Table of Contents

EPF Belanjawanku 2025 Retirement Savings Target

This month KWSP EPF released an updated retirement income adequacy framework and launches the Belanjawanku 2024/2025 framework.

Now both of this framework basically serve the purpose of giving Malaysian a benchmark and path to accumulate enough for retirement.

Three tiers of retirement living standard

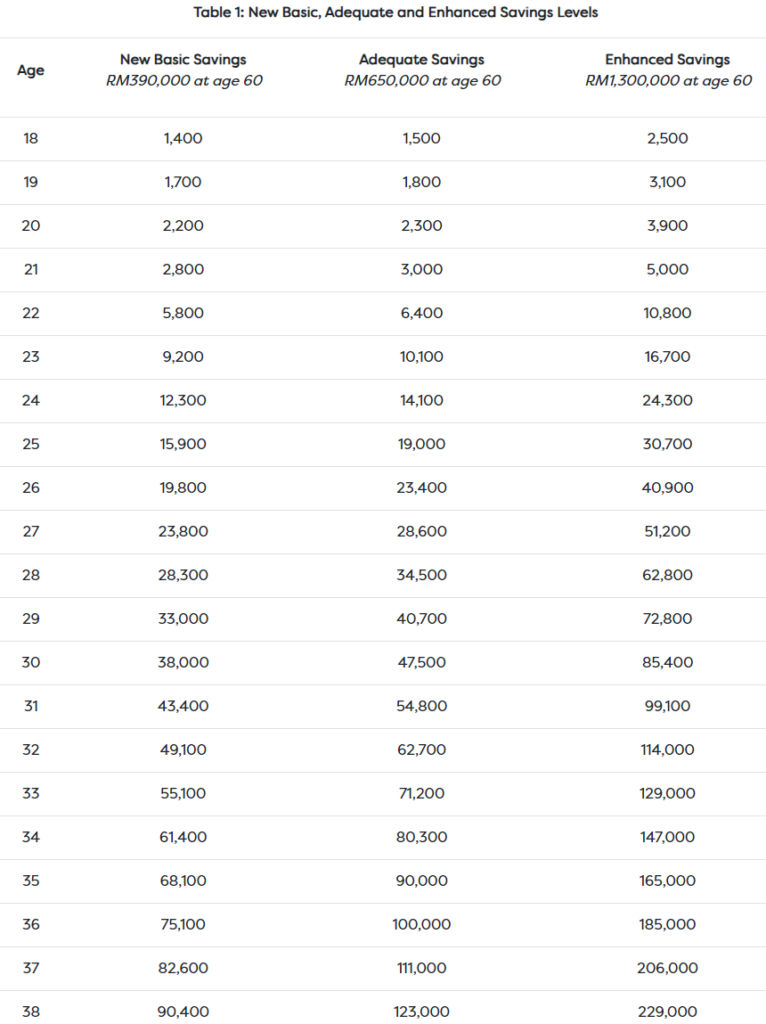

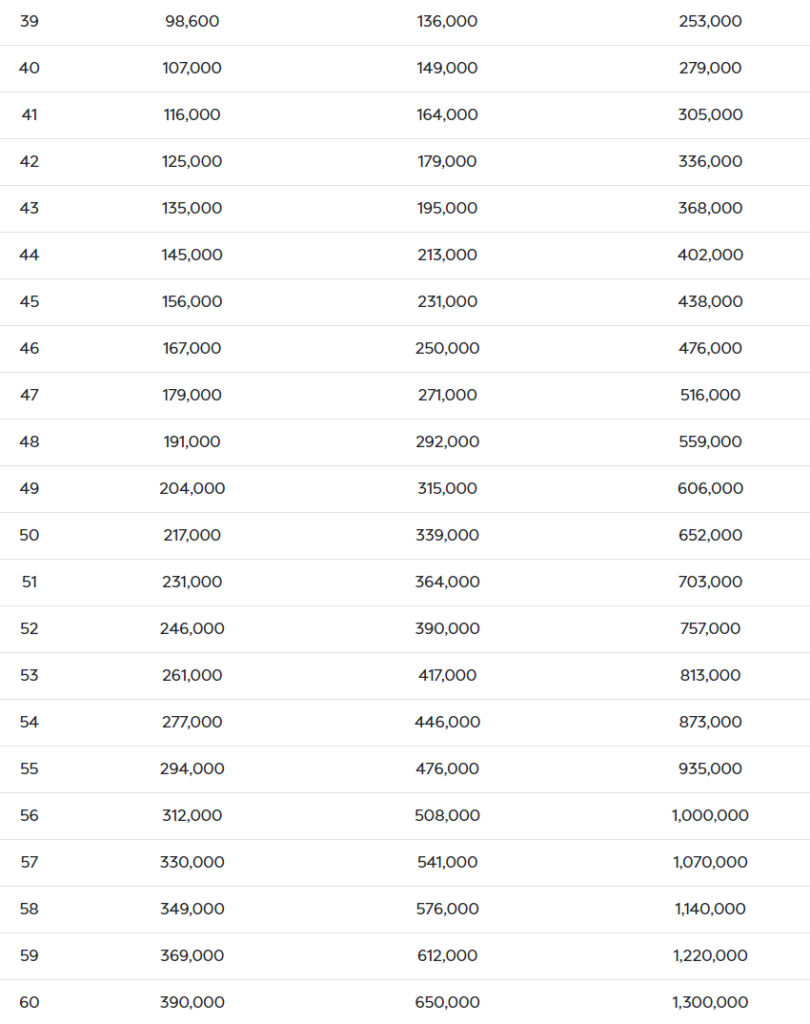

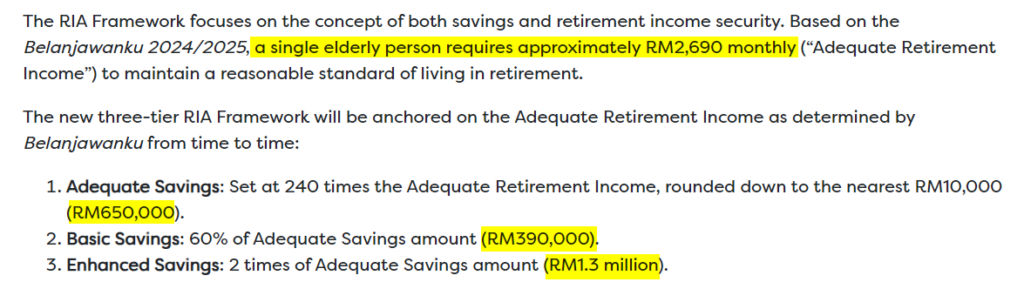

It consist three tiers of income and savings target, from Basic that covers essential retirement needs, Adequate that provide a reasonable retirement living standard and Enhanced for a higher quality of retirement.

Each tiers give you a target for the amount you should have by the age of 60 for retirement and expect them to sustain for another 20 years, close to the life expectancy of Malaysian. That is RM390,000 for Basic, RM650,000 for Adequate and RM1,3000,000 for enhanced.

Keep in mind the numbers here are based on single person, not household.

Are the savings target realistic?

