Table of Contents

Introduction to Treasury Bills for Malaysian

If you read a lot of finance topic from US market, or took a course about finance from US lecturer, you probably heard the terms “risk free rate”, Treasury Bills (T-bills) are commonly regarded as the closest approximation to a risk-free rate in financial markets.

This perception stems from the fact that T-bills are backed by the full faith and credit of the US government, which is considered one of the safest entities in the world. As a result, the risk of default on T-bills is considered extremely low, making them a benchmark for risk-free investments.

However, it’s essential to note that while T-bills are considered low-risk investments, they are not entirely risk-free. Like all investments, T-bills are subject to certain risks, such as inflation risk and interest rate risk, and currency risk (for foreign investors like us).

Additionally, while the likelihood of the US government defaulting on its debt obligations is extremely low, it’s not entirely impossible. Nonetheless, T-bills remain one of the safest investment options available to investors seeking to preserve capital and mitigate risk.

Benefits of Investing in Short Term Treasury Bills

Investing in US Treasury Bills can be a smart move for Malaysian investors looking for stability and security, especially if you plan to diversify your portfolio to include exposure to foreign currency, especially if you are already saving USD.

Diversifying portfolio to include currency from one of the largest economy also help you to lower the risk of inflation and the weakening Malaysian Ringgit.

Some people think if they live and spend in Malaysia the weakening Ringgit should not affect them, but that is simply not true unless you doesn’t consume any product that are imported, or use imported material to produce.

Treasury bills are also highly liquid, they are pretty easy to buy and sell, so it doesn’t lock up your fund, which means it is also a good option to park your money and access it whenever you need it.

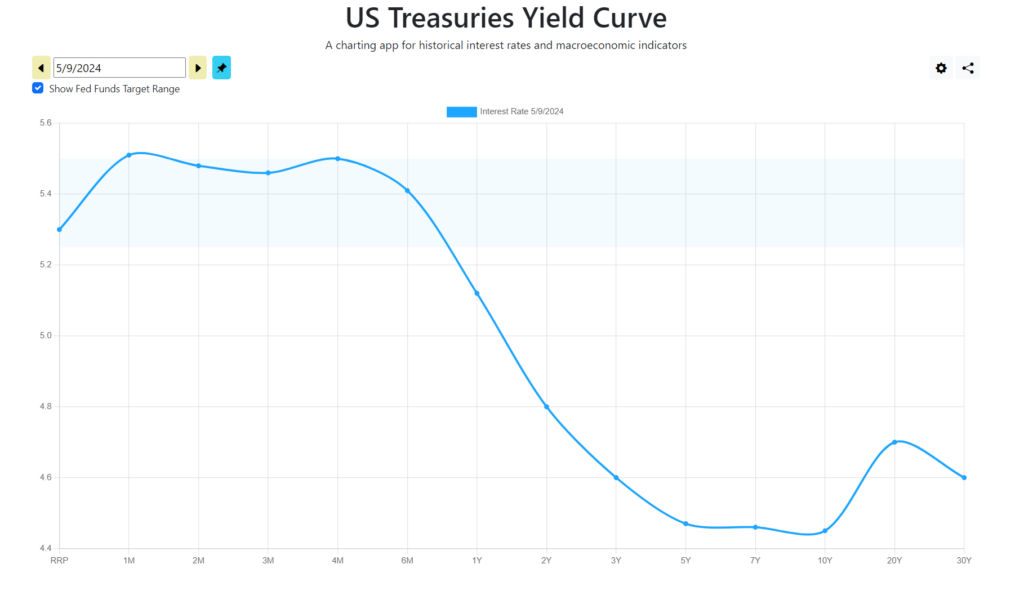

Plus, with the current inverted yield curve, short-term Treasury Bills are offering attractive yields, hovering around 5.4%. This means you can earn a decent return without taking on too much risk.

How to Buy Treasury Bills As Malaysian

There are two different ways most people buy short term treasury bills, by short term, we are talking about T-bills that mature within 3 months, which also have the highest yield as shown in previous yield curve chart.

