Table of Contents

Cost Matters in Investing

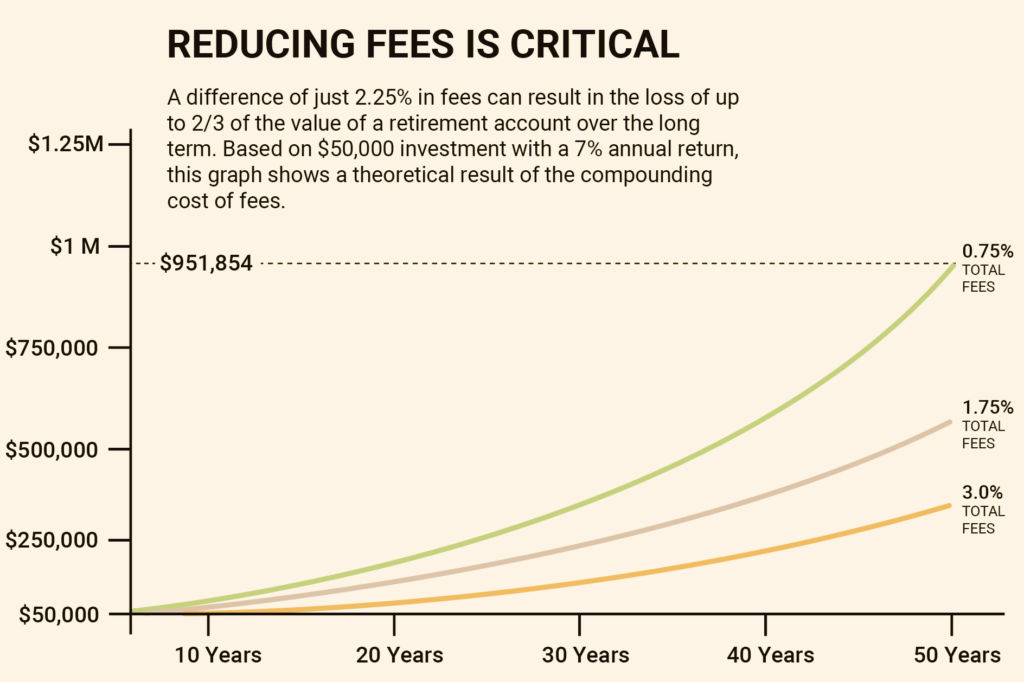

Most people underperform the market average return because they overlooked their cost of investment, and it can hurt your portfolio return especially in the long term, the cost you saved can be invested and compounded.

That is why every time when I talk about investing, I often talk about the total expense ratio (TER) of funds, the tax advantage of using Irish domiciled ETF, the foreign currency conversion fees based on raw mid market rate and in this post the cheapest way to fund your Interactive Brokers account.

Funding Size, Funding Frequency & Opportunity Cost

Funding size and frequency are also important aspects that can heavily impact the cost of funding your IBKR account in long term, this is because most funding method will have a fixed fees.

You probably won’t be surprise when a person A who makes RM2,000 deposit to their IBKR account to invest index funds ended up incur more funding fees than the person B who saved the same amount every month and make a lump sum deposit of RM24,000 at the 12th month.

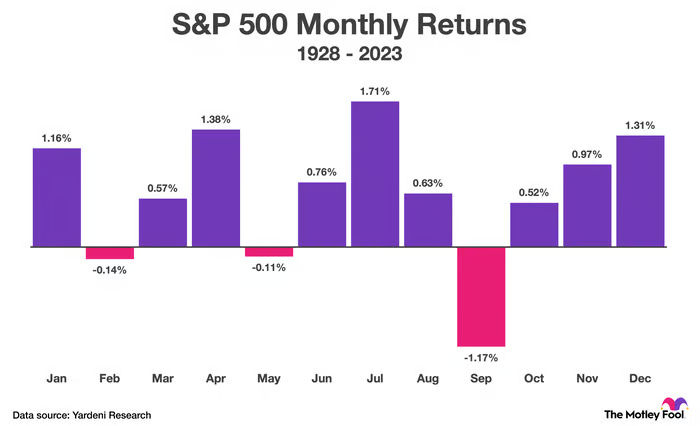

However there is another factor in play here, which is the opportunity cost, will the person B saved more fees than the person A profited from S&P500 index funds?

