Table of Contents

What Is Irish Domiciled ETFs

Ireland-domiciled ETFs are exchange-traded funds legally established in Ireland but commonly listed on the London Stock Exchange (LSE), giving non-US citizens convenient access to US and global markets.

They are structured under Ireland’s favorable regulatory framework and tax treaties, making them distinct from US-based ETFs, and in this post we will go over the benefits of Malaysian investor over the US domiciled ETFs.

Benefits of Irish Domiciled ETFs for Malaysian

Before we look into the benefits of Irish domiciled ETFs over US domiciled ETFs, it’s important to know some basics about taxation in investing.

First of all, there is no capital gain tax for Malaysian, which means when you buy stock and sold at a higher price, you will not have to pay any tax on the difference. (Unless you traded them frequently which the profit may be consider active income instead of capital gain.)

However, when a US company which you own the stock pays out dividend, that dividend is considered taxable, you will have to pay a 30% dividend withholding tax, usually that will be deducted from the dividend before it arrive your brokerage account.

Now you will learn how Irish domiciled ETFs tax treaties change that.

15% Dividend Withholding Tax Instead of 30%

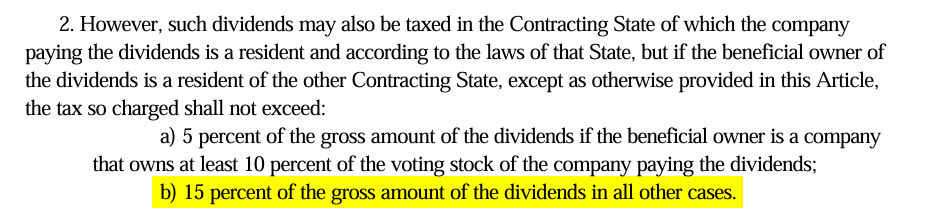

Ireland maintain a tax treaty relation with US, which you can find the details on IRS official website, but in short, entity in Ireland, in this case the Irish domiciled ETFs are subject to a 15% maximum tax on dividend.

That means you will only get taxed 15% for your US investment if it is exposed via Irish ETFs, and there will be no other tax in Malaysia because of the double taxation avoidance agreement between Malaysia and Ireland.

Now let’s illustrate what that means to you if you own S&P index ETF, based on Gurufocus S&P historical dividend yield chart, we can see a median dividend yield is 2.85% since year 1957

If you were invested in US ETF, you will be paying an average 0.855% in dividend withholding tax per year for the same period, but with Irish ETF that you will only pay an average of 0.4275% per year, the tax saved when compounded could be a difference of ~10% difference by the time you retire.

Exempt From Estate Tax Up to 40%

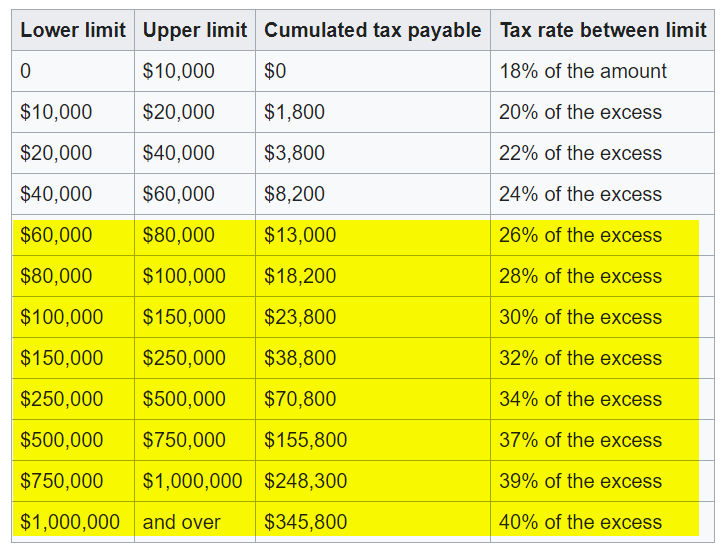

Malaysia does not have tax on inheritance, estate and gifts, however we also do not have estate tax treaty with the US, which mean we are subject to US estate tax on US located assets. The tax free allowance is only $60,000 and anything above will be tax according to below table:

Irish domiciled ETFs are regulated under Irish law, even though they still invested in US stocks, the ETF itself is a non-US financial products, therefore it is not classified as US located assets, and Irish estate tax does not apply to non-residents like us.

