Table of Contents

Introduction

My car insurance are expiring this week, as this is the second year of having my first car, I have no prior experience with car insurance products, this post is just me sharing the process of me choosing an insurance.

The first year of my car insurance are included when I buy the car, which is from Honda Insurance Plus and I believe the underwriter is likely Etiqa Takaful Insurance or Liberty Insurance.

There is No Best Car Insurance

While in this post I ended up with Etiqa Motor Takaful but I want to highlight there is no such thing as best car insurance product.

Factors such as living in rainy area with flood risk, financial affordability factor, risk tolerance, car driving mileage can play a huge role in decide the right product for yourself.

However, that doesn’t mean you can’t find a better deal, if both insurance product have similar coverage, similar reputation and positive feedback from users, then you will probably want the lower cost option.

What Coverage I Am Looking For

There are two common types of car insurance in Malaysia, comprehensive and third party insurance, the later are the minimum required insurance to drive your car on the road, as the name suggest it is meant to cover the damages you cause to third party.

Comprehensive insurance included third party coverage plus your vehicle and many other addon insurance for you to insure. (Whatever insurance company can make profit, they will sell you the insurance.)

Since I am not using the car frequently, with less than 8k mileage a year on my car, I need the insurance with below features:

- Unlimited third party coverage

- Unnamed drivers (Since my family drive the car sometimes)

- Insured at least 80% of the car outstanding loan

- Windscreen

- Legal liability of passengers

- Good enough towing coverage (I don’t drive far either)

As you can see, it’s pretty basic requirement, almost any insurance company’s comprehensive car insurance fulfill my needs, so to me it just come down to their reputation, reliability and price.

Offer From Honda Insurance Plus

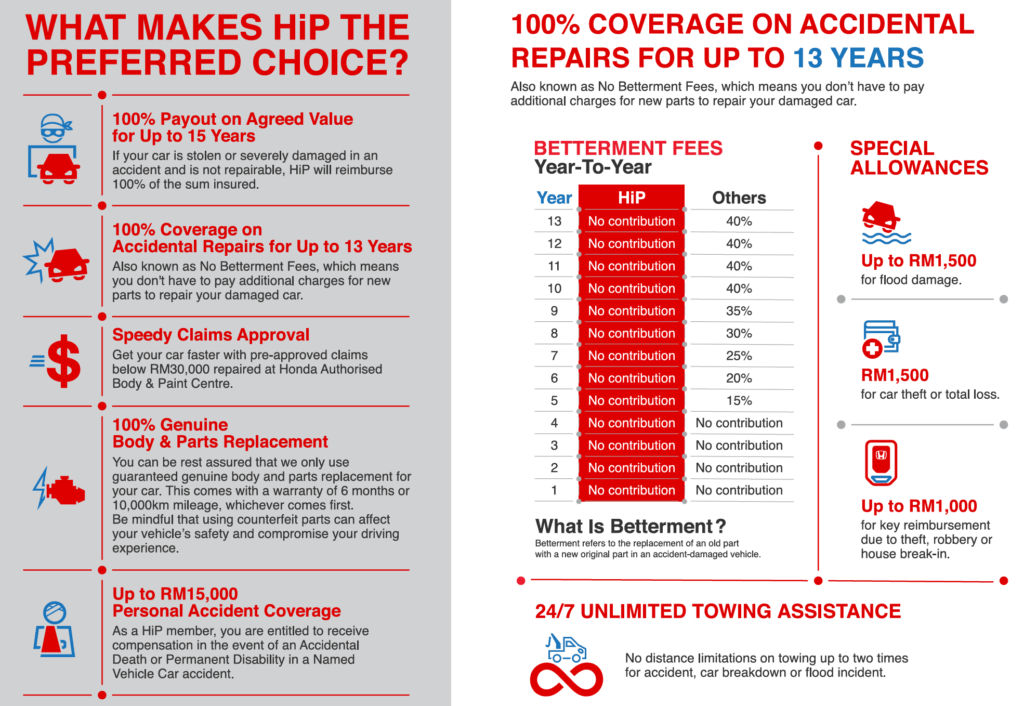

Their agent first reach out to me as my car insurance nearing expires and they provide me a quote of their Honda Insurance Plus offer at RM4063 (after 25% no claim discount) which covers:

