Table of Contents

New Tariff Structure from July 2025

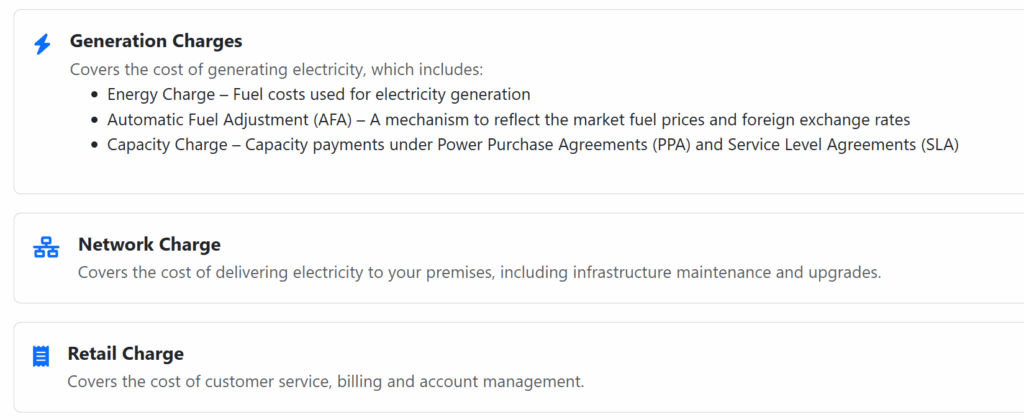

Tenaga Nasional Berhad (TNB) introduced a new tariff structure and claim it is more transparent and fairer to the user, there will be three components in your TNB bill.

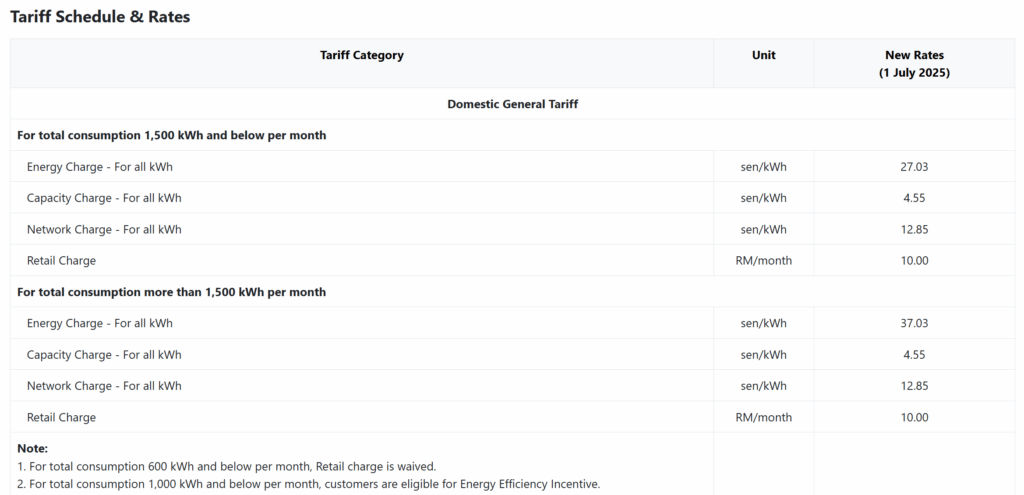

The energy charge will see a huge jump if you use above 1,500kWh on billing month, so it will either be 27.03 or 37.03 sen/kWh, unlike the older tariff structure.

