Table of Contents

Why Get Credit Card For KrisFlyer Air Miles

It’s been a while since I wrote a credit card review. I already have cards for Enrich miles and cashback, so this time let’s look at one that focuses on KrisFlyer.

I had some KrisFlyer miles before, but since most of my destinations had direct flights with Malaysia Airlines, I never really used them and they expired during Covid.

However, if you travel to destinations without direct flights, KrisFlyer miles may be worth accumulating since Singapore Airlines covers far more destinations than Malaysia Airlines, and in some cases costs even less.

I’ll share a real example comparing Malaysia Airlines and Singapore Airlines flights at the end of this post so you get a clearer idea.

Benefits of Maybank KrisFlyer Amex Platinum Card

KrisFlyer Air Miles Benefits

The main benefit of this card is straightforward, KrisFlyer miles earning rate. Let’s look at it and see if it’s worth it.

KrisFlyer Miles earning rates:

- 1 mile for every local spent of RM2.5 (1.6%)

- 1 mile for online or overseas transaction of RM2 (2%)

- 1 mile for every RM1 spent on Singapore Airlines, Scoot and KrisShop (4%)

- Exclude Jompay, FPX transaction, Government and E-wallet reload

The percentage means cashback equivalent, and for generic spending it falls between 1.6~2% return on spending.

Overseas spending is rarely worth it because Maybank AMEX charges a 2.5% conversion fee, which is often higher than the value of the miles you earn.

One thing to pay attention is the miles are credited directly to your KrisFlyer account around the statement date since the card is tied to your membership. This means you need to accumulate and use them before expiry, which is 36 months since it accruals.

Other Benefits

There are other benefits such as lounge access, dining discount, fast track for KrisFlyer gold status, travel insurance, free 7000 KrisFlyer miles for new signup (worth RM280), and many more.

However, most of these benefits aren’t particularly useful or desirable (except the signup bonus miles), so I won’t elaborate further…

You can check out Maybank KrisFlyer Amex Platinum product page if you are interested to find out all the benefits.

Annual Fees & Salary Requirement

To apply for this card, you need a minimum annual income of RM60,000.

It comes with an annual fee of RM300 for the principal card and RM150 for the supplementary card, the first year is waived for the principal card.

There’s no waiver program for this card, and many users report that fee waiver requests are often rejected. You’ll need to spend significantly to make it worthwhile.

How Much Spending Is Worth Getting This Card?

The return on spend is between 1.6–2%. More local spending brings you closer to 1.6%, while more online spending gets you nearer to 2%. For calculation, let’s assume a 50/50 split, giving an effective return of 1.8%.

However, after fees, the real return is slightly below 1.8%. The more you spend, the closer you get to that figure. But since there are other cards offering close to 1% cashback without annual fees, this card only makes sense if you can get better return on spending.

If we treat the RM300 annual fee as 0.3% of spend and aim for a 1.5% effective return, dividing RM300 by 0.003 gives RM100,000. So you need to spend at least RM100K per year to achieve that return.

Also consider KrisFlyer air miles expire after 36 months since it accrued, realistically you should try to accumulate at least RM3000 worth of miles in this 3 year period, which mean RM167K spending in 3 years, or RM55.6K per year.

In short, if you can’t spend above RM4.5K per month with this card, you may be better off with other credit cards, such as those focus on cashback.

Example Flight Comparison Between MH vs. SQ

I was planning to visit Japan next year for sakura season, but to avoid the extreme crowds in Osaka or Tokyo, I considered a road trip in Kyushu starting from Fukuoka. Let’s look at flight options to Fukuoka airport.

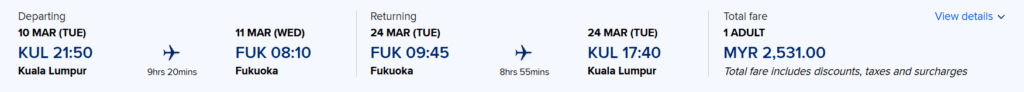

The economy flight ticket cost RM2,531 and can be redeemed with 54,000 miles plus RM276 in taxes, the total travel time is 9 hours and 20 minutes.

This mean the 54,000 miles offset RM2,255 and each miles are equivalent to 4.17 cent in this specific flight.

