Table of Contents

What is Balance Transfer Plans?

Many people may have heard about Balance Transfer offerings from their credit cards and banks but quickly dismissed them because they don’t think it’s relevant to them. Some believe that Balance Transfer is only useful for consolidating credit card debts for individuals who have trouble repaying their debt.

But is it true that’s the only use case? Let’s delve into the concept of Balance Transfer. As the name suggests, it allows you to transfer an existing balance, typically credit card debt, from one bank to another.

Usually, it’s bundled with an installment offer that allows you to convert the transferred balance (debt) into an installment plan.

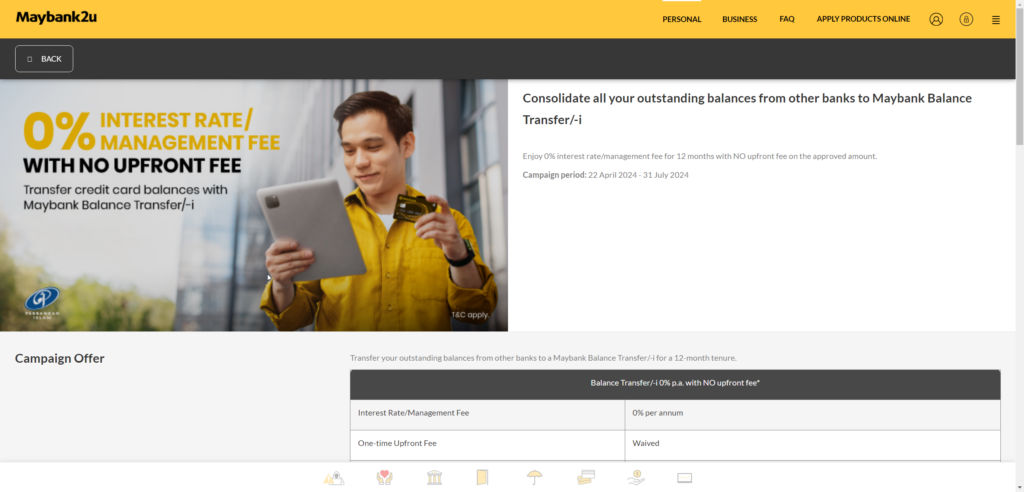

Here’s a simple example: Last month, I spent RM12,000 with my Maybank credit card. This month, I can’t come up with the money to repay the outstanding balance, so I took advantage of the 0% interest balance transfer offer from CIMB bank.

CIMB bank would then pay RM12,000 to my Maybank credit card, thus settling the outstanding balance. Then, CIMB converts the balance into a 12-month interest-free installment plan. Now, I would only need to pay RM1,000 to CIMB for this month and RM1,000 for every next month until the RM12,000 is fully repaid.

Take Advantage of The Interest Free Capital

Now that you understand what Balance Transfer is, if you still believe it’s only helpful for people with trouble paying their credit card debt, then you should continue reading this.

Interest-free capital is essentially free money, and a loan is just one of many financial tools that can be very helpful if used correctly. It can even accelerate your progress in wealth accumulation.

Here’s the idea: you can use the interest-free capital from Balance Transfer to invest in something else that generates profit. For simplicity’s sake, let’s say a risk-free high-interest-rate savings account. Then, you repay the installment every month, and in the end, you keep the interest earned.

Alternatively, you can also think of the interest-free capital as an advance salary that you can use to invest. You can pay the monthly installment later with your monthly salary. Essentially, this means you are always front-running yourself by about one year ahead.

How To Access the Capital from Balance Transfer

There are two ways to do this. The simplest way would be to put most of your regular expenses onto your credit card, meaning you pay with your credit card whenever possible. Then, utilize the balance transfer offer to pay off your existing outstanding balance.

Which means your Balance Transfer offering bank helps you pay your living expenses first, which you originally would have had to pay yourself. However, you can now choose to invest the funds you don’t have to use to pay off the debt. This is also the most recommended way to do this.

Alternative Method: Cash Out from Your Credit Card

While it’s entirely legal and there is no law against this, there may be some costs you would incur if you plan to do this frequently and in larger amounts.

The most common way people cash out from their credit card is by using it to top up their e-wallet balance and then transferring the balance from the e-wallet back to their bank account for further utilization. However, most e-wallets have started to charge fees if you choose to top up with credit cards.

Some of the e-wallets that allow credit card top-up and transfer back to the bank include:

- Boost Wallet – First RM1,000 credit card top up is free, subsequent top up have 1% fees

- Lazada Wallet – Limited to RM1,000 credit card top up and withdrawal, no fees

- KiplePay – Limited to RM1,000 credit card top up and withdrawal, RM2 withdrawal fees (0.2%)

- TNG Wallet – 1% Fees for any amount of top up and it’s transferable

- BigPay – 1% Fees for any amount of top up and it’s transferable

- Grab / Shopee – You can’t withdraw balance, can only spend it

If it comes with fees, you would have to re-evaluate your use cases for the capital. Can you generate more than the fees while maintaining the risk? You would have to find out before proceeding.

Other ways to do it include helping your friends or family to pay for big-ticket purchases or buying items to resell later. I’ve seen many creative ways people do this, but it is out of the scope for this post.

What Are The Risks? Banks Can’t Be Doing Charity, Right?

The answer is quite obvious. The reason banks offer interest-free balance transfer plans or low-interest ones is because they bet on people defaulting on the debt. It’s similar to credit cards—if you fail to make payments on time, the interest can be as high as 18% on the outstanding balance.

Does it mean balance transfer is just a trap from banks? Yes, if you are the kind that takes loans irresponsibly or the kind that doesn’t evaluate risks before making any investments.

Balance transfers are just financial tools. There’s no right or wrong when it comes to a financial tool; it all comes down to the user.

What About CashXcess, Cash Advance, Ezipay, Etc?

If you already understand the idea behind balance transfer and the benefits of interest-free capital, then all these offerings are going to be similar, but with different names. Some may be more straightforward, such as 0% cash advance, which is basically a 0% interest short-term loan.

Others come in the form of converting your existing transactions, usually above a certain ringgit value, into a 0% interest installment plan. However, the idea of how to make use of it remains the same.

How To Hunt for Balance Transfer Offer?

When looking for the right balance transfer, there are only a few things you need to consider:

- Instalment periods – Longer repayment periods are better

- Instalment interest fees – Lower is better, ideally, look for a 0% interest rate

- Processing fees – Often overlooked, lower is better, ideally, you want zero processing fees

Banks provide balance transfer offers periodically, making it difficult for me to recommend a specific one in this post. However, there are some comparison sites you can check:

- https://ringgitplus.com/en/balance-transfer/

- https://www.comparehero.my/credit-card/balance-transfer

- https://loanstreet.com.my/credit-card/balance-transfer

- https://www.imoney.my/credit-card/balance-transfer

Closing Thoughts

If there’s anything you believe should be discussed in this post that I missed, please comment below and let me know. I’m always happy to improve the content of my post and hope it can be as informational as possible.

Lastly, be responsible when using any kind of financial tools, especially those involving loans and leverages.

Great sharing and analysis.

Thanks! Glad you found it useful!