Irish Domiciled ETFs Follow UCITS Framework

Many Irish-domiciled ETFs follow the UCITS (Undertakings for the Collective Investment in Transferable Securities) framework, which is widely recognized and tax-efficient for international investors.

For example, UCITS ETFs come in two types, distributing ETFs which is similar to US ETFs where the dividend will be distributed to investors brokerage account according to the schedule, and Accumulating ETFs which automatically reinvest the dividends to the fund.

These are particularly helpful to avoid having cash uninvested, needing more time to manage your portfolio and incur additional transaction fees on dividend reinvest, and are often preferred by investors who seek for a simple, long term capital growth portfolio.

Aside from that UCITS funds are regulated under EU law, ensuring high investor protection standards, such as liquidity requirements and transparency.

Top Irish Domiciled ETFs You Should Know

In the following list of Irish domiciled ETFs, I will only focus on funds that have popular demand (exposure to S&P500, government bonds, worldwide exposure, etc), large asset under management for better liquidity and tighter spread, low total expense ratio (TER) and prefer accumulating ETFs with USD denomination (USD-hedged).

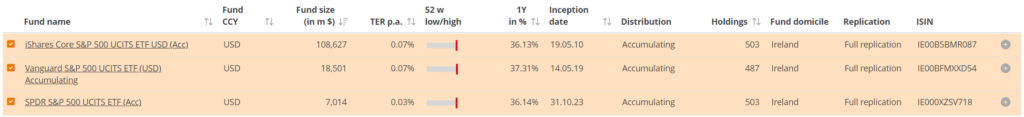

CSPX, VUAA, SPYL – S&P500 Index ETFs

For those who want to invest in S&P500 funds, both CSPX and VUAA is a popular share:

- CSPX = BlackRock iShares Core S&P 500 UCITS ETF USD (Accumulating)

- VUAA = Vanguard S&P 500 UCITS ETF USD (Accumulating)

- SPYL = SPDR S&P 500 UCITS ETF USD (Accumulating)

Both track the S&P500 index and have 0.07% total expense ratio, USD denominated and are accumulating ETF, however CSPX has larger asset undermanagement of $108 billion while VUAA is $18.5 billion, as of writing the spread are equally tight as well at 0.02%.

The SPYL from State Street is recently incepted it has the smallest AUM of $7 billion however due to its lower TER of 0.03% it has been growing fast and attracted many investors recently, and despite of it being smallest fund out of three, it also has a very tight spread of around 0.01%.

SPYL also has the smallest unit price of $14.57 as of writing, while VUAA at $113.76 and CSPX at $634.63, which some investor might find the smaller unit price easier to invest recurringly and have avoid cash stay uninvested.

Personally SPYL is what I would invest If I wanted to have exposure to S&P500 index fund and plan on holding it for long term, but if you already owned CSPX or VUAA then it’s fine too, switching it may incur even more transaction fees than TER saved.

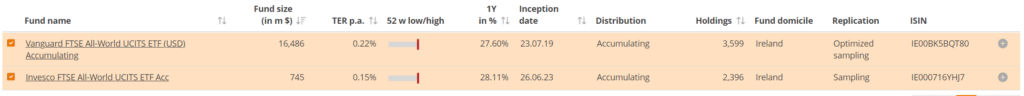

VWRA / FWRA – FTSE All-World Index ETFs

While some think US stock are globally diversified because nearly half of the revenue come from global market, for example Apple selling iPhone globally, etc. Some people prefer to have global diversification in company around the world instead of just by revenue, if you are one of them, then you may look into VWRA or FWRA.

Both of this fund aims to track the FTSE All-World index, however there is some difference in their approach and the total expense ratio, VWRA inception year is 2019 and has 3599 holdings compared to 2396 holdings from FWRA, which incepted at year 2023.

The difference in the holdings may explain by their priorities, Vanguard are known for its focus on minimizing tracking error and delivering near-perfect replication, while Invesco may aims to lower trading and operational costs by excluding low weighted stocks that contribute minimally to the index overall performance.

