Table of Contents

What Is The Cash Value of Airmiles?

Air miles credit cards are often considered the pinnacle of credit card strategies, offering significantly greater savings potential compared to cashback cards or other credit card types.

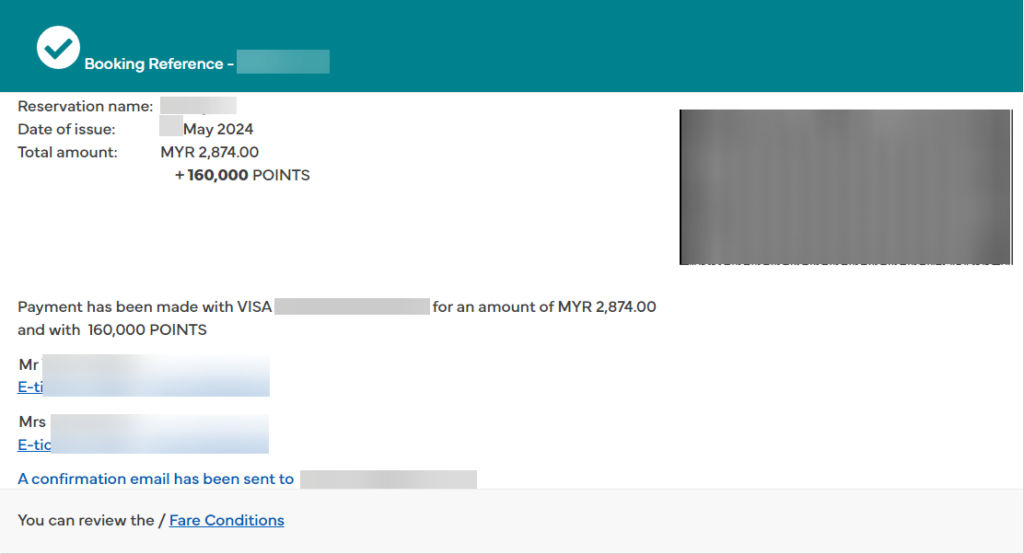

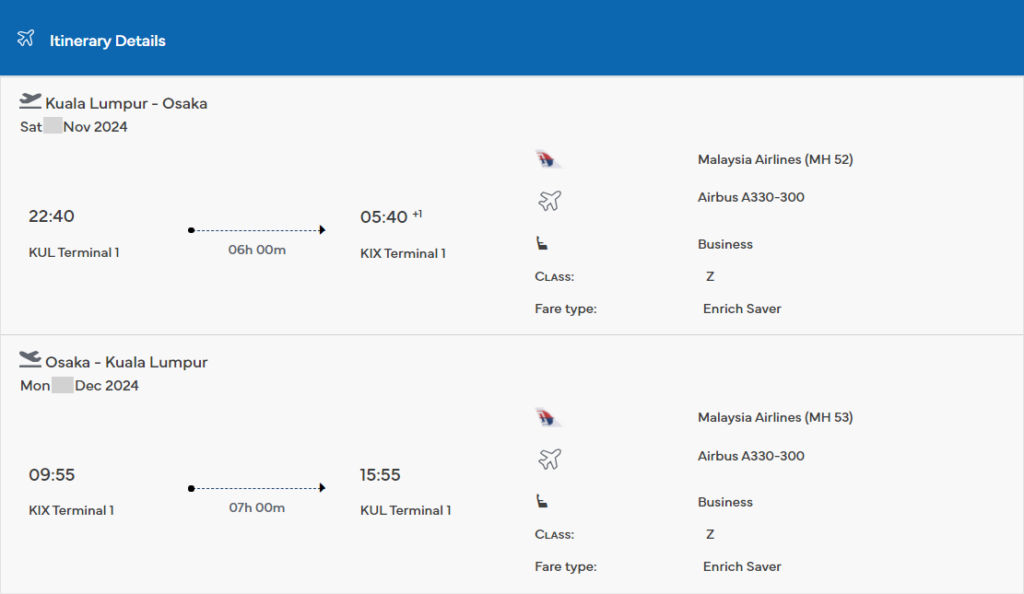

For instance, I recently booked another business class flight to Japan for the upcoming autumn season with my spouse. The total cost amounted to RM 2,874, along with redeeming 160,000 Enrich points for two round-trip flight tickets.

