Table of Contents

Why I Am Writing This

This post is not a “how to buy a house” guide or a checklist of house buying costs. It is simply how I personally think about buying a house as a Malaysian.

I recently bought my first home, just before turning 30. It was a personal goal I set almost a decade ago when I was a freshman in college, and reaching it feels meaningful to me. But beyond the emotional side, this is also a major financial decision, one with trade offs that I wanted to quantify.

I asked myself, what is the opportunity cost of owning this house compared to delaying the purchase and investing for another 10 years instead?

Buy Now or Rent and Invest Later?

Personal finance is not a hard science, it is about making choices in our life that is ultimately for the betterment of ourselves, so when you strip down the complex question of buying a house, the choice look like this:

- Buy now. Pay the down payment, renovation fees, agreement fees, title transfer fees, monthly installment, maintenance fees and all the extras, move in, and enjoy the house for the next 10 years. Hopefully the value of the property appreciates.

- Or rent. Pay a lower rent, take the difference, invest it, and let it compound. After 10 years, compare that investment to the property’s value.

The reason I use 10 years for a checkpoint isn’t specific, in my personal calculation for all finance matter I would use every 5 or 10 years as a checkpoint, so for this post I think 10 years is a good interval to actually see the difference.

Obviously in this post I will not go into every tiny details, not going to use a spreadsheet with hundreds of row for every single cost, but will only focus on the largest items for a rough comparison to get a sense of what I am giving up and what I am gaining.

The Cost Of Buying My Home

The house I’m buying was initially listed for RM3 million, it has one of the larger land size in the community so the price is slightly higher for the additional land size, but fortunately I was able to negotiate the price to RM2.8 mil, about 7.33% lower.

Buying House At Fair Value

Now the price I get is considered slightly below market value, and I was able to know that because I have done extensive research for the land and house price of this area, which is also useful in helping myself negotiate with a price in my favor.

The way I research is first by identifying the land price without the structural cost, this is important because land price is more consistent, while the structural cost can be varying depends on what kind of material was use to built the house, the age of the house, etc.

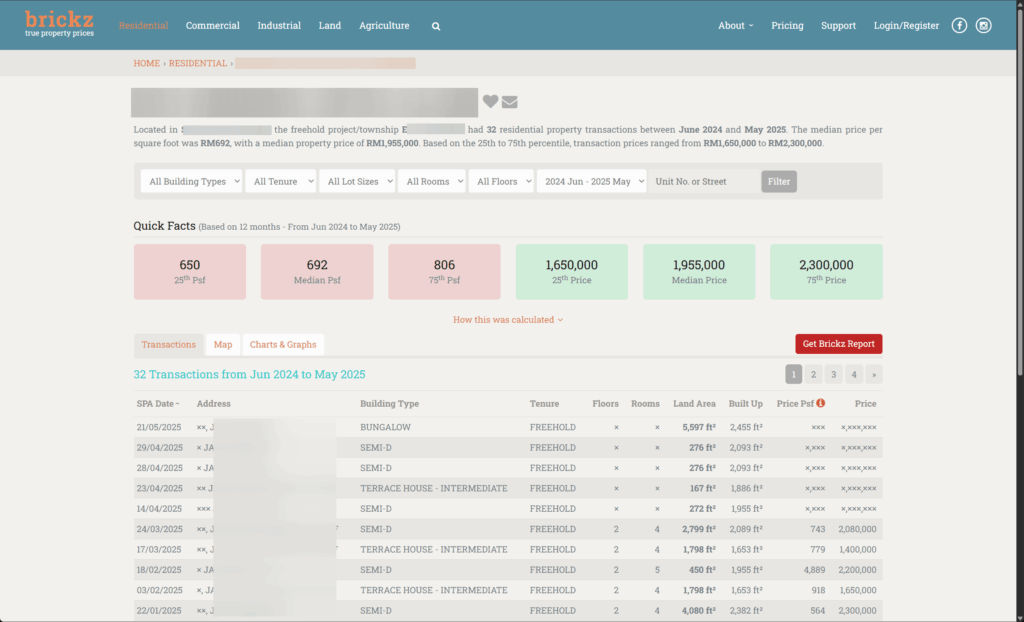

Maybe I will make a post in future about how I research for a fair price in housing market for specific area, but aside from checking price from listing sites, one website helps a lot is Brickz which you can pay RM69 to get 10 years historical transaction of an area.

