Table of Contents

UOB PRVI Miles Elite Card Introduction

I have reviewed credit cards for cashback and air miles accumulation for local spending, but in this post we will talk about UOB PRVI Miles Elite Card, a “higher tier” travel credit card for overseas spending.

In this post we will talk about if this card benefits are worth our consideration to apply, and who may find this card beneficial, and who won’t.

As this is a card is marketed as a travel credit card for airline miles accumulation, so we will first look at the air miles benefits then the other benefits.

Airline Miles Benefits

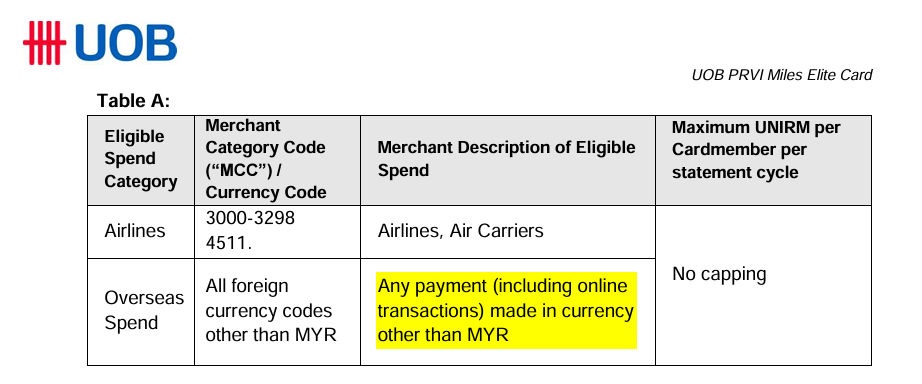

Like every other UOB credit cards, the airline miles can be redeem with UNIRM (aka UNIRinggit), and you earn UNIRM by spending with this card, here’s the UNIRM earning rate:

- 10 points for every RM1 spent overseas

- 5 points for every RM1 spent on airlines

- 1 points for every RM1 spent locally

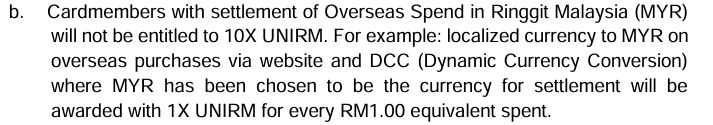

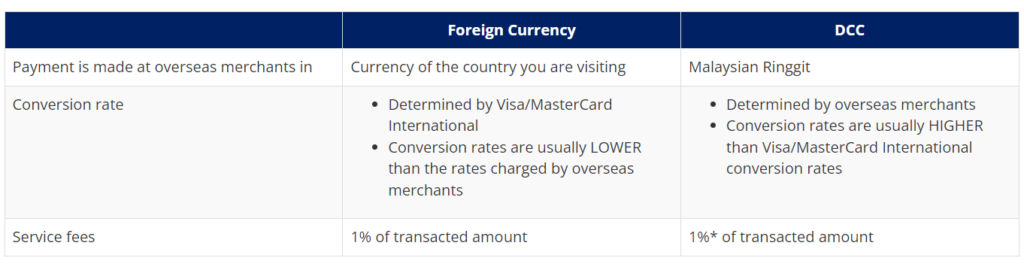

And by spent overseas, it actually include online transaction in foreign currency as stated in this table below, for airlines ticket purchase in foreign currency, it will reward 10 points.

And you should never choose MYR over the foreign currency when you pay for something at the cashier during travel, not only these rate are usually horrible, it will also earn you only 1 points with this card.

