Table of Contents

What Is Balance Transfer

Balance transfer is a services often come with your credit cards, and as the name suggest, it’s a service that transfer the outstanding balance from one credit card to the other.

In most cases the balance will be converted into monthly installment.

Many credit card holders overlook the balance transfer services their cards offer, assuming they’re only for those struggling to pay their monthly statements.

However, the strategy I am about to share in this post is way beyond that, and when it’s use correctly this can greatly accelerate your financial growth.

The 0% Balance Transfer Campaign from Banks

This is the main criteria we needed for our balance transfer strategy to work, and let me tell you this, banks often have this kind of campaign from time to time, you just need to be aware and pay attention to them.

0% interest on balance transfer literally means the bank are giving you a no interest loan, this mean whatever amount that you was about to pay to your credit card statement can be use to invest into something else, earn an interest on that, then pay back with the principal.

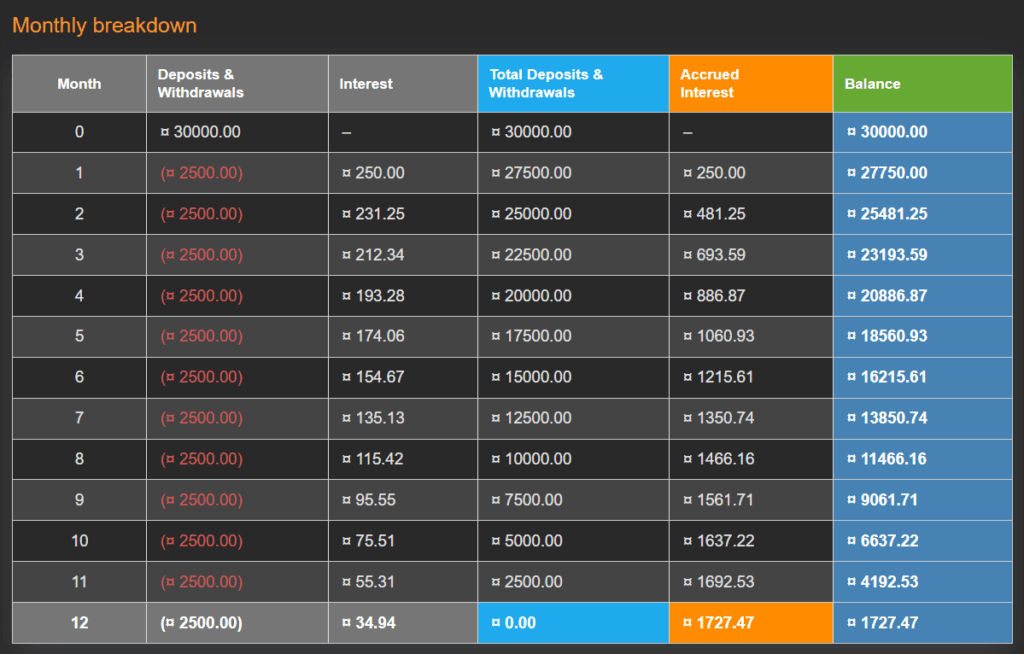

Here’s an illustration on how that works, assume you are due RM30,000 on a credit card statement, but you took advantage of the 0% balance transfer, so now you are required to pay RM2,500 installment for 12 months, and you put that RM30,000 into investment, and withdraw from it monthly.

By the end of paying the last installment you would end up with RM1,727 assuming an annual profit rate of 10%, this is the profit you wouldn’t have if you paid the RM30,000 without balance transfer!

Before You Jump Into Conclusion

Whenever I share this strategy, people often jump to conclusions and raise objections like, ‘What if the investment fails?’ or ‘It’s not worth the effort.’ For those who can spend RM30k, the potential profit might seem small.

When they shutdown the discussion like that it’s hard for me to continue share with them the following strategy, but for anyone who are interest to learn more, read along.

The Strategy: Chaining Balance Transfer Indefinitely

Now here is the really exciting part, what if we chain all the balance transfer campaign together?

You see based on the previous example we were supposed to withdraw RM2,500 to pay the installment of balance transfer we applied in previous month, but what if you pay that RM2,500 with another balance transfer? And keep doing that for the following months?

It’s simple, you wouldn’t need to withdraw any of the RM2,500, and instead those money continue to stay in whatever investment vehicle you chose and continue to earn profit or interest.