Well that depends what you think about the RM2,690 monthly budget, but I think that is acceptable for many people, and if you are too then yes the saved up amount would be able to sustain that for another 20 years.

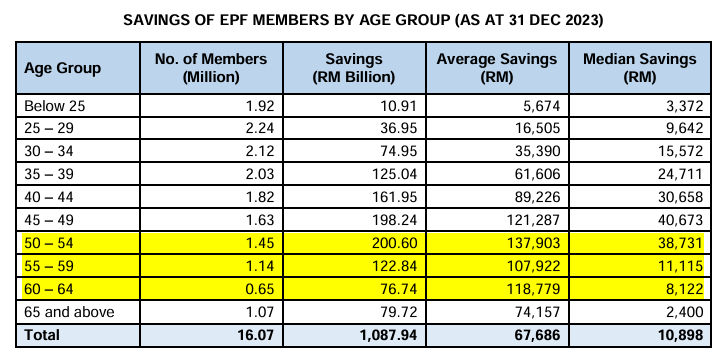

The only real question is how most people will be able to reach that target? Based on the EPF savings report of Dec 2023 more than 50% of EPF registrants above age 50 are 10 times below the retirement target:

I am sure our government already have plans for that. (Hopefully it’s not just raising more taxes to subsidize more and transfer the economic burden to young generation that already have very little chance to escape the rat race.)

Understanding The Savings Table by Age

You probably seen people sharing this savings table from EPF’s RIA framework, but this table can be misleading for some and may give false expectation.

While not explicitly mention, this chart are only for present, that means you should only check if your savings against this chart when it was first announced because it doesn’t account for inflation.

For example if you’re retirement goal is to achieve the adequate savings, and you are 30 years old right now, you can check the chart and see if you’re behind or ahead of the savings of RM47500.