So the decision to choose between VWRA or FWRA depends on which approach is more align with you, if you prefer minimal tracking error then you can choose VWRA, if you prefer lower expense then you may consider FWRA.

What Does It Actually Mean by Global Diversification?

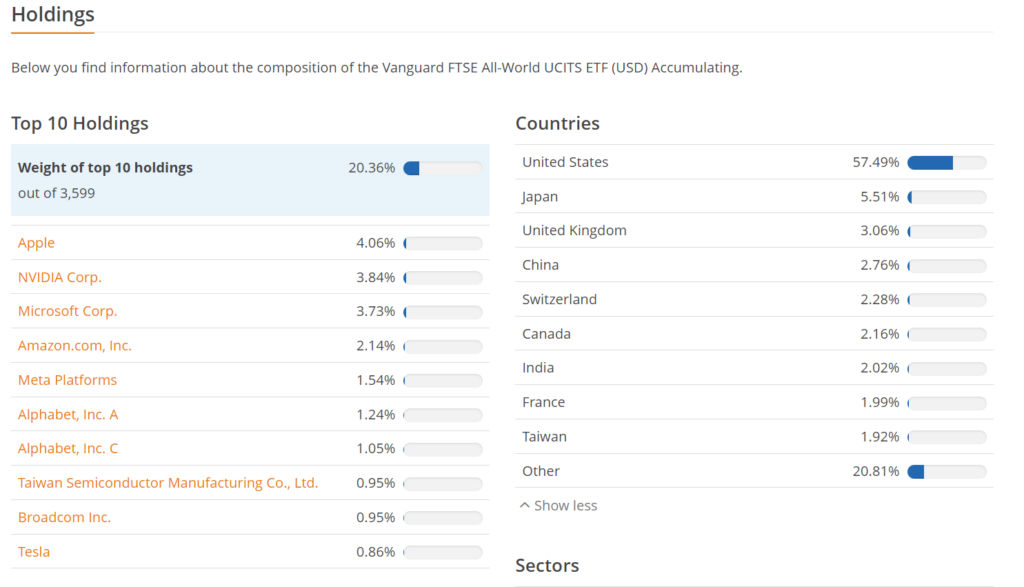

Before anyone jump into buying ETFs that track FTSE All-World index, I would like to explain a bit about what does global diversification means, and what you are actually invest into. First let’s look at the top holdings by VWRA:

As you can see roughly ~58% are still invested in US market, and for some it may be puzzling why is the holdings not proportional to the economy size of the countries?

FTSE All-World index covers large and mid cap stocks globally, does not include small caps, but still represent 90~95% of the investable market capitalization.

And the reason why US makes up a large portion of the index lies in market capitalization weighting and free-float adjustments:

- The US equity market (dominated by large corporations like Apple, Microsoft, etc.) is by far the largest in the world, accounting for a disproportionate share of global market value.

- Only shares that are freely available for trading (not closely held by insiders, governments, or other entities) are considered. The US has a higher free-float percentage compared to other countries, which is why it also have more weight in the index.

There is also Irish domiciled ETF that track FTSE Global All Cap Choice index — V3AA, which include small cap, however due to the relatively smaller AUM, higher TER and certain ESG criteria applied, which resulted in less popularity and less often recommended, but you can look into that if that is what you looking for.

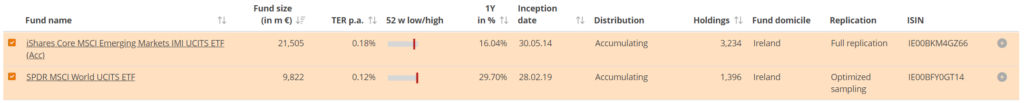

SWRD & EIMI – MSCI World & Emerging Market

SWRD are MSCI World index tracking Irish domiciled ETF by State Street, this index only include developed country, and has a total expense ratio of 0.12%.

EIMI are MSCI Emerging Markets index tracking Irish domiciled ETF by BlackRock iShares, which as the name suggest only includes emerging market, and has a total expense ratio of 0.18%.

Some investors prefer a combination of SWRD & EIMI over VWRA to achieve diversification globally for a several reasons:

- Cost efficiency: Both SWRD and EIMI has lower TER over VWRA, which means when weighted appropriately, they can achieve a lower cost than holding VWRA, and may slightly increase the return due to cost saved.