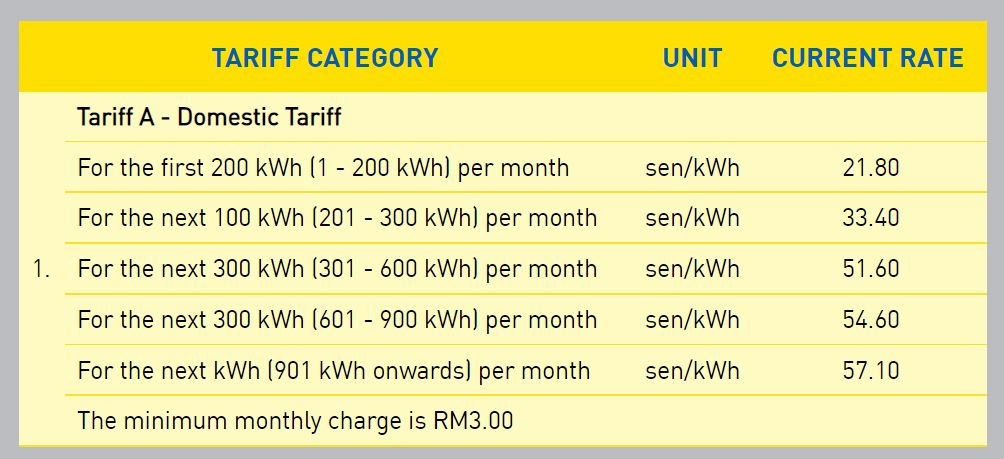

The older tariff structure combines everything in a simpler tier based on the monthly usage:

The Impact for Solar Panel Users with NEM Contract

With net energy metering scheme (NEM), users are able to sell the excess solar energy back to the grid during day time and use it to offset the bill for energy use during night time, at least that’s the entire point of the scheme.

