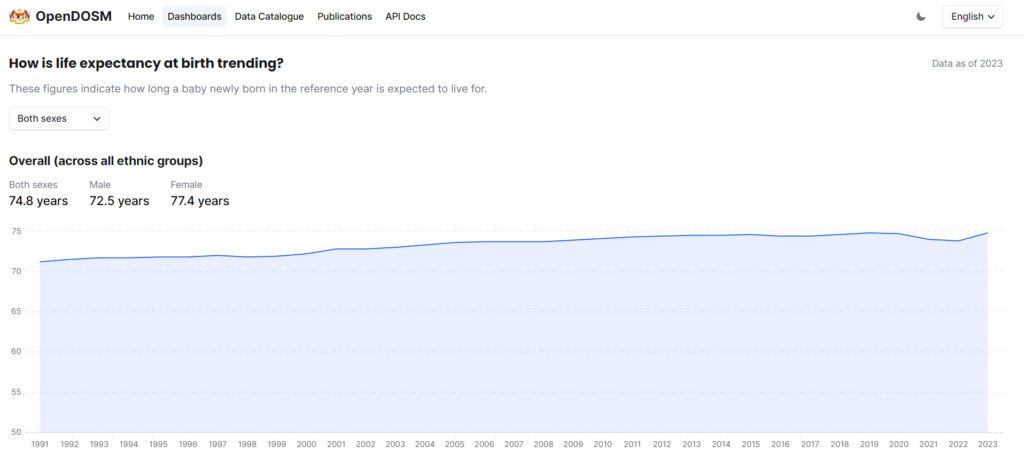

Next, let’s assume we will retire at the age of 45 and expect to live for another 30 years, based on the average life expectancy of Malaysians.

Now that we know we will need RM10,000 per month or RM120,000 per year for 30 years in retirement, let’s find out how much we need to save for retirement.

Safe Withdrawal Rate and Asset Allocation

Now, we need to make our first estimation using a 4% safe withdrawal rate. The safe withdrawal rate is the percentage of your retirement savings that you will withdraw annually to cover your expenses. Most people start with the 4% rule created by William Bengen.

So, if we take RM120,000 and divide it by 0.04 (4%), we get our first estimation of RM3 million.

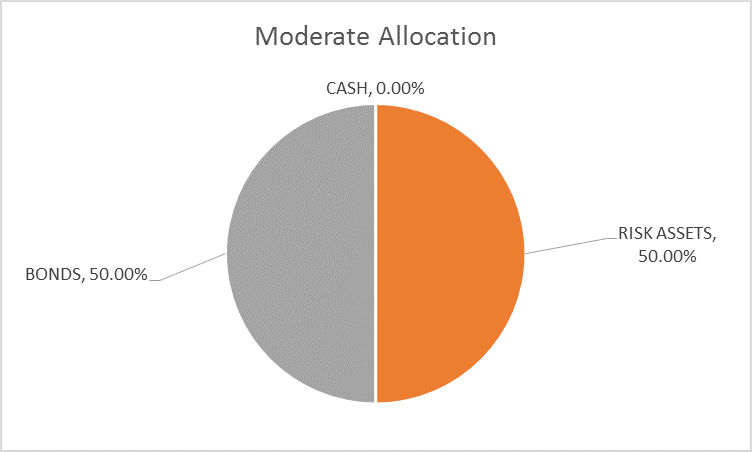

However, Bengen’s 4% rule assumes that your entire RM3 million is allocated in a mix of US stocks and bonds. The portfolio is expected to generate more than a 4% return, which would cover your expenses and allow you to reinvest the remainder to offset inflation and protect against significant market downturns.

While this gives us a starting point, it’s crucial to understand that Bengen’s withdrawal rate is based on historical data. If you plan to invest in different asset classes or markets, you cannot simply use the same number.

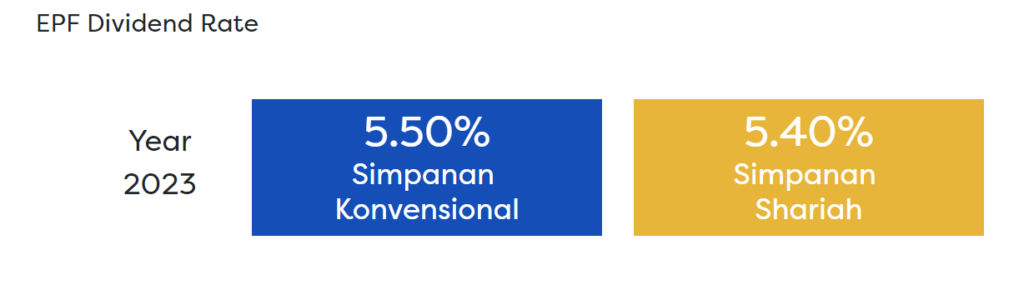

For example, if your plan is to invest 100% in EPF, which has an average historical return of 6% over the past 10 years, withdrawing 4% from your portfolio annually would leave you with only 2% for compounding. This may not be enough to offset inflation, leading to lower purchasing power and a declining quality of life over time.

