Table of Contents

What Is EPF Self Contribution?

After my previous post about the new EPF account flexible, I decided to write this post. I’ve seen many people discussing withdrawing money from their new account flexible and reinvesting it into EPF self contribution accounts. So, I’ll share my opinion on why this strategy may not be suitable for everyone.

EPF self contribution, as the name suggests, is a voluntary contribution that you make yourself, unlike the compulsory contribution if you are an employee. The self contributed funds go into all three different EPF accounts, following the same distribution as the compulsory contribution.

Types of EPF Self Contribution (Regular vs. i-Saraan)

There are a few different voluntary contribution schemes with EPF. For example, i-Suri is a voluntary contribution scheme for housewives, a top-up contribution allows you to save for your family member, and excess contributions are for employees.

The ones we’ll discuss in this post are EPF Self Contribution and EPF Self Contribution (i-Saraan). What’s the difference between them?

Let’s take a look at who can apply for each of them, for the EPF Self Contribution:

- Malaysian & Permanent Resident

- EPF Member

- Below 75 years of age

And here’s the requirement for EPF Self Contribution (i-Saraan):

- Malaysian & Permanent Resident

- Self employed individuals (Must not be an employee)

- EPF Member

- Below 60 years of age

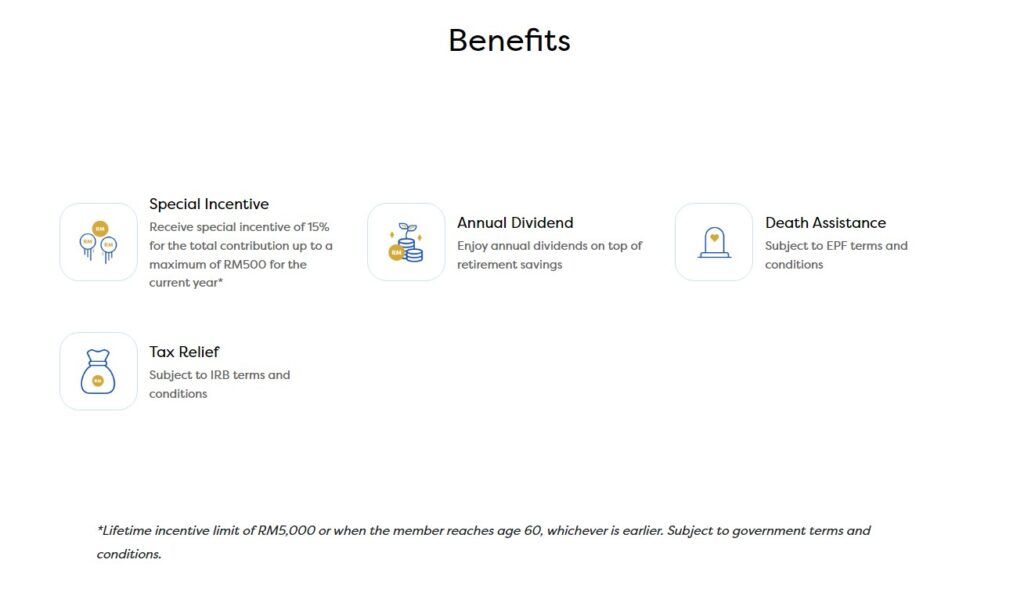

- Special incentive that matches 15% of your contribution (Up to RM500/year)

As you can tell, i-Saraan is for self employed individuals. So, in the next section, I’ll discuss when I think it’s good to invest in the self contribution scheme and when it is not.

Should You Invest in EPF Self Contribution?

There is no simple answer to this question, but I will share my thought process and the points that you should consider before reaching a conclusion for yourself.