- More control over allocation: Some investor may prefer to increase or decrease the exposure to the emerging market based on their views.

- Small caps exposure in emerging market: As previously mentioned VWRA only include large and mid cap stocks, but EIMI includes small caps stock in emerging market.

The tradeoff is that you need to manage two ETFs instead of one, including periodic rebalancing. For many investors, the simplicity of VWRA outweighs these potential benefits.

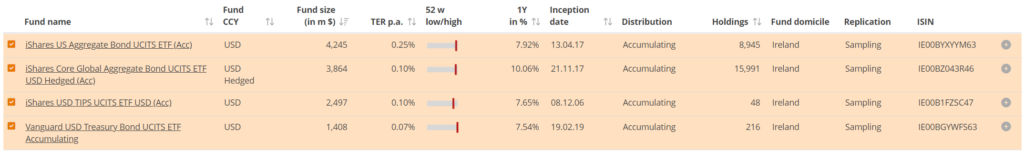

AGGU, IUAA, VDTA & IDTP – Bonds Index ETFs

Finally we will look at some of the popular bonds index ETFs, and see how they differs and when you should buy which, in the picture above we have:

- IUAA – iShares US Aggregate Bond UCITS ETF (Acc) – 0.25% TER

- Track the Bloomberg US Aggregate Bond Index

- Include only US investment grade bonds, such as treasuries, government issued bonds, corporate bonds and securitized products (or collateralized).

- Similar to the AGG/BND ETFs in US

- AGGU – iShares Core Global Aggregate Bond UCITS ETF (Acc) – 0.1% TER

- Track the Bloomberg Global Aggregate Bond Index

- Similar to IUAA but includes global investment grade bonds, including both developed and emerging countries.

- Preferred by investors that want global diversification in their portfolio

- IDTP – iShares USD TIPS UCITS ETF USD (Acc) – 0.1% TER

- This ETF seeks to track the performance of an index composed of US inflation-linked government bonds, commonly known as Treasury Inflation-Protected Securities (TIPS)

- These treasuries principal will be adjusted based on inflation (CPI) and have lower initial yield, but can provide more protection on inflation.

- It is preferred by investors that want protection over inflation or expect the future inflation will be higher.

- VDTA – Vanguard USD Treasury Bond UCITS ETF (Acc) – 0.07% TER

- Its portfolio primarily consists of US Treasury Notes with varying maturities and interest rates

- Has lowest risks but are not inflation protected like IDTP

There is also other categories of Irish domiciled US bonds ETF such as IB01 which invest in short term treasury yield with 0-1 year maturity, it was very popular when the yield curve is inverted, (short term treasury has higher yield than long term bonds), and it still has ~$13 billion AUM now, but yield curve has been un-inverted and these may become less appealing so I excluded in above list.

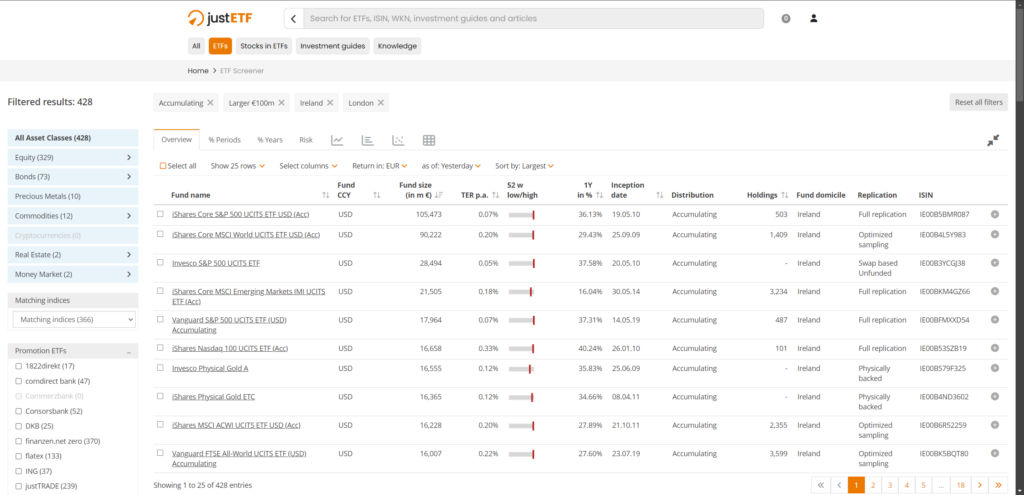

Use ETF Screener From justETF to Find Other

Now if you want to explore even more ETFs to construct your portfolio, I recommend using the ETF Screener from justETF website, which has tons of filters that you can apply.