- Sum insured RM159,000

- Windsreen RM2,500

- Flood allowance RM1,500

- Personal accident coverage of RM15,000

- Underwritten by Etiqa Takaful

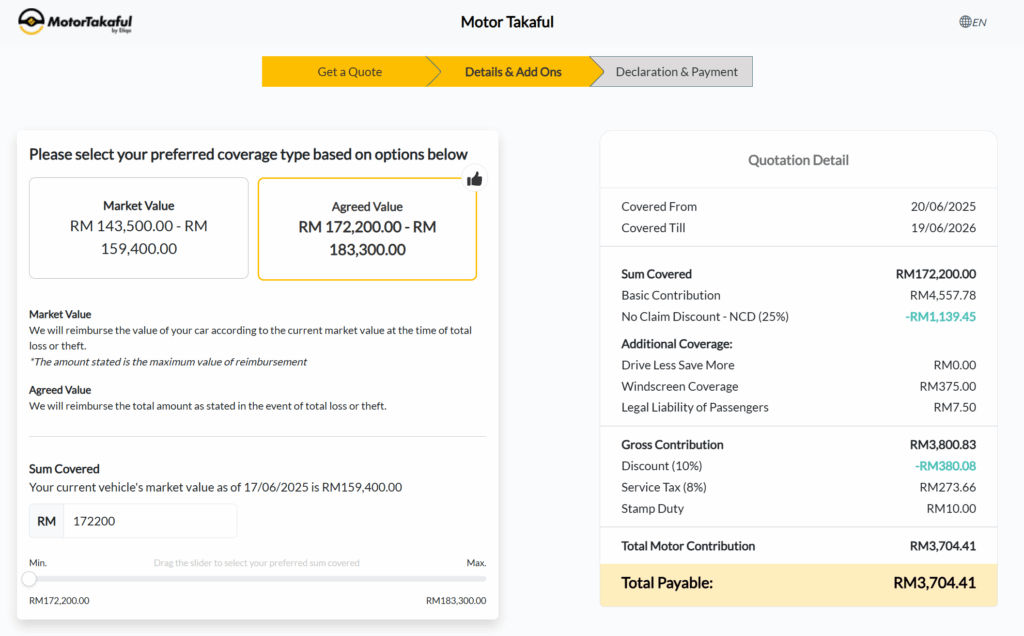

Now let’s look at the quotation directly on Etiqa website:

The quotation from Etiqa with slightly higher insured value with the same Windscreen coverage of RM2500 are around RM3704, while this seems to be cheaper than the offer from HIP but keep in mind it doesn’t include a few additional coverage come with HIP

That is you are getting some flood damage coverage, goods lost from car theft, key reimbursement and some personal accident coverage.

However these are less relevant for me because I don’t live in a high flood risk area and I already have personal accident coverage from other insurance company and you can’t claim from multiple insurance company so it mean I’m paying for premium for things I don’t need.

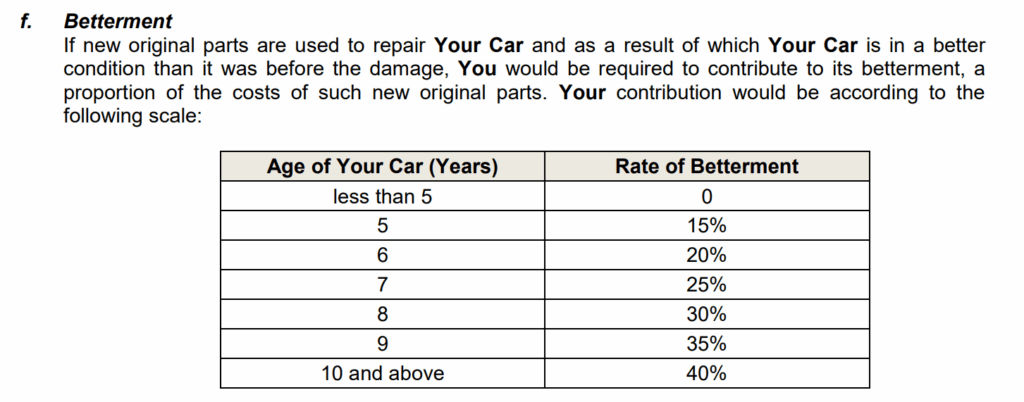

As for the betterment fees that simply means when the repair use original parts your vehicle end up in a better state that it was because of the new parts, but that was included in Etiqa takaful too.

So while HIP isn’t bad but it pre-packaged coverage that I don’t need so it wouldn’t make sense for me to paying for that additional premium.

Drive Less Save More from Etiqa Insurance

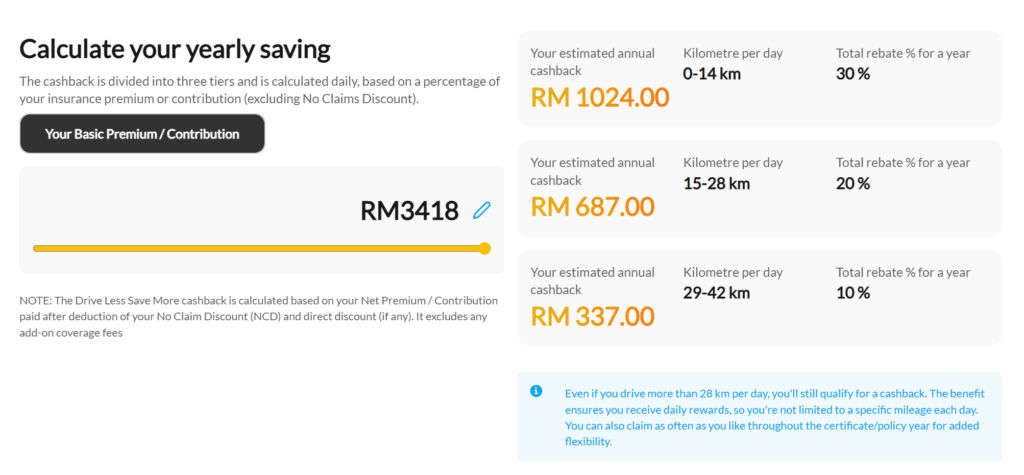

What really makes Etiqa stand out is not only that it’s cheaper, more customizable coverage, it also allow me to save more with their drive less save more offering.