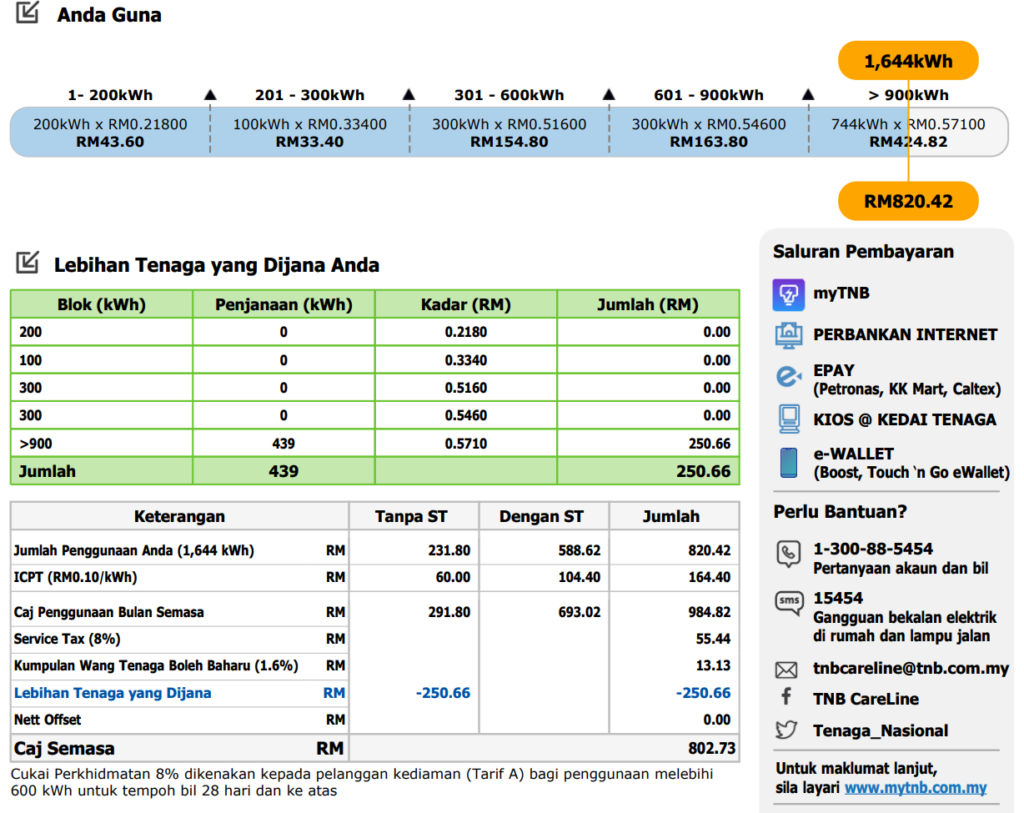

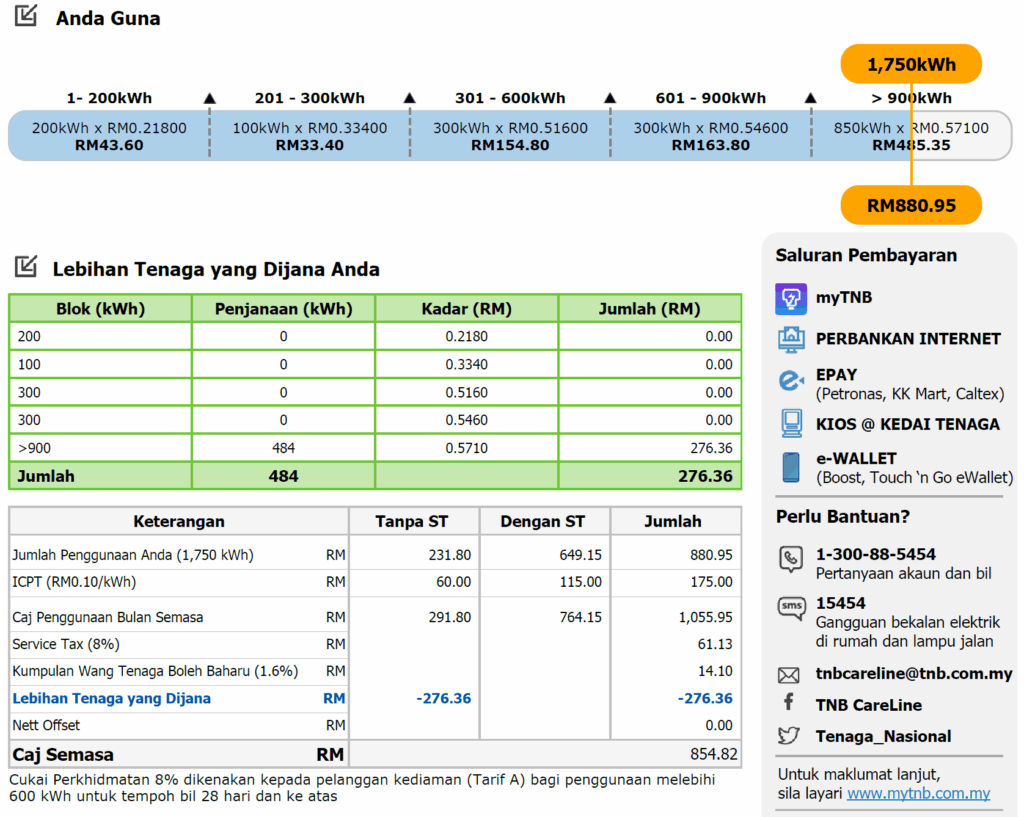

And the offset always goes from the highest tier to lowest, meaning in most cases solar panel users are expecting it to offset at a rate of 57.10 sen/kWh, for example this is my bill where it offset 439kWh at 57.10 sen.

The problem for the new tariff structure is only energy charge are being offset, this mean it will offset either at a rate of 27.03 or 37.03 sen/kWh, and many users from social media think this a breach of the NEM contract. Take a look at this news report:

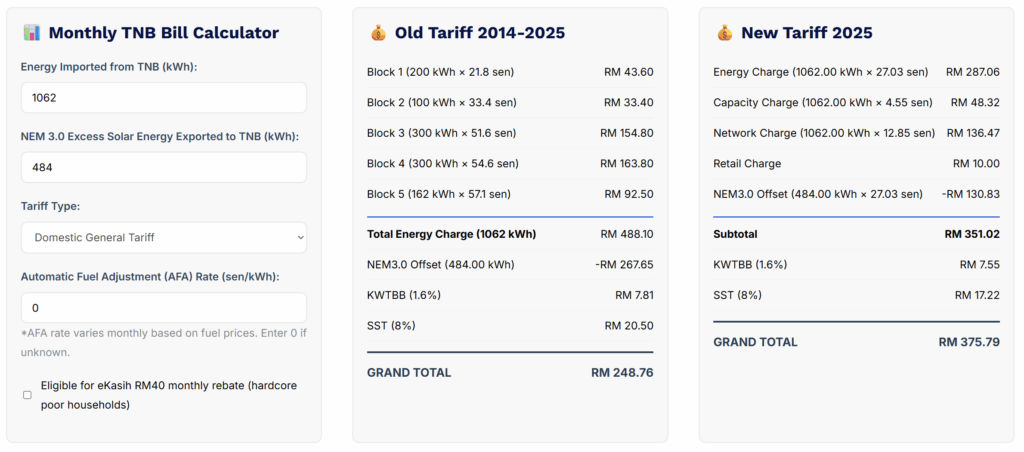

Before we go into the details calculation on how it impact my solar investment, let’s look at the estimated bill difference between new and previous tariff.

Old vs New Tariff Comparison

Let’s look at the tariff for regular user without NEM first, we can use calculator from TNB:

Here’s a table from SoyaCincau post on the difference between old and new tariff for user between 100 to 2000 kWh:

We can see that for non solar panel users they are actually getting a lower bill, and in some cases up to nearly 10% cheaper, but do that actually make it less worthwhile to invest in solar panel? I’ll use my own bill as example in next section to find out that.

Solar System Investment Still Make Sense?

This is my TNB bill with an average usage in March 2025:

That month my solar system generated 922kWh, and 438kWh is consumed while 484kWh are excess exported to TNB. My real total consumption is 2188kWh.

The savings on the exported 484kWh is RM276.36 while the consumed 438kWh savings is RM321.41 because of the savings included ICPT and taxes (RM0.675/kWh), so total savings on that month is RM597.78

We have a 60 months no interest installment for our solar system which is RM565 per month, so that basically means we completely offset the installment with our savings, and once the 60 months installment is fully paid we still have 5 years of NEM contract which means we will save roughly that amount from our bill from year 6 onwards.

So invest in solar system with previous tariff structure made sense to us financially, but now we shall examine that under new structure.

My Solar System Investment With New Tariff

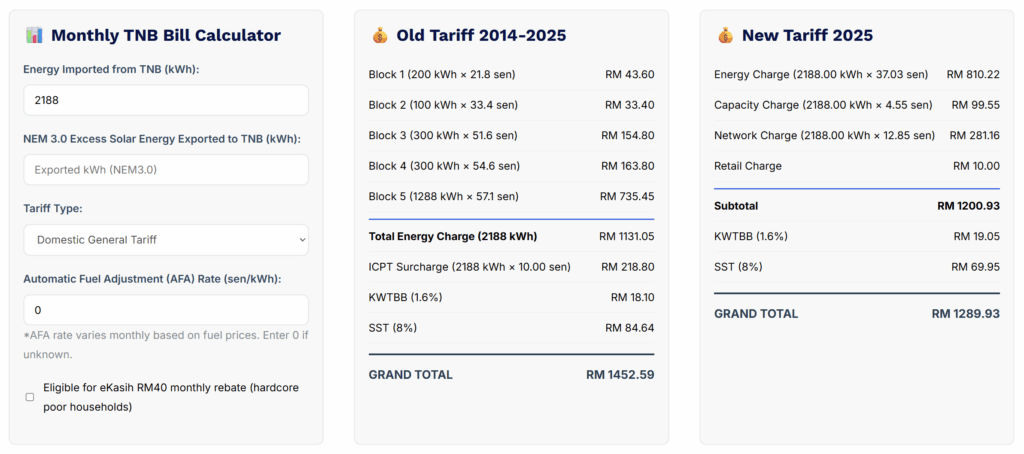

First I will input my real total consumption of that same month as if I do not have any solar system at all and you will see my bill will be roughly 11.2% cheaper with the new tariff at RM1,289.93 compare to old tariff at RM1,452.59