The answer is most likely no if they both were using a relatively low cost funding methods we will be talk about later in this post.

But how much of a difference between person A and person B? What if person B were saving his money in banks that offer promotional fixed deposit rates, would that change the outcome?

You see, what I am going with this is to let you know the relationship between funding size, funding frequency and opportunity cost, there is no straight forward the best frequency because the expected return in the market are always changing, the fixed deposits promotion from banks are too!

Personally what I would like to do is to keep the funding cost of each deposit to below half month average of market return, for example if the last 5 years of compounded annual growth rate of S&P500 index fund is 12%, then I would make sure every time I fund my account to buy the index fund have a cost below 0.5%.

Of course the break even point with that is when you are not able to accumulate enough to make the funding cost below 0.5% in 3~4 months, (considered that you keep it in a high yield savings account), then it make it indifferent for you to fund with 1% funding cost.

I know what I’m trying to say seem complex, I tried my best to keep it as simple as possible, hopefully it will make sense to you once you started calculate the funding fees for yourself.

Common Ways to Fund IBKR Account in Malaysia

Alright now let’s get into the actual topic, let’s look at some of the common ways to fund IBKR Account in Malaysia and compare the cost to see which are the cheapest.

Fund IBKR Account using Wise Balance (MYR to USD/EUR)

Wise is a fintech based on UK, and it is listed on BNM website as E-Money Issuer, similar to other ewallet company (TNG, ShopeePay, Bigpay, etc.. )

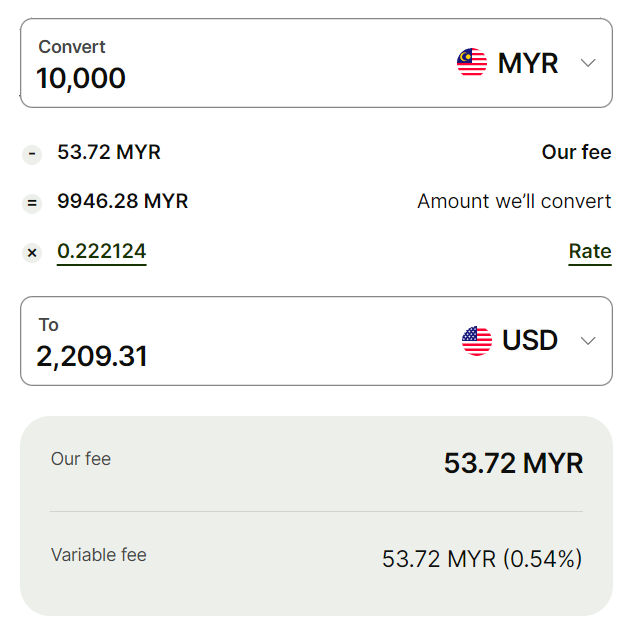

Unlike regular banks that tells you their foreign currency exchange rate which included their spread (fees), Wise tells you the mid market rate they have access to, and then a variable fees they charge you for the exchange, basically it tells you their cost and profit which make it more transparent than regular banks.

Mid market rate usually means a combination of FX networks they have access to with their partnered bank across the world, it means they can exchange currency between banks or other financial institutions without intermediaries.

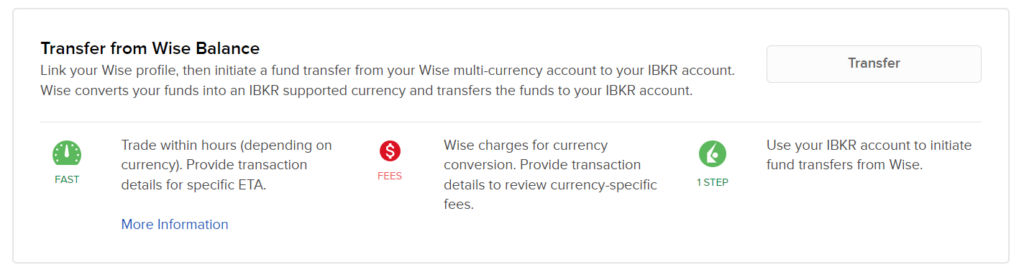

Here is the basic info and fees you need to know about funding IBKR Account with Wise:

- Typical fees for conversion from MYR to USD is 0.54%

- Typical fees for conversion from MYR to EUR is 0.52%

- Sending USD balance from Wise to IBKR have a fixed fees around $1.13

- Sending EUR balance from Wise to IBKR is free

- Sending funds from Wise Balance to IBKR takes one business day, cut off time at around 7PM

