Table of Contents

What are ASNB, ASB, ASM & ASN?

Most people often confused by these acronym, when I first learn about them many years ago, I was confused by them too, so let’s just quickly learn what are these acronym before we look into the investment analysis.

- ASNB (Amanah Saham Nasional Berhad) – The NB are often confused as “non-bumi”, but this is actually the name of the unit trust management company, which is wholly owned by Permodalan Nasional Berhad, PNB is Malaysia government owned company.

- ASB (Amanah Saham Bumiputera) – This is the name of the fixed price unit trust product offered by ASNB, and as the name suggest, this is only available for Bumiputera.

- ASM (Amanah Saham Malaysia) – This is the name of the fixed price unit trust product offered by ASNB, but is available for all Malaysian to invest.

- ASN (Amanah Saham Nasional) – This is the name of the variable price unit trust product offered by ASNB, and is only available for Bumiputera.

When Malaysian talk about investing in ASNB, most of the time they are referring to the fixed price unit trust ASB and ASM, and as of writing there a 3 variations unit trust for each of them, they are often referred to ASB, ASB 2, ASB 3 and ASM, ASM 2, ASM 3.

What are fixed price & variable price unit trust mean?

To put it simply, the price for each unit of these fund are set at a fixed value, which is RM1 for all ASNB fixed price unit trust, and that is achieved by maintaining the NAV at 1:1 ratio with the outstanding unit, the excess are payout as dividend.

Which means when people purchase these funds they are expecting no capital loss, because the unit price are fixed, and a consistent yearly dividend paid out.

Now I guess some of you may ask, what if there’s a sharp market downturn? How can a fixed price be guarantee in a free market? I had these questions too, but we will talk about that later in this post.

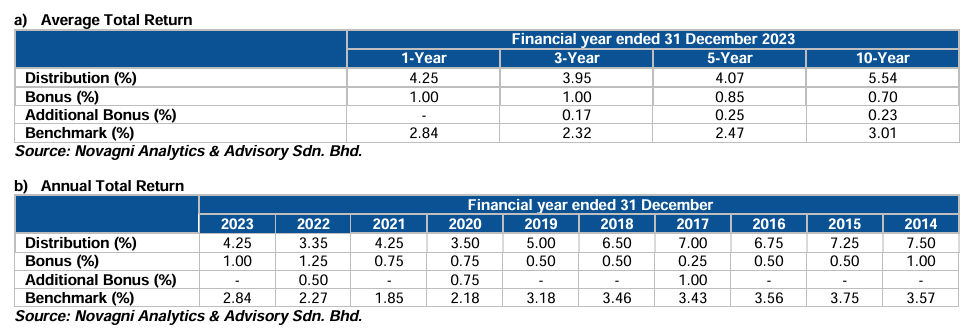

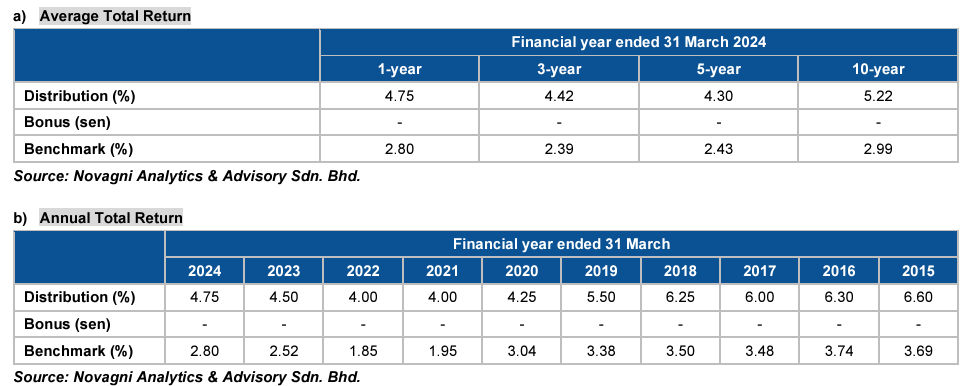

Past Average Performance of ASB & ASM

ASNB publish the latest dividend for all their unit trust product and you can find them at their income distribution table, and for this post we will look at the product highlights of just the ASB and ASM, but you can find similar info for other products in their unit trust products page.

You can probably tell why these products are so popular in Malaysia, because they typically have higher annual return than fixed deposits, low risk of capital loss because of the fixed price and are offered by government owned unit trust company.

I am aware the ASB 2 seems to have higher historical return than ASB, but for the sake of this post we will just compare their most popular “flagship” product, but you can look into that on their products offering.

Inflation adjusted return

Next we will also look at the inflation adjusted return, while I’m not going to precisely calculate the year over year inflation adjusted return, we will just have a quick look on this.

From the consumer prices chart we can roughly estimate the average inflation in Malaysia is around 2%, this mean the inflation adjusted return is roughly around 3%, and the investment are able to beat the inflation.

However most people actually experienced a much high inflation in real life, while no one know for sure what is the exact products and brands are used to measure the inflation, but I’d argue the real life inflation for many people, at least in urban area, are significant above the 2% nation average.

Top Holdings & Investment Objectives of ASB & ASM

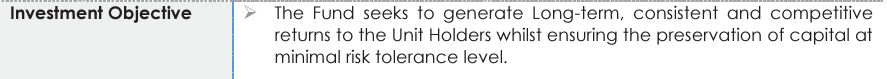

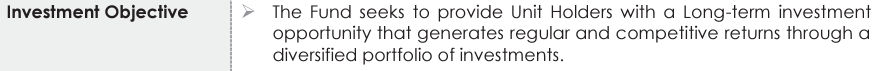

According to the prospectus from ASNB both ASB and ASM has similar investment objective, which aims to generate a consistent income for their investors.

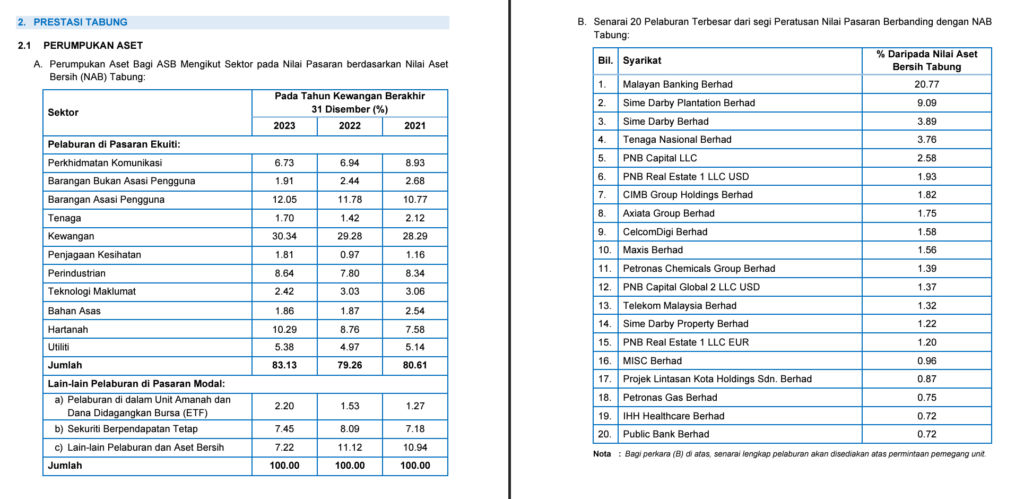

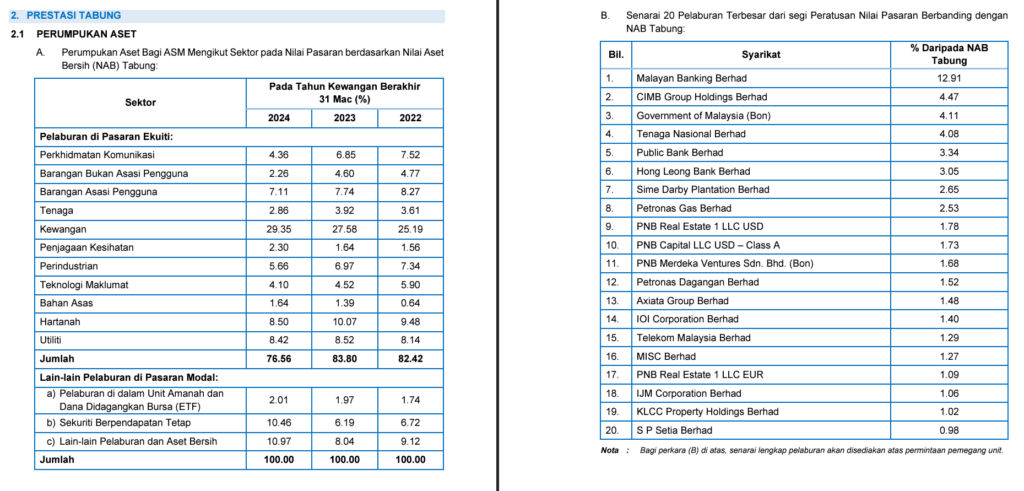

Top 20 holdings and sectors

As the investment objective is to generate consistent income, it is not surprised to see top 20 holdings of both funds are mostly in blue chip company, banking, and government owned company.

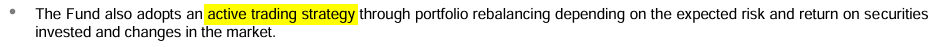

Keep in mind that both funds are actively managed, which the holdings will be adjust by the ASNB fund managers from time to time to align with the investment objectives.

Unlike index funds that passively track an index, which you can learn the methodology of the index, it is harder to know exactly how the fund managers will adjust the holdings, and active funds usually have higher turnover ratio which may incur more cost.

The Risks of Investing ASB & ASM

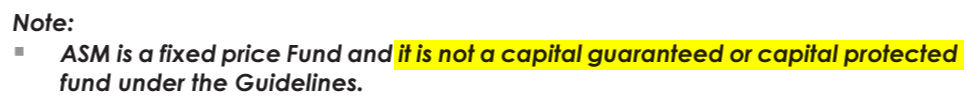

Now, contrary to most beliefs, the fixed price unit trusts does not really means there will be no capital risks, unfortunately many blogs and YouTube videos have been giving the wrong info and led many to believe their capital are guaranteed.

In fact you can find this disclaimer in the prospectus and product highlights stating that the capital is not guaranteed nor protected:

While it is in the government’s interest to ensure that investors in these funds face low capital risk, and we might hope that these government-linked companies would be bailed out during a black swan event, there is simply no guarantee against capital loss for your investment.

There are also other common risks of investing in unit trusts, such as country risk, default risk, market risk, etc… But in my opinion the most important risks for investing in ASB / ASM is the concentration risk, opportunity risk and currency risk.

If you only owned investment in local market, regardless of whether you’re invested in ASNB unit trusts or other local funds, you basically tied your financial with the economy of Malaysia, which is relatively small by economy size.

Under diversifying is the first thing you’d want to avoid, especially as a risk averse investors, and diversifying is the easiest approach to increase risk adjust return.

The Cost of Investing in ASB & ASM

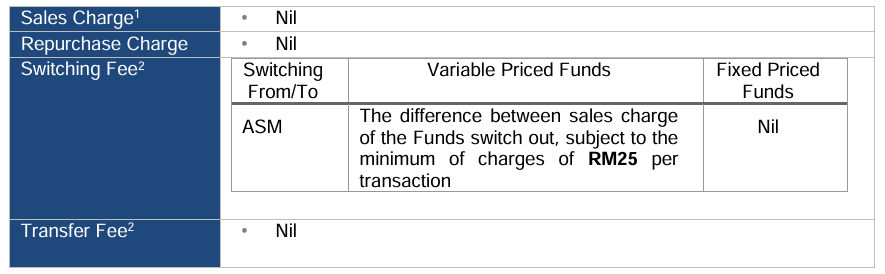

Fortunately there is no sales charge nor repurchase charge for both funds:

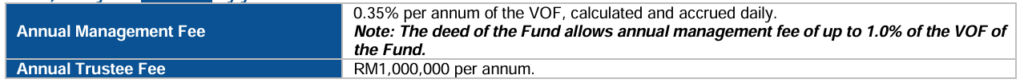

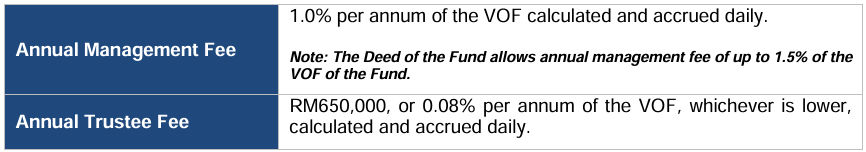

However there is a 0.35% annual fees for the ASB and 1% annual fees for ASM:

The fees are expected to be much higher than popular index funds or index etfs, because it is active managed and have relatively smaller asset under management.

Fees when compounded actually make a huge differences, for example if you invest RM1000 with an average of 5% return, after 30 years that number will turn into RM4321, but if the fees are none and you get a return of 6%, you will end up having RM5743, a difference of 32.9%.

Invest ASNB Unit Trusts from myASNB

To purchase ASNB unit trusts the process is easy now since the release of their mobile apps, you can register an account directly from the myASNB application, upload your document and fill in your info for verification, then you can make your purchase.

It took me only less than 5 minutes to setup my account, and less than few hours of waiting for verification, but the apps in my opinion are quite unpolished, there are many unnecessary steps and buttons that leads to nowhere…

You can however also use their website once you register the account from the myASNB application.

The Quota / Availability to Invest ASNB Unit Trusts

Another things to keep in mind is that ASNB funds are not always available to invest, many people could not participate in the funds and have to wait until someone else exit or a fund size increase decision is made.

Which may introduce some inconvenience for people planning their financial, and some people have funds left uninvested just to wait for the funds available.

Is It a Good Investment in Your Portfolio?

It is impossible to answer this question for everyone, because it largely depends on your current financial situation, income, age and risk tolerance.

However I can see that for certain groups of people that are more risk averse, close to retiring age or retired to include ASB or ASM in their portfolio, but remember, this is basically a mid-large cap active managed funds that concentrate in Malaysia market, while it hasn’t had a “loss” and able to maintain the fixed price, this is never guaranteed.

For instances, you may want to consider maxed out the allocation in EPF, especially you are close to the withdrawing age or already above 55, which let you withdraw your fund at will without locking up your funds.

For younger groups of people, for example a fresh graduates, while it’s okay to start with ASNB funds before you are confidence with other investment product and financial planning, it is generally more recommended to take more risk while you are young, and again, not to mistake fixed price unit trusts to capital protected funds like government bonds.