Table of Contents

Ryt Bank by YTL Group and Sea Limited

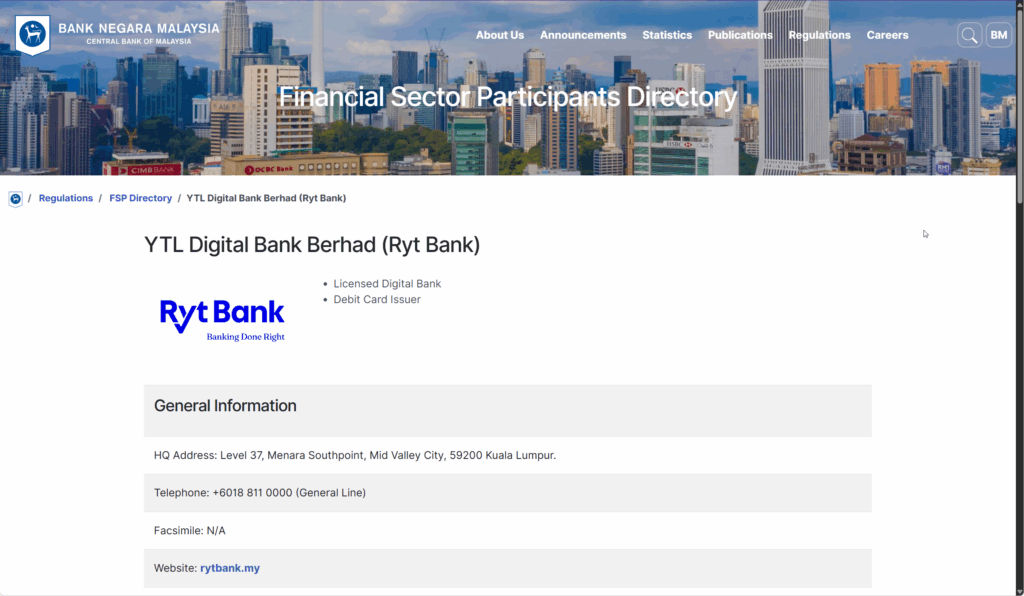

Ryt Bank is a newly launched bank licensed by the Ministry of Finance, and you can verify it on Bank Negara Malaysia’s website.

YTL Digital Bank Berhad operates under the brand name Ryt Bank, and it was established by YTL Digital Capital Sdn Bhd together with Sea Limited. YTL is a public listed company with core business in constructions, and Sea Limited is the company behind Shopee and Garena.