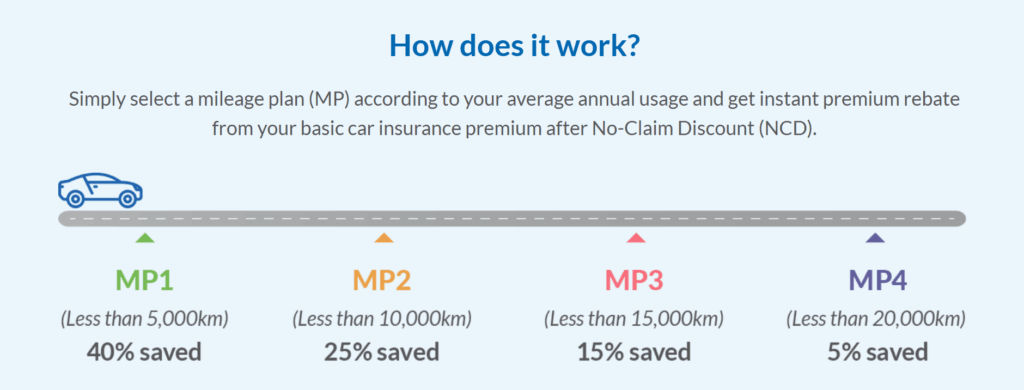

So how this works is you will be able to upload photo of your odometer in their app as frequent as every 10 days or just do it once right before the policy expires, and you’ll get a rebate if you have mileage below certain threshold.

Since I drive less than 10,000 KM per year it’s very likely I am likely able to save around 20~30% my basic premium, which bring the total cost of my car insurance down to around RM2900 while still cover what I need and are significantly cheaper than other offer in the market because of the rebate.

RHB Insurance has similar offer call Motor Saver

While I only did a limited search on offerings from other insurance company, since I already had a pre-filter on which insurance company I would choose based on their reputation, popularity and positive feedback, it’s possible other insurance provider would have similar offer, such as RHB Motor Saver.

Unlike Etiqa, RHB Motor Saver give you the discount upfront, but there’s a caveat. Let’s say you select MP2 but you drove more than 10,500KM and got into accident, you will be require to cover that 25% of the cost for repairing your vehicle.

It is less flexible and you are forced to estimate your car usage accurately, and for most people they probably will just end up being more conservative and pick the higher mileage rebate in the beginning, and you end up saving more and less the same as Etiqa.

That’s one reason I’m not going with RHB, the other reason is I never considered RHB in the first place because it’s less popular and I’m not sure if they approve claim easily or reject frequently.

What About Other Offers?

To be honest in the beginning I already set my mind to decide between Etiqa, Tokyo Marine and Allianz because I had successful claiming experience with Etiqa and my family members had experience with Tokyo Marine and Allianz.

However feel free to explore all the other options, for example you can use below website like PolicyStreet or MyEG Compare to get a quotation from various company at once.

But keep in mind when you go through these “agent” website it will usually be slightly expensive than going directly to the insurance company website because they pay commission to them obviously. (Usually around 10%)

Why Not Buying From Agent?

There are a few simple reason I am not looking for an car insurance agent, to keep things short I’ll use a bullet list:

- Insurance agent may not know what’s best for you nor may act in your best interest when the insurance company pays their commission, they simply do not have the fiduciary duty.

- Insurance agent turnover rate are high, the moment you need help applying for claim they may already not working for the company

- It’s not that hard to claim with the insurance company directly especially when these insurance company make the process easier in recent years.

- I have the ability to sift through the offers myself and pick what’s most suitable for myself, and I will act in my best interest

- It’s cheaper

Thus I’ve ruled out seeking for an insurance agent because of above reasons.

My Final Pick – Etiqa Takaful

Like I mentioned previously, I had experience claiming with Etiqa, and it’s a reputable enough insurance company with high popularity and generally positive feedback on the internet, so it’s not that hard for me to pick them as my car insurance.

Plus with their drive less save more scheme the insurance also end up to provide most value for the cost, so it make financial sense for me too.

Since Etiqa is under Maybank Group and I have a Maybank card I could also use a 12 month installment with zero interest when making payment, which to me it’s a bonus. Just don’t mistake taking advantage of every low or zero interest loan as lack of affordability.

Where Do I Renew Road Tax?

Once I purchased the car insurance I can finally renew my road tax, and the fee to renew road tax are more and less the same no matter where you choose, for me I just renew at MyEG website for RM130 (SUV road tax is RM120) and it comes with a physical copy which will be more convenient since my family member drive my car.

I hope this post helps you with your car insurance renewal as well, this post is more about sharing the process of me doing it than telling you which is best for you, because there’s no one size fit all insurance product you should always pick coverage that most suit your needs.