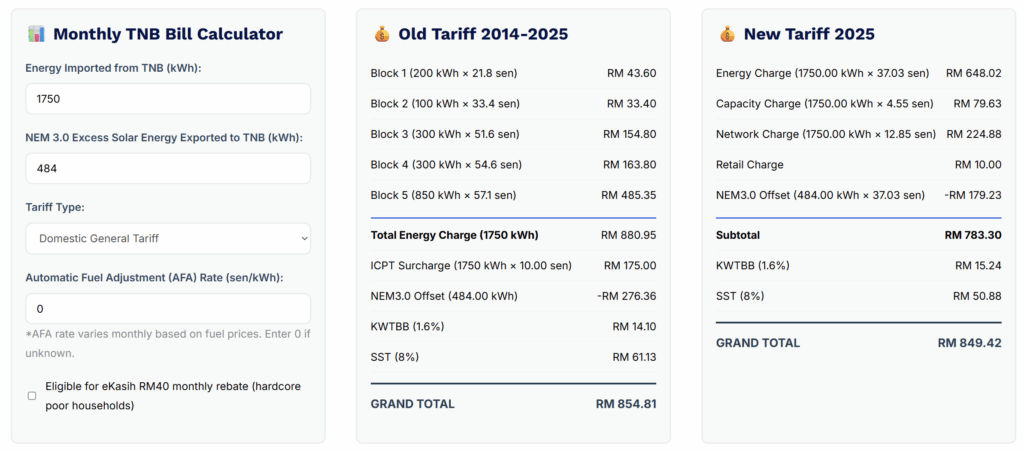

Next we input our bill with NEM export

The difference in old tariff is RM597.78 as previously calculated, but with the new tariff the difference with and without solar system shrunk to RM440.51 and this mean my solar system savings are reduced by 26.3%

In real world terms it means if I am going to invest in the same solar system today with the same installment plan, I am expected to spend more money upfront and it will take 35.7% longer for me to break even, (actually it will be longer if you consider the opportunity cost from the upfront payments).

As you can see the investment while isn’t “unprofitable” it become a lot less appealing when it requires more upfront cash, and went from 60 months to 81 months to break even.

This would be even worse for people recently invested in solar system with shorter period of installment or no installment at all, due to the higher upfront cost and lower savings.

Solar Investment for Below 1,500kWh Monthly Usage

Because the new tariff are only having two tiers, which is RM0.37/kWh when usage above 1500kWh or RM0.27/kWh for below 1500kWh it can be even worse for lower usage solar system user.

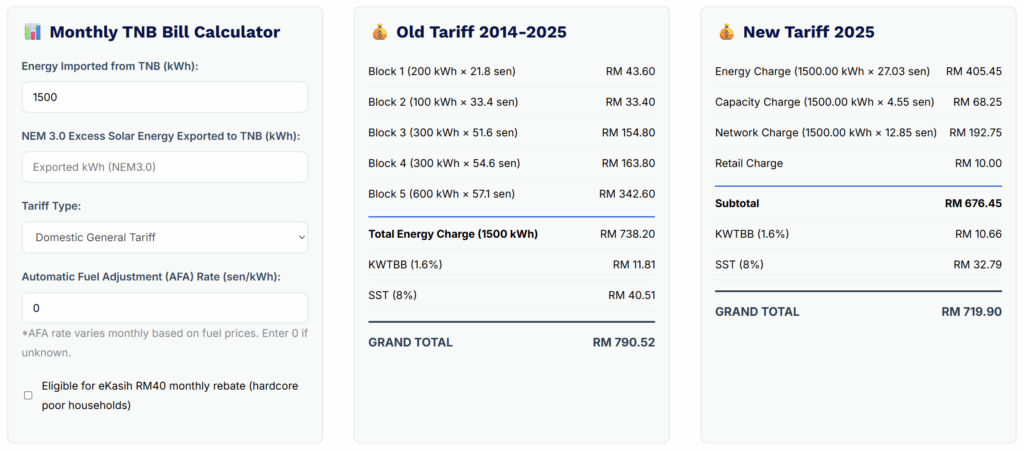

For example let’s say I use exactly 1500kWh per month, this is my bill with old and new tariff:

Now we use the same amount it generated with my solar system at 922kWh, 438kWh is consumed so we deduct it from the 1500kWh imported and we export the same amount 484kWh.