For starting I would make sure the fund size is larger than $100 million, domiciled in Ireland, listed on London Stock Exchange and is accumulating ETFs, then you can try different filters, for example you can find specific ETF that track certain indices, or ETFs that invest in different assets.

Constructing Portfolio With Irish Domiciled ETFs

There is thousands of way people construct their portfolio, while I’m not going into details on different ways and ideology behind each type of portfolio, I’d like to say that it is best to keep it simple stupid if you aren’t an expert with applied financial degree.

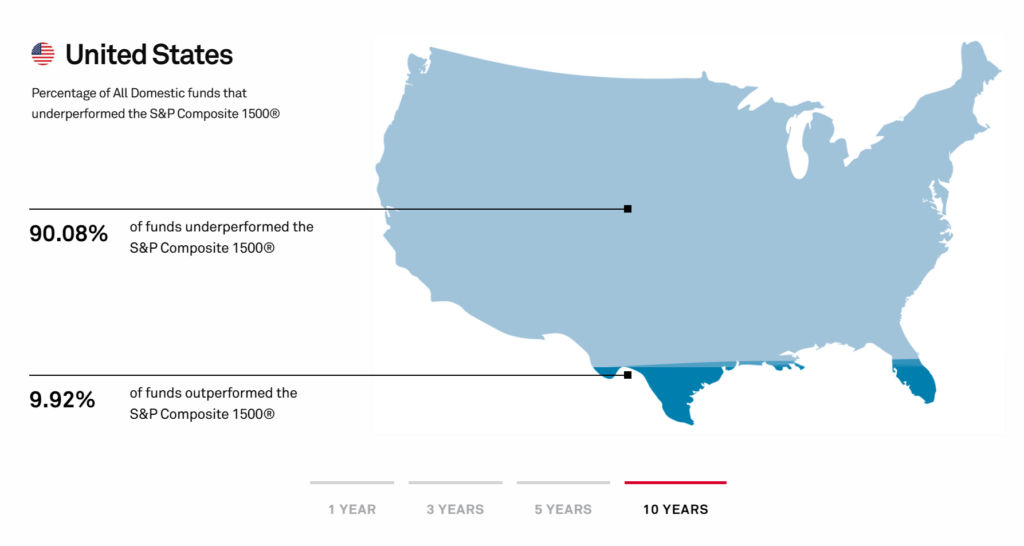

A simple 2-fund portfolio with low cost and diversified index ETFs that track the market return won’t help you the beat the market, but it often outperforms 90% of the actively managed funds in long run.

I am talking about active funds managed by groups of intelligent finance expert with doctorate degree from Ivy league schools, and if they can’t beat the market, chance are you probably won’t be able to find an active managed ETF that help you to do so.

(And certainly not the “too goo to be true investment company” that someone spam to you on WhatsApp, yes these are 99.99% waste of time and money, if they can beat the market consistently, your money is the last place they will try to fundraise from.)

Now you ask, what about that 9.92% funds that outperform the market? This is where I urge you to read into the SPIVA report if you are curious, but the short answer is:

- Survivorship Biases: Many unprofitable funds that unable to attract investors are closed down or merged with other funds, which inflated the % of funds that outperform

- They may got lucky in one decade, but chance are many of them will underperform in the next decade, because it’s basically too little timeframe to be able to statistically confirm these fund aren’t just lucky.

- The fund managers that work for the funds doesn’t work there forever, this mean even if the fund managers that outperform the market for last 10 years, may not be working on the same fund.

The reason I am telling you these is not to deny that there are in fact some investors are actually able to find alpha in the market, but it is that the chance is so slim and if you aren’t plan on devoting a lot of time to study and take more risk (both opportunity and monetary), then getting market return is good enough for most people.