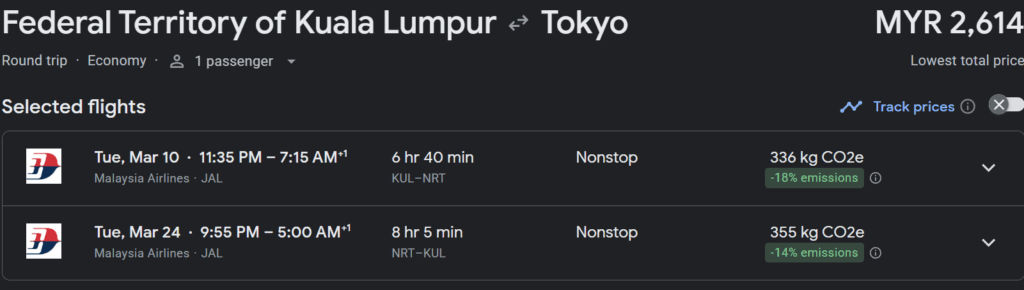

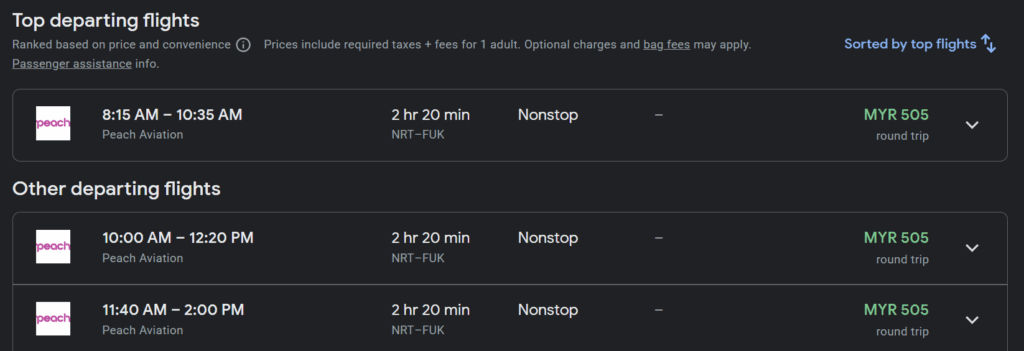

For the same date a direct flight from Kuala Lumpur to Osaka cost RM4,252 or RM2,614 to Tokyo, then a domestic return flight from Tokyo to Fukuoka cost another RM505.

The total flight cost is about RM3,100+ if you fly to Tokyo and take a domestic flight to Fukuoka.

So you end up paying more for a longer journey with layovers, extra hassle of separate baggage check-ins, and possibly more fees for domestic flight baggage allowance and seat selection.

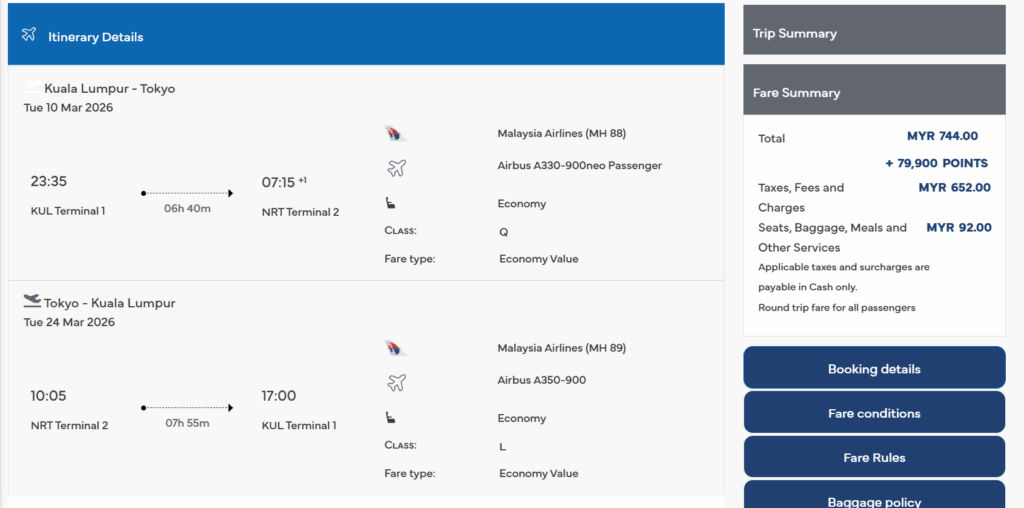

It is even worse if you chose to utilize Enrich miles on this flight, it will cost you 79,000 miles, RM652 in taxes and RM92 for seat selection which is included even with the lowest tier of Singapore Airlines.

The 79,000 Enrich miles offset about RM1,962 which make every mile equivalent to 2.48 cent, much lower value then KrisFlyer miles for this flight, and you have to pay another RM92 for seat selection.

Keep in mind this comparison is only for this specific flight destination where Malaysia Airlines doesn’t have direct flight option, usually you will still be able to find flights with MAS where Enrich miles are equivalent to 4 cents, albeit the available flight date has been reduced a lot in recent years.