The Actual Cost From Loan Interest and Fees

To secure higher amount of loan so that I can reduce the up front cash requirement for renovation and other fees, the seller has agreed to a markup price of RM3.6 mil which matched the bank valuer assessment, we will have lawyer to sign a supplement agreement so that the actual amount received from the seller remain at agreed selling price.

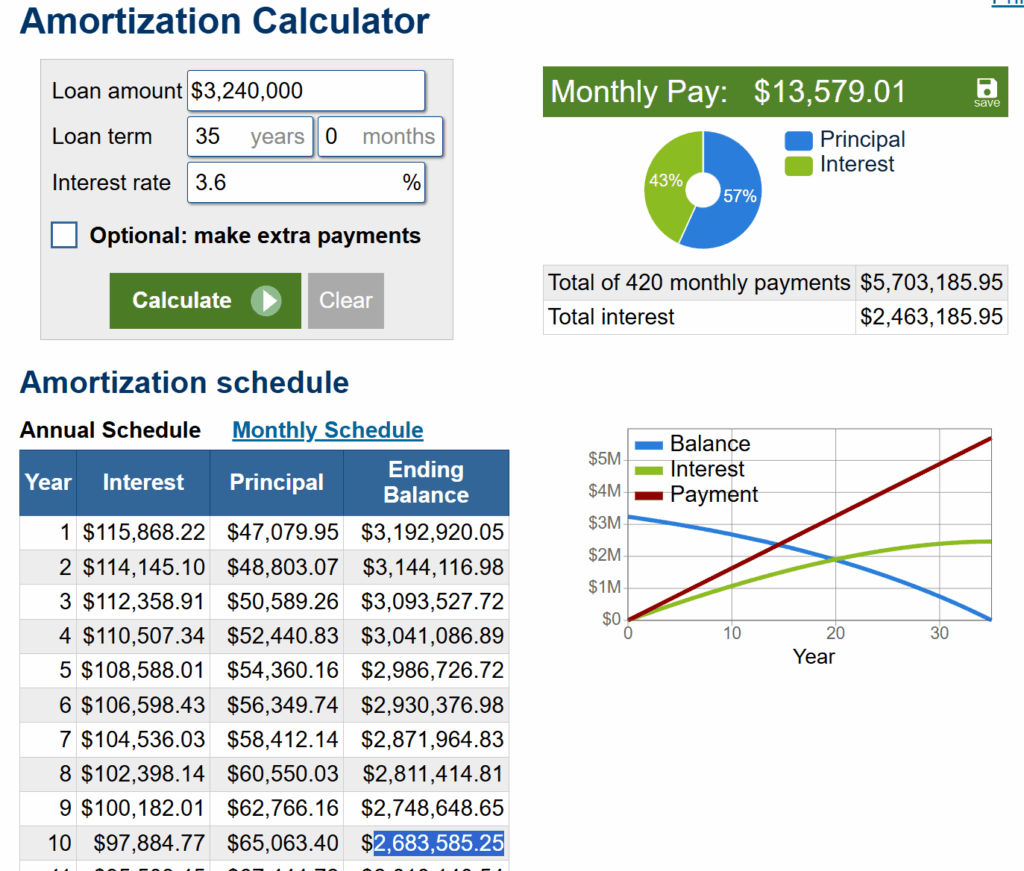

The loan I have obtained is as follows:

- Loan at 90% LTV: RM 3,240,000

- MRTA insurance: RM 21,615

- Total financed amount: RM RM 3,261,615.00

- Tenure: 420 Months (35 Years)

- Interest rate: 3.6% (2.75% OPR + 0.85% Profit Rate)

- Monthly Installment: RM 13,670.00

This mean I have extra loan of RM440,000 in cash, then consider the agreement fees and title transfer fees which is about RM180,000 and a renovation budget of RM400,000 the upfront cost would be around RM140,000.