- You can only hold RM20,000 value in Wise account at all time

- Buying USD denominated stocks with EUR balance will incur a 0.03% charge from IBKR but conversion is with live FX rate (Manual convert is fixed fee ~$2)

Now the fees are simple to understand, since the fees for currency conversion is based on percentage, the only fees we can tackle is the fixed fees of $1.13 USD, if you are going to invest $1000, then the fixed fees will add 0.113% on top of the conversion fees of 0.54%, bringing it to a total of 0.653%, if you invest $2000, it will be 0.597%.

While it doesn’t get lower than 0.5%, it is actually close enough and still below the average monthly return of US market, but is there a slightly cheaper option? Let’s look at the EUR case which doesn’t have the fixed fees.

If you convert your MYR balance into EUR in Wise, you can transfer it to IBKR with no fees, (I am not sure how long this would be the case), then once the EUR arrived in your account balance, don’t convert it manually, instead just buy any USD denominated stocks/funds it will be converted with 0.03%, bringing the total fees to 0.55%.

But there’s a caveat for the EUR option you can only have cash account type in IBKR and not margin account, if not it will use your EUR as collateral and loan USD to purchase stocks, which will incur interest fees.

The benefits of using EUR deposit option will also be less significant when you transfer larger amount which spread out the fixed fees, and because the deposit typically takes 1 business day, you do not need to worry about FX rate fluctuations in between transit.

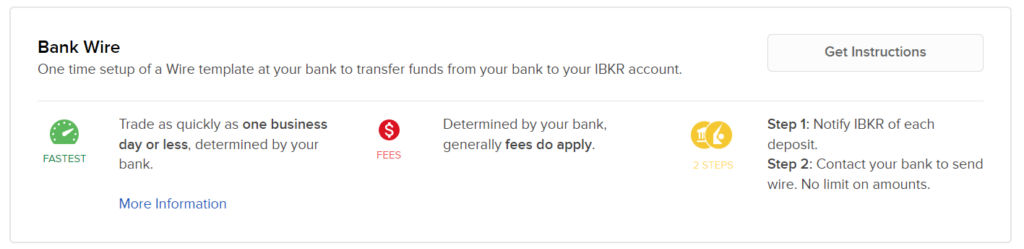

Using Wire Transfer From Bank

I remember when I first started investing with IBKR many years ago, there’s nothing like Wise, and bank wire were the only reliable option available, the obvious downside with this method is most bank generally do not offer a good exchange rate and there will be additional fees.

