Table of Contents

Alliance Bank Visa Infinite Introduction

This is the first card from Alliance Bank I have applied for, and it has helped me to accumulate some flight tickets in the past, it’s also used to be my favorite card because it matches my spending habits.

However Alliance Bank later had been cutting down the benefits of the card, not only increased the points required to redeem air miles but also added a cap on how much timeless bonus points you can earn per statement.

Nevertheless the air miles earning rate are still acceptable at the moment of writing this, at least for local ecommerce spending I still couldn’t find a better alternative.

Air Miles Benefits & Earning Rates

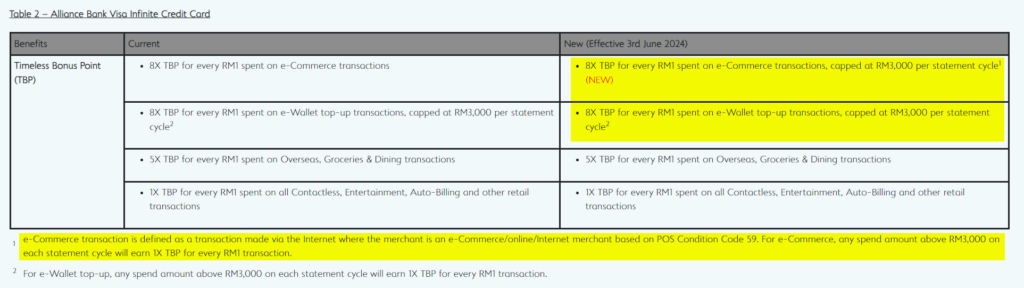

Timeless bonus points are the credit card points name for Alliance Bank, with Alliance Bank Visa Infinite there are only limited ways you can earn meaningful credit card points.

As per the latest revision you can earn 8 points per RM1 spent on ecommerce and e-wallet top up, each of them come with a separate quota of RM3000.

For foreign currency spending, dining and groceries you will earn 5 points per RM1 spent, fortunately there is no capping on these categories.

Air miles earning rates and ROI calculation

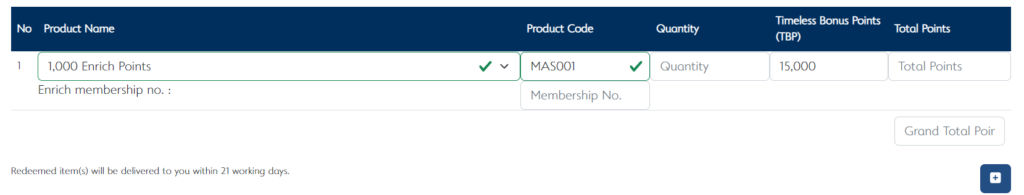

You can redeem your timeless bonus points on Alliance Bank redemption order form, but for air miles there are only Enrich miles. (and Airasia miles, which is typical low value)

We can redeem 1000 Enrich miles with 15000 timeless bonus points, and we earn 8 points with RM1 spent, which give us 0.53 miles per ringgit (MPR), or in ROI terms 2.12% assuming each Enrich miles worth 4 cents.

What about earnings from foreign currency spending, dining and groceries? For 5 points with RM1 spent, that translate into 0.33 mpr or 1.33% ROI.

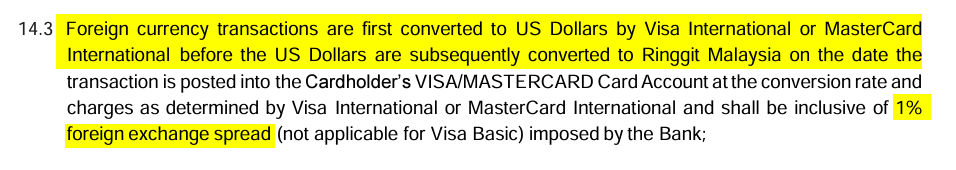

Alliance Bank do impose 1% currency conversion fees on top of the visa exchange rate, which mean the true ROI for overseas spending will be 0.33%.

Other Benefits

The other benefits include 2 entry for Plaza Premium Lounge and 1 entry for Travel Club Lounge, both only for principal card holder.

You can also convert you purchase of flight tickets, hotel bookings and overseas spend into a zero interest 3 month flexi payment plan.

Redeem for TNG eWallet cash

In the redemption order form you can also select other cash voucher such as the AEON voucher, Grab voucher, but the most popular would be TNG reload pin, which all of them cost 60000 timeless bonus points for RM100 equivalent of voucher/pin.

Usually I only redeem for air miles, but for anyone curious the ROI of redeeming vouchers would be 1.33% (8 points / RM1 spent) or 0.83% (5 points / RM1 spent).

What about 8X points on e-wallet top up?

There are very few e-wallet that does not charge an additional fees, in fact in recent years most of the e-wallet added additional 0.75% ~ 1% fees for e-wallet top up with credit cards.

Well yes you still earn 1% value in air miles after fees, and you are basically paying RM30 for RM60 worth of air miles with each Alliance Bank credit card, but in my opinion spending cash that can be invested elsewhere to buy air miles that you never know when you will need it, may not be a good idea.

Annual Fees & Salary Requirement

The annual salary requirement for this credit card is RM60,000 or a monthly income of RM5000.

The Alliance Bank Visa Infinite credit card has an annual fees of RM438 for principal, free for supplementary and the standard RM25 service tax for each activated card. First year of the fees are waived, and subsequent year will be waived automatically when yearly spending of RM12000 is reached.

Who Should Get Alliance Bank Visa Infinite?

Personally when I apply for this card it has 0.8 MPR, which is around 3.2% for online ecommerce spending, but with the current 0.53 MPR, I would only recommend if you:

- Can spend more than RM1000 per month on ecommerce (Shopee, Lazada, etc…)

- Can spend more than RM12000 per year with this card

- REALLY need the 2X access to lounge

- Cannot apply for other cards that have better MPR or ROI rates on dining and groceries

If not you should just apply for the Alliance Bank Visa Platinum or Visa Virtual which has the same earning rates for ecommerce, but lower air miles earning rates for dining and groceries.

Or you spend more than RM7000 per month on ecommerce that you maxed out the RM3000 cappings for 8X timeless bonus points earning on the Visa Platinum and Visa Virtual card.

Anyway thanks for reading my post, if you find this useful please share it with your friends and family, and if you have other questions, or specific card you’d like me to review, just post them in the comment section below!