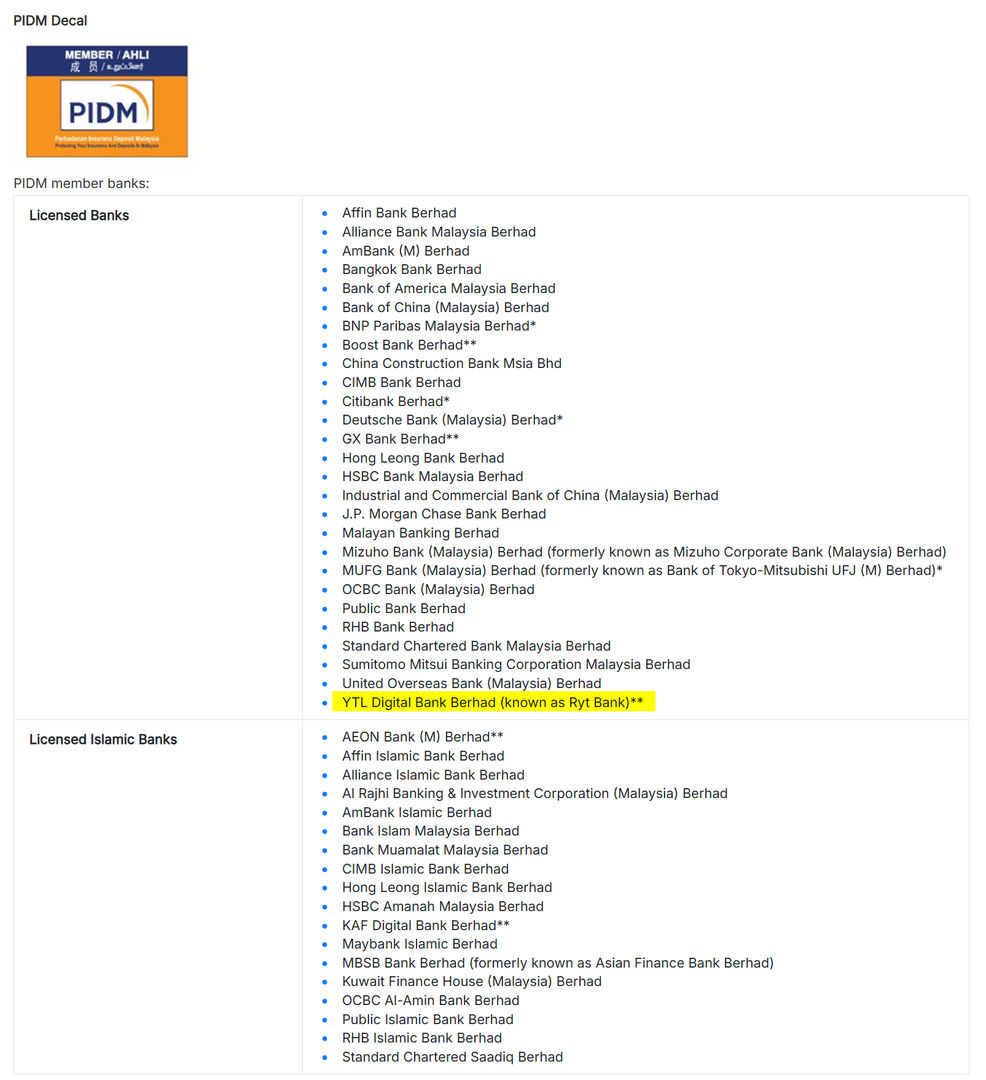

Ryt Bank is also a PIDM member, which insures deposits up to RM250,000. You can verify this on the PIDM website.

Now that we know the bank is insured and who’s behind it, let’s look at the real benefits it offers and whether it’s worth trying.

Ryt Bank Beneifts: 4% Interest, 1.2% Cashback, etc..

I’m not going to cover every single product offerings, just the ones most people care about, starting with the 4% interest savings account.

4% Interest Saving Account (Save Pocket)

