A friend asked me to look into the Shares Transfer-In campaign from Webull Malaysia, which rewards up to 2% matching the total value of shares transfer into the brokerage during the campaign period.

The inconvenient terms for existing users

I have looked into it, and without wasting your time, I will start with the conclusion, this campaign may only worth it if you do not plan to withdraw any amount from your account for up to 360 days.

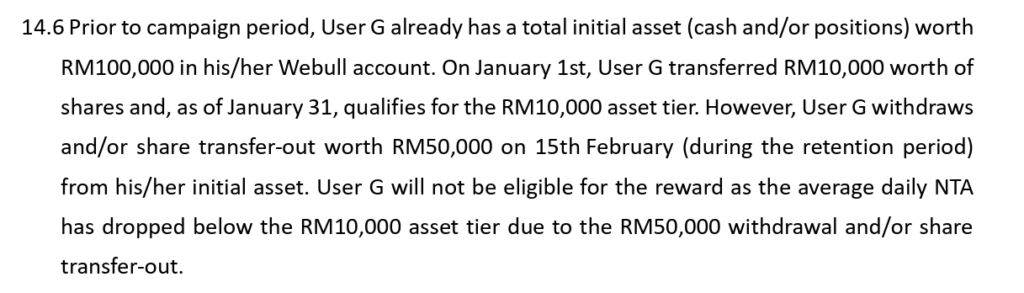

Even if you are already using Webull Malaysia and have existing asset inside, to get the full rewards from your new transfer in shares, you can’t sell your existing asset and withdraw too, this is stated example in the terms:

As I have some short term position in Webull, that I may close the position at any time soon, this immediately tells me I probably shouldn’t participate in this campaign.

Who would be able to take advantage of this promo?

Now let’s talk about the people that could consider in taking advantage of this campaign, and what kind of shares you should really move in.

People who do not plan to sell any shares and withdraw

This is the main criteria, as long as you sell any shares before all the rewards are distribute, you will void the yet to be distribute rewards if you make any withdrawals as stated in the example above.

The reward tier is decided at day 31 since you made the share transfer using the total transferred in shares value and withdrawals, then the rewards are distribute in 12 instalments in 12 months, so you would not be making any withdrawals for up to 391 days.

You only transfer shares that are meant for long term holding

If you are transferring shares from foreign brokerage like Interactive Brokers, keep in mind all brokerage licensed in Malaysia are required to pay stamping fees, and may have higher brokerage fees, or worse execution quality.

The stamping fees itself is 0.1% (RM1 per RM1000) of the order amount, so the fees may rack up and become less ideal, keep in mind the total reward of this campaign is only 2%, every time you buy sell you’re paying 0.2% stamping fees.

You do not plan to transfer the share out from Webull Malaysia

Now this one I am not sure if it’s changed or not, but when I asked previously I was told the ACAT transfer out is not yet supported by Webull Malaysia and I do not know when this would change.

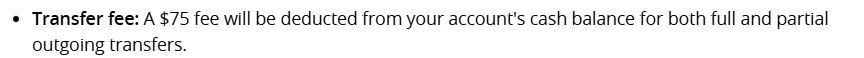

In the FAQ there is no info about transfer out the share, but on Webull US website, they do provide both ACAT and DTC transfer out options for a fee of $75.

If you really plan to transfer out after the campaign, I suggest you to double confirm with the customer support before any action.

Is Webull Malaysia good for holding long term stocks?

Now let’s say you made up your decision to take part in the campaign for the 2% rewards, the next thing we need to ask is, is Webull Malaysia actually a competitive brokerage to use, or will you end up paying more than the 2% rewards for using it?

When I look into this question, I was thinking about two things.

Options Trading Fees

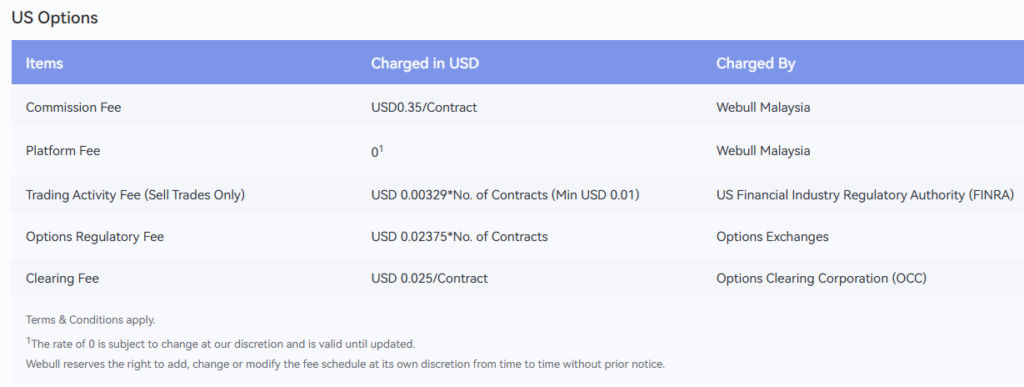

We already know trading stocks won’t be competitive because of the stamping fees, but what about people that like to sell covered calls on their stock for collecting premium?

Surprisingly their options fees are actually quite competitive a $0.35/contract, this is actually cheaper than Interactive Brokers, especially when the platform fee are still at 0, and there is no stamping fees for options trading.

However, it seems like it doesn’t provide any rebate for adding liquidity, which when I am using IBKR and do limit orders with options, I would sometimes able to offset the fees with the rebate for adding liquidity.

But still, at $0.35/contract it is already a competitive pricing.

Currency Exchange Spread

Now let’s say you have held the shares without withdrawal after the end of the campaign and received all the rewards, and you plan to sell some shares and withdraw into cash, but does Webull provide competitive spread for currency exchange from USD to MYR?

Let’s find out by comparing with the common way people withdrawing from foreign brokerage platform, like using Wise or using Singapore CIMB account.

| USD | MYR | Rate | |

| Webull MY | 10,000 | 39,122 | 3.9122 |

| Wise | 10,000 | 39,009 | 3.9009 |

| IBKR>CIMG SG | 10,000 | 39,031 | 3.9031 |

| Visa (Schwab) | 10,000 | 39,180 | 3.9180 |

These are all compared during the same time during working hours of 12 Feb 2026.

From the table, it seems while Webull Malaysia is very competitive on the currency exchange rate as well, which is consistent and expected as in my previous post I have notice their round trip exchange spread is within 1%.

The Visa (Schwab) row refers to withdrawing USD from Charles Schwab One international account using their debit card, it’s less ideal for actual withdrawing as the card has a daily limit of $1,000 but I left it here for reference.

The Verdict

To sum it up, this campaign is a classic case of “golden handcuffs.” The 2% reward is objectively generous, but the terms regarding withdrawals are strictly designed to keep your capital locked in for over a year.

If you are a “diamond hand” investor who plans to hold US tech stocks for the long run and maybe sell some covered calls to collect premium, the low options fees and competitive FX rates make this a solid deal. However, if you value liquidity and the freedom to move your money at a moment’s notice, the 2% yield might not be worth the restriction.

What do you think? Is the 2% matching bonus enough to convince you to lock up your portfolio for 360 days, or do the stamping fees and withdrawal terms make this a “pass” for you? Let me know your strategy in the comments below.