To calculate the return of ringgit spent (ROI) on this booking, we’ll start by determining the average cost of booking a business class flight ticket to Japan without using air miles. Then, we’ll conduct a reverse calculation to find out your ROI.

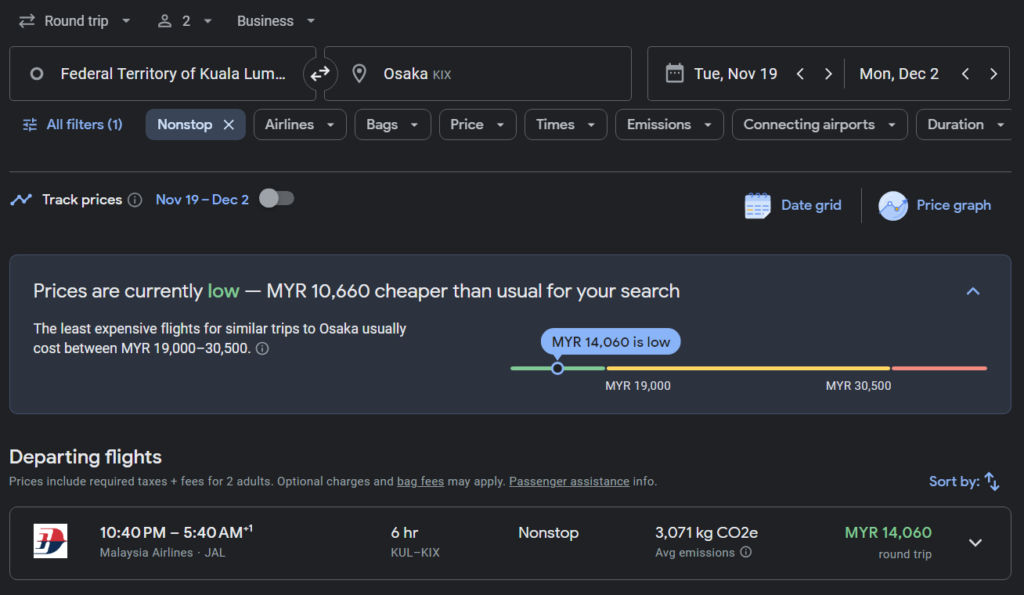

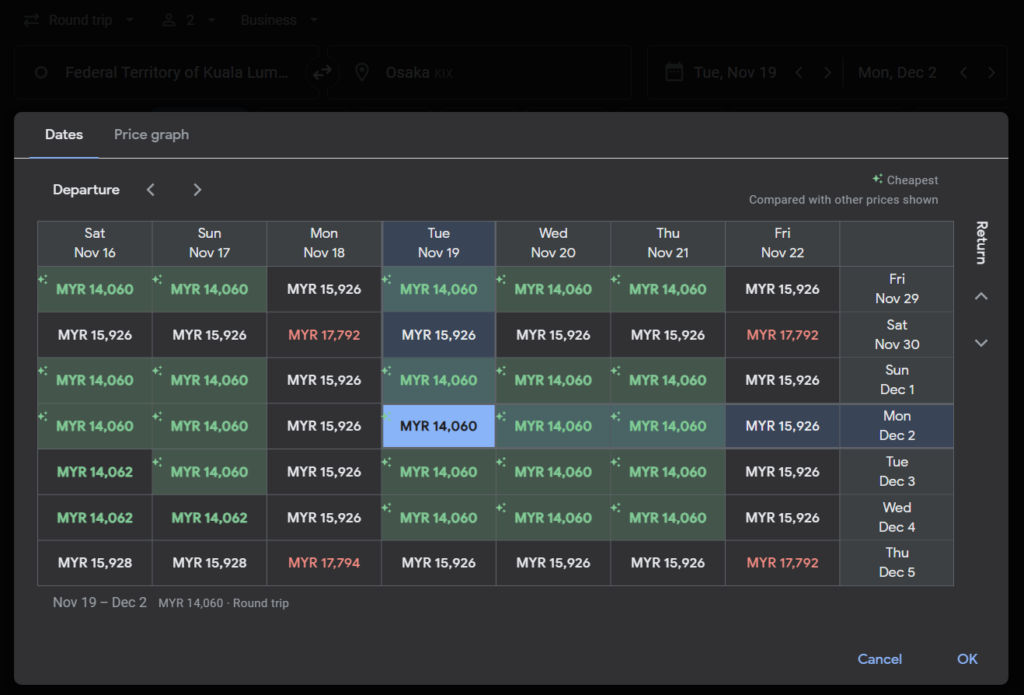

First, let’s utilize Google Flights to gauge the typical cost for this flight. We’ll ensure we’re not selecting the most expensive date to avoid skewing the calculations.