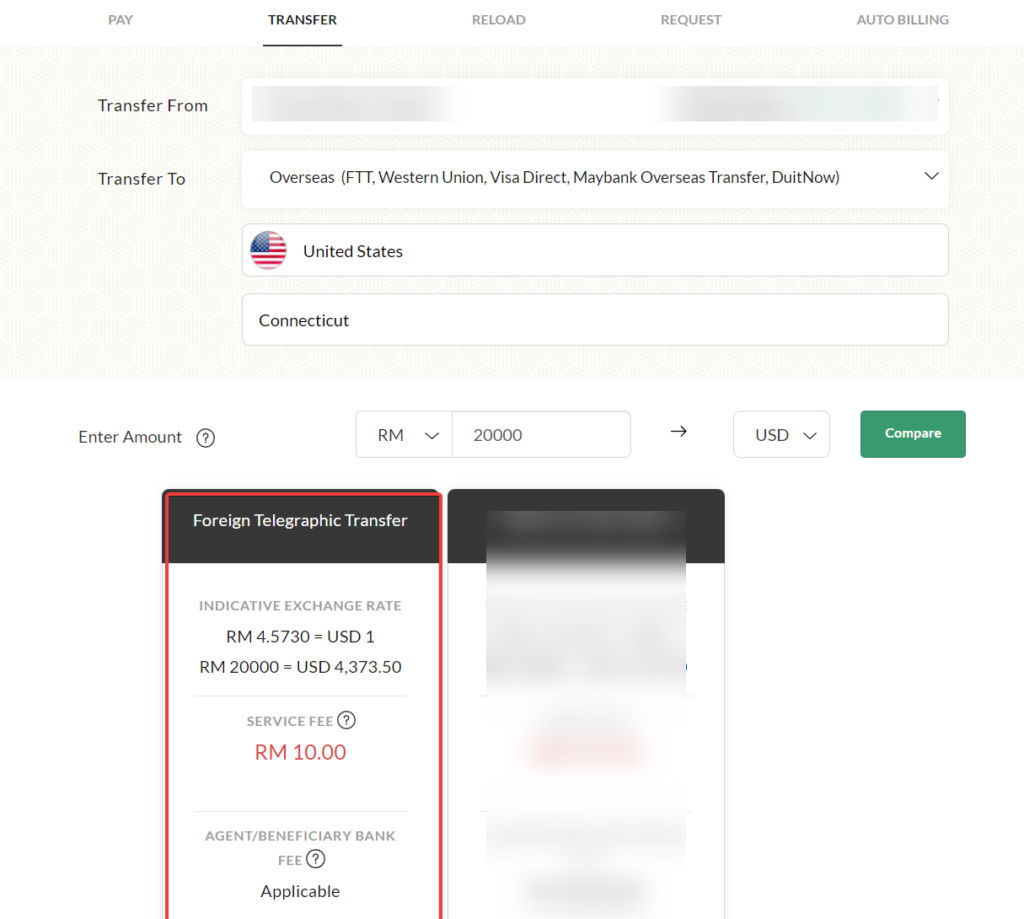

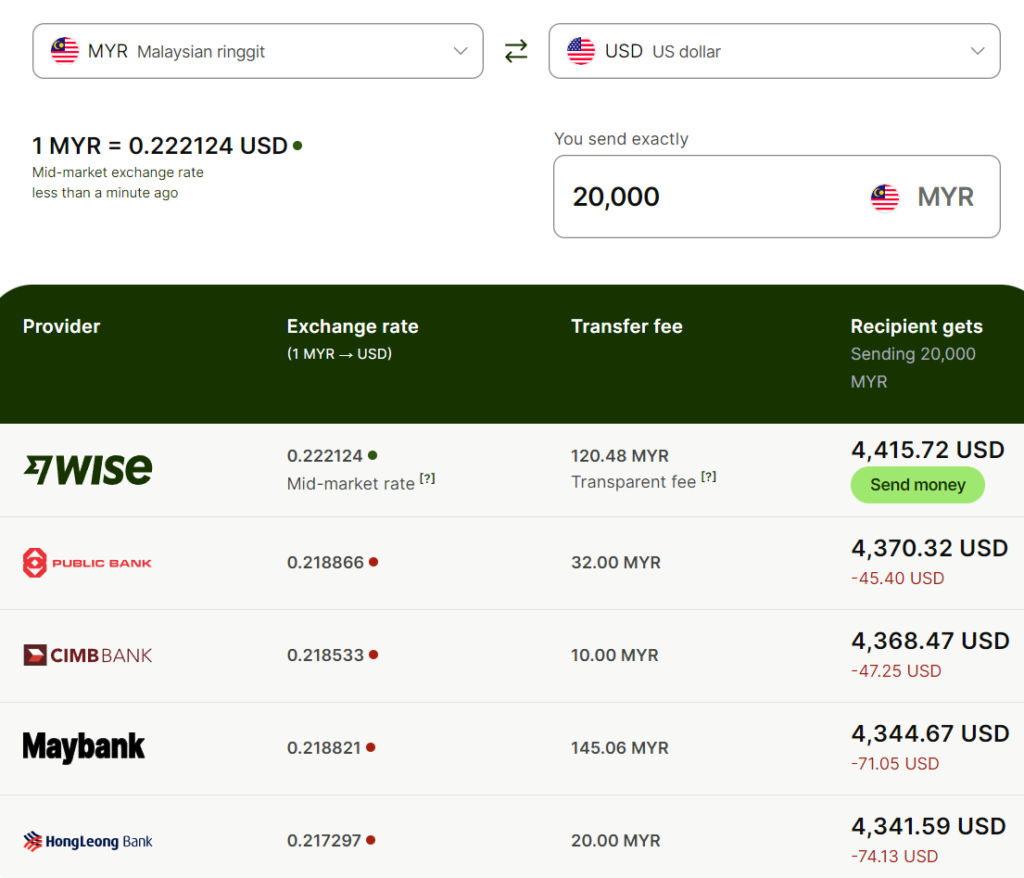

Let’s take a look at Maybank foreign telegraphic transfer (it’s just a different name to wire transfer), Maybank sell each USD for RM4.5730 and there’s an additional fee of RM10, that means you will get $4373.50 USD to your IBKR account with RM20,010 at RM4.575 per USD.