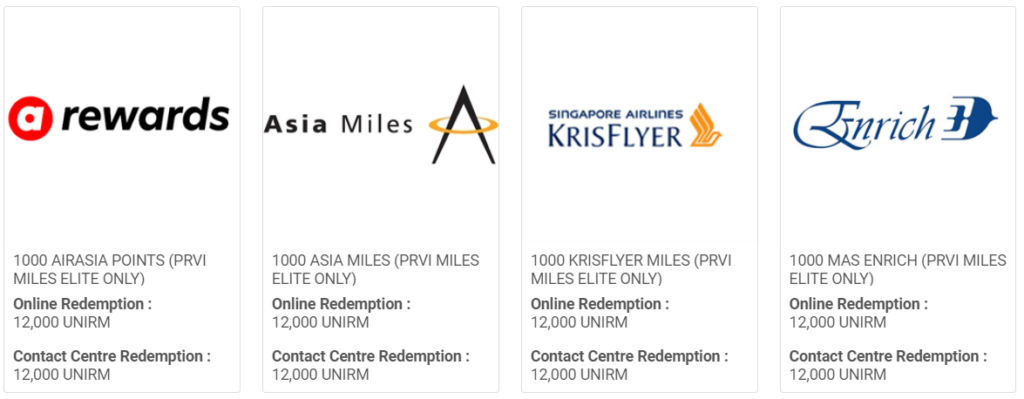

Next we will look at the air miles catalogue for UOB PRVI Miles Elite Card, which you can select from Enrich, Air Asia Points, Asia Miles and Krisflyer Miles.

As usual, we will use Enrich miles for calculation like every other of my post, I know Krisflyer usually have better value on paper, but unless you are planning for a super long range flight, it feels impractical to me if you have to book the ticket for months in advance and transfer at Singapore airport.

Let’s run the quick calculation:

- Assume 1000 Enrich miles = RM40 value, or 4 cents per mile

- You need to spend RM1200 overseas for 12000 UNIRM for RM40 worth of miles

- The ROI for this transaction is 3.33% and the miles per ringgit is 0.83

Foreign Currency Conversion Fees

Since the main use cases of this card is to spend foreign currency with it, it is important to understand what are the conversion fees as well, we’ll talk about the reason shortly.

As expected the currency conversion fees are 1% of the transacted amount, and again, this is the fees imposed by UOB, the conversion rate by VISA are usually included 1% margin above the mid market rate as well.

If we factor in the 1% fees into our ROI calculation with the Enrich Miles, it means we will spend RM1200 overseas, get RM40 worth of miles, but pay RM12 in fees, that means an ROI of 2.33% when fees are account for.

Why do we talk about the currency conversion fees?

Okay the 1% are pretty standard for most bank in Malaysia offering Visa or Master credit cards, but the reason we need to understand this layer of fees is because there are competing cards that offer zero foreign conversion fees such as the Touch n’ Go Visa debit card or the Charles Schwab debit card.

This adds a dimension to consider when comparing between cards to use during travel, and let you compare cards more realistically and logical.

For example you can say UOB PRVI Miles Elite Card are 2.33% better than TnG Visa debit card, but you can’t say that it is 3.33% better, I hope that make sense.

Other Benefits of UOB PRVI Miles Elite Card

There are a few more notable benefits of this credit card, let’s go through them as well.

8X Lounge access per year

With this card you can access to Plaza Premium Lounges for up to 8 times per year, and you can also access the private lounge at KLIA Terminal 1.

However the participated lounges are actually very limited, you can take a look at the participated lounges list for UOB PRVI Miles Elite Card.

Usually people find lounges in these location to share the similar quality of a “Pasar”, so you’ll decide if you would consider lounge access as an attractive benefits or not…

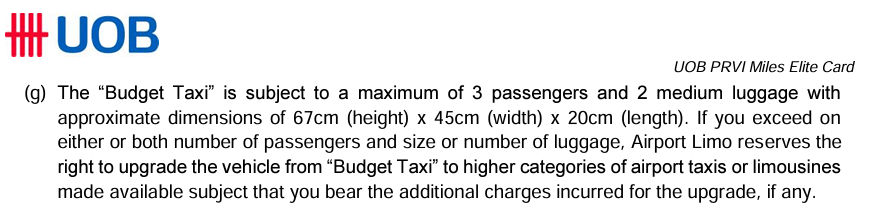

Complimentary ride home with budget taxi

If you bring 3 receipts of using this card overseas, you can request for a complimentary ride home, but with a few catch:

- For up to 3 person and 2 medium luggage

- Only eligible if your flight are landed at KLIA Terminal 1

- “Budget Taxi” subject to availability, such as Proton Persona

If you are couple then this offer is fine, but if you are family with more than 3 member then you may choose to upgrade to a larger limo.