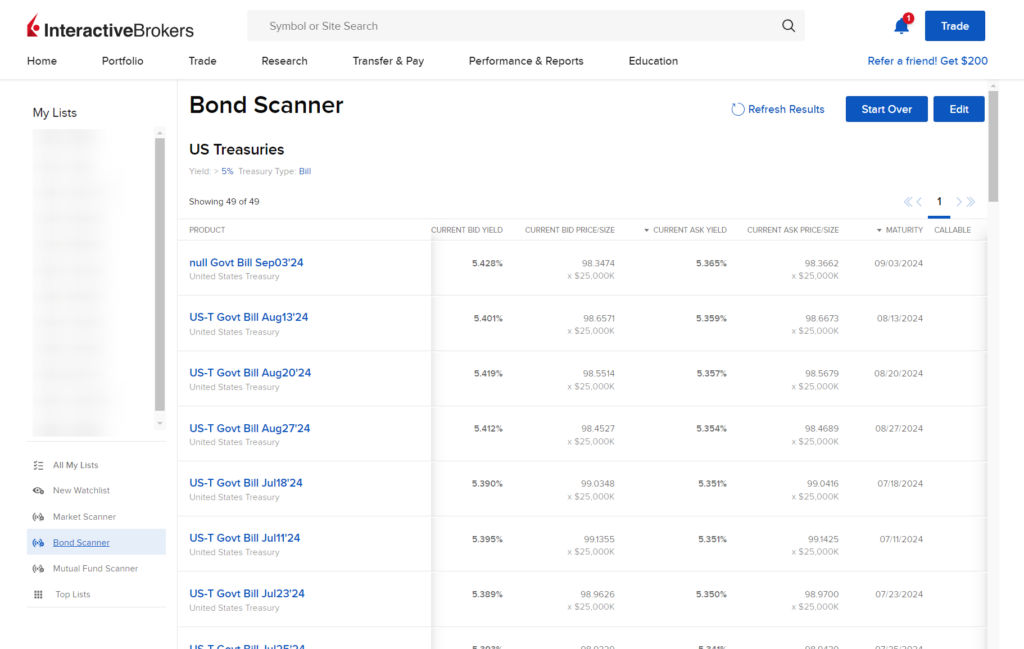

If you own an account with US stock brokerage like Interactive Brokers, you can easily search for treasury bills with a bond scanner, for example here’s how I search it from Interactive Brokers account, and by default it will sort by the highest to lowest yield based on Ask price.

US treasury bill are usually denominated a face value of $100, which mean when they matured they will be redeem for $100, and it is trade in a discount price before the maturity date. Confused? Let’s go through an example with the Sep03’24 T-bills, which the ask price is $98.3662, and mature in about 115 days.

Here’s how the yield is calculated, we take $100 divide by current price $98.3662 to find the return, then divide by 115 days to get the yield per day, then multiply 365 to get annual yield:

(((100 / 98.3662)-1) / 115 ) * 365 = 0.05271667636 = 5.271%However there is some problem with buying treasury bill directly, which is you will need to buy a new treasury bills whenever the previous one expires, also known as maintaining your own T-bills ladders, which can be time consuming.

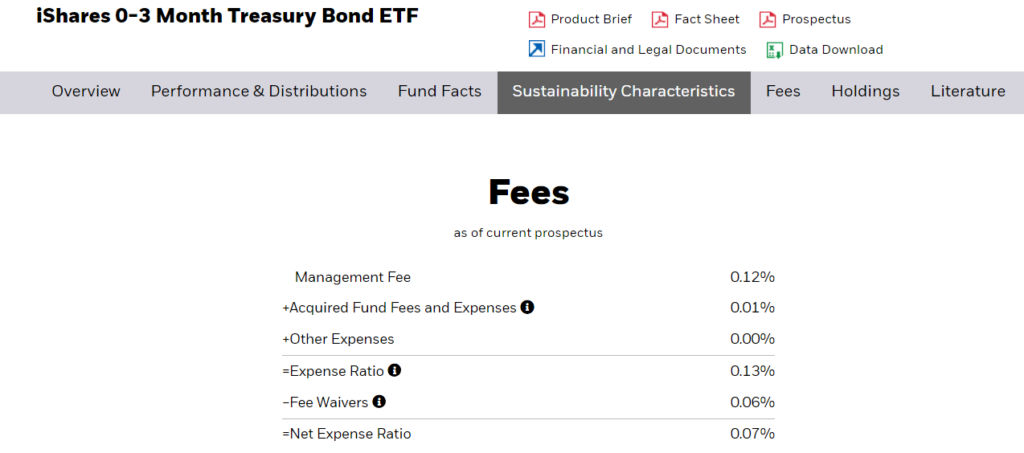

The alternative solution is to buy short term treasury bills via ETFs that buy treasury bills, the most popular ETFs are SGOV by Blackrock iShares which buys treasury bills with a maturity date of 0-3 months, and the other one is BIL by SPDR which buy treasury bills with a maturity date of 1-3 months.

Personally I prefer SGOV because it has the lower expense ratio compared to BIL:

The fees impact are minuscule, so I wouldn’t worry about it too much of picking one over another, just go with the lowest fees option that is available with your broker should be fine.

Risk Factors to Consider

I have touched on this a little bit in the introduction, but it wouldn’t be responsible for me to tell you that treasury bill are completely risk free even though treasury bill are commonly use as the proxy to assess US risk free rate.

Currency Risk for Malaysian Investor

Although we consume imported goods and goods that produce with imported materials, we still live and spend in Malaysia, so the currency risk can’t be ignore, that is why you should manage the currency risk when investing US treasury bills, and understand the exchange rate fluctuations can directly impact your return as well.

The most common way to manage the risk is to diversify, don’t over allocate your portfolio in single foreign assets, at the minimum you should still have your emergency fund saved in the currency you spend everyday.

Interest Rate Risk

Changes in interest rates can affect the value of Treasury Bills. If interest rates rise after an investor purchases Treasury Bills, the market value of the Bills may decrease, leading to a potential loss if sold before maturity.

But this shouldn’t be too much of an issues since we are mostly focusing on short term treasury bills the impact of this should be minimal.

Credit Risk

While US Treasury Bills are backed by the full faith and credit of the US government, there is still a small risk of default. While this risk is considered extremely low, it’s essential for investors to be aware of the possibility.

Final Thoughts

Investing in US Treasury Bills can be a smart move for Malaysian investors seeking stability and security. With short-term T-bills currently offering yields around 5.4%, they provide an attractive option for preserving capital while earning competitive returns.

By diversifying your portfolio with Treasury Bills, you not only gain exposure to one of the largest economies globally but also mitigate risks such as inflation and currency depreciation. However, it’s essential to remain vigilant about potential risks, including currency fluctuations, interest rate changes, and credit risk.

We hope this guide has provided valuable insights into US Treasury Bills for Malaysian investors. Feel free to share your thoughts or questions in the comments below, and don’t forget to share this post with others who might find it useful. Happy investing!