Calculate The Actual Opportunity Cost

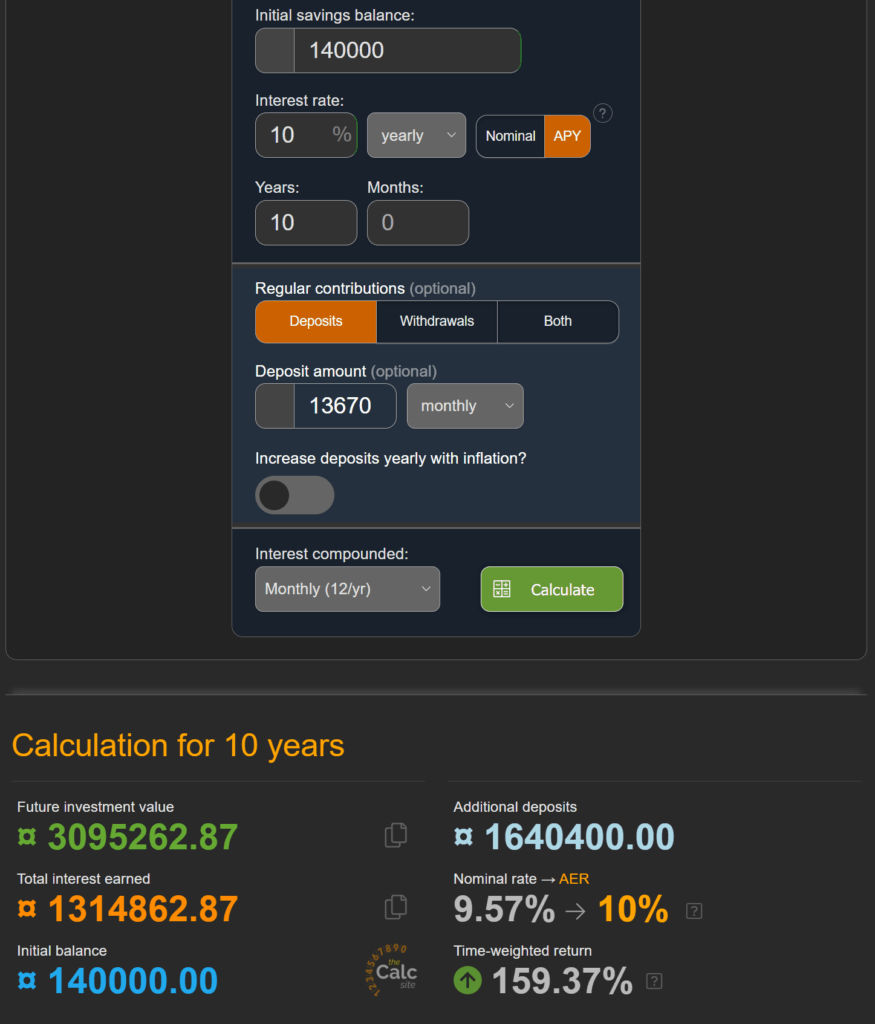

Now we know there’ll be an upfront cost of RM140,000 and a monthly installment of RM13,670 the way we can calculate the opportunity cost is by defining what would we invest with the money if it isn’t spend here?

Personally I would use 10% as my default return for opportunity calculation, this align with my portfolio return which consist of mostly globally diversified low cost index fund, but it is fine to use a lower or higher number, because it depends on what you would typically invest.

So the simplest way to calculate the opportunity cost is we see the upfront cost as our initial investment and the monthly installment as future investment, then with any compound calculators to get the numbers:

The calculation tells me I would have RM3,095,262 if I chose not to buy the house and invest instead, but there is few more things left out for a fair comparison, which is the value of the property at that time after outstanding loan, and the rental for renting.