As you can see with the old tariff the same solar system would still save RM541.76 per month while with the new tariff the saving is only RM344.11

That means the total cash outflow during the installment period is higher because now you have to fork out another RM220.89 to cover the installment payments

The break even period with such savings would be up to 9 years! At this point there is very little reason to invest solar system at all, considering in a few years there might be more efficient panels available (like those shade resistant panels) or lower cost.

So why does household with consumption below 1500kWh getting worse return with solar system? The obvious answer is because the NEM offset is only RM0.27/kWh

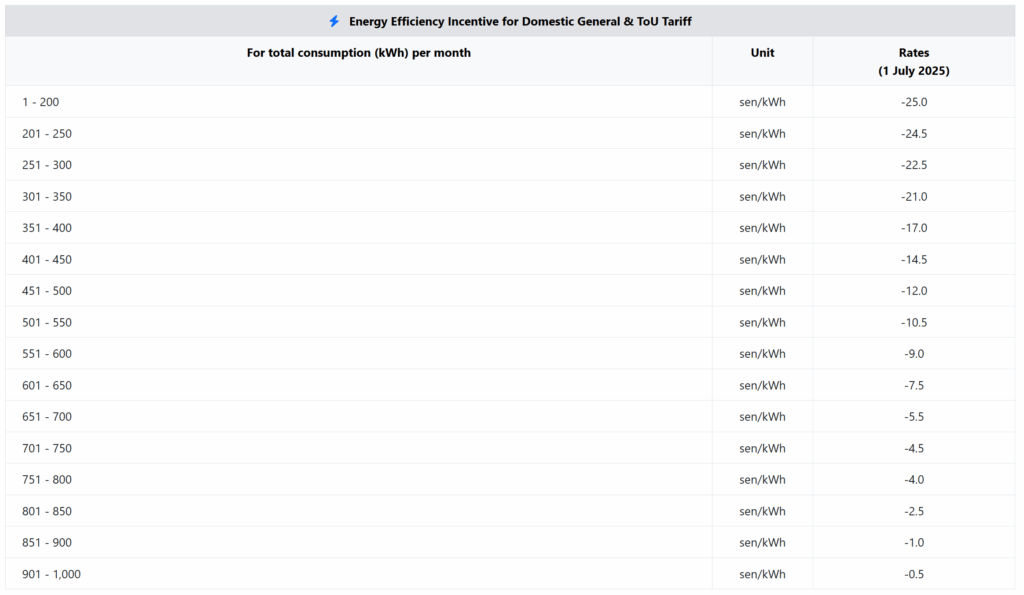

And if you use even less energy and eligible for the “energy efficiency incentive” rebate then the saving from solar system would be even less for you to justify the investment at all.

What Do I Feel About This

I am not surprised anymore by whatever “taxes” impose by current administration, we have had so many taxes like real property gain tax, tax from share disposal, the “revised” sales tax, low value good tax, luxury good tax, ICPT, etc.

Most of these taxes aren’t actually targeting the rich like many people thought it is, they are mostly targeting middle income family, making them even harder to have any chance at all to get out of the middle-income trap.

Think about this, the last few year government are pushing green energy, encourage and incentivize people to invest in solar system, using the old tariff to demonstrate potential savings to attract people that are carefully planning their expenses and budget, people who hoped to save some money in the long run, but turns out this is all bait and switch strategy.