In my opinion, the main factors to consider when deciding whether self contribution is right for you include:

- Your age (investment time horizon)

- Your risk tolerance level

- Your portfolio allocation strategy

- Your employment status

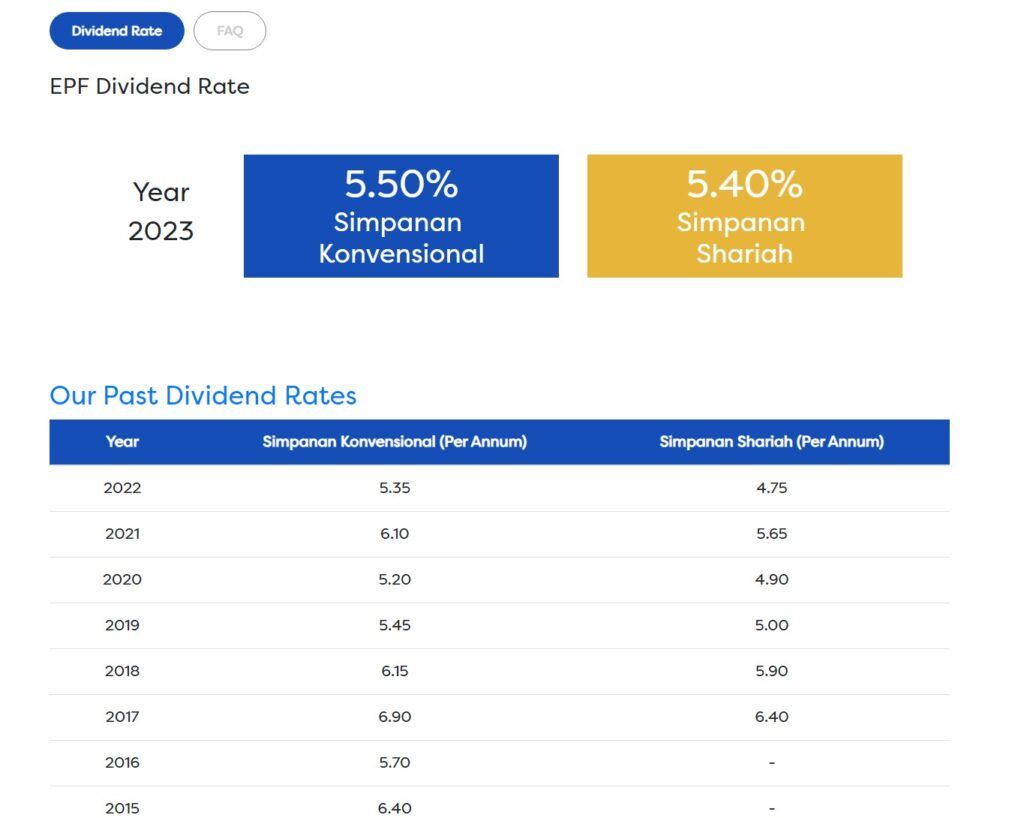

In my view, EPF can be seen as the closest to a risk-free investment scheme in Malaysia because it is backed by our country. Therefore, it should be treated like a bond in your portfolio allocation. In my opinion, if you are young, you should generally avoid overallocation in bond-like investments.

With a much longer investment time horizon and a higher risk tolerance level, you have more value that can be extracted from work. That labor value or future salary can be seen as a kind of bond investment pending maturity. Additionally, don’t forget that you already contribute part of your salary to EPF with the compulsory contribution.

Which means we are already over-invested in bond-like assets, and that may not be a good thing when you are young. You should be able to take more risk with higher potential rewards when you still have time to endure a large drawback from the financial market.

As self contribution follows the same distribution into your EPF accounts, it also means locking the funds away until you are age 55 or age 60.

Plus, when I say “closest to risk-free,” it isn’t completely risk-free. There are many types of risk, and locking your funds for years makes you unable to control or respond to some risks. For example, the risk of inflation is a very real issue you should be considering.