When compare to Wise you can get $4418.62 with RM20,000 which translate to RM4.5263 for per USD, Wise is basically 1.064% cheaper than using Maybank at the time of writing.

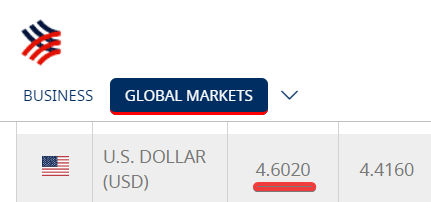

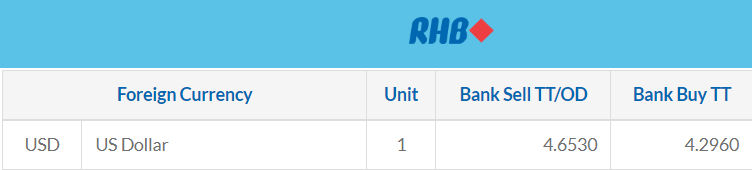

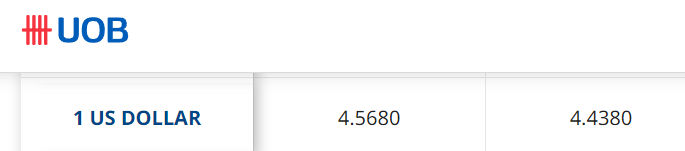

What about the other bank? Let’s look the other bank TT selling rate at the same day:

As you see most of their exchange rate for wire transfer is similar or even higher than Maybank, and they usually charge an additional fees like Maybank too.

However that does no mean using local bank wire transfer to fund IBKR don’t have its use, there are some reasons you may consider using your bank wire transfer for example:

- You are premier or private banking clients with access to better FX rates

- You need to make a lump sum deposit which you can try bargain for better rates (>RM100k)

But based on what I’ve seen most of the “preferred rates” are still hard to beat Wise 0.54% fees on mid market rate, and you need to be making really large transfer to negotiate a better rate, but if you can meet any of the criteria then of course you should use whatever with the lowest cost.

Other Funding Options

There are some other funding option that involve using Wise ACH transfer, or a combination of Wise with Singapore bank account, or using other bank that is not mentioned in this post.

In my opinion they are largely similar, for example while some people claim that selecting the ACH deposit method in IBKR then initiate ACH transfer from Wise will incur lower fees, but this method could create some hassle as the Wise bank account in US doesn’t have your name, and there has been multiple instances IBKR will hold that payment and require additional verification before it get credit to your account.

As for the Wise plus overseas bank option, such as sending MYR to your Singapore bank account with Wise, then deposit into IBKR with SGD, then convert back to USD, while it may or may not result in a lower fees, the additional steps of double conversion, more time in between could lead to less predictable outcome, which makes predicting the final cost a little bit more complex, and won’t really get you any significant cost saving if there’s any.

(But withdrawing from IBKR to Singapore CIMB is a different case, Singapore CIMB offer really competitive rate to convert you SGD back to MYR during business hours.)

Does That Mean Wise Is the Cheapest Option?

As much as I hate to admit, but at the moment there isn’t many option for us to exchange currency at a competitive rate like Wise able to provide, which make it generally the cheapest way to fund your IBKR account.

I’m not promoting Wise, I don’t even have a referral link or anything, I’m simply provide the possible options to fund IBKR account in Malaysia.

Personally I would like to see this to change, and hopefully more banks will try to offer a better rates, or our local fintech company will able to let us fund our IBKR while provide competitive exchange rates.

Anyway I hope this post can save you some time and give you some idea on where to look for the best rates to fund your IBKR account, if there’s anything I missed feel free to leave a comment below!

Thanks. Excellent writing. Now I know it is better to use WISE than to use Bank wire transfer to IBKR account.

Hey, thanks for the write up. Wise has a limit of RM30K per day. Do you know other ways to fund IBKR?

I’m not sure about now but previously there’s a trick to bypass the RM30k limit by initiate the transfer, then make another transfer, then cancel both then your account has 60k, then repeat. As for other option I think you can try in this order: