Table of Contents

Introduction to Cash Back Credit Cards

I’ve covered the best airmiles credit cards and travel credit cards in previous posts, but I’ve put off creating a guide for cashback credit cards for a while. I wasn’t certain if I could offer significant value with this post, and there are a few reasons for that hesitation.

Cashback credit cards typically offer a lower return per ringgit spent compared to airmiles credit cards. Additionally, they often come with a cap on the maximum cashback you can earn per month. Moreover, many cashback cards require you to meet spending requirements in various categories such as petrol, dining, shopping, and utilities to maximize your cashback earnings.

I dislike the fact that cashback credit cards often require you to adjust your spending habits to maximize rewards. That’s why I prefer airmiles credit cards, as they typically have fewer restrictions and rules compared to cashback cards.

Does that mean cashback cards are pointless? Definitely not. If your monthly expenses align with the spending categories specified by a cashback credit card and you don’t mind taking a moment to determine which card to use for each transaction, then there are a few cashback cards worth considering.

Misleading Ads from Cash Back Cards

Oh, and I forgot to mention this in the previous section, but another reason I dislike cashback credit cards is because they are often advertised in a misleading way. Let’s take a look at some examples of misleading cashback credit card advertisements.

Alliance Bank Visa Signature Credit Card

For our first example, let’s look at the Alliance Bank Visa Signature Credit Card product page:

Based on the information provided on their product page, this card might seem like an attractive option, especially for inexperienced credit card users. Offering 5% cash back on almost any retail spending could make it appear as if it’s the best cash back credit card available. However, I would advise against canceling an airmiles credit card just yet.

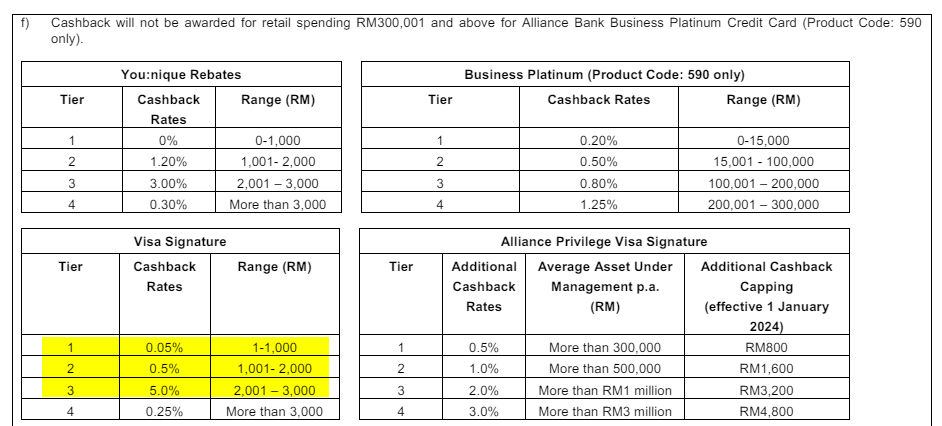

The “Get up to 5% Cashback…” wording does raise suspicion and highlights the importance of reviewing the product disclosure sheet for clarity, and this is what I found:

Based on this table, the maximum potential cash back is when you spend exactly RM3,000 and you will receive 0.05% for the first RM1,000 and 0.5% for the next RM1,000 and finally 5% for the next RM1,000.

The total rebate from RM3,000 spending is RM55.5 and that equal to a return of 1.85% which is far below the 5% from their product page.

This type of misleading advertisement is concerning, especially when it comes to financial products like credit cards. It’s surprising that regulatory bodies like Bank Negara Malaysia (BNM) allow such practices to continue unchecked.

Standard Chartered Simply Cash Credit Card

On their product page:

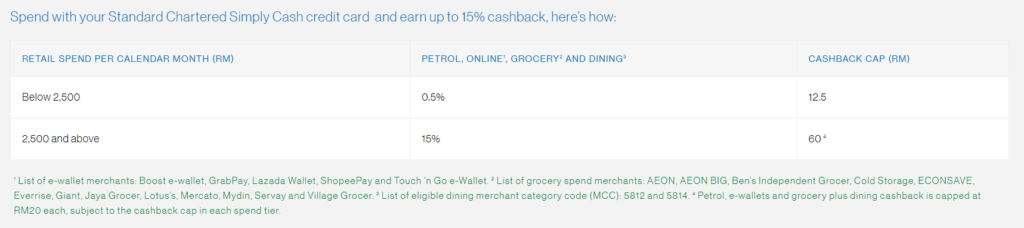

I think you already know that number is crazily inflated and misleading, so let’s get straight into the details.

Let me translate that for you. It essentially means you can get RM60 cash back if you spend exactly RM2,500, which equals to a return of 2.4%. Clearly, there’s nothing close to the advertised 15%.

UOB ONE Card

For our last example, let’s examine the UOB ONE Card product page:

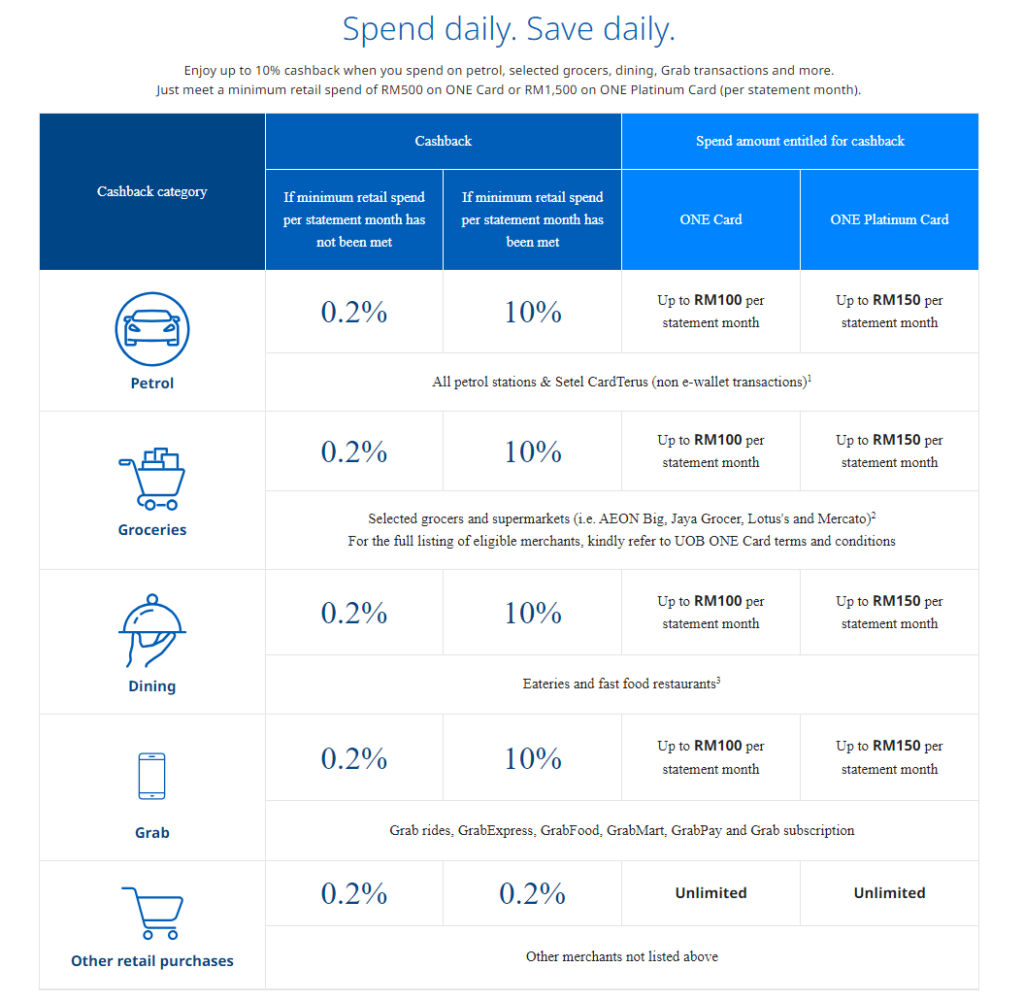

10%? That sounds enticing, but is there a catch? Let’s delve into the next section:

What’s this? It’s a confusing jumble of words that seems designed to be unnecessarily confusing, and I’m not even sure what the purpose is.

Probably is to confuse cardholders, potentially encouraging them to spend more without fully understanding how to maximize their rebates.

Annoying Spending Rules and Cash Back Capping

If you remember high school math, the previous table is akin to solving equations with X, Y, Z functions where you must first solve for X before substituting it into functions Y, etc.

Luckily, I’m here to help you decode this and uncover the true return on every ringgit spent. Now that we know a minimum retail spend of RM500 is required, let’s assume we spend exactly that. Then, allocate RM100 each for the four categories: petrol, groceries, dining, and Grab. Finally, spend the remaining RM100 on anything not listed above.

Here’s the maximum potential cash back you can get:

- RM10 – 10% of RM100 rebate from petrol spending

- RM10 – 10% of RM100 rebate from groceries spending

- RM10 – 10% of RM100 rebate from dining spending

- RM10 – 10% of RM100 rebate from Grab spending

- RM0.2 – 0.2% of RM100 rebate from other spending

From a RM500 spending, you’d get back RM40.2, roughly 8% cashback. It’s not the advertised 10%, but still decent if you can consistently spend in this manner, or at least close to it.

Many other cashback credit cards follow similar rules, requiring you to meet a minimum retail spending every month with caps on different spending categories.

Best Cash Back Credit Card in Malaysia

Alright, we’ll divide cashback credit cards into two categories. The first category will include credit cards with less complicated spending rules, while the second category will feature cashback cards with more spending restrictions but potentially higher returns on ringgit spent.

Best simple cash back credit cards

| Card Name | Max Potential Return | Cashback at Max Return | Spending Requirement | Note |

| Alliance Bank Visa Signature | 1.85% | RM 55.5 | RM 3,000 | Spending more will have a diminishing return |

| Maybank 2 Card Gold Amex | 5% | RM 50 | RM 1,000 | Only spending on weekend is eligible |

| UOB EVOL Card | 3% / 2.5% | RM 30 / 50 | RM 1,000 / 2,000 | Spend exactly RM1,000 to get RM30, or RM2,000 for RM50 |

| AFFIN DUO Visa Cash Back | 3% | RM 30 | RM 1,000 | Online transaction, ewallet and auto billing |

| Standard Chartered Simply Cash | 2.4% | RM 60 | RM 2,500 | |

| Public Islamic Bank Platinum Visa Credit Card-i | 4% | RM 30 | RM 750 | Online and Overseas transactions |

| GXBank Debit Card | 1% | Unlimited | n/a | Foreign currency transaction excluded |

We’ll exclude any other cashback credit cards that offer returns below 1%, as the GXBank debit card already provides 1% unlimited cashback.

Cash back credit cards with spending conditions

| Card Name | Max Potential Return | Cashback at Max Return | Spending for Max Return | Note |

| UOB ONE Card | 8% | RM 40.2 | RM 500 | Spend like this |

| RHB Shell Visa Credit Card | 5% | RM 50 | RM 1000 | 5% on petrol, rest are not worth it unless you spent more than RM625 on petrol per month |

| Hong Leong Wise Gold | 8% | RM 60 | RM 750 | Spend exactly RM187.5 on groceries, petrol, dining, online at weekend for max return |

| Maybank Islamic Petronas Ikhwan Visa Platinum Card-i | 8% | RM 50 | RM 625 | Weekend spending made at Petronas. No min spend |

| Maybank Islamic MasterCard Ikhwan Gold Card-i | 5% | RM 50 | RM 1000 | Petrol and Groceries at Friday & Saturday. No min spend |

| Public Bank Visa Signature | 3% | RM30 | RM 1000 | Groceries, Dining and Online Purchases. RM100 min spend |

| Public Bank Quantum Visa | 2% | RM20 | RM 1000 | Contactless transaction. RM100 min spend |

| Public Bank Quantum MasterCard | 3.5% | RM70 | RM 2000 | RM 1000 on online and insurance, another RM1000 on overseas transaction |

Closing Thoughts

As you can see, maximizing the returns on your spending with cashback credit cards requires close attention and sometimes adjustments to your spending habits.

Whether it’s worth altering your spending behavior for a cashback credit card is a personal decision. In my opinion, credit cards are meant to simplify your financial life, not add stress and hassle. That’s why I prefer to use air miles credit cards, allowing me to worry less about maximizing rewards.

Thanks for reading my post. If you believe I missed out on a credit card, it’s possible that it didn’t offer enough value compared to the ones I listed. However, if you think otherwise, please leave a comment, and I’ll be sure to look into it!