Table of Contents

Alliance Bank Visa Virtual Credit Card Introduction

In the world finance there is a saying “there is no such thing as free lunch”, which is typically use in the context that you can’t simply get higher profit without taking more risk, but the Alliance Bank Visa Virtual credit card may probably be the closest thing to “free lunch” when use correctly.

This card are often overlook by people because of it being a basic card, especially after Alliance Bank increase the required points for air miles by 50% last year and capping for points you can earn per statement.

However there are some less talked about benefit that make this card the best credit card for me in year 2024 and will continue to be in this year 2025, let me uncover them for you.

Benefits of Alliance Bank Visa Virtual

Let’s start with the most obvious benefits of this credit card, then we will move onto the lesser known benefits shortly.

Earning timeless bonus points for air miles redemption

Timeless bonus points are the name for Alliance Bank credit card points, similar to Visa Infinite from Alliance Bank, you can earn 8 points per RM1 spent on ecommerce platform like Shopee or Lazada, as well as ewallet topup.

There is a separate quota of RM3000 for both category, which mean the maximize earn rate of 8 points per RM1 will be reach once you spent RM3000 on ecommerce and RM3000 on ewallet topup, and you will get 48000 timeless bonus points in total.

Any spending above that quota will give you only 1 point per RM1 spent, for other transactions regardless of local currency or foreign currency it will always be 1 point per RM1 spent.

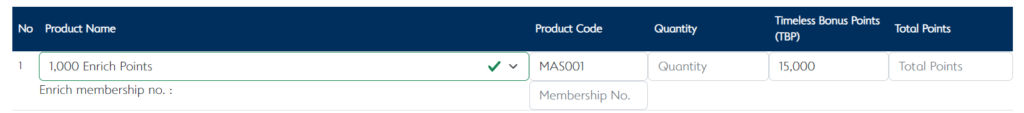

You can redeem 1000 Enrich miles with 15000 timeless bonus points, which mean if you earn those points at 8 points per RM1 spent, this will be the calculation for MPR and ROI:

MPR = (points per RM1 spent) / (points needed per mile) = 8 / (15000/1000) = 0.53

ROI = (MPR * value per mile) = 0.0256 = 2.13%Not too shabby for a basic credit card, in fact it has better MPR and ROI than many higher end credit cards from other bank.

The downside is you can only redeem Enrich miles and Airasia miles, or you can also redeem the TNG RM100 reload pin, if you can accept a ROI of 1.33%.

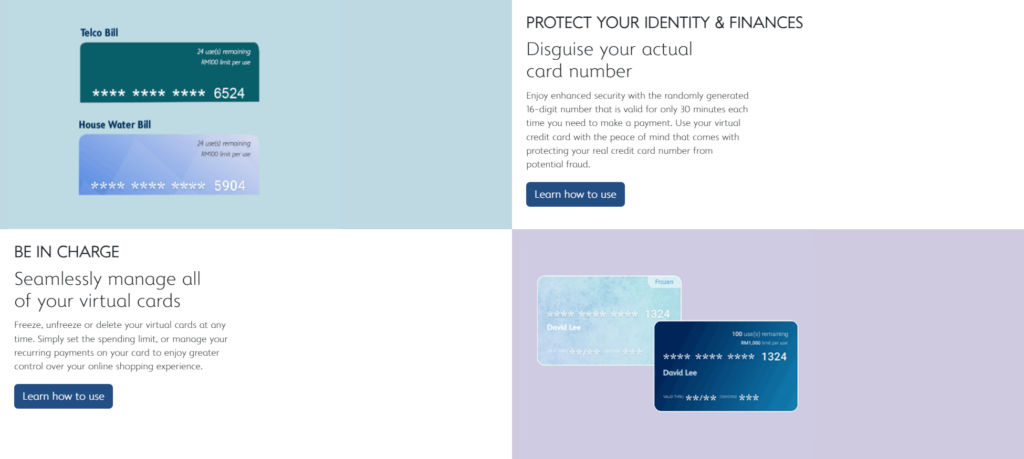

Create as many virtual credit card as you need

Do you hate the idea that you have to enter a credit card number with thousands of credit limits into a website to buy small value goods? I do, that is why this feature is so much useful for me, I no longer need to worry about my card number being leaked or stolen to make fraudulent purchases.

