Table of Contents

Planning a holiday abroad and aiming to save some money? No problem! In this post, we’ll discuss the best credit cards and debit cards that offer excellent benefits for overseas travel.

Deciding The Right Card with Cash Value

If you’ve read my previous post about the best air miles credit cards in Malaysia, you’ll know that the key to finding the best cards always begins with determining the cash value of any type of return.

For instance, cashback cards are the simplest. The cash value is typically fixed, allowing us to determine the return on spend (ROI) immediately.

For air miles credit cards, the cash value of each air mile varies for each person. You’d need to calculate how much you save each time you spend your air miles for flight tickets. However, for simplicity’s sake, we typically assign a cash value of around RM0.04 per air mile.

With that, we can calculate the return on spend for an air miles card. For instance, an air miles credit card with 0.8 MPR (miles per ringgit) means the return on spend would be 0.8 * 0.04 = 0.032, which equals 3.2%.

Other Fees for Spending in Foreign Currency

Currency conversion fees imposed by banks are often overlooked by most people. A credit card offering 1% cashback on spending might seem appealing, but if it carries a 1.5% fee, the actual return on spend could be negative. In such cases, a debit card with 0% fees and no benefits would still be preferable to one with a negative value.

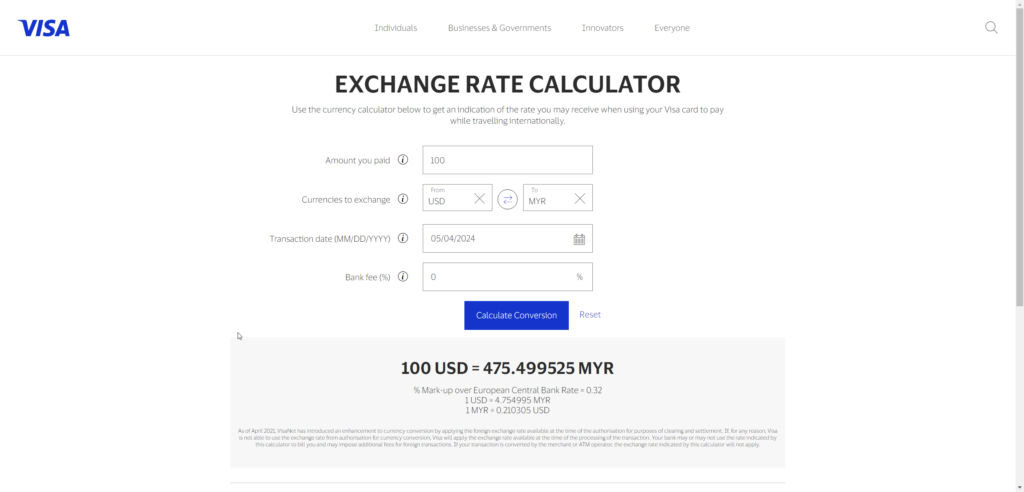

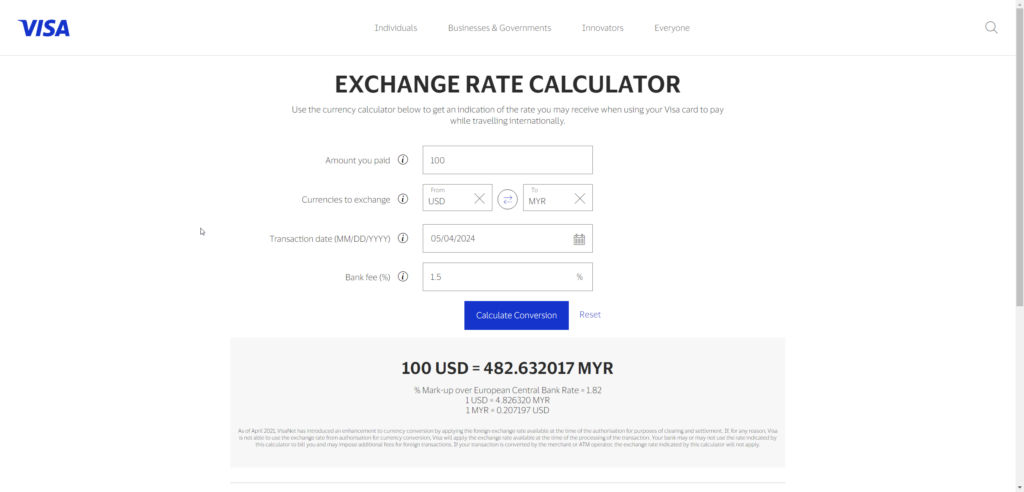

If you’re unsure about the fees charged by your bank and can’t easily find them on their website, one simple way to find out is to reverse the calculation using the Visa exchange rate calculator.