From the above screenshots, it’s evident that our flight fares are lower than usual, which is advantageous and ensures a more conservative approach for our calculation. Opting for a less expensive date guards against bias toward the benefits of air miles credit cards, as it means our air miles are worth their typical value rather than inflated due to higher-than-average flight costs.

Let’s proceed with the calculation. We’ll determine the value of each air mile by subtracting the cash paid from the regular ticket price, then dividing the result by the number of air miles redeemed.

(RM14,060 - RM2,874) / 160,000 = 0.0699125Based on our calculation, the value per Enrich mile is approximately RM0.07. These miles are predominantly accumulated through the Alliance Bank Visa Infinite card, which provides approximately 0.8 air miles for every RM1 spent.

To calculate the return on spend (ROI) of this air miles credit card, we first determine the cash value of 0.8 air miles by multiplying (0.8 * RM0.07), resulting in RM0.056 for every RM1 spent. This equates to a 5.6% return on ringgit spend (ROI).

Isn’t that an incredibly impressive return on ringgit spent (ROI)?

Additionally, it’s worth noting that a significant portion of my air miles were redeemed during promotional periods with a 20% bonus offered by Malaysia Airlines on occasion. This bonus further enhances the overall value proposition of utilizing air miles credit cards.

Best Airmiles Credit Card in Malaysia

Before determining the best air miles credit card for our needs, there are several crucial factors to consider. Primarily, we should evaluate the miles per ringgit spent (MPR) to gauge the card’s earning potential. Additionally, it’s essential to understand which types of spending qualify for the best MPR to maximize rewards. Lastly, we need to examine the card’s annual costs to assess its overall value proposition.

| Card | MPR (higher better) | Qualified Spending | Annual Fees | Minimum Annual Salary to Apply |

| UOB PRVI Miles Elite | 1.11 | For Overseas spending | RM600 | RM100,000 |

| Maybank Amex Platinum Charge Card | 0.71 | Everything except utilities, education and insurance. | RM3250 | RM190,000 |

| UOB Visa Infinite | 0.56 | For Dining Only | RM600, waived if RM50k spent | RM120,000 |

| Alliance Bank Visa Infinite | 0.53 | All kind of online spending (MYR, Uncapped) & e-wallet charge(Limited to RM3,000/month) | RM438, waived if RM12k spent | RM60,000 |

| Alliance Bank Visa Infinite | 0.33 | Groceries, Overseas Transaction, Dining | ~ | ~ |

| Alliance Bank Visa Virtual | 0.53 | All kind of online spending (MYR, Uncapped) & e-wallet charge(Limited to RM3,000/month) | Free for life | RM24,000 |

| Alliance Bank Visa Platinum | 0.53 | All kind of online spending (MYR, Uncapped) & e-wallet charge(Limited to RM3,000/month) | RM120, waived if swiped x12 | RM24,000 |

| UOB PRVI Miles Elite | 1.11 | For Overseas spending | RM600 | RM100,000 |

**Credit cards with tons of rules and capping or running promo for only limited time are not recommended here as well. (EG: UOB World Card)

Maximizing The Return from Airmiles Credit Card

Now that we’ve explored the value of air miles and identified the top credit cards in Malaysia for accumulating them, did you know there are additional ways to maximize the return of your air miles credit card?

Essentially, maximizing the return of your air miles credit card involves paying close attention to ongoing promotion campaigns from both your credit card bank and the airlines from which you want to earn air miles.

Here’s an example of how you can capitalize on flight booking promotions with Enrich miles on Malaysia Airlines: during the promotion period, you can enjoy a 20% discount on air miles when booking a flight. By leveraging this promotion, we were able to book our flight to Japan and maximize our savings.

Another example of maximizing your air miles is through past promotion campaigns by Malaysia Airlines. For instance, they offered a promotion where you could receive a bonus of 10-20% Enrich miles by converting your credit card points into air miles during the promotional period. This is another opportunity to boost your air miles balance and increase your redemption options.

Here’s a quick calculation: by taking advantage of both promotions, you’re effectively getting up to 50% more value in terms of miles per ringgit spent.