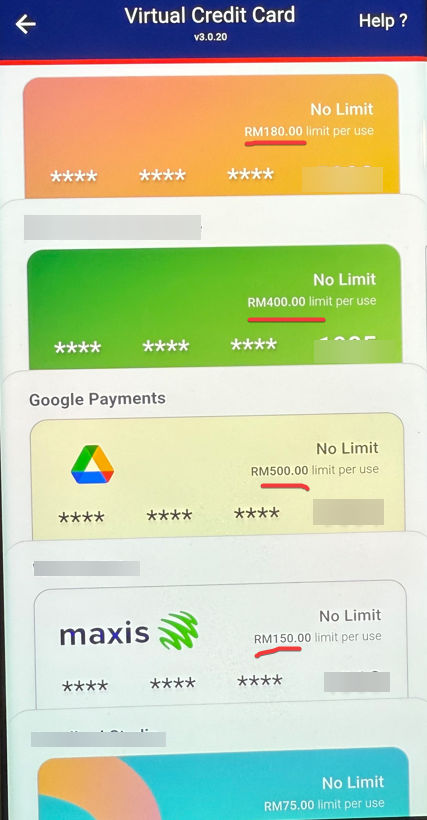

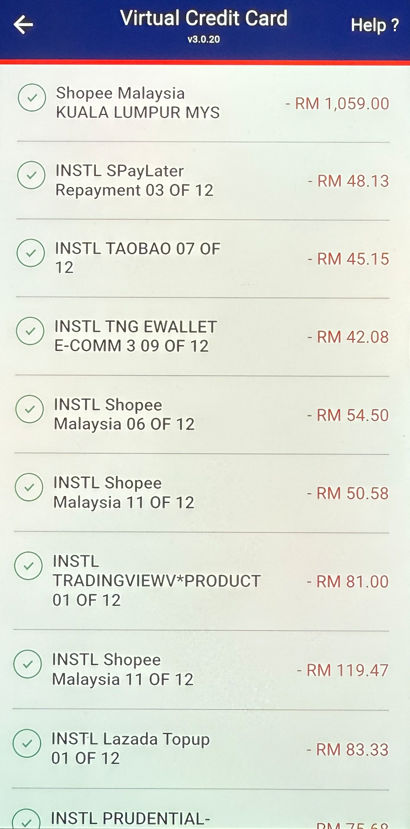

You can see from my screenshot for some of the card I have created, all with different limits based on how much I am expecting the charge to be, and I use this especially on services that I cannot fully trust with credit cards of higher limits.

Each virtual credit cards you created can set different limits per charge, times to be charge and expiry date, it can also be freeze or delete at anytime.

Another use cases is when I signup on services that offer trials, I can always create a one-time use virtual credit card that will expires after 30 minutes, so that I don’t have to remember cancelling after the trial period is up, if I need that service later I can just update payment method to subscribe it.

Basically this feature give you a peace of mind and it alone is worth for me to keep this credit card, but you know what is the best part? There is another more exciting benefit from an ongoing campaign which make this card the best basic credit card in my opinion.

Convert transaction above RM500 into 0% interest installment

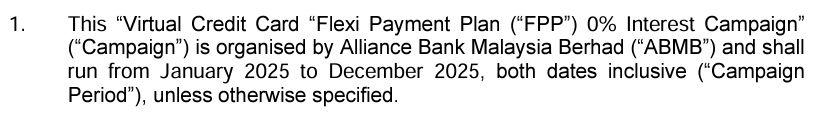

I hold onto writing a review for Alliance Bank Visa Virtual nearing year end because I was not sure if they will extend this benefits, but it seems they do, which is why this card will most likely continue to be the best basic card for me this year.

Based on the terms of the extended flexi payment plan campaign, everything seems to remain the same as year 2024, every visa virtual credit card transaction above RM500 will have the option to convert into a 12-month installment with 0% interest rate.

This is basically free money, and the idea to fully utilize this is to pay for everything with visa virtual credit card and convert the transaction into installment until your limit ran out.

Of course you doesn’t have to use up all your limit in a month, but while the campaign is ongoing, just keep paying anything above RM500 with this card then convert to installment is fine. Another option is to “cash out” using e-wallet with low to no fees, for example Boost Pay only has 0.75% fees, which you can see it as interest, but still fairly low.

I have been paying everything above RM500 with this card and almost used up ~90% of the limit, every month after paying the installment, I will have the limit available, then I just have to repeat, it’s basically I constantly utilizing my 0% interest credit line.

So what do you do with the money that were supposed to be paying these expenses? You simply invest with them, but before you do so, know that while this is a 0% installment it still has to be paid off eventually, so the first rules is make sure the investment you make are relatively low risk.

For example you can save it in ASNB unit trust, EPF self contribute account, fixed deposits from bank, or invest in stuff that you regularly DCA into such as index ETFs. However for investment with more risk you will want to make sure you have the ability to repay it even if your investment is losing money.

Annual Fees & Salary Requirement

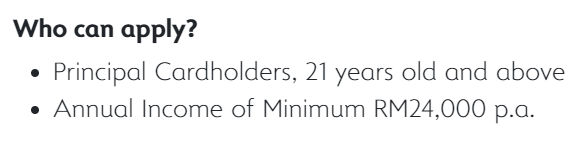

The annual salary requirement for this credit card is RM24,000 or a monthly income of RM2000, it is a entry level basic credit card that can be easily obtain.

The Alliance Bank Visa Virtual have zero annual fees, but the usual RM25 service tax still applies even though there is no physical card.

Who Should Consider Alliance Bank Visa Virtual Card?

The card has no annual fees, can be apply with basic income, but come with great benefits such as the ability to unlimited virtual credit cards, MPR or ROI that is similar to Alliance Bank Visa Infinite and has 0% interest installment plan makes it a no brainer for almost anyone.

Even if you do not want to participate the 0% interest installment flexi payment plan, the virtual features alone still make this a great credit card to have.

However if you are going to utilize your credit card limit as much as possible for the 0% interest installment plan like I do, just make sure you don’t spend more money because of the card, instead spend what you usually do, but take advantage of the campaign to delay the payment while letting your cash earning interest somewhere else.

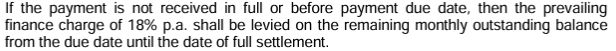

If you aren’t good at making sure you can pay your credit card before due date, then any credit cards will do more harm for you than helping you, because credit cards due payment are typically charge at a 18% flat interest rate.

Finally, thanks for reading my post, if you find this useful please share it with your friends and family, and if you have other questions, or specific card you’d like me to review, just post them in the comment section below!