However, for the next year you shouldn’t just compare it with the RM54800 from the table, you should multiply that by inflation then only do the comparison, and assume the inflation is 3%, the amount you should achieve when you are age 31 will be RM56444.

You probably think that’s just a small difference right? Let’s find out what is the number you should then compare when you’re 40, which is 10 years later.

The table shows RM149000, assuming the same inflation 3%, that would be RM149000*1.03^10, which is RM200243, about 34.4% more than the chart shows after accounting in the inflation.

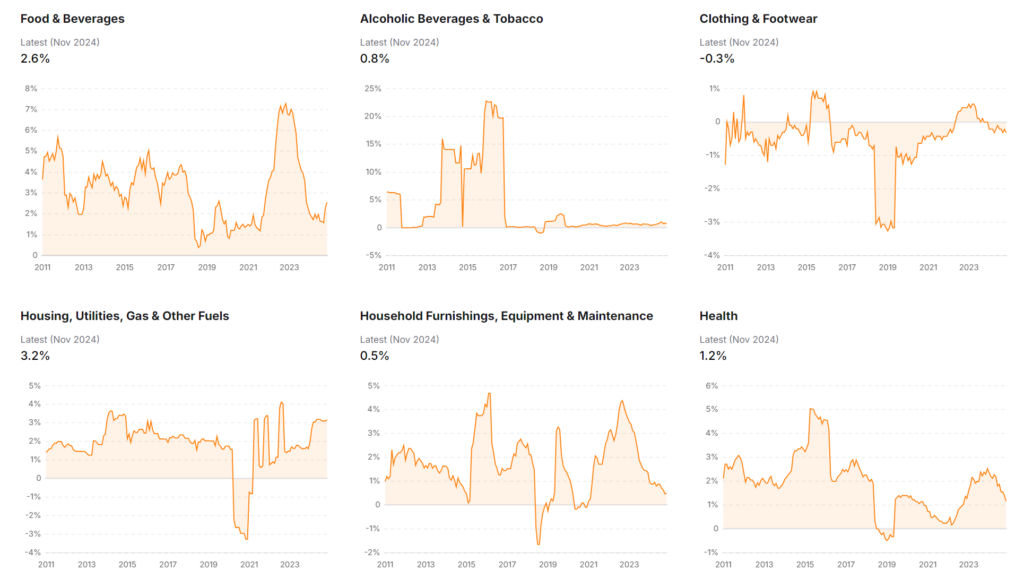

What to expect with future inflations?

The Department of Statistics Malaysia data shows an average inflation of ~2% based on the past few years, but without knowing what exact products, brands, outlets used in their basket of measurement, the locations of collections, what subsidized products are included, it’s hard to know how close is the report inflation is to the average Malaysian.

You may experience higher inflation if you use more import goods, live in an urban area, use less of subsidized products. That’s why it’s better to expect a higher inflation for financial planning, it’s better to have more wiggle room.

How much money to save every month?

There is a better way to calculate how much you need to save every year or month, how much you should aim to have by age without relying on the savings table by EPF.

First you will need to find out how much exactly the retirement target will be when you retire by multiplying the target with inflation to the power of how many years until you are age 60.

Let’s use the same example, assume we are age 30 right now, there is 30 years until age 60, so the adequate retirement target when we are 60 will be:

Adequate: 650000 * 1.03 ^ 30 = 1577720 ≈ RM1.58mil

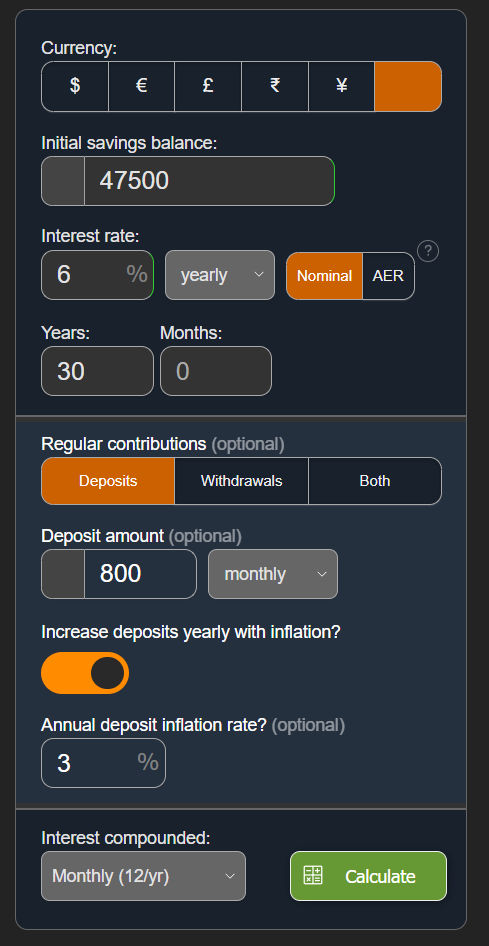

Enhanced: 1300000 * 1.03 ^ 30 = 3155441 ≈ RM3.16milFor next step we can use any compound interest calculator with regular deposit input, in this example we will use the one from thecaclulatorsite.