[100% * 120% (Points Conversion Promo)] / 80% (Booking Discount Promo) = 150%If you’re a frequent flyer with Malaysia Airlines, keep an eye out for their promotions in your email inbox or on their website: https://enrich.malaysiaairlines.com/enrich/promotions.html

What About Other Credit Cards? Missing Info?

I try my best to keep this post up to date but as a human I may still missed out on some credit cards, or maybe revision from some banks affecting certain cards miles per ringgit, but don’t worry, if you think I missed out on some card should be listed here, or information that are outdated, just leave a comment and I’ll look into it!

why is maybank amex no longer recommended? many told me its the best card for airmiles

If you are talking about the 2 cards premier, Maybank revised the redemption rate to 10,000 TreatPoints to Airmiles effective from 22th May 2024, and they revised the treatpoints earned per ringgit spent to 2X last year. Plus Maybank also added a 100 million airmiles redemption cap from May 2024, which the 100mil airmiles quota are depleted just few hours in the first month they implement this, I wouldn’t want my a credit card that reject my redemption request because they “ran out of budget”

This means the Maybank 2 Cards Premier Amex MPR is only 0.2 now, not to mentioned there’s already very few merchant that accept Amex locally.

Can you advise in comparison to HSBC Travel One card or Singapore Airlines Amex Maybank card?

If you are comparing these 2 cards for purpose of accumulating Krisflyer miles, then the HSBC Travel One only give 0.2 miles per ringgit spent in local, 0.32 per ringgit spent overseas. The Maybank Singapore Airlines Amex give 0.4 miles per ringgit spent local, 0.5 miles per ringgit spent overseas

Hi can you share further on HSBC Visa Signature. Is this card good for air miles?

Hihi Joseph! Which credit card will be great if we want to target air miles redemption. If we spend heavily locally and only travel occasionally (coz uob elite only has higher mpr when transacted oversea) . I also realized Maybank 2 cards have lost its position.

What’s your take on the Standard Chartered Journey and Priority Banking Visa Infinite if most if not all of my spending is local?

Thanks for this post – one of the most updated that i found thus far.

Have you checked/compared Maybank Krisflyer Platinum card?

It seems UOB Zenith card has a better MPR for both local and overseas spend?

may I know why CIMB world elite is not recommended? is the redemption limited like maybank cc?

They revised the points award on local spending as well as imposed capping on various category, which makes it harder to simply recommend for anyone especially consider the annual fees, it would only make sense if your spending can fit right into each capping for maximize ROI, you can take a look at their updated clause here:

https://www.cimb.com.my/content/dam/cimb/personal/documents/important-notices/important-notice-amendments-to-member-rewards-tnc-jan-2024.pdf

How about the HSBC Visa Signature Credit Card? with the points per ringgit spend, it seems better.

21,000 points for 1000 Enrich miles, 25,000 points for 1000 Krisflyer/Asiamiles, 12,000 points for 1000 Airasia. Assume 0.04 per Enrich miles, we can do below calculations.

8 points for every RM1 spent in foreign currency:

(8/21000)*1000 = 0.3809 Enrich miles ≈ 1.52% Rebate

and 5 points for every RM1 spent local:

(5/21000)*1000 = 0.238 Enrich miles ≈ 0.95% Rebate

This card seems to be good if spending mostly on local physical spending, especially after GXBank reduce local spent rebate to 0.1%, for overseas I think there’s better option, for example TNG Visa has 2% cash rebate until end of 2024.

*By the way keep in mind both TNG Visa and HSBC Visa Signature has 1% on foreign currency conversion fees

Source:

HSBC Rewards Catalogue

How about PB World Mastercard? Any good?

On their redemption page it requires 8,500 points for 1000 Enrich miles or 2000 Airasia miles (only these 2), and you get 3 points per RM1 spent overseas. Let’s assume each miles is 0.04MYR, Here’s the calculation:

(3/8500)*1000 = 0.3529 Miles per RM1 spent overseas ≈ 1.41% Rebate

(1/8500)*1000 = 0.1176 Miles per RM1 spent locally ≈ 0.47% Rebate

Not entirely bad but depends if you have cards with better miles per ringgit spent, because for example, the TNG Visa now gives 2% rebate for oversea spent until 31 Dec 2024, which is 41% higher than this card.

Source:

PB Redemption Catalog