Travel insurance up to RM300k

This card also included a generic travel insurance underwrite by LIBERTY GENERAL INSURANCE BERHAD that covers event such as accidental death, disablement, overseas medical expense, thefts, flights and baggage related claims.

I couldn’t find info on whether you’re eligible for the insurance as long as you own the card, or if you have to use it to purchase flight ticket, so make sure to call UOB if you are considering to apply or is already the card owner.

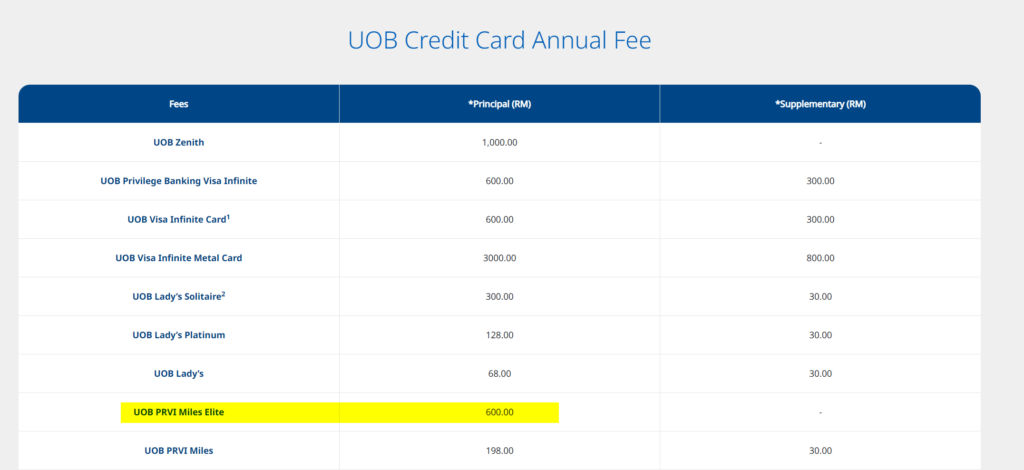

60K UNIRM rebate on annual fees payment

You will also get 60000 of UNIRM when you pay for the RM600 annual fees, which you can use to redeem 5000 miles of your choice, and the value of that is between RM200~RM250.

Keep in mind the UNIRM can also be use to spend it directly or redeem other stuff, but because it typically offer worse value than airline miles I just skip it. (Except for using it for annual fees & service tax.)

Annual Fees & Salary Requirement

The annual salary requirement for this credit card is RM100,000 or a monthly income of RM8333.

The UOB PRVI Miles Elite Card has an annual fees of RM600 for principal and the standard RM25 service tax for each activated card.

Who Should Get UOB PRVI Miles Elite Card?

Whether the card is suitable for you it depends on much you typically spend overseas, the simplest approach to answer the question is to look at the fees itself directly, that is your cost.

Example compare with CIMB Travel Platinum

For example the CIMB Travel Platinum card also has 1.6% ROI for Enrich miles accumulation, since they both have 1% conversion fees, this makes UOB PRVI Miles Elite only about 1.73% better than the CIMB card. (3.33% – 1.6% = 1.73%)

The annual fees are RM600, but the 60k UNIRM rebate worth around RM200, so it brings the cost balance to RM400, then we take RM400 / 1.73% = RM23121

Now what is this RM23121 means? This mean the first RM23121 you spent on both card will yield equal Enrich miles, when the fees are factored in.

That means if you don’t spend significantly above RM23k then you are probably better off with the no annual fees CIMB Travel Platinum Card.

Compare it with other travel credit cards

There are many other travel credit cards option, but I wouldn’t be able to compare all of them right here, I suggest you take a look at my Best Credit Cards in Malaysia list, pick the type of air miles card, eligible salary requirement, then look at the ROI or MPR and the annual fees to find the ideal card for yourself.

Anyway thanks for reading my post, if you find this useful please share it with your friends and family, and if you have other questions, or specific card you’d like me to review, just post them in the comment section below!