Experimenting with historical data

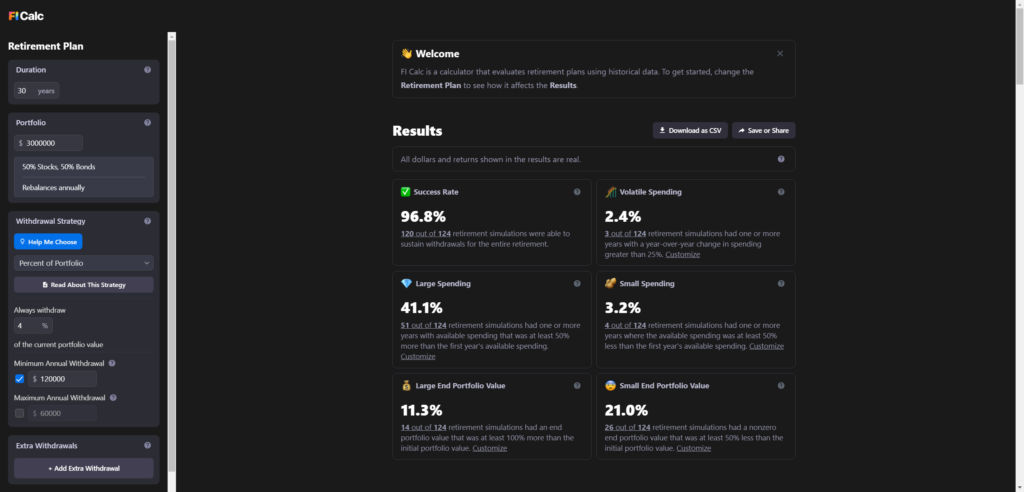

If you’re planning to invest in US index funds, there’s a handy tool that allows you to experiment with different withdrawal rates, retirement amounts, and withdrawal strategies.

This calculator uses historical data from the US stock market, slicing the data into 30-year segments, similar to what William Bengen used to determine the optimal withdrawal rate.

Visit https://ficalc.app/ to use this withdrawal calculator.

In the screenshot below, you can see my input for a 30 year retirement with a RM3 million portfolio, a 50/50 stock-bond allocation, and a 4% annual withdrawal rate, with a minimum yearly withdrawal of RM120,000. The calculator shows a success rate of 96.8%. (Ignore the dollar symbol, the calculations remain the same.)

So, what does the success rate mean in this calculator? The calculator uses historical data from 1871 to the present, slicing every 30 year period as one simulation. This allows you to see how your portfolio would perform under various market conditions.

If you are conservative, you will want a higher success rate because that means your portfolio can sustain withdrawals even during periods of adverse market conditions, such as multiple bear markets and high inflation decades.

Another important note is that the withdrawal rate is sensitive to the investment time horizon. If you expect to live much longer, such as 40 or 50 years after retirement, you should generally have a lower withdrawal rate to ensure your savings last throughout your retirement.

What about other asset allocations?

Some people may not know, but William Bengen’s first paper on the optimal withdrawal rate was published in 1994. He used a portfolio consisting solely of the S&P 500 index fund and US intermediate treasuries.

Since then, he has continued to research this topic, and in his 2020 paper, he suggested a higher withdrawal rate of 4.5% because he included US small-cap funds in the portfolio, which historically have higher returns.

The takeaway here is that if you are planning to have a retirement portfolio with different asset allocations or invest in different markets, you should spend some time backtesting it to determine the success rate.

Having access to longer historical data allows for more simulations and is always better.

Quick Way to Calculate How Much You Need

Now you’ve learned that if you need RM10,000 per month for your 30 year retirement, the 4% rule suggests you need RM3 million, with a 96.8% success rate if you allocate 50% in the US stock market and 50% in US bonds.

You can quickly determine that the multiplier between RM10,000 and RM3 million is 300. So, if you plan to have a similar asset allocation and retirement duration, you can use this 300 multiplier to calculate how much you need to retire.

For example, if you expect monthly expenses of RM4,000, you would multiply it by 300 to get RM1.2 million.

Start Planning Your Retirement Early

I started planning for my own retirement while I was a student in college, and I strongly believe everyone should start planning for retirement as early as possible for several reasons.

The retirement number becomes a goal that motivates you to find ways to achieve it, driving you to seek a more rewarding career.

Additionally, starting early gives you more time to adjust your retirement plan and strategy. It encourages you to be mindful about personal finance and learn about investing.

Conclusion: Your Retirement Journey

Planning for retirement is a highly individual process that requires careful consideration of your personal circumstances, goals, and financial situation.

By understanding your monthly expenses, using tools to calculate safe withdrawal rates, and planning your asset allocation, you can develop a retirement plan that suits your needs.

Remember, the earlier you start, the more time you have to adjust and optimize your plan. Take control of your financial future today, and work towards a comfortable and secure retirement.