Table of Contents

Revision to Alliance Bank Credit Card Benefits

Alliance Bank made an announcement on 11th July 2025 regarding to their credit cards, specifically the Visa Platinum and Visa Infinite, so does it still worth keeping these two cards?

To answer that we will look at what benefits have been removed and what’s added.

No More 8X TBP for Ecommerce & E-wallet

These benefits will be removed on both the Visa Platinum and Visa Infinite from 1st August 2025:

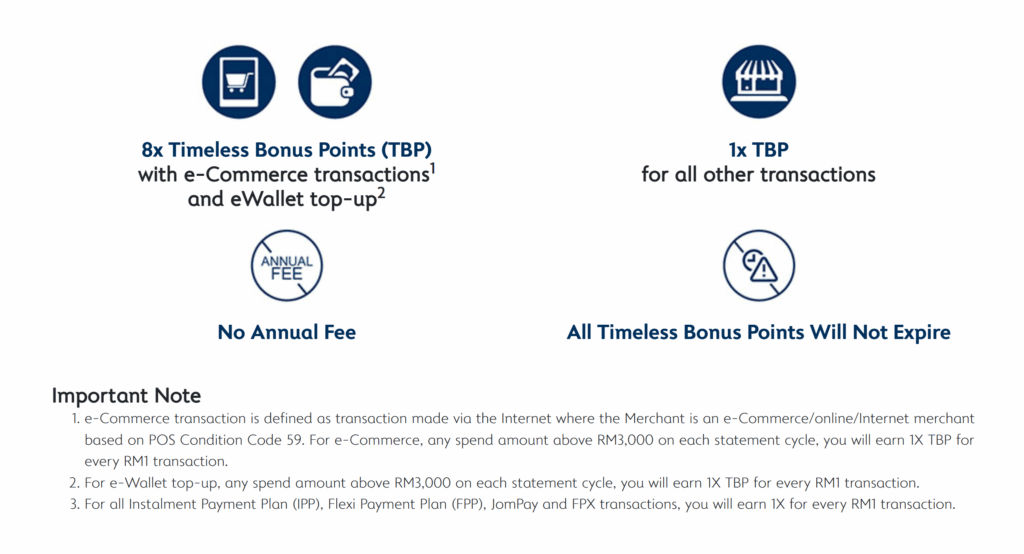

- 8X TBP for every RM1 spent on e-Commerce transactions, capped at

RM3,000 per statement cycle - 8X TBP for every RM1 spent on e-Wallet top-up transactions, capped

at RM3,000 per statement cycle

Fortunately they are still available with the Alliance Bank Visa Virtual credit card, so if you’re previously using either of these card for ecommerce just apply for the Visa Virtual and use that instead, plus Visa Virtual still provide 0% FPP campaign.

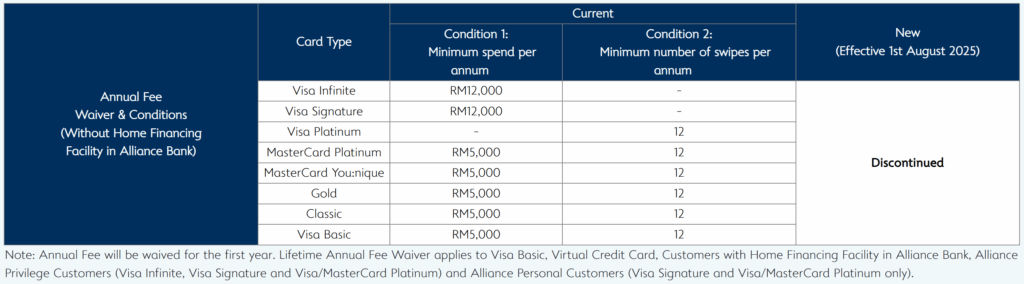

No More Annual Fees Waiver

Alliance bank discontinued all annual fees waiver program in this announcement, that means you will no longer be able to waive the annual fees automatically just by spending, in another words they want your annual fees.