From the above screenshots, we can discern that even if the credit card with a 1.5% fee offers 1% cashback, the actual charge for spending $100 USD is still RM477.8 higher than the card with 0% fees.

The exchange rate shown on the Visa website typically includes their payment settlement network charges. As a result, it tends to be slightly higher than the forex market price.

You can also check the exchange rates from Mastercard and UnionPay:

- https://www.mastercard.com/content/mastercardcom/global/en/personal/get-support/convert-currency.html

- https://m.unionpayintl.com/cn/rate/

Best Credit Card for Overseas Travel

Here, we will define the best cards for different use cases. One scenario is for regular swiping, tap, or wave payments. Another is for cash withdrawals via ATM machines. This is particularly important because credit cards may not be accepted everywhere, and if we run out of cash, we might need to withdraw local currency from an ATM machine.

Credit card for spending

| Card | MPR | Conversion fees | Effective Return on spend (ROI%) (higher better) | Annual Fees | Minimum Annual Salary to Apply |

| UOB PRVI Miles Elite | 1.11 | 1% | 3.44% | RM600 | RM100,000 |

| UOB Visa Infinite | 0.889 | 1% | 2.55% | RM600 | RM120,000 |

| CIMB Travel World Elite | 0.8 | 0% | 3.2% | RM1,215, waive if rm240k spent | RM250,000 |

| Alliance Bank Visa Infinite | 0.5 | 1% | 1% | RM438, waived if RM12k spent | RM60,000 |

| CIMB Travel Platinum | 0.4 | 1% | 0.6% | Free for life | RM24,000 |

| UOB PRVI Miles | 0.33 | 1% | 0.33% | RM198 | RM60,000 |

| GXBank Debit Card | n/a | 0% | 0% | n/a | n/a |

| TNG Visa Card | n/a | 0% | 0% | n/a | n/a |

| Standard Chartered JumpStart | n/a | 0% | 0% | n/a | n/a |

Rather than simply stating which card is the best to use, I’ve included most of the popular travel credit cards and even debit cards in the table above. This way, you can get a better idea of how they compare to each other and make an informed decision based on your specific needs and preferences.

Unfortunately, in my opinion, there aren’t many good travel credit cards that effectively help you save money on overseas spending. Those with higher ROI typically tend to be air miles credit cards, as usual. However, they also come with higher requirements and annual fees.

For instance, the UOB PRVI Miles Elite card requires an annual income of RM100,000 to apply. Even if you meet the requirement, the air miles you earn from the first RM17,441 spending are just enough to cancel out the RM600 annual fee. Additionally, the value of those air miles isn’t realized until you redeem them for a flight ticket, which means they lose “time money value” by remaining unspent.

With that being said, if you’re frequently flying abroad and spend significantly more than that every year, then the UOB PRVI Miles Elite card could indeed be the best credit card for you in this category.

If you only travel a few times a year and spend less than that threshold, you may be better off with a credit card that offers a lower ROI but has no annual fees. This way, you don’t have to worry about underspending and not fully utilizing the benefits of a higher-tier card.

*GXbank 1% rebate doesn’t seems to be apply for transaction in foreign currency as per my own testing for online purchases, in their terms clause 3.3 also mentioned foreign currency is excluded, although some people mentioned it does have rebate (no proof to be verified.)

Credit Card for Overseas ATM Cash Withdrawal

| Card | Foreign Currency Withdrawal Fees | Note |

| GXBank Debit Card | 1.2% | Waived until 31 Dec 2024 |

| TNG Visa Card | RM10 | |

| Standard Chartered JumpStart Savings Account-i Debit Card | 0% |

For ATM cash withdrawals in foreign currency, most credit cards have hefty fees. That’s why in this section, you’ll only find debit cards. Keep in mind that the fees here do not include exchange network fees imposed by Plus (Visa), Cirrus (Mastercard), or other networks.

Your Favorite Cards Not Mentioned?

I strive to keep this post updated regularly, but it’s possible that I may miss something or overlook changes. If you notice any discrepancies or updates that I’ve missed, please leave a comment, and I’ll promptly look into it! Your feedback is valuable in ensuring the accuracy and relevance of the information provided.