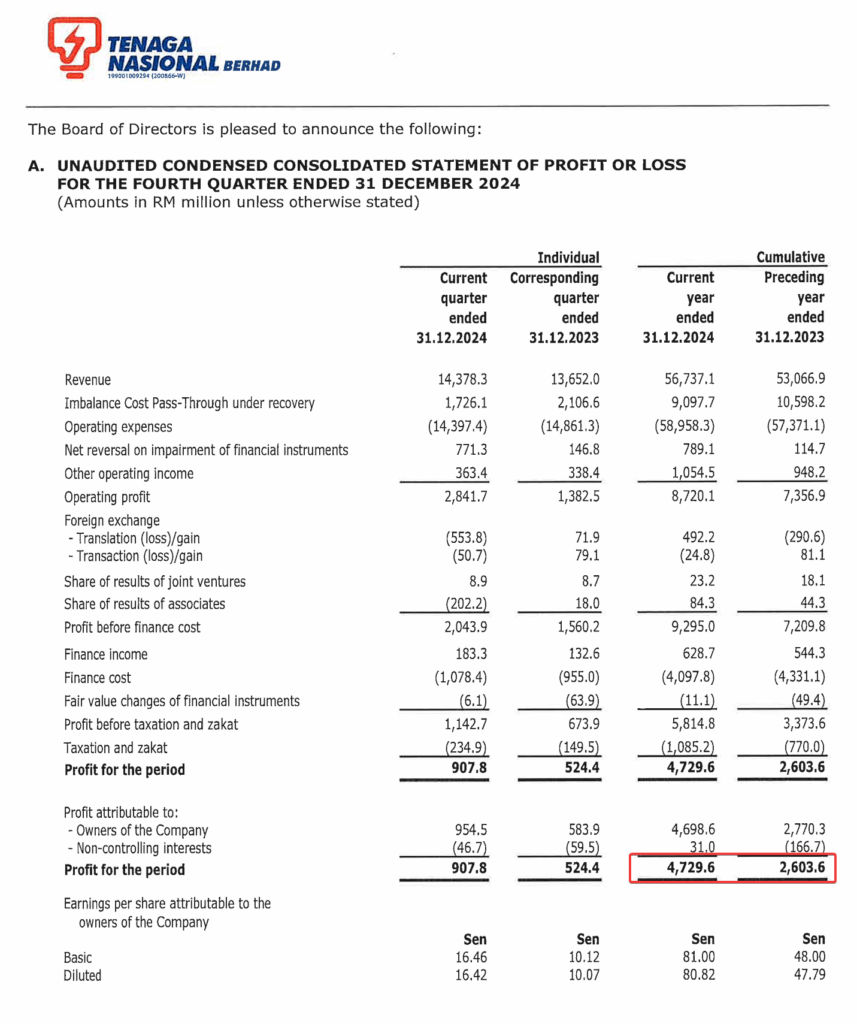

Just in case anyone believed in excuses like inflation or fuel price increase, passing cost to consumer, please go read their financial statement

In financial year 2024 TNB posted a profit surge of 81.6% to RM4.729 billion compare to previous year of RM2.603 billion.

But Wait, This Is Not Final Yet…

Every people who bought solar system in recent years are rage about this, and have been loud about this and sending complain letters to all the relevant department, while there is no class action law suit in Malaysia, let’s hope there will be enough pressure to make them reverse this stupid tariff.

Right now this is pending finalize with Petra/ST with stakeholders, I will edit update to this post once there is a result on reversal or revision.