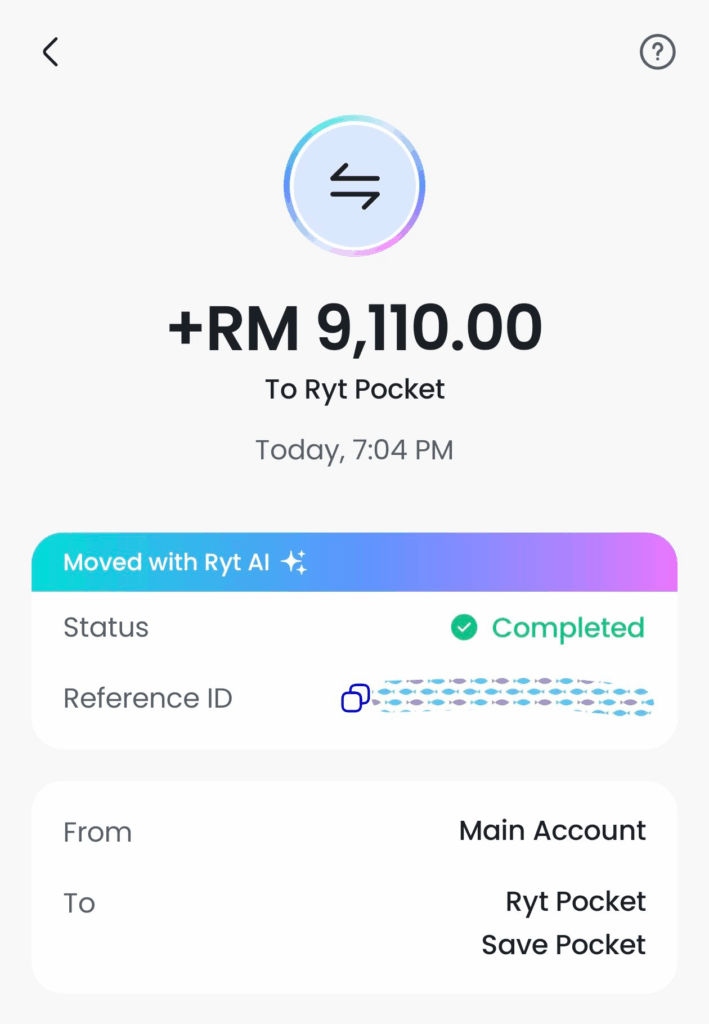

I created an account and transferred RM9,150 into the Save Pocket. Based on the 4% rate, I should see about RM1 added daily as interest.

When you transfer money into Ryt Bank, it first goes into the Main Account. You’ll need to move it into the Save Pocket to earn the bonus interest.

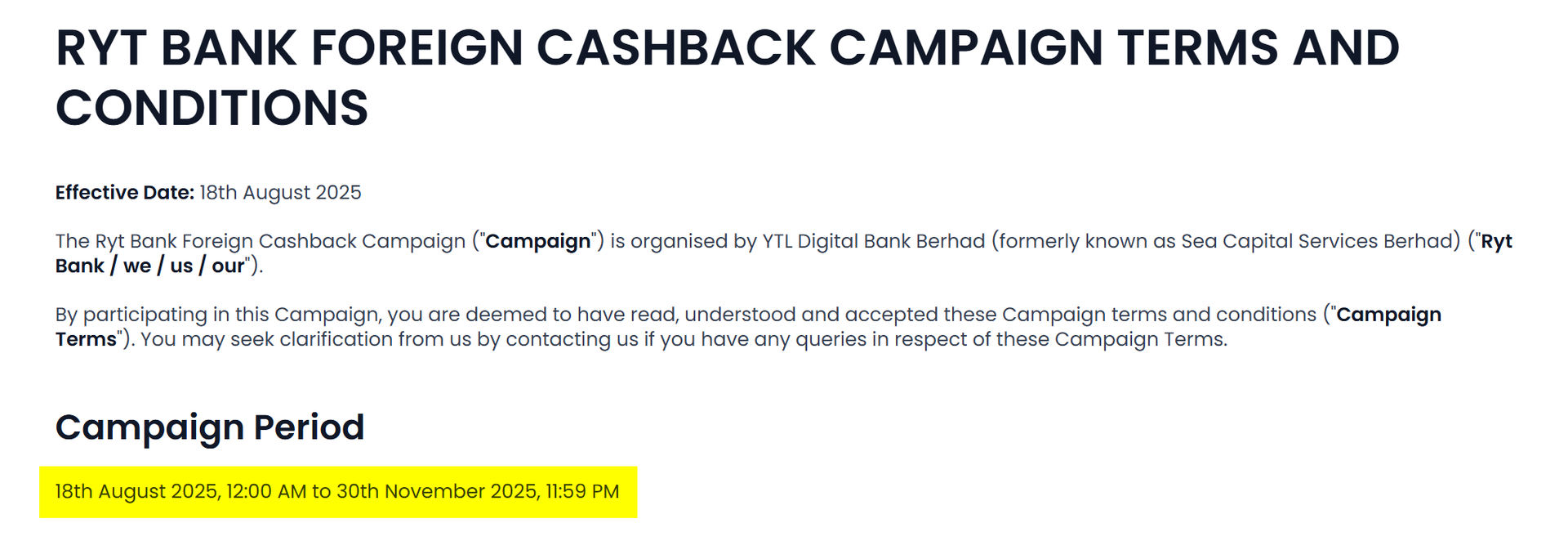

Unfortunately the 1% bonus interest promotion only last until 30 November 2025, it is a short campaign with a capping for the total deposit of RM 1 billion, and it’s limited for RM20,000 per person, as per the campaign terms.

Without the bonus interest you will still have 3% base interest, which by the terms and conditions will be determined by the bank and subject to change from time to time.

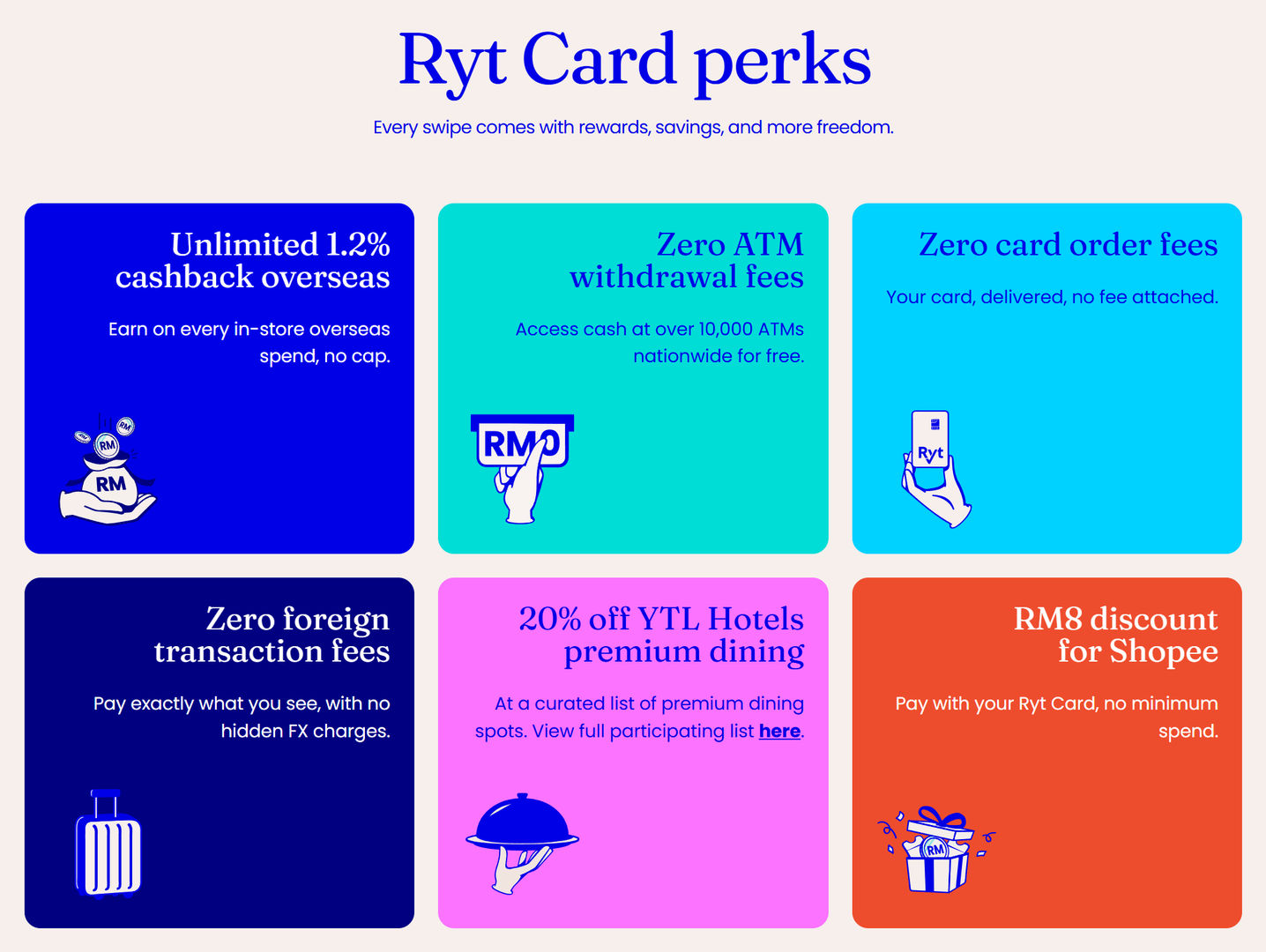

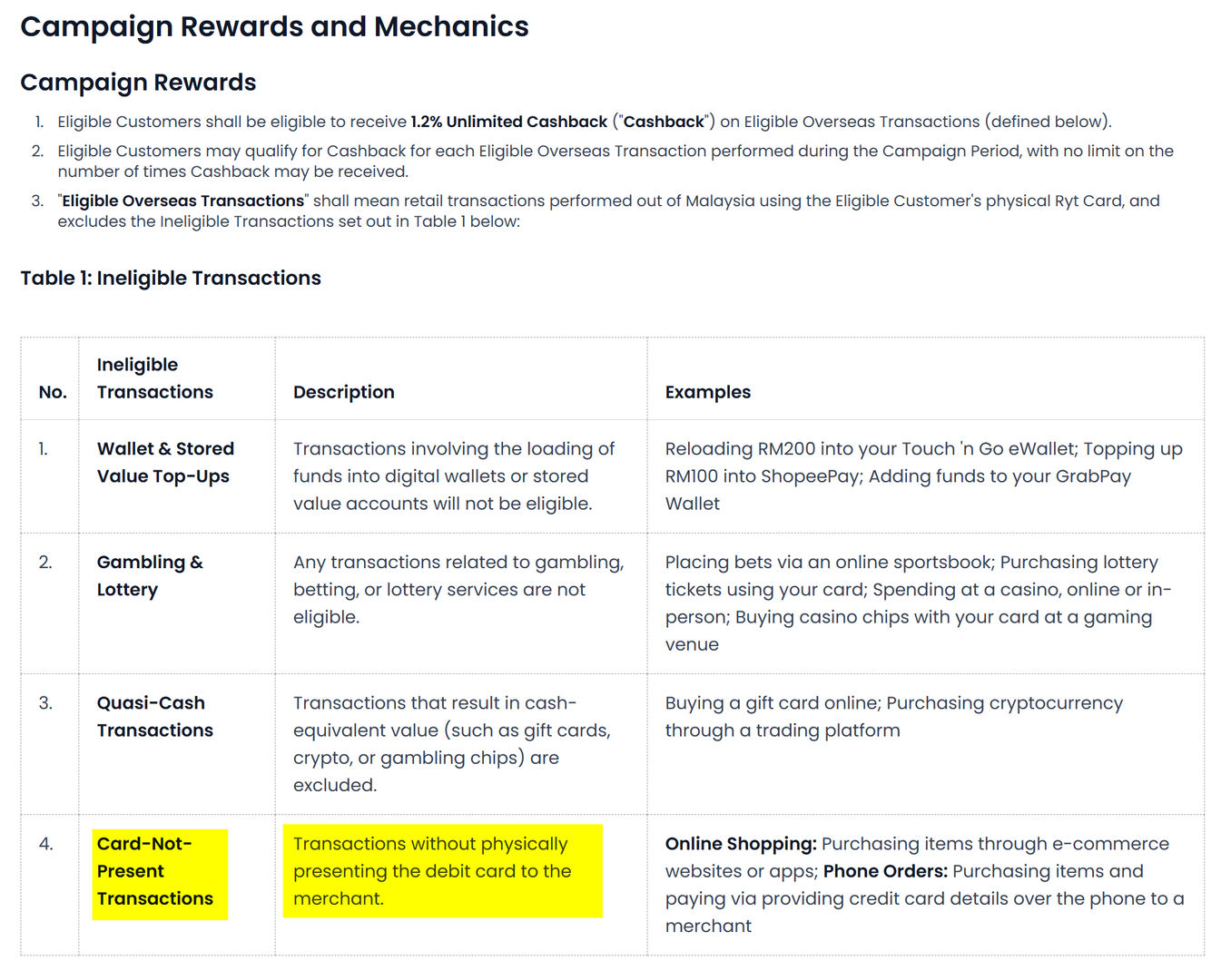

1.2% Cashback on Overseas Spending With Ryt Card

The Ryt Card issuance fee is waived until 30 November 2025 and has no annual fees, no SST as it’s a debit card not credit card.

The most attractive offer from this card is obviously the unlimited 1.2% cashback on overseas transactions, and there is no additional conversion fees, so you get exactly the Visa exchange rate plus 1.2% in cashback.

However, all these benefits will also expire on 30 November 2025, both 1.2% cashback for overseas spending and conversion fees waiver, as per the campaign terms and fees schedule on the website.

From the table it seems like there will also be fees included for ATM cash withdrawal…

Another important point: cashback only applies to physical overseas retail spending, not online transactions in foreign currency.

Touch n Go 2% cashback campaign ends on 31 August 2025, and with no news of renewal yet, this temporarily makes Ryt Bank card slightly better.

GXBank debit card cashback is 1% slightly lower than the 1.2% offered by Ryt Bank, and GXBank conversion fees waiver is ending at 6 November 2025.

This makes Ryt Bank debit card the better cashback option from 1 September to 30 November 2025, unless TNG renews with a stronger offer.

Ryt PayLater: Beware of the Interest up to 31.72%

This is similar to other buy now pay later (BNPL) offerings from other providers, even the effective interest rate is close to the one from Shopee SPayLater.

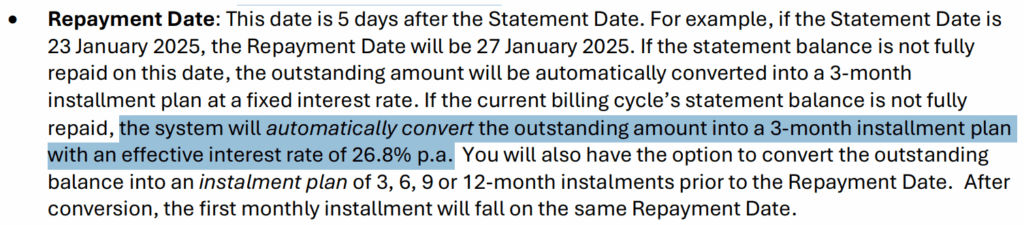

The billing cycle runs from the 20th to the 19th of the following month. The statement date is expected on the 23rd, and if you settle within 5 days, no interest is charged.

However, if the statement balance is not fully paid by the repayment date, it will be converted into a 3 months installment with 26.8% effective interest, which you should probably avoid.

In my opinion, all BNPL offerings in Malaysia are predatory financial services, fortunately in July 2025 Consumer Credit Bill is passed and is now in the process of setting up Consumer Credit Oversight Board (CCOB), and hopefully there will be a lower ceiling cap for the effective interest rate and transparency for all the BNPL providers.

The Ryt AI Feature

The AI feature does seem handy, especially with the snap and pay feature where you can just upload a photo of your TNB bill, phone bill, or other invoice, then it will read the bill and help you prepare the transaction and ask for your approval.

Since I had no bills to test with, I tried a simple instruction, moving money from my Main Account to the Save Pocket. It was fast and responsive.

However, this feature is still in beta, and its reliability has yet to be proven, and the terms and conditions are saying if it made mistakes, (sending to wrong account, send wrong amount, etc.), they are not responsible for the financial damage and you should hold them harmless (ie you can’t sue.)

Is It Worth Opening An Account With Ryt Bank?

More competition in financial services is always good for consumers, my only concern is, whether these new banks have good protocol in place for data and privacy protection, aside of that I think it’s a good thing for consumer to have more options.

For Ryt Bank, personally I think the 4% campaign can be a great place to park money that you may need to use it instantly, similar to TNG Go+, it is always available and PIDM insured, making it a better option than a money market fund when rates are similar.

Money market fund is considered an investment and is not insured by PIDM nor capital secured, and usually require a 1~3 business day for buy in or redemption.

The other actual useful benefit is the 1.2% cashback for overseas spending, and I hope the campaign will be renew or extend after 30 November 2025.

Overall, Ryt Bank is worth considering mainly for its 4% Save Pocket promo and 1.2% overseas cashback. Beyond that, the long-term value will depend on whether these benefits are extended after November 2025.

If you’ve opened a Ryt account or tested the card overseas, share your experience in the comments!

thanks for sharing!