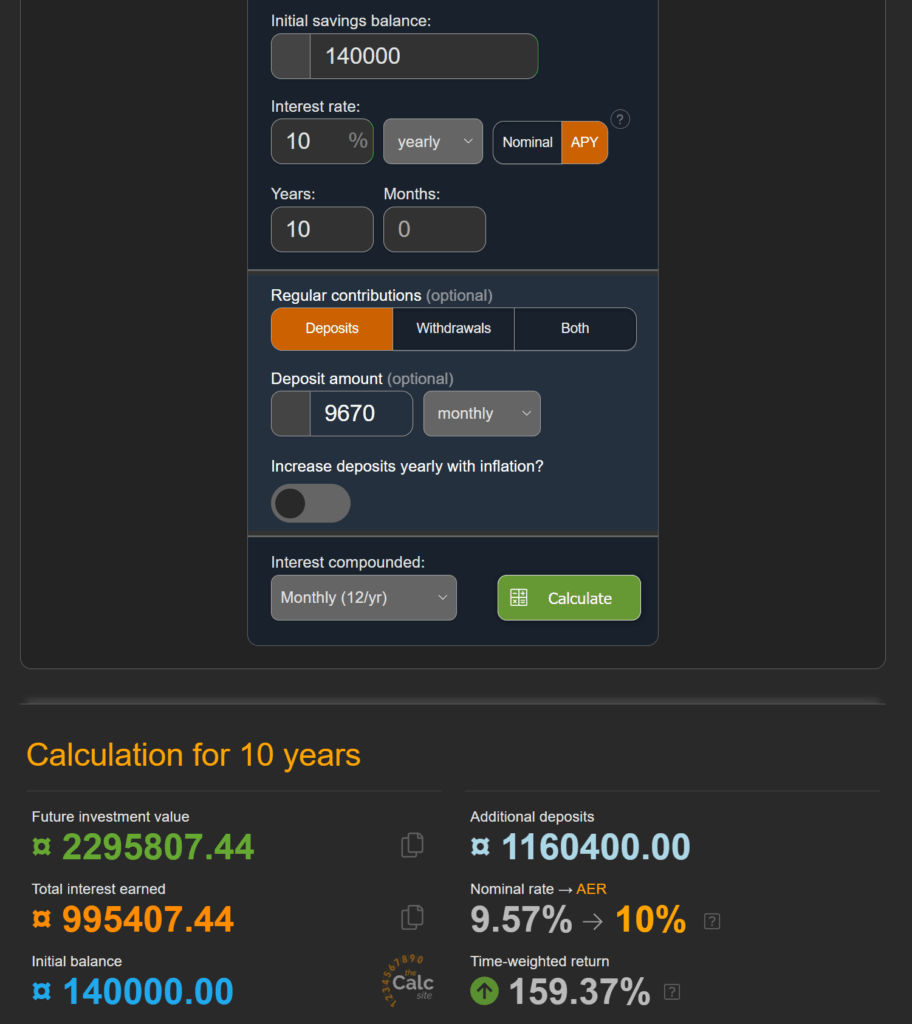

For rental I would just reduce the monthly deposit value based on the rental I will be paying for, which in my situation is about RM4,000 per month, so the monthly deposit will become RM9,670. The compounded investment value of RM140,000 and monthly deposit of RM9,670 in 10 years end up around RM2,295,807.

For the property value you can find out the average appreciation rate base on historical transaction and National Property Information Centre (NAPIC) data, for the house I am buying I will use the lower range appreciate rate for conservative calculation, which is about 2% cagr, this mean the property would be market for around RM3,500,000 in 10 years.

Last thing we need is the outstanding balance, which can be easily calculated using amortization calculator, and the outstanding balance in 10 years is about RM2,683,585

So the property value in 10 years would be the market price minus the outstanding balance, roughly around RM816,415 and this number should be use to offset our opportunity cost RM2,295,807 to get the final value of RM1,479,392

So if I bought the house, my net position after 10 years might be around RM1.5 million lower than if I rented and invested. Not a perfect calculation, but enough to see the scale of the trade off.

The Debate I Had With Myself

Here is the honest part. Once I saw the numbers, I struggled. On one side, I really wanted a place of my own, somewhere I could renovate, customize, and truly enjoy. On the other side, I could not ignore the compounding I would give up. That gap stared me in the face every time I ran the math.

I went back and forth, searching on forums and social media for arguments that would convince me to buy now. Most of what I found was not helpful, usually the same old “rent is a better financial decision” line.

Then I came across a reference to the book Die With Zero. I read it, and one idea clicked immediately, the “memory dividend.” The notion that experiences generate value that keeps compounding in life, just like money does in a portfolio.

That shifted my perspective. Suddenly the trade off was not just numbers versus lifestyle. It was compounding wealth versus compounding memories. And for this decision, I realized the latter mattered more.

I chose to create memories with my family in a place I like and own, in the best years of my life, which is not something can be buy back at future.

Final Thoughts

Buying my house was not the best move if I only measured net financial position. But it was the right move for me.

And that is the takeaway I wanted to share. Financial decisions are not just about maximizing money, they are about weighing trade offs. When you see those trade offs clearly, you can make your choices with confidence, whether you prioritize returns or the life you want to live.

There is no right or wrong answer for a choices like this, it all comes down to how much opportunity cost you are willing to give up for, how significant is that in your future wealth, and finally what do you get in return for giving that up.

Finally, this way of thinking does not apply only for buying a house, the same mental model can be apply to any big purchase, whether it is a car upgrade, a long trip or any other lifestyle choices.

It keeps me from drifting into big spending without awareness, while still letting me say yes when the experience is worth it.