Update: GOOD NEWS

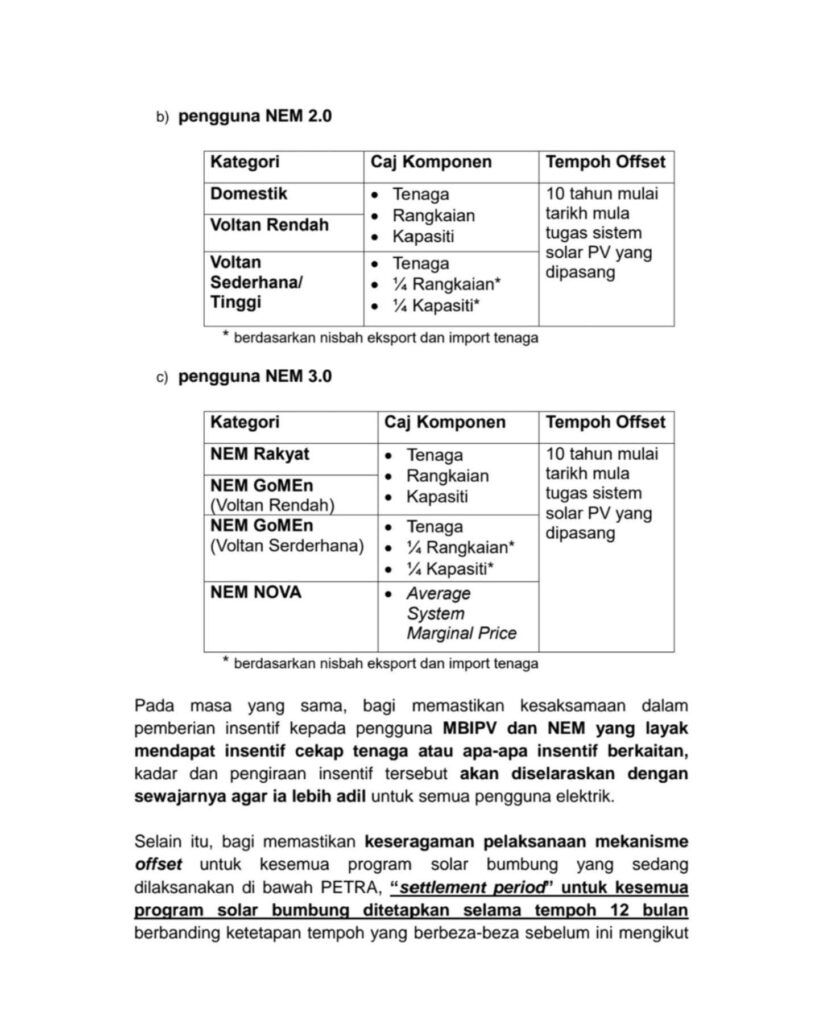

Looks like public pressure does work and we’re now going to get full offset on energy, capacity and network charge for up to 10 years on installation date, basically as the original contract length.

1750kwh-484kwh=1266kwh still need to pay with old tariff bill is RM854.82, IF 1266KWH NEED TO Pay according new tariff will be RM605.96, THIS will encourage more people to install solar

The bill does not directly deduct the amount you exported, can take a look at my bill or the calculator, you will have to first calculate the imported then only deduct the exported

Very good write ups. Easy to understand. thanks

I’m a solar user under NEM 3.0, my July 2025 bill almost double despite having almost similar energy usage and solar generation in one of the previous month. ROI gone case, meaning investment lost since NEM is 10 years only. The fact remains, solar user get paid far less by TNB for the generated energy and had to pay slightly higher to TNB for using electricity from the grid. Net is a total bill close to double or more from previous tariff. Worst TNB charge you the energy efficiency incentive generated from solar (no solar is better since you can get the incentive times full energy usage).

I wonder if assuming i dont use any electricity (zero) and sell my solar energy to TNB, will TNB pay me far less by charging me the energy efficiency incentive times solar energy generated. It just make things worst.

I believe this is a major backstab for solar users by govt., precedent has been set, dont trust the next solar initiative by govt., they can u-turn, change formula and bleed you dry.

Solar users who got a loan to install solar and those subscribing to solar monthly packages by solar company will be in worst position.

Solar company high likely will be impacted, dont know if they can survive. How to convince and get customer if no benefit to the customer (cannot even show the ROI less 5 years or even 10 years).

Anyways, good article but unfortunately not good news for solar users. We got scammed indeed.

Hope enough loud voices reach those in power to make adjustment for fairness to solar users who had spent own capital investment, loans and contractual solar subscribtion (with hefty penalty if terminated) but taken away all benefits and at a lost for very long time. Govt, have mercy and be competent please.