Rolling That Interest Free Loan

When you have credit card from multiple banks and apply this strategy for long enough, eventually you will be saturating up to 60~80% of all your available limits.

To fully utilize the interest free loan with this strategy is simple, you just put all your regular living expenses onto the card as much as possible, as you roll the loan by continuously taking up 0% interest balance transfer campaign, your credit limit will eventually saturated.

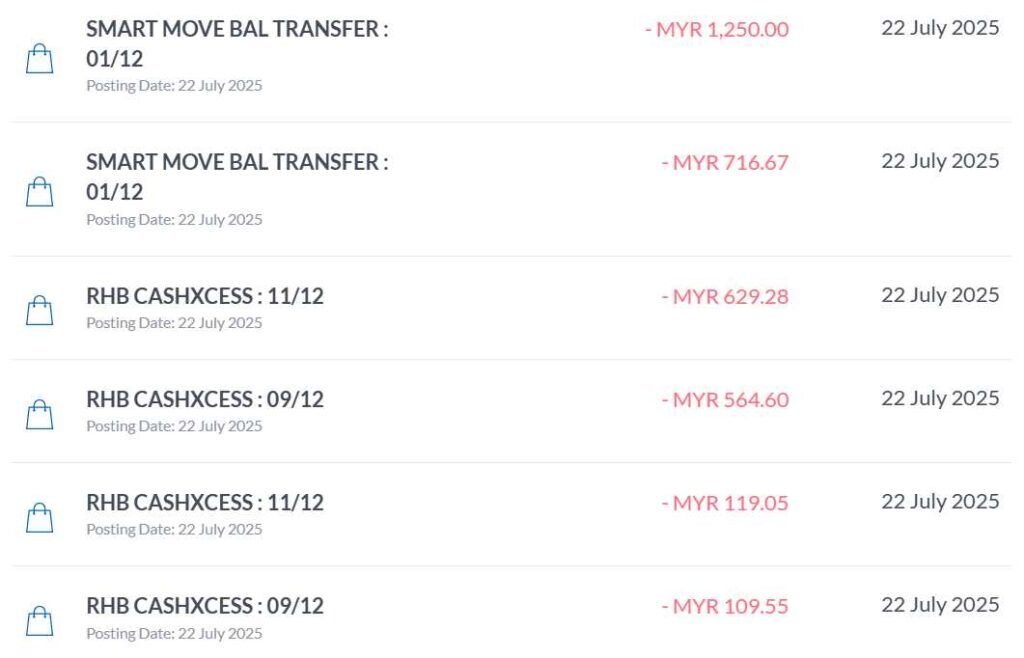

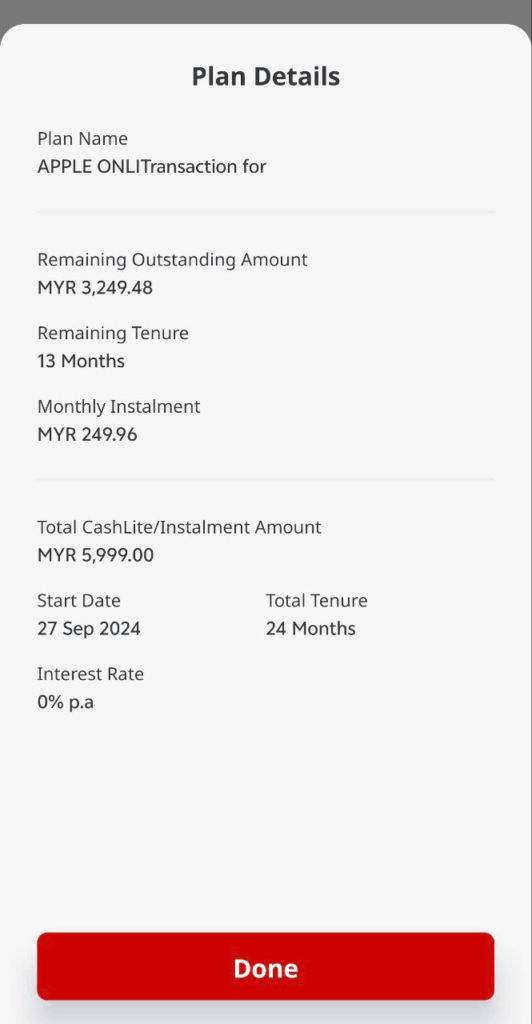

This is how my statement looks like with those balance transfer items:

Other 0% Interest Loan from Cards

Now for those with sharp eye should see that the items on my Alliance Bank Visa Virtual is not balance transfer, some items on my RHB is not balance transfer too!

That’s right but they are essentially the same thing, it just extend the way you are able to “put your regular living expenses” to your credit card, let me explain.

The Alliance Visa Virtual let me convert any transaction above RM500 into 0% interest installment, that means the card itself would already allowed me to utilize up to 100% of whatever credit limit Alliance Bank gave me.

The RHB CashXcess was applied during their 0% campaign period, which let’s me cash out my credit card limit directly to my bank account, so that I can cover expenses that are not even payable by credit card.

Sometimes some card will run 0% EPP/FPP/IPP or whatever to let you convert transaction above certain amount into 0% installment too.

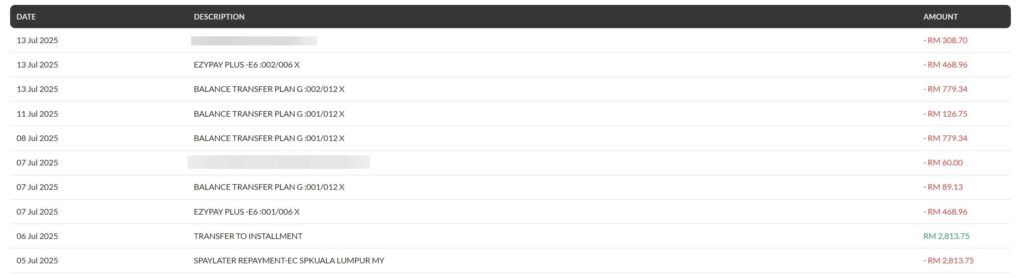

For example this was from CIMB last year campaign, forgot the exact name, FPP or EPP, which let me reply to SMS to convert transaction to 0% installment.

All of these are essentially the same thing, a 0% interest loan from bank based on your credit card limit, and whenever your monthly statement arrive, just pay that statement with another balance transfer campaign.

Keeping Track of All The Balance Transfer

One question I get asked often when sharing this strategy is, how the hell I am supposed to keep track of all these balance transfer?

The short answer is: You’ don’t.

You’ll check your credit card statement on the first of the month as usual. The only difference is that instead of paying the statement with cash, you’ll apply for a balance transfer to pay it off. It’s that simple.

What if that month there is no balance transfer campaign ongoing from all the banks you have credit cards with? Well then pay it with cash or withdraw from your investment, that’s it.

The Advantage of The Balance Transfer Strategy

Now let’s talk about why I say when this strategy is used correctly, you could accelerate your financial growth, especially if you are in 20s or early 30s with average salary income, let me illustrate with simple math.

Banks often give credit card limit of 25~50% of your annual income, this mean when you have credit cards from multiple banks, your combined credit limit could easily go up to 100~200% of your gross annual income.

Personally I have credit cards from 6 banks, and my combined limits of all that is roughly 200% of my gross annual income.

Now if I just utilize 50% of that it means I took a interest free loan 100% of gross annual income, and those are invested and earning me interest every year.

How long does it take an average person to save up an income equal to his gross annual income?

Assuming if you save 30% of your income after tax, and assumed an average income tax at 15%, that means you can save 25.5% per year.

That means it will take you 4 years to invest that same amount I got from my credit card 0% interest free loan, and you are considered saving at a rate above Malaysia average.

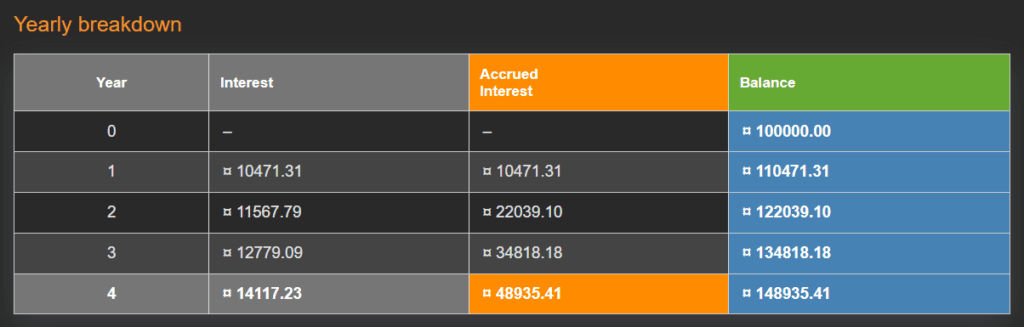

Now let’s compare the difference of them, assuming an annual income of RM100k, invested into an index ETF with 10% per year.

Both invested RM100,000 in cumulative, but the guy utilize the balance transfer strategy to “invest first, pay back later” ended up with RM149k instead of RM122k, the difference is significant!

Hey but hold up, but like I said the strategy was not about paying back later, but to chain the balance transfer indefinitely, in other words, there is no reason for the first guy to pay that RM100k outstanding if he can continue to get 0% interest loan!

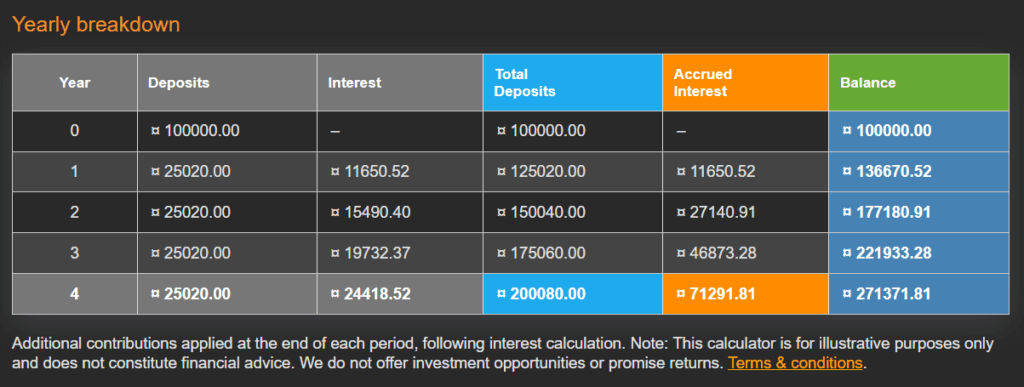

This mean the first guy shall be able to also invest 30% of his net income while utilizing the strategy, and this is what will happen:

The first guy would end up with RM271k in his investment account, and if he decides to pay off the RM100k outstanding balance, he would end up with RM171k.

The Difference Is Even Mind Blowing in Long Term

I couldn’t resist but I want to show you how the benefits from that early 4 years of “front running” would turn into huge advantage for the first guy over the regular guy in longer term.

Assuming both of them maintain the same salary for next 10 years for simple calculation. However keep in mind it doesn’t matter much, or might even be beneficial to the guy utilizing the strategy as he can request to increase his credit limit.

In 10 years, the first guy would end up with RM698k in his account, means RM598k after deducting the outstanding, 40% more than the second guy at RM427k.

In 20 years, the first guy would end up with RM2.216 million compared to the second guy with RM1.58mil, the difference maintain at 40% because the RM100k has turn into relatively smaller amount to the net balance.

Wait, But Investment Is Not Guaranteed?

That’s right investment is not guaranteed and won’t happen as our linear calculation, but that actually make it more favorable to the first guy, not the second guy.

If anything we learn from basic finance is that the time in the market is more important than to time the market, this is because by being in the market for longer time, we reduce the sequence to return risk.

The longer time in market allows the first person to average out his investment, with a more likely chance to achieve a compounded annual growth rate at 10% then the second guy.

What To Invest with Interest Free Capital?

Now if you read my previous section correctly, you should understand the idea is to have the ability to be able to invest first with future income savings, with the options to pay off the loan at any time later.

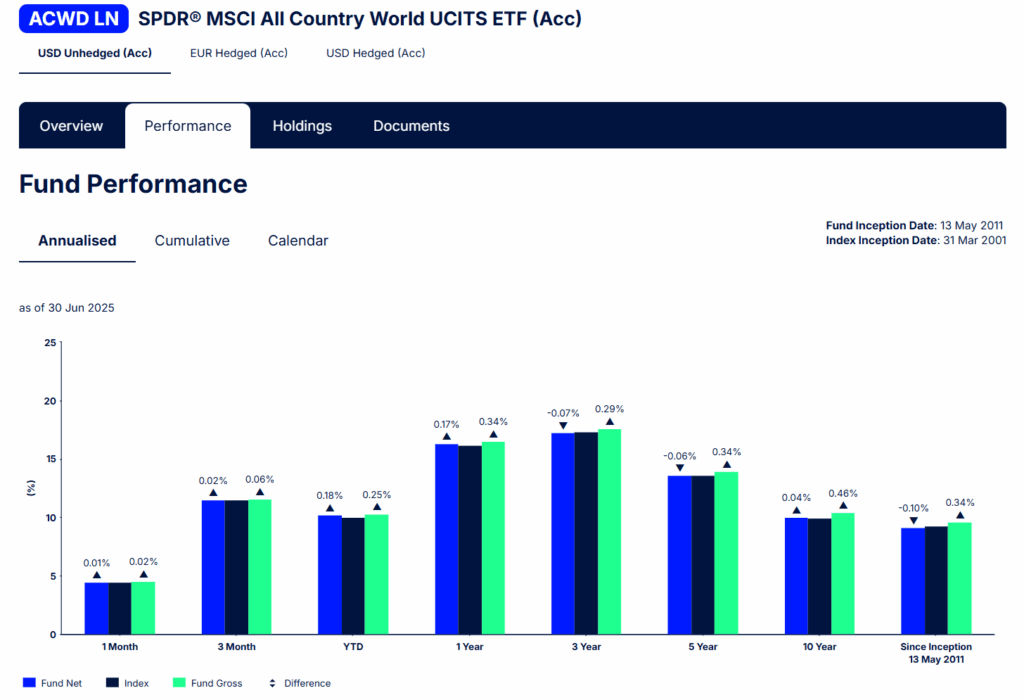

For most people this mean you should just invest as regular, if you already figured out your life long investment strategy is to DCA into a low cost globally diversified index ETF like FWRA or ACWD? Then just invest in those.

You shouldn’t be taking more risk than you would normally do with the interest free capital, and you also wouldn’t need to take a lower risk too, but with one caveat.

The only reason you would invest into something with lower risk and return like a mix of bond funds and index funds, money market funds, or even EPF self contribution, is that you aren’t sure about your future income or job security.

That is if you have a non consistent job like a sales, or jobs that are easily influence by market spending appetite, or simply have no confidence in securing your job, which mean during months without balance transfer campaign offers, you will be forced to sell your investment, and you want to make sure those maintain in value.

This purpose of this post is to share a strategy that I am personally exercising, I do not understand nor have the obligations to understand your financial situation and job security, these are all up to you.

If you are not confidence or risk averse but still wanted to implement this strategy? Then maybe considering low risk option like bond funds, money market funds or just fixed deposit.

While these seems to be less exciting in terms of return, keep in mind you still make free money that you wouldn’t originally have make.

When to Avoid This Balance Transfer Strategy

Now that you have understand the strategy, but I want to share some heads up on when you should not be doing this strategy, or at least not utilize your entire credit limit.

Insecure Job & Future Income

I’ve mentioned about this, but I’d like to repeat again, if you have insecure job or future income, maybe your priority should be to secure them first, and even if you truly want to do this, you should opt for low risk investment like fixed deposit.

There is no guaranteed 0% interest balance transfer campaign will always be available, you should always make sure to have the ability to pay back those installments in those times.

You Plan To Apply Loan / Credit Cards in Short Term

If you plan to apply for anything in the short term, the high credit utilization may be consider as a negative factor for some banks, especially if you do not have long credit history.

That doesn’t mean you have to give up the strategy entirely, and wait until you have applied those loan or credit cards, but you should maybe consider utilizing a smaller percentage of your available credit limits to this strategy.

You Cannot Control Your Spending Habits or Stick to Plan

Now it would be backfire if you have bad discipline and can’t contain your temptation to spend with the interest free capital, remember the idea is to front run your savings to invest, not to spend more than you can afford.

It would be bad too if you do not have a clear plan on how you would invest, I suggest figure that out first before you do this, you need to have at least a 10 year or even longer plan on how you want to build your portfolio.

Closing Thoughts and Disclaimer

In this post I shared a credit card strategy or finance strategy that I am personally exercising with no issue or hurdles, because I have a clear financial planning, and understand my own financial situation.

Yours financial situation will be different, and you need to understand that and assess it yourself, I am not going to be responsible for your financial loss.

Anyway, welcome to leave a comment if you have any questions or want to discuss any details with me.