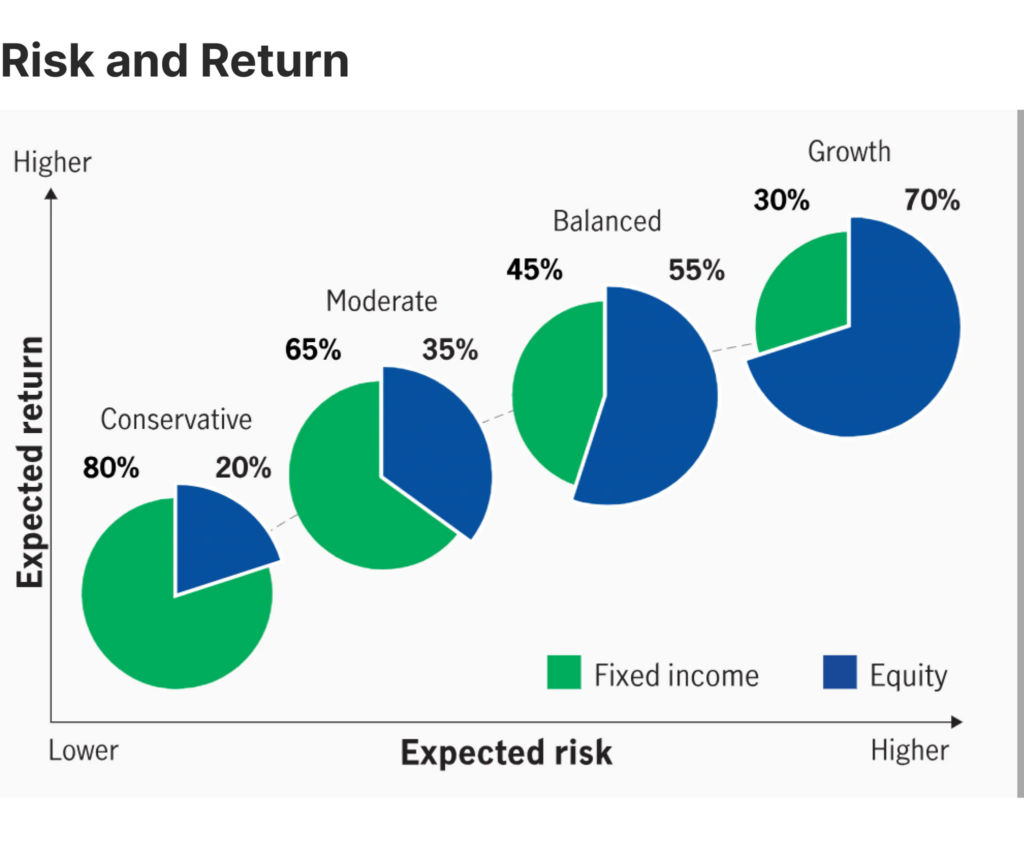

So, how do you construct a simple 2-fund portfolio with just bonds ETF and index ETF? Most fund management company gave answers based on their Target Retirement Funds, but in general rule of thumb is:

Stock allocation % = 130 - Your ageYou can obvious go with lower number such as 120 minus your age if you are more risk averse.

Based on that if I am in 40 years old, I would have a portfolio of 90% SPYL and 10% IUAA, or if I wanted global diversification, it will be 90% VWRA/FWRA and 10% AGGU.

Closing Thoughts

I hope this post give you some ideas on constructing your own portfolio with the tax advantageous Irish domiciled ETFs, however keep in mind this is not the only way to create a portfolio, in fact this portfolio only have stocks and bonds as asset classes.

Some investors may also want to include exposure to other asset classes such as precious metal, real estate or other commodity based on their personal experience and knowledge.

Anyway if you have any questions or believe I should include certain ETFs please let me know!

Truly appreciate your effort to point investors (especially new ones) to the correct direction. In particularly the tax part which many investors tend to ignore and find out subsequently. The “Accumulation” is also very important for investors to know too. I wish I found your article earlier to avoid me spending so much time to do my own research. In short, thank you very much and I hope your article can reach out more investors.

Glad it helped!