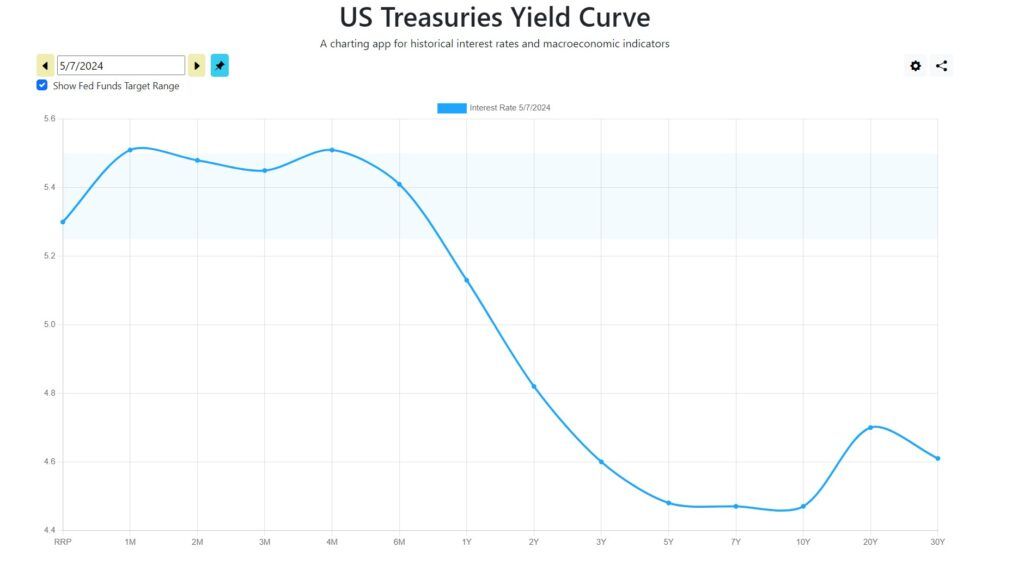

Also, you have to think about the opportunities that you sacrifice when you lock your funds in EPF. For example, as of writing this post, the US short-term Treasury yield is around ~5.4%, which is also more liquid (but of course, that introduces us to an additional currency risk).

When Is It Okay To Invest into EPF Self Contribution?

Alright, I have argued that if you are young, it may not be a great idea to over-invest in bond-like instruments via EPF self contribution, but what about as you grow older?

I think it can be a good idea to treat the EPF account like a bond investment. Hence, as you grow older and plan to allocate a higher percentage of your portfolio into less risky assets, the EPF account can be one option.

It is also important to consider all your assets when deciding how much of your portfolio should go into less risky assets like EPF. From what I have observed, EPF is already one of the largest assets for many people, so please keep that in mind when planning your allocation.

Maxing out the special incentive from EPF Self Contribution

Now, there is a case where EPF self contribution is a good idea, which is to take advantage of the special incentives that match your contribution.

Unfortunately, these incentives are only available for self employed individuals or housewives. However, if you fall within these categories, ensure not to miss out on them.

The i-Saraan special incentives match 15% of your contribution, up to RM500 per year. So, to fully take advantage of that, you should self contribute at least RM3,333 per year to enjoy that instant 15% reward.

For i-Suri, it matches 50% of your contribution for up to RM300 per year. That means you just have to contribute RM600 per year to max it out.

However, there’s a lifetime limit for both of these. For the i-Saraan, it is RM5,000, and for the i-Suri, it is RM3,000. So, you can max out those incentives in about 10 years of contribution.

Wrapping Up: Navigating EPF Self Contribution

In summary, EPF self contribution isn’t a universal solution but rather a nuanced financial decision influenced by individual circumstances. While it offers stability, its implications on portfolio diversification and opportunity cost necessitate careful evaluation.

As you chart your financial path, consider the balance between risk and reward, and leverage opportunities wisely to secure your future.

Feel free to share your thoughts or questions in the comments below. If there’s anything you’d like me to delve into further or if you have additional insights to add, I’d love to hear from you!