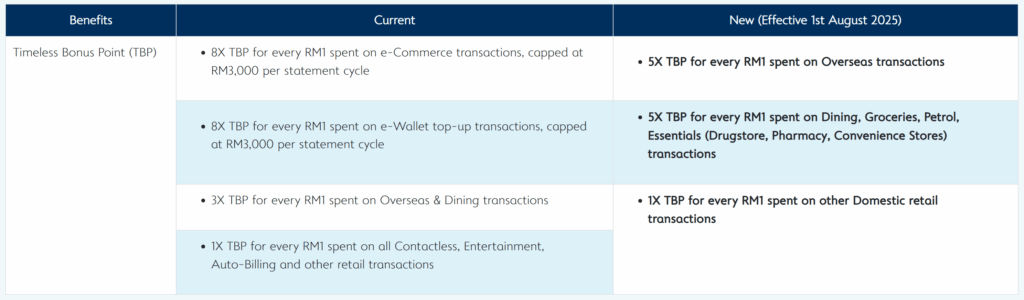

Alliance Bank Visa Platinum Benefits

The new benefits are no longer targeting local ecommerce, it seems the card has shifted its focus to overseas transaction where you will earn 5 points for every RM1 spent and some local retail categories like dining, groceries, petrol and essentials.

Each air miles require 15 points to exchange, and assume each air miles value are RM0.04 that means for local spending with 5 points you get 1.33% cashback equivalent of points.

For overseas spending you get 0.33% because it charge additional 1% on top of the Visa conversion rate, making this currently worse than the 2% you can get from using TNG Visa debit card and 1% from GXBank Mastercard.

Verdict: Does the Visa Platinum card still worth it?

With RM120 annual fees plus RM25 SST, there’s not much reason to own this card now, there’s better card for those local spending categories and the debit card from TNG and GXBank are better for overseas spending than this card.

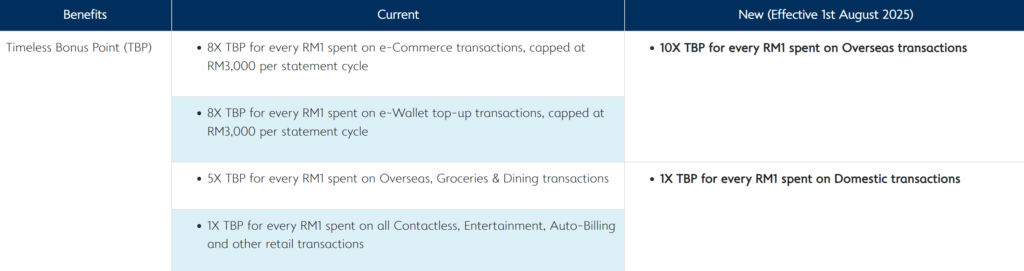

Alliance Bank Visa Infinite Benefits

The Alliance Bank Visa Infinite now gives 10 points for every ringgit spent in overseas transaction, and with the 1% markup on top of the Visa exchange rate this mean you will get 1.66% cashback equivalent of points.

There is literally no other benefits for domestic spending, not even the 5 points per ringgit on groceries or dining like the Visa Platinum.

The 3 month flexi payment are kinda short, it doesn’t give as much capital flexibility compare to their Visa Virtual which you can still convert transaction above RM500 into 12 months installment with 0% interest within the app.

The lounge access are rarely meaningful for me, but now with the requirement of spending more than RM120,000 per year to have the access right just make this even less attractive for everyone.

Verdict: Does the Visa Infinite card still worth it?

With RM438 annual fees and RM25 SST, there is NO REASON to own this card and I am cancelling this card myself, the spending benefits can’t even match with debit card from TNG 2% and are just slightly better than GXBank at 1% make it very little reason to need this card at all.

The lounge access are pointless too, there’s other card like RHB Visa Signature which give more access with no spending requirement and NO ANNUAL FEES.

What About Alliance Bank Visa Virtual

Visa Virtual is still a great, in fact one of the best credit card product I would recommend to my friends, you still get the 8 points per ringgit spent on local ecommerce and e-wallet, plus:

- Multi virtual card / one-time card are super convenient

- Convert transaction above RM500 to 12 months installment with 0% interest IN APP

- No annual fees

You can read my full review on Alliance Bank Visa Virtual card here.

That’s such a drastic cut, thank for your breakdown, I would be canceling my card too