The currency doesn’t matter because we just need to find out the numbers, type in your current savings into initial savings balance, for the interest rate should be the return you expect from the market for next 30 years, in this case we’ll just use 6% which is close to EPF return.

Next we will type in 30 years and choose deposit and input the amount you will be able to save every month, the inflation here means how much we will increase our deposit year by year, we’ll use 3% here as well, everything else just leave as is, then hit calculate.

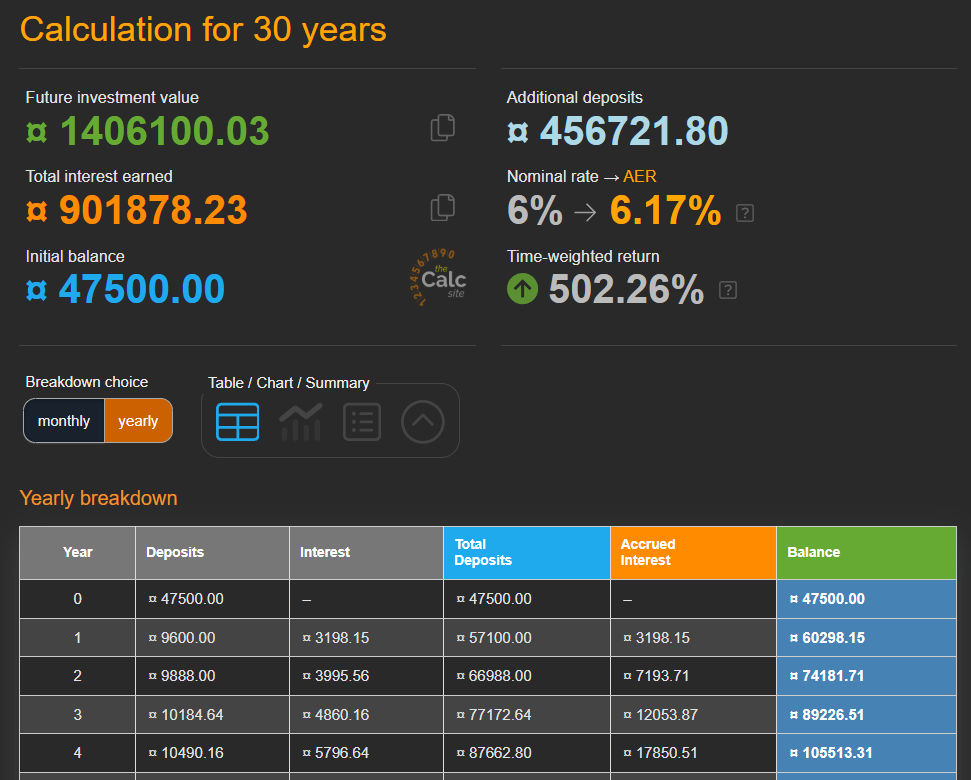

In the compute results the future investment value of RM1.4mil means what you will have when you are at 60 years old, now we compare that to the RM1.58mil adequate target, you will find that this is below the target amount.

If the results are below your retirement saving target (after inflation), that means you may need to save more by increasing the initial monthly deposit, or improve your salary at a faster pace by increasing the inflation rate here.

The inflation rate you calculate here is not related to consumer prices, but it’s simply means how much more you will save every year, if you use 3% that means every year you will save 3% more by next year, and you will have to have salary increase by similar or higher rate.

Closing Thoughts

While the adequate and enhanced retirement savings target are mostly realistic, but our government only tell us the number we need to have but did not gave any path on how to actually achieve that.

Judging by our EPF savings report, it tells me there is a huge gap to be fill, and in my opinion that start from awareness and personal finance literacy, that is what motivates me to write post like this.

Now I know some of you reading this are more financially aware and usually have better literacy in personal finance, so it’s most likely you will be able to exceed those targets easily.

However for the others that are still working on their financial betterment I hope this post helps you in planning your retirement savings goal, and if there